Iowa Domestic Partnership Cohabitation Agreement

Description

How to fill out Domestic Partnership Cohabitation Agreement?

Are you currently in a location where you require documents for either business or personal purposes on a daily basis.

There are numerous legal document templates available online, but finding forms you can trust is challenging.

US Legal Forms provides a vast array of form templates, such as the Iowa Domestic Partnership Cohabitation Agreement, designed to comply with state and federal regulations.

If you obtain the correct form, click on Purchase now.

Choose the payment plan you need, provide the required information to create your account, and complete the order using your PayPal or Visa or MasterCard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Iowa Domestic Partnership Cohabitation Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- 1. Find the form you need and ensure it is for your correct locality/state.

- 2. Use the Preview option to examine the form.

- 3. Check the description to confirm that you have selected the right form.

- 4. If the form isn't what you're looking for, utilize the Search field to locate the form that meets your needs and requirements.

Form popularity

FAQ

Typically, you won't be held responsible for your partner's debts incurred before the partnership began. However, once you enter an Iowa Domestic Partnership Cohabitation Agreement, any debts shared during the partnership can create joint liability. It’s beneficial to create a detailed agreement that specifies financial responsibilities to prevent potential conflicts. Consulting a professional can help clarify these issues.

While California generally treats registered domestic partners and married couples equally in terms of rights and responsibilities, the federal government does not always treat registered domestic partners the same as spouses for legal or tax purposes.

Iowa does not require cohabitation to exist for a particular amount of time before it is considered continuous. Finally, there can be no secret marriage. The couple must make a public declaration or hold out to the public that they are married in order to be considered common-law married.

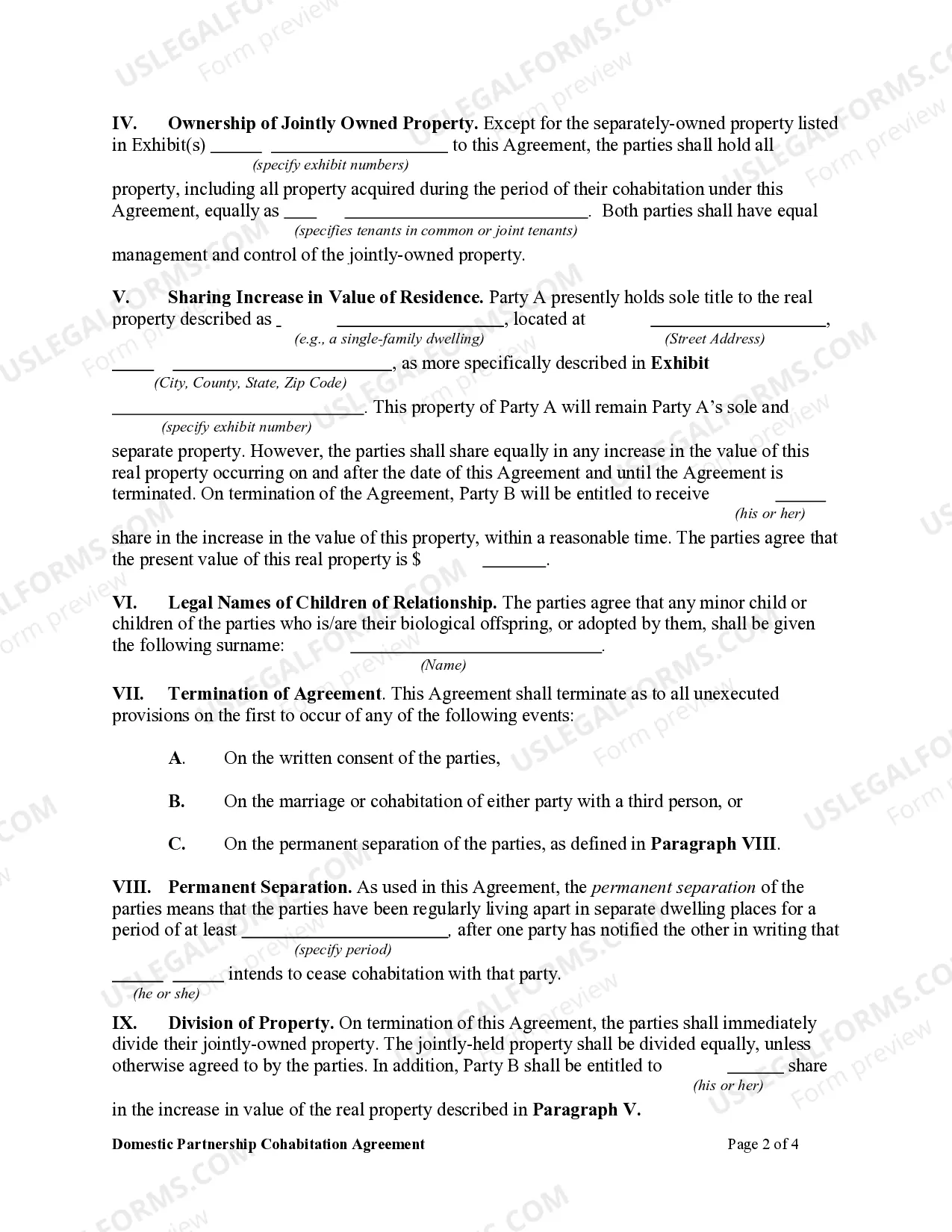

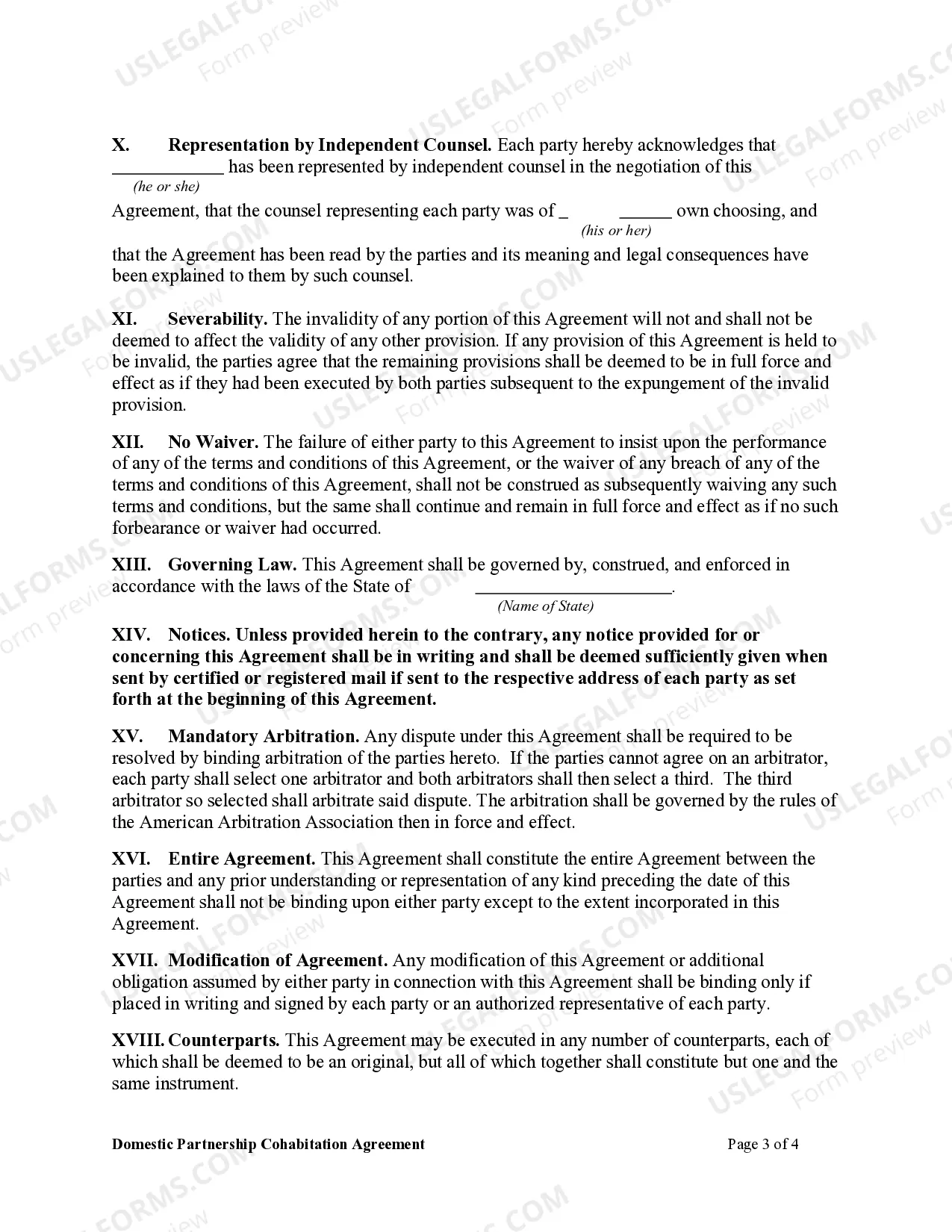

A cohabitation agreement is a contract between two people who are in relationship and live together but are not married. Good cohabitation agreements are (ideally) crafted early on, and deal with issues involving property, debts, inheritances, other estate planning considerations and health care decisions.

Registered domestic partners may not file a federal return using a married filing separately or jointly filing status. Registered domestic partners are not married under state law. Therefore, these taxpayers are not married for federal tax purposes.

A domestic partnership agreement (also called a cohabitation agreement) is a legally binding contract that outlines the rights and obligations of two individuals who intend to live together but either do not wish to or are legally prohibited from marrying each other.

A domestic partnership agreement (also called a cohabitation agreement) is a legally binding contract that outlines the rights and obligations of two individuals who intend to live together but either do not wish to or are legally prohibited from marrying each other.

In Iowa, a domestic partnership is a legal or personal relationship between two people who live together and share a common domestic life but are not legally married in the traditional sense. There are completely different family laws concerning a domestic partnership and a marriage or civil union.

So yes, you can write your own cohabitation agreement. Although it is possible to write your own cohabitation contract you should be aware of certain important pre-contract conditions that must be met to make your agreement legally enforceable.

The State of Iowa employee must be benefit-eligible to cover a domestic partner for health and dental coverage and meet the conditions outlined in the Declaration of Domestic Partnership.