Minutes are a permanent, formal, and detailed (although not verbatim) record of business transacted, and resolutions adopted, at a firm's official meetings such as board of directors of a corporation or members of a limited liability company. Once written up (or typed) in a minute book and approved at the next meeting, the minutes are accepted as a true representation of the proceedings they record and can be used as prima facie evidence in legal matters.

Iowa Minutes and Resolutions of the Board of Trustees of a Non-Profit Corporation Authorizing to the Refinancing of a Loan

Description

How to fill out Minutes And Resolutions Of The Board Of Trustees Of A Non-Profit Corporation Authorizing To The Refinancing Of A Loan?

You can spend multiple hours online looking for the valid document template that complies with the state and federal standards you need.

US Legal Forms offers thousands of valid forms that have been evaluated by experts.

It is easy to download or print the Iowa Minutes and Resolutions of the Board of Trustees of a Non-Profit Corporation Authorizing the Refinancing of a Loan from our service.

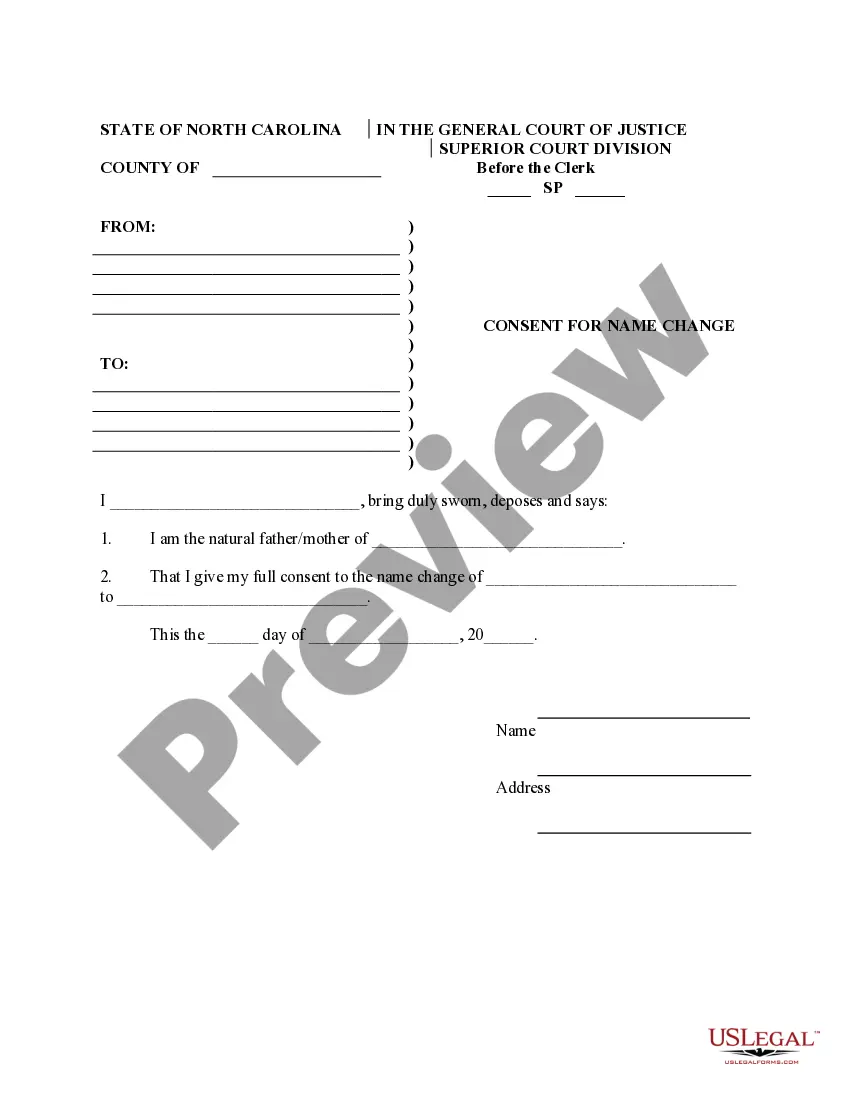

If available, use the Preview option to examine the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the Iowa Minutes and Resolutions of the Board of Trustees of a Non-Profit Corporation Authorizing the Refinancing of a Loan.

- Every valid document template you acquire is yours indefinitely.

- To obtain an additional copy of the purchased form, visit the My documents tab and click on the corresponding option.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure that you have selected the correct document template for your desired area/city.

- Review the form summary to confirm you have chosen the appropriate document.

Form popularity

FAQ

It is not unusual or illegal for nonprofit board members to make a loan to their organizations for any number of reasons. Board members may lend money to a nonprofit to help it through a temporary cash crunch, start a new program that furthers the nonprofit's mission, or even fund capital improvements.

A 501(c)(3) eligible nonprofit board of directors in Iowa MUST: Have a minimum of five board members. Elect the following members: president, treasurer and secretary. Be comprised mostly of independent persons, not employees.

Here are eight tips for making a resolution you can keepalthough you'll have to say goodbye to the word resolution!Ditch the usual vocab.Be positive.Be specific.Take baby steps.Tell your friends and family.Give yourself a break.Reward yourself.Don't give up!

YES, NON-PROFITS CAN GIVE FINANCIAL ASSISTANCE TO INDIVIDUALS! Section 501(c)(3) of the Internal Revenue Code provides that an organization that qualifies for exemption from income tax is one that is organized and operated exclusively for charitable purposes.

A 501(c)(3) may loan funds to a 501(c)(4). Unlike grant funds, a 501(c)(4) may use a 501(c)(3) loan for general support or fundraising and its use does not count against the 501(c)(3)'s lobbying limits.

All Resolved clauses within a resolution should use the objective form of the verb (for example, Resolved, that the American Library Association (ALA), on behalf of its members: (1) supports...; (2) provides...; and last resolved urges....") rather than the subjunctive form of the verb (for example, Resolved,

It is not unusual or illegal for nonprofit board members to make a loan to their organizations for any number of reasons. Board members may lend money to a nonprofit to help it through a temporary cash crunch, start a new program that furthers the nonprofit's mission, or even fund capital improvements.

A conflict of interest occurs when a director, officer, key employee, or other person in a position to influence the nonprofit (an insider) may benefit personally in some way from a transaction or relationship with the nonprofit organization that he or she serves.

Some basic information a resolution should include is the name of the corporation; the date of the board meeting when the resolution was approved; and the names of the board members who attended the meeting, or a statement that all board members or a quorum were present.