Iowa Stock Option Agreement between Corporation and Officer or Key Employee

Description

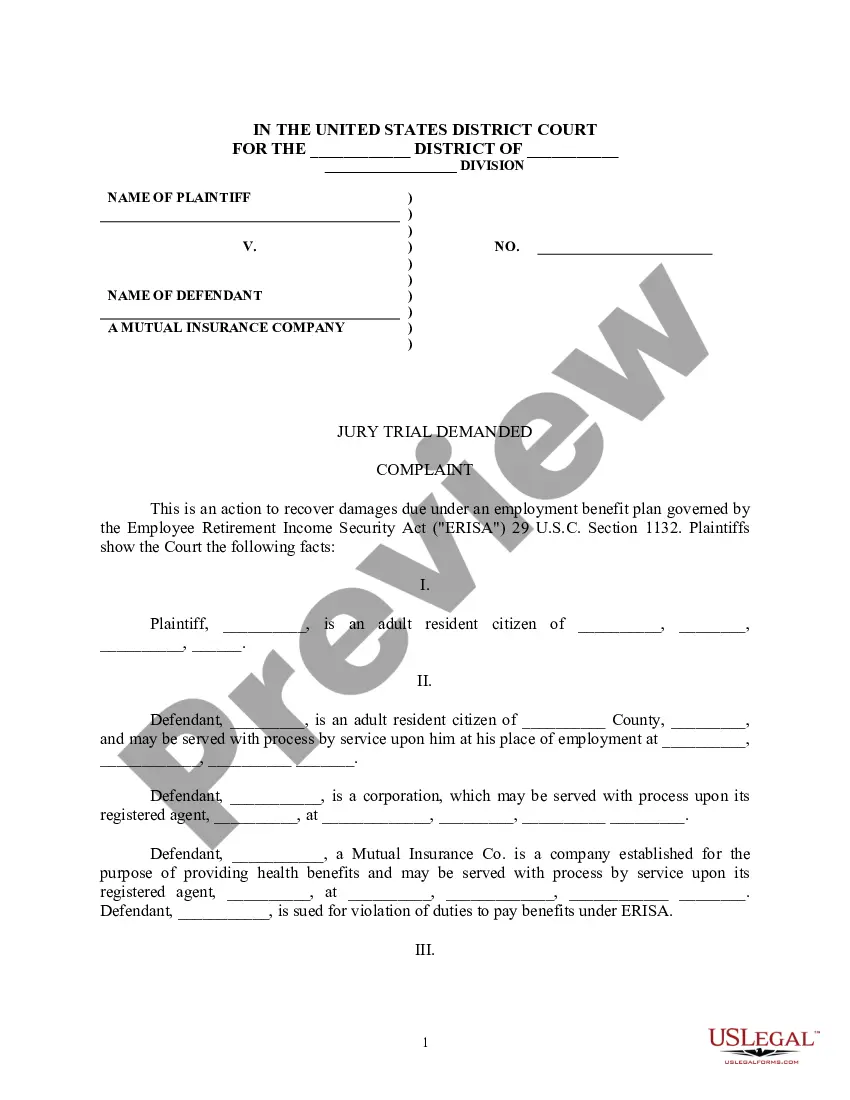

How to fill out Stock Option Agreement Between Corporation And Officer Or Key Employee?

If you wish to obtain, procure, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the site's user-friendly and efficient search to locate the documents you require.

Various templates for business and personal purposes are categorized by types and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Select your desired pricing plan and enter your details to register for an account.

Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to locate the Iowa Stock Option Agreement between Corporation and Officer or Key Employee in just a few clicks.

- If you are currently a user of US Legal Forms, sign in to your account and click the Acquire button to find the Iowa Stock Option Agreement between Corporation and Officer or Key Employee.

- You can also access forms you previously saved in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

The most typical way of granting employees an equity ownership in a company is by the issuance of stock options. A stock option gives an employee the right to buy a fixed number of shares in a company at a fixed price over a certain period of time.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price.

Private company stock options are call options, giving the holder the right to purchase shares of the company's stock at a specified price. This right to purchase or exercise stock options is often subject to a vesting schedule that defines when the options can be exercised.

The phenomena of stock options is more prevalent in start-up companies which can not afford to pay huge salaries to its employees but are willing to share the future prosperity of the company. In such cases the employees are given the stock options as part of the compensation package.

Stock options are an employee benefit that grants employees the right to buy shares of the company at a set price after a certain period of time. Employees and employers agree ahead of time on how many shares they can purchase and how long the vesting period will be before they can buy the stock.

If the options will be issued to the entity and it is not an accredited investor then the company may have to rely on Section 4(a)(2) of the Securities Act, which exempts private offerings of securities, or perhaps a different exemption like Rule 504.

About Stock Option Agreements Such an option, once granted to the employee, gives the employee the opportunity to benefit from increases in the company's share value by granting the right to buy shares at a future point in time at a price equal to the fair market value of such shares at the time of the grant.

Basically, as the company profits, employees profit as well. Thus, stock options are a way to create a loyal partnership with employees. Stock options are a way for companies to motivate employees to be more productive. Through stock options, employees receive a percentage of ownership in the company.

Companies grant stock options to motivate employees. A stock option is a type of investment that allows the holder to buy a certain number of shares of a company's stock at a locked-in price.

The UBS research found that stock options were viewed by employees as one of the more complicated performance incentives, second only to performance shares. Thus, it's important that employers offering stock options also offer support if they want their employees to properly value and leverage the benefit.