Iowa Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse

Description

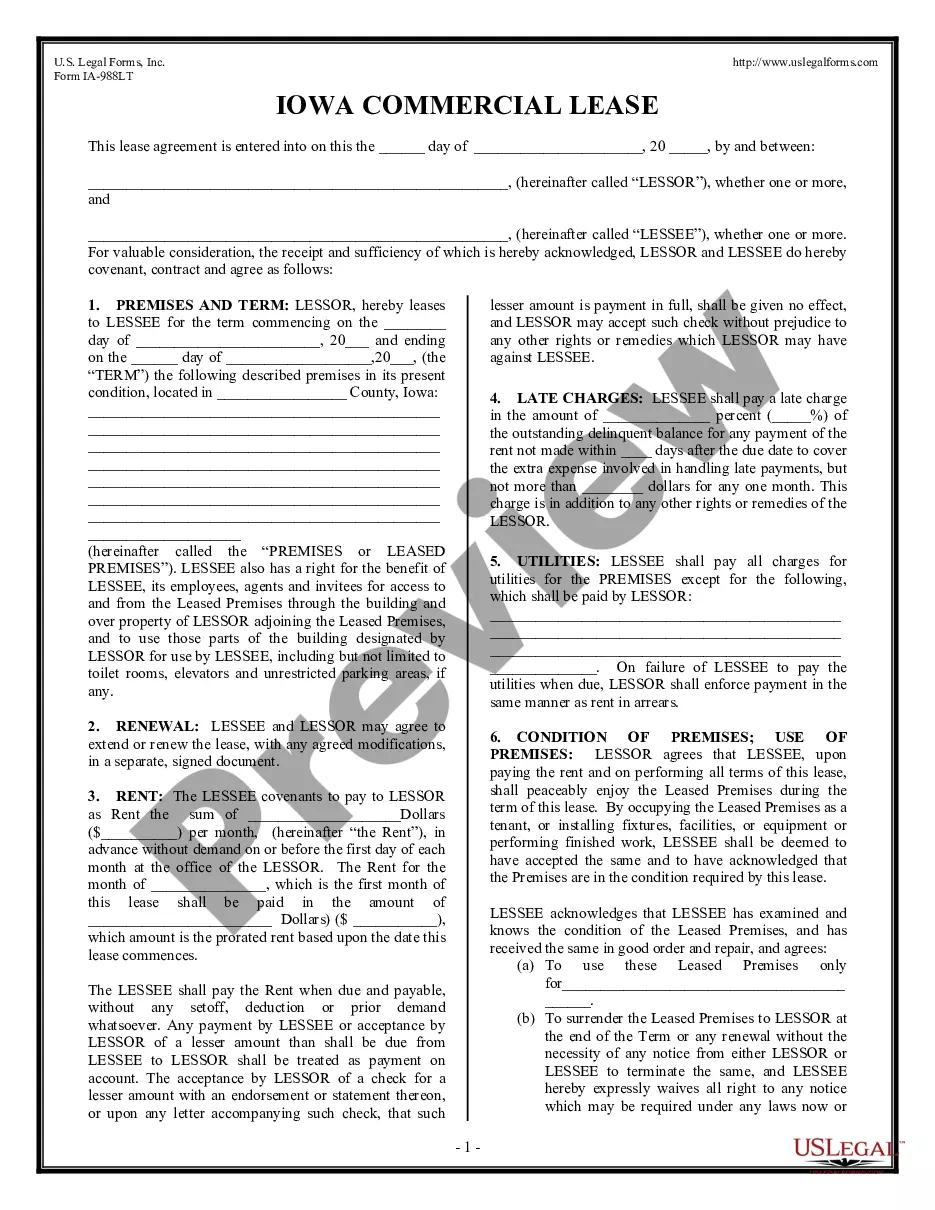

How to fill out Deed Conveying Condominium Unit To Charity With Reservation Of Life Tenancy In Donor And Donor's Spouse?

Have you been within a situation where you need documents for sometimes organization or specific uses virtually every day? There are a lot of legitimate record templates available on the Internet, but locating versions you can trust isn`t easy. US Legal Forms provides 1000s of type templates, just like the Iowa Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse, which can be created to meet state and federal needs.

When you are presently knowledgeable about US Legal Forms website and possess your account, simply log in. Next, it is possible to obtain the Iowa Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse web template.

If you do not have an profile and want to begin to use US Legal Forms, adopt these measures:

- Discover the type you require and make sure it is for that appropriate area/area.

- Utilize the Review option to analyze the shape.

- Read the description to actually have chosen the proper type.

- When the type isn`t what you`re searching for, use the Search discipline to obtain the type that fits your needs and needs.

- Whenever you discover the appropriate type, just click Purchase now.

- Select the rates plan you desire, fill out the desired info to make your money, and pay money for your order using your PayPal or Visa or Mastercard.

- Decide on a hassle-free data file file format and obtain your version.

Find every one of the record templates you might have bought in the My Forms food selection. You can get a extra version of Iowa Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse at any time, if possible. Just select the necessary type to obtain or printing the record web template.

Use US Legal Forms, by far the most substantial selection of legitimate kinds, to conserve time and steer clear of blunders. The assistance provides professionally produced legitimate record templates which can be used for an array of uses. Make your account on US Legal Forms and initiate creating your way of life a little easier.

Form popularity

FAQ

Defining a California Life Estate A life estate is a form of ownership that allows one person to live in or on a piece of real property until they pass away. At their death, the real property passes to the intended beneficiary of the original owner.

Under adverse possession laws, if a trespasser openly inhabits and improves a property, or even a small part, for a determined amount of time, he or she may gain legal title to property. Under Iowa law, an individual must occupy property for at least 5 years before the possibility of ownership.

Joint tenancy is a form of ownership by two or more individuals together. It differs from other types of co-ownership in that the surviving joint tenant immediately becomes the owner of the whole property upon the death of the other joint tenant. This is called a Right of Survivorship.

Tenancy in Common is one of three types of shared ownership. The other two types are Joint Tenancy and Tenancy by Entirety. A TIC has no right of survivorship and when a tenant in common dies, their share of the property passes to their estate, where a beneficiary of the share of property may be named.

When joint tenants have right of survivorship, it means that the property shares of one co-tenant are transferred directly to the surviving co-tenant (or co-tenants) upon their death. While ownership of the property is shared equally in life, the living owners gain total ownership of any deceased co-owners' shares.

1. A conveyance of real property to two or more grantees each in their own right creates a tenancy in common, unless a contrary intent is expressed in the conveyance instrument or as provided in subsection 2.

Key Takeaways. Some of the main benefits of joint tenancy include avoiding probate courts, sharing responsibility, and maintaining continuity. The primary pitfalls are the need for agreement, the potential for assets to be frozen, and loss of control over the distribution of assets after death.

Joint tenancy is a form of ownership by two or more individuals together. It differs from other types of co-ownership in that the surviving joint tenant immediately becomes the owner of the whole property upon the death of the other joint tenant. This is called a Right of Survivorship.