Iowa Renunciation of Legacy in Favor of Other Family Members: Detailed Description and Different Types In Iowa, a Renunciation of Legacy in Favor of Other Family Members refers to the legal act of voluntarily giving up one's right to a portion or the entirety of an inheritance from a deceased person. This renunciation allows the renouncing party to redirect their share of the inheritance to other designated family members or beneficiaries. This process can be crucial in estate planning, ensuring that the assets are distributed according to the deceased person's wishes or to benefit other deserving family members. There are several types of Iowa Renunciation of Legacy in Favor of Other Family Members, each serving a specific purpose: 1. Partial Renunciation: This type of renunciation allows an heir to disclaim only a portion of their inheritance, allowing them to receive the remaining assets or benefits. This may be useful in cases where the heir wants to redirect a specific asset or safeguard their personal financial situation. 2. Full Renunciation: A full renunciation involves renouncing the entire inheritance. The renouncing party completely forfeits their right to any assets or benefits from the deceased person's estate. This can be done if the heir prefers to prioritize other family members or believes that they are not in a position to handle the responsibilities associated with the inheritance. 3. Contingent Renunciation: This form of renunciation is dependent on certain conditions being met. For example, an heir may renounce their legacy in favor of another family member only if the designated beneficiary is alive or mentally competent at the time of distribution. This helps ensure that the assets are directed to an appropriate recipient. 4. Posthumous Renunciation: In some cases, an heir may decide to renounce their legacy after the death of the decedent. This can be done if the heir realizes that accepting the inheritance would create financial burdens or conflicts within the family. However, it's important to note that renunciations made after accepting any benefits from the estate may not be legally enforceable. By utilizing a Renunciation of Legacy in Favor of Other Family Members, individuals in Iowa can carefully plan the distribution of their assets and provide for their loved ones accordingly. It allows for the fair and efficient allocation of assets while respecting the individual wishes of the deceased person. Consulting with an experienced estate planning attorney is crucial to ensure the renunciation process adheres to the Iowa laws and is properly documented. Key keywords: Iowa, renunciation, legacy, family members, inheritance, estate planning, assets, beneficiaries, heir, partial renunciation, full renunciation, contingent renunciation, posthumous renunciation, decedent, estate, distribution, estate planning attorney, Iowa laws.

Iowa Renunciation of Legacy in Favor of Other Family Members

Description

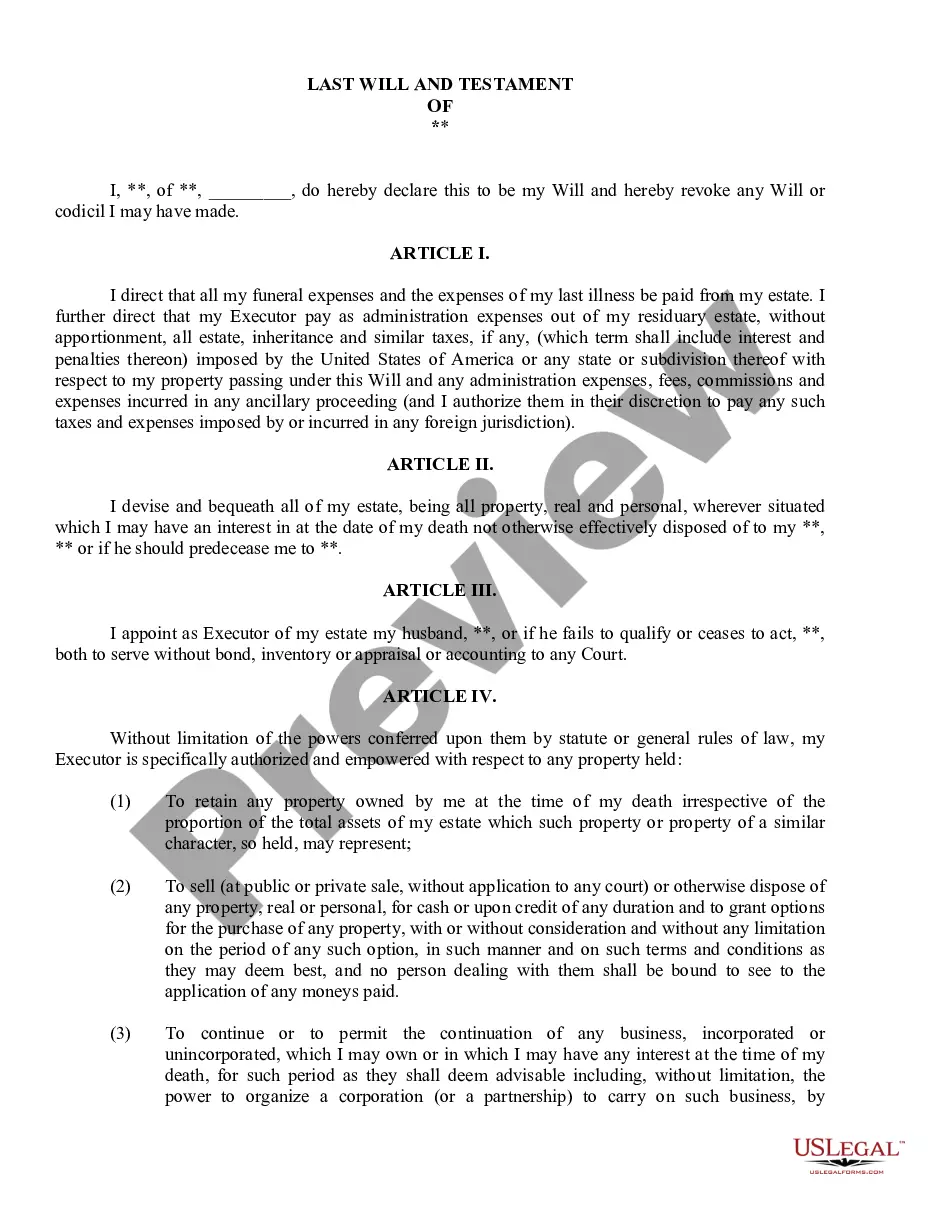

How to fill out Iowa Renunciation Of Legacy In Favor Of Other Family Members?

Choosing the right legitimate record format could be a have a problem. Naturally, there are plenty of themes available on the Internet, but how will you find the legitimate kind you require? Make use of the US Legal Forms internet site. The support provides a large number of themes, like the Iowa Renunciation of Legacy in Favor of Other Family Members, which can be used for enterprise and personal needs. Every one of the varieties are checked by professionals and meet federal and state requirements.

If you are currently signed up, log in to your profile and then click the Obtain key to find the Iowa Renunciation of Legacy in Favor of Other Family Members. Make use of your profile to search throughout the legitimate varieties you may have purchased formerly. Visit the My Forms tab of the profile and obtain one more version from the record you require.

If you are a fresh consumer of US Legal Forms, allow me to share simple instructions so that you can adhere to:

- First, ensure you have selected the proper kind for your area/region. It is possible to check out the shape while using Review key and look at the shape description to make certain this is the best for you.

- In the event the kind is not going to meet your requirements, make use of the Seach discipline to find the proper kind.

- Once you are positive that the shape is acceptable, select the Buy now key to find the kind.

- Pick the prices prepare you want and type in the needed info. Make your profile and purchase the transaction making use of your PayPal profile or bank card.

- Select the data file format and down load the legitimate record format to your system.

- Complete, edit and printing and sign the attained Iowa Renunciation of Legacy in Favor of Other Family Members.

US Legal Forms is definitely the largest local library of legitimate varieties that you can find different record themes. Make use of the company to down load expertly-produced papers that adhere to state requirements.

Form popularity

FAQ

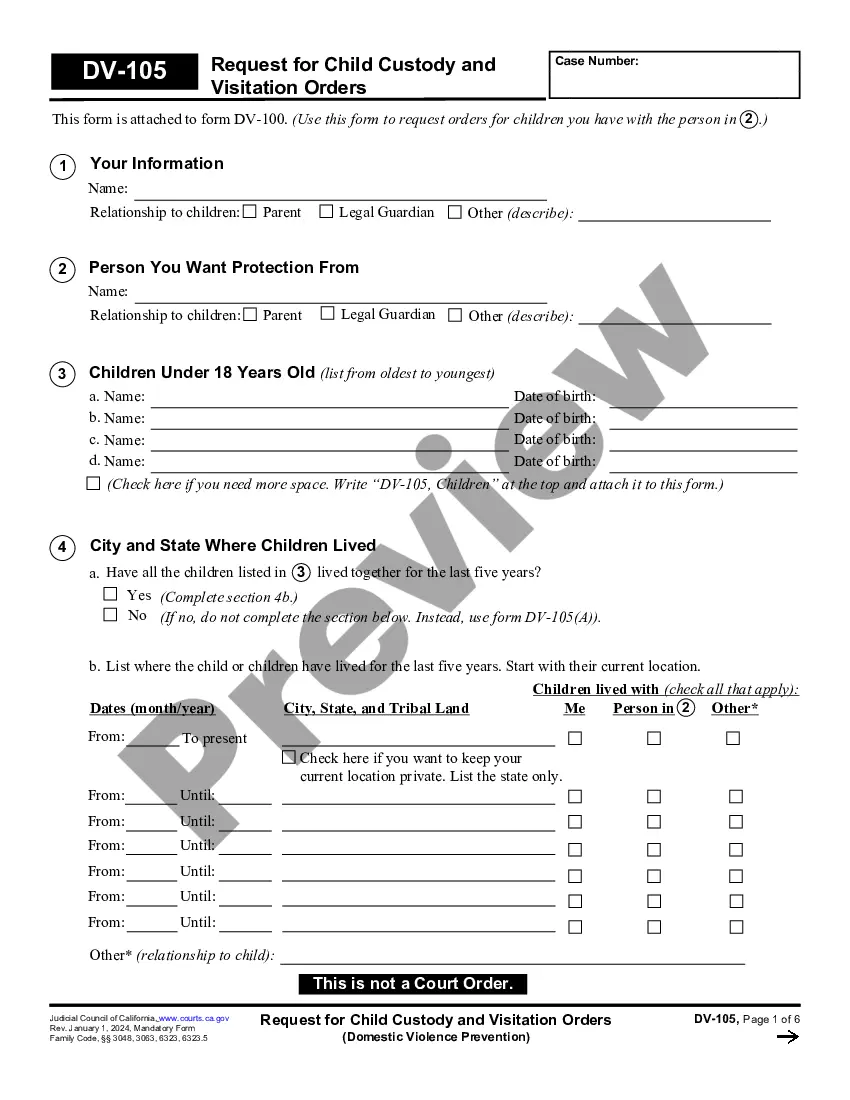

633.212 Share of surviving spouse if decedent left issue some of whom are not issue of surviving spouse. If the decedent dies intestate leaving a surviving spouse and leaving issue some of whom are not the issue of the surviving spouse, the surviving spouse shall receive the following share: 1.

If you die without a will in Iowa, your children will receive an "intestate share" of your property. The size of each child's share depends on how many children you have, whether or not you are married, and whether your spouse is also their parent (See the table above.)

When a person dies without a will, Iowa Code provides a surviving spouse with an exclusive right for 20 days to file with the court a petition to initiate administration of the estate. Other heirs in succession, starting with surviving children, if any, have an additional 10 days to file such a petition.

Your spouse will receive all your property if you either have no children or all of your children are also your spouse's children. If you have children from a previous marriage, your spouse will receive a portion of your property with the rest to be divided equally among your children from the previous marriage.

Unless the courts grant you an extension, Iowa Probate Code 633.361 affirms you'll have you three months starting from the day the court appoints you as executor to appraise, report, and inventory the deceased's estate accurately.

Unless the courts grant you an extension, Iowa Probate Code 633.361 affirms you'll have you three months starting from the day the court appoints you as executor to appraise, report, and inventory the deceased's estate accurately.

Notice by publication. In the case of proceedings against unknown persons or persons whose address or whereabouts are unknown, the court shall prescribe that notice may be served by publication within the time and in the manner provided by the rules of civil procedure.

'55 The slayer rule is designed to preserve our property-transfer system's integrity; it prevents a person from altering, the intended course of property succession by means of a wrongful slaying.