Iowa Sample Letter for Petition to Close Estate and For Other Relief

Description

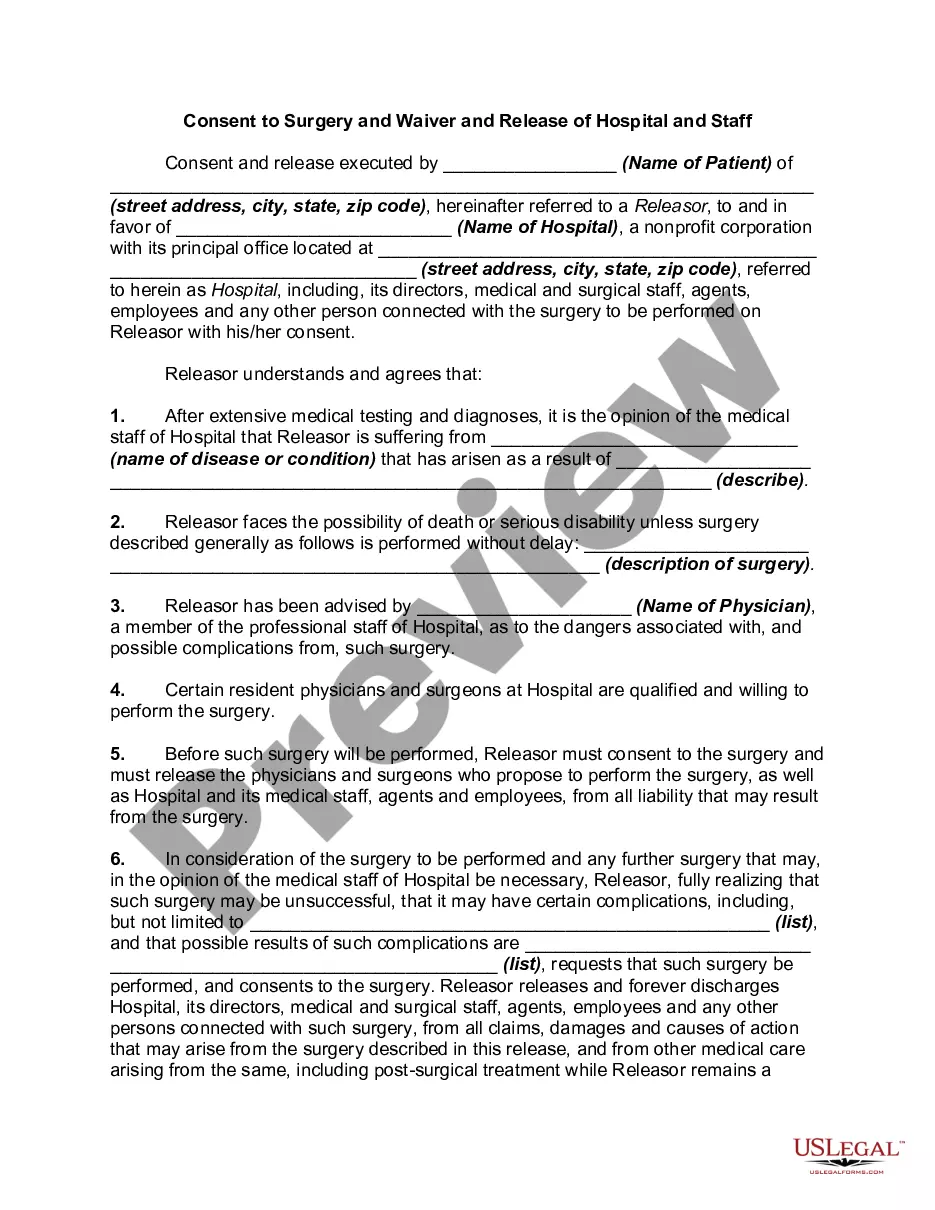

How to fill out Sample Letter For Petition To Close Estate And For Other Relief?

Discovering the right lawful record design might be a have difficulties. Naturally, there are a lot of templates accessible on the Internet, but how can you discover the lawful form you need? Use the US Legal Forms website. The support delivers a large number of templates, like the Iowa Sample Letter for Petition to Close Estate and For Other Relief, that can be used for business and personal requirements. Each of the kinds are checked by experts and fulfill federal and state needs.

If you are already registered, log in to the bank account and click the Obtain switch to obtain the Iowa Sample Letter for Petition to Close Estate and For Other Relief. Use your bank account to appear throughout the lawful kinds you have ordered in the past. Visit the My Forms tab of your own bank account and obtain an additional duplicate of the record you need.

If you are a whole new consumer of US Legal Forms, listed here are simple recommendations that you should follow:

- First, ensure you have selected the correct form for the metropolis/county. You are able to look over the shape utilizing the Preview switch and study the shape description to ensure it will be the right one for you.

- When the form does not fulfill your requirements, use the Seach discipline to find the appropriate form.

- Once you are positive that the shape is suitable, select the Buy now switch to obtain the form.

- Opt for the costs program you would like and enter the essential information. Create your bank account and pay for an order making use of your PayPal bank account or charge card.

- Opt for the document structure and acquire the lawful record design to the device.

- Complete, modify and produce and indicator the obtained Iowa Sample Letter for Petition to Close Estate and For Other Relief.

US Legal Forms is the biggest collection of lawful kinds in which you can see numerous record templates. Use the company to acquire professionally-created paperwork that follow condition needs.

Form popularity

FAQ

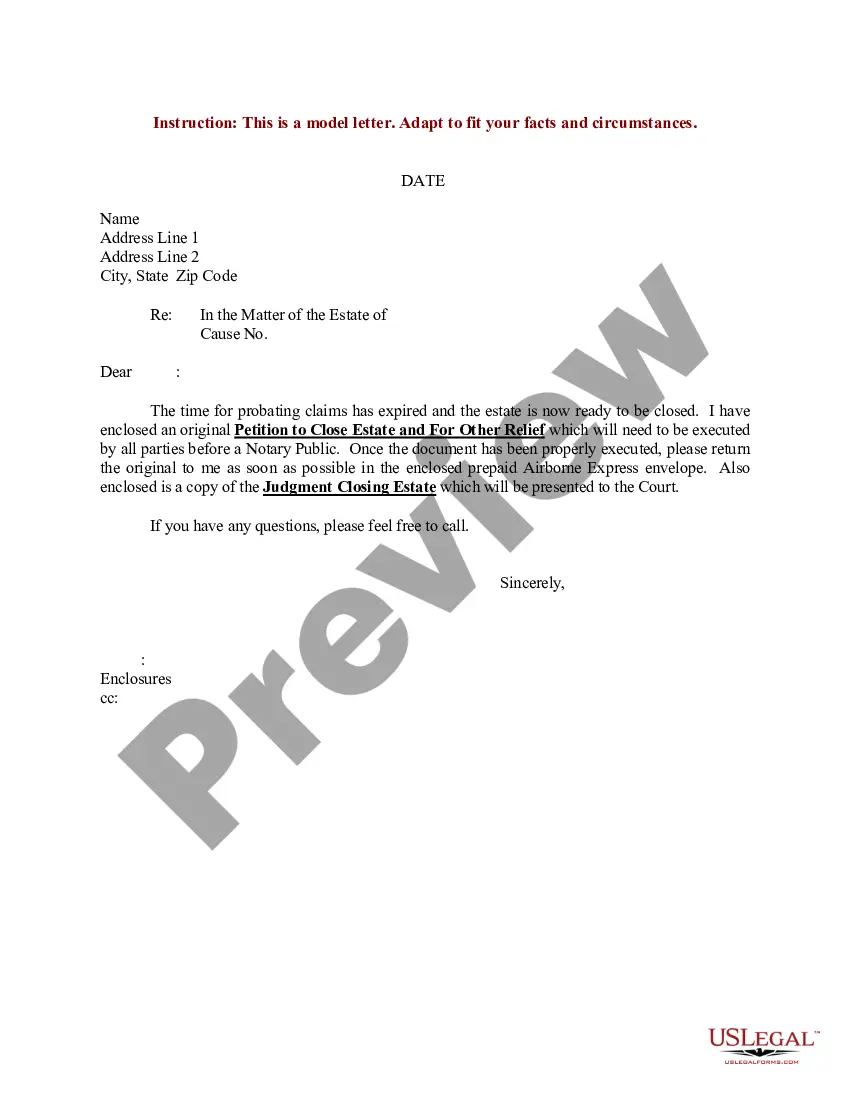

Iowa law requires that an estate be closed within 3 years after the second publication of the notice to creditors, unless a court grants an extension. Even while the estate is still in probate, however, beneficiaries may be able to receive part of their inheritance.

In ordering discovery of such materials when the required showing has been made, the court shall protect against disclosure of the mental impressions, conclusions, opinions, or legal theories of an attorney or other representative of a party concerning the litigation.

Most inheritance cases in Iowa will require probate. However, there are a few exceptions, such as having an estate with a value of less than $25,000 that only includes personal property.

Estates must be closed three years from the date of the second publication of these notices. In some cases, a judge may approve keeping the estate open for a longer period. How much can an attorney charge to probate an estate? Iowa law says that attorneys and Executors can each receive $220 for estates less than $5000.

Common Probate Fees in Iowa Court and filing fees (determined by the value of the estate) Probate attorney fees - if an attorney is hired. Personal Representative fees - Iowa is a reasonable compensation state; typical fee is two percent of the estate value; Executors can waive their fee (which would be taxable)

Is Probate Required in Iowa? Most inheritance cases in Iowa will require probate. However, there are a few exceptions, such as having an estate with a value of less than $25,000 that only includes personal property. If you name a beneficiary to your assets, you can also avoid probate.

Iowa probate follows this general flow: contact the court, get appointed as personal representative, submit will if it exists, inventory and submit valuations of all relevant assets, have the court and beneficiaries approve it, and then distribute the assets to beneficiaries.

Probate. In Iowa, a small estate is categorized based on the assets owned by the deceased at the time of death. To be considered a small estate, the sum of the assets must equal $200,000 or less.

Most inheritance cases in Iowa will require probate. However, there are a few exceptions, such as having an estate with a value of less than $25,000 that only includes personal property.

A lawyer can design a will and estate plan that will save your heirs time and money later. If your estate does not exceed a certain value (currently $25,000.00) and consists solely of personal property, a probate proceeding may not be required and the estate can be transferred with an affidavit.