Subject: Iowa Sample Letter for Closure of Estate — Expiration of Probating Claims Keywords: Iowa, sample letter, closure of estate, expiration, probating claims Dear [Executor/Personal Representative's Name], I hope this letter finds you well. As we approach the closure of the estate of [Deceased's Full Name], I would like to bring your attention to the upcoming expiration date of probating claims. Under the Iowa laws governing probate matters, there is a specific timeframe during which interested parties can present their claims against the estate for consideration. This period, known as the "probating claims period," allows creditors, heirs, and other individuals with potential claims to come forward and file their claims with the court. As the primary representative responsible for administering the estate, it is crucial to be aware of the expiration date for these claims. Failure to meet this deadline may result in these claims being barred, protecting the estate from any future legal liabilities arising from these claims. To assist you in efficiently closing the estate and ensuring that all probating claims are properly addressed, we have prepared a sample letter that you can use to notify potential claimants about the expiration of the probating claims period. Below, you will find two types of sample letters for your convenience: 1. Sample Letter for Closure of Estate — Expiration of Probating Claims This letter is intended to inform potential claimants that the probating claims period is coming to an end. It should provide detailed instructions on how they can submit their claims before the expiration date. 2. Sample Letter for Closure of Estate — Expiration of Probating Claims (Reminder) This letter is meant to serve as a friendly reminder to any potential claimants who may have been previously notified but have yet to submit their claims. It should emphasize the approaching expiration date and the need to act swiftly. Please note that these sample letters are to be used as a reference only and may require personalization based on the specific circumstances of the estate. You can modify them as per your requirements, ensuring all necessary information is provided and clearly stated. Enclosed with this letter, you will find the two sample letters mentioned above. We trust that these resources will be helpful in guiding you through the process of notifying potential claimants and ultimately closing the estate in accordance with Iowa probate laws. Should you have any questions or require further assistance, please do not hesitate to reach out to us. We are here to support you throughout this process. Thank you for your attention to this matter, and we wish you success in the overall administration of the estate. Sincerely, [Your Name] [Your Title/Organization]

Iowa Sample Letter for Closure of Estate - Expiration of Probating Claims

Description

How to fill out Iowa Sample Letter For Closure Of Estate - Expiration Of Probating Claims?

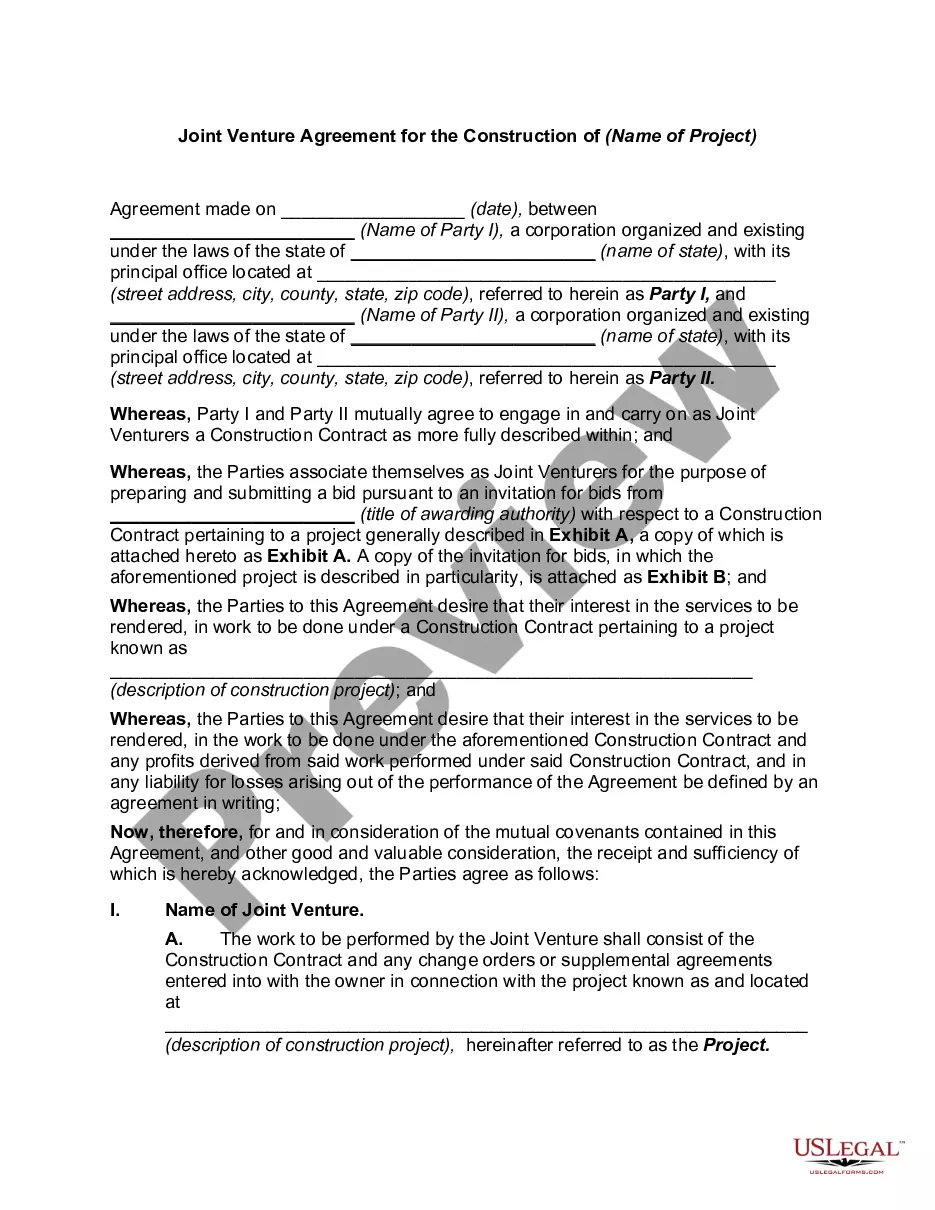

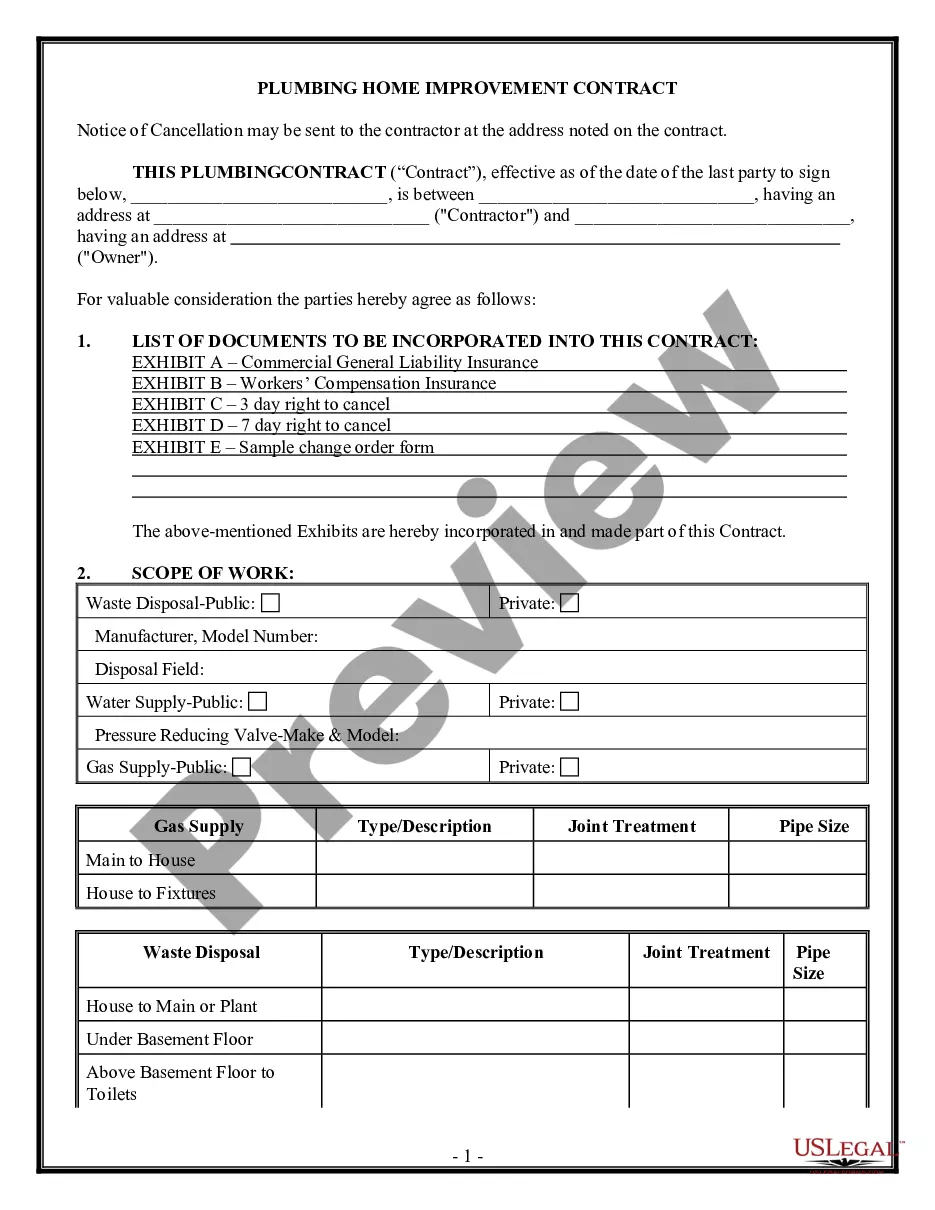

Choosing the best lawful papers template can be quite a battle. Obviously, there are a lot of themes available online, but how do you discover the lawful kind you need? Utilize the US Legal Forms site. The service offers thousands of themes, like the Iowa Sample Letter for Closure of Estate - Expiration of Probating Claims, that you can use for company and personal needs. Every one of the forms are checked by pros and meet up with federal and state needs.

When you are currently registered, log in to your accounts and click on the Obtain button to obtain the Iowa Sample Letter for Closure of Estate - Expiration of Probating Claims. Make use of accounts to check with the lawful forms you have acquired in the past. Check out the My Forms tab of your respective accounts and have another duplicate from the papers you need.

When you are a fresh end user of US Legal Forms, listed here are basic directions that you can comply with:

- Very first, make certain you have chosen the appropriate kind to your area/state. You can look through the form making use of the Review button and study the form information to make certain it is the right one for you.

- In case the kind does not meet up with your expectations, take advantage of the Seach area to get the proper kind.

- When you are certain the form would work, click the Get now button to obtain the kind.

- Pick the pricing strategy you desire and type in the needed details. Build your accounts and pay for an order utilizing your PayPal accounts or Visa or Mastercard.

- Opt for the document structure and obtain the lawful papers template to your product.

- Complete, edit and print out and sign the received Iowa Sample Letter for Closure of Estate - Expiration of Probating Claims.

US Legal Forms is the largest collection of lawful forms where you can discover numerous papers themes. Utilize the service to obtain professionally-produced paperwork that comply with condition needs.

Form popularity

FAQ

Unless the courts grant you an extension, Iowa Probate Code 633.361 affirms you'll have you three months starting from the day the court appoints you as executor to appraise, report, and inventory the deceased's estate accurately.

While there is no specific timeline, a person with possession of the will must file it after learning of the person's death. By filing the will promptly, you can begin the probate process as soon as possible.

Iowa law provides that a surviving spouse is entitled to receive a minimum amount of the estate known as the "elective share." Essentially, the surviving spouse is entitled to one-third the value of certain property owned by the deceased spouse, which may include personal property, real estate, financial instruments, ...

Is Probate Required in Iowa? Most inheritance cases in Iowa will require probate. However, there are a few exceptions, such as having an estate with a value of less than $25,000 that only includes personal property. If you name a beneficiary to your assets, you can also avoid probate.

Estates must be closed three years from the date of the second publication of these notices. In some cases, a judge may approve keeping the estate open for a longer period. How much can an attorney charge to probate an estate? Iowa law says that attorneys and Executors can each receive $220 for estates less than $5000.

If you have no descendants, your spouse will inherit everything. If you only have descendants from your relationship with your spouse, your spouse will still inherit everything.

Iowa probate follows this general flow: contact the court, get appointed as personal representative, submit will if it exists, inventory and submit valuations of all relevant assets, have the court and beneficiaries approve it, and then distribute the assets to beneficiaries.

If the property received by the surviving spouse under subsections 1, 2 and 3 of this section is not equal in value to the sum of fifty thousand dollars, then so much additional of any remaining homestead interest and of the remaining real and personal property of the decedent that is subject to payment of debts and ...

In most situations, your surviving spouse and your children from the previous relationship will split your property 50/50. However, your spouse's share must always equal at least $50,000. If the amount falls short, it will be made up from the property left to your children.

Unless the courts grant you an extension, Iowa Probate Code 633.361 affirms you'll have you three months starting from the day the court appoints you as executor to appraise, report, and inventory the deceased's estate accurately.