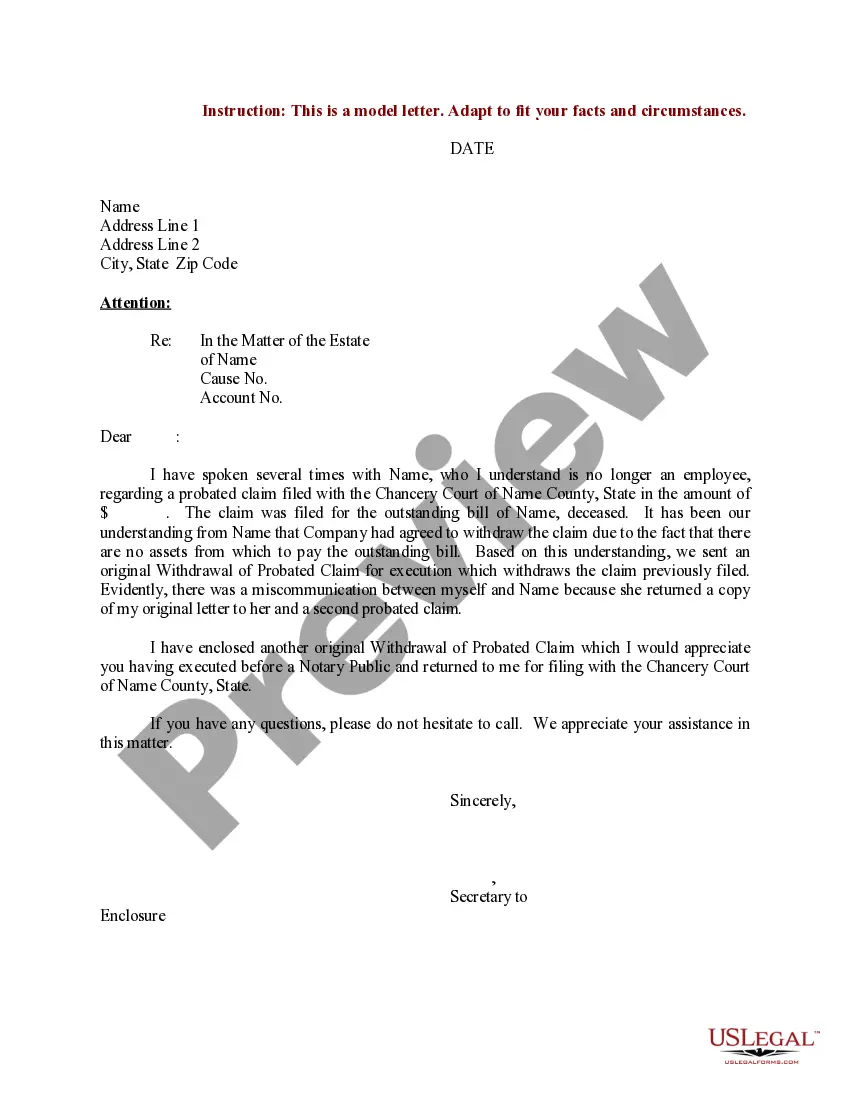

Iowa Sample Letter for Settlement of Outstanding Bill of Deceased

Description

How to fill out Sample Letter For Settlement Of Outstanding Bill Of Deceased?

US Legal Forms - one of several largest libraries of lawful varieties in the United States - provides an array of lawful document templates you can obtain or printing. While using site, you can find a large number of varieties for company and individual functions, categorized by categories, says, or key phrases.You can find the most recent types of varieties much like the Iowa Sample Letter for Settlement of Outstanding Bill of Deceased in seconds.

If you already possess a monthly subscription, log in and obtain Iowa Sample Letter for Settlement of Outstanding Bill of Deceased in the US Legal Forms collection. The Acquire option will appear on every form you view. You get access to all formerly saved varieties from the My Forms tab of your own bank account.

If you want to use US Legal Forms for the first time, listed here are basic recommendations to help you started:

- Be sure to have picked the proper form for the area/area. Go through the Review option to check the form`s articles. See the form outline to ensure that you have selected the correct form.

- In the event the form doesn`t match your specifications, use the Look for discipline towards the top of the display to discover the one which does.

- When you are happy with the form, validate your selection by visiting the Acquire now option. Then, opt for the rates plan you favor and supply your references to sign up for the bank account.

- Method the deal. Make use of your credit card or PayPal bank account to perform the deal.

- Choose the file format and obtain the form on your own product.

- Make modifications. Load, revise and printing and sign the saved Iowa Sample Letter for Settlement of Outstanding Bill of Deceased.

Each template you included in your account lacks an expiry day and it is the one you have forever. So, in order to obtain or printing another backup, just visit the My Forms area and then click on the form you will need.

Get access to the Iowa Sample Letter for Settlement of Outstanding Bill of Deceased with US Legal Forms, probably the most considerable collection of lawful document templates. Use a large number of skilled and status-particular templates that fulfill your business or individual requires and specifications.

Form popularity

FAQ

A personal representative is an estate executor or administrator, or someone who has legal authority to pay debts from the estate. A personal representative's job is to make payments to survivors and handle the debts of someone who has died. When a loved one dies and debt collectors come calling consumerfinance.gov ? educator-tools ? wh... consumerfinance.gov ? educator-tools ? wh...

The executor ? the person named in a will to carry out what it says after the person's death ? is responsible for settling the deceased person's debts. If there's no will, the court may appoint an administrator, personal representative, or universal successor and give them the power to settle the affairs of the estate. Debts and Deceased Relatives | Consumer Advice ftc.gov ? articles ? debts-and-deceased-r... ftc.gov ? articles ? debts-and-deceased-r...

When someone dies, their debts are generally paid out of the money or property left in the estate. If the estate can't pay it and there's no one who shared responsibility for the debt, it may go unpaid. Generally, when a person dies, their money and property will go towards repaying their debt. Does a person's debt go away when they die? consumerfinance.gov ? ask-cfpb ? does-a-p... consumerfinance.gov ? ask-cfpb ? does-a-p...

Unfortunately, ?(Detail Deceased's name) ?passed away on ?(Detail Date)?. I enclose a copy of their death certificate. They didn't leave behind any assets and there is no money to pay what they owe. Please consider writing off this debt because there is no prospect of you ever recovering any money towards it. Asking for a debt write-off when someone is deceased adviceni.net ? sites ? default ? files adviceni.net ? sites ? default ? files PDF

You are not responsible for someone else's debt. This is often called their estate. If there is no estate, or the estate can't pay, then the debt generally will not be paid.

Additional examples of unsecured debt include medical debt and most types of credit card debt. If you die with unsecured debt, repayment becomes the responsibility of your estate. Your legal estate refers to all the assets, property and money left behind by you or another deceased person when they die.

The FTC guide shows that, apart from some specific instances involving co-ownership of assets and debt, surviving family members usually don't have to pay the debts of someone in their family who has died. However, the debt won't simply dissolve into thin air. When a person dies, their assets transfer to their estate.

It's important to remember that credit card debt does not automatically go away when someone dies. It must be paid by the estate or the co-signers on the account.