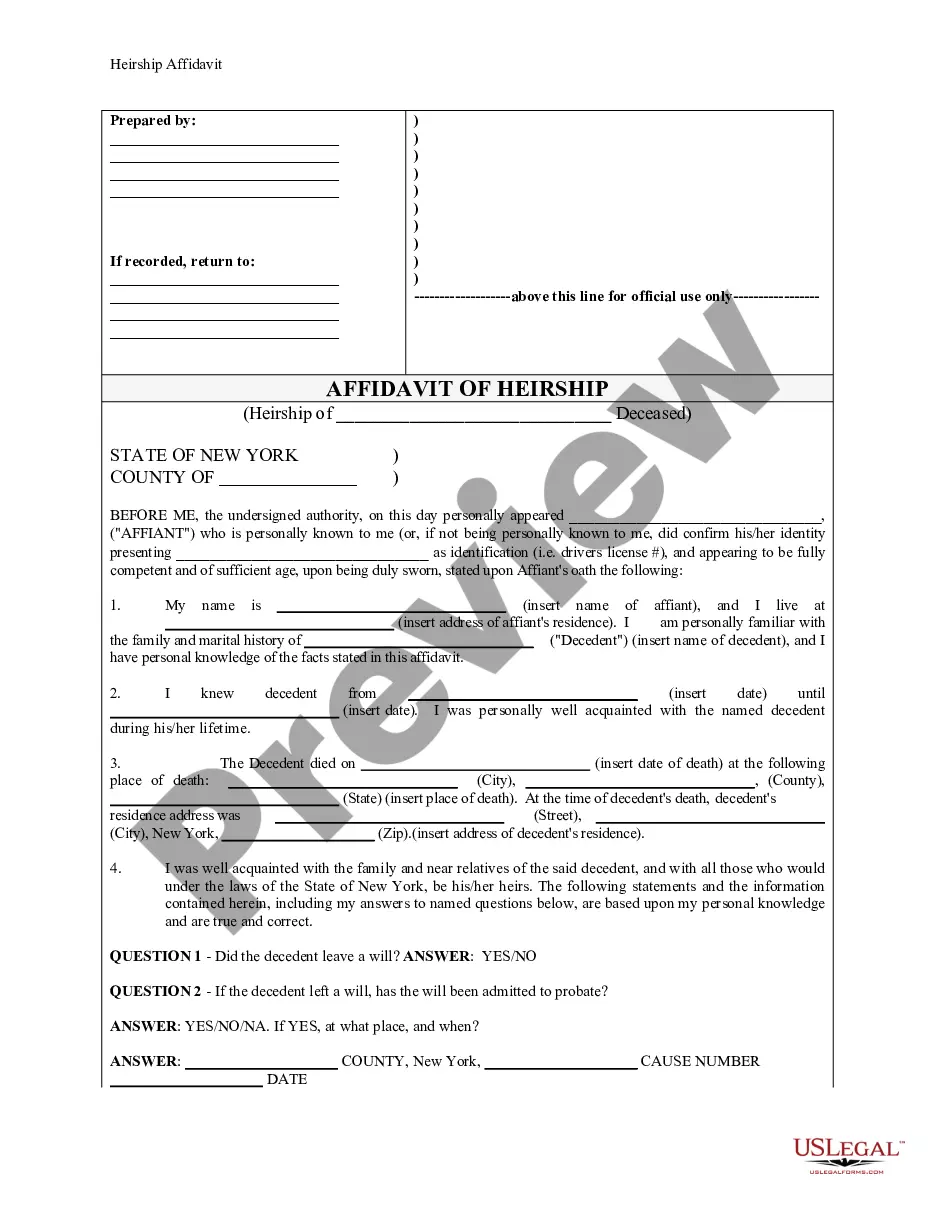

Iowa Family Limited Partnership Agreement and Certificate: A Comprehensive Overview The Iowa Family Limited Partnership Agreement (FLP) and Certificate embody an essential legal arrangement designed for families in Iowa seeking to safeguard their assets, maintain control, and enjoy various tax advantages. This powerful legal document enables families to establish a partnership, protect their wealth, and pass it on to future generations while minimizing potential risks and tax implications. A Family Limited Partnership is a type of partnership formed by family members, where at least one general partner oversees the partnership's day-to-day operations, while limited partners contribute capital and hold a more passive role. This agreement, recognized and governed by Iowa state laws, lays down the framework and terms under which the family partnership operates. Key elements incorporated within the Iowa Family Limited Partnership Agreement and Certificate include: 1. Formation and Purpose: This section elucidates the intentions behind forming the partnership, clarifying the objectives, assets involved, and the desired management structure. 2. Contributions and Interests: The agreement outlines the contributions made by each partner and delineates their respective partnership interests, specifying rights, responsibilities, and profit-sharing arrangements. 3. Management and Decision-Making: This portion details the authority, responsibilities, and limitations imposed on general and limited partners. It also addresses voting procedures, partner meetings, and mechanisms for dispute resolution. 4. Distribution of Profits and Losses: The agreement outlines the distribution of profits and losses among the partners, considering the contribution percentages and allocated interest discussed earlier. 5. Restrictions and Transfers: This section defines the rules and restrictions regarding transfers of partnership interest, including provisions for buy-sell agreements, control over admissions, withdrawals, and selling of partnership interests. 6. Dissolution and Liquidation: In case of partnership dissolution, this section provides guidelines for the liquidation of assets, debt settlement, and the distribution of remaining proceeds. Types of Iowa Family Limited Partnership Agreements: While there may not be specific variations of Family Limited Partnership Agreements in Iowa, families can tailor the agreement to fit their unique circumstances. Some common adaptations and considerations include: 1. Estate Planning FLP: Designed to facilitate efficient wealth transfer and tax minimization across generations, this FLP is commonly utilized to mitigate estate taxes while maintaining family control over assets. 2. Asset Protection FLP: Aimed at shielding family assets from potential lawsuits and creditors, this FLP provides an added layer of protection and can play a crucial role in risk management. 3. Business Succession FLP: Particularly relevant for family-owned businesses, this FLP arrangement ensures seamless transition and succession planning, safeguarding the family enterprise for the future. In summary, the Iowa Family Limited Partnership Agreement and Certificate serve as a vital instrument for families to maintain control over their assets, safeguard their wealth, and enjoy numerous fiscal benefits. Adaptable to different family circumstances and designed to meet the distinct needs of various situations, this comprehensive legal agreement facilitates efficient wealth transfer, asset protection, and successful business succession for Iowa families.

Iowa Family Limited Partnership Agreement and Certificate

Description

How to fill out Iowa Family Limited Partnership Agreement And Certificate?

If you have to full, down load, or printing legitimate file layouts, use US Legal Forms, the most important selection of legitimate types, which can be found online. Take advantage of the site`s simple and easy practical look for to discover the files you will need. Various layouts for business and specific reasons are sorted by categories and claims, or keywords. Use US Legal Forms to discover the Iowa Family Limited Partnership Agreement and Certificate in just a couple of click throughs.

When you are previously a US Legal Forms client, log in to your profile and click on the Down load option to obtain the Iowa Family Limited Partnership Agreement and Certificate. You may also gain access to types you in the past acquired from the My Forms tab of your profile.

Should you use US Legal Forms the first time, follow the instructions under:

- Step 1. Be sure you have selected the shape for that right area/land.

- Step 2. Take advantage of the Review method to look over the form`s information. Don`t neglect to read through the information.

- Step 3. When you are unsatisfied using the form, take advantage of the Lookup discipline near the top of the display to find other models from the legitimate form design.

- Step 4. When you have discovered the shape you will need, click the Purchase now option. Choose the rates program you favor and put your qualifications to sign up for an profile.

- Step 5. Procedure the deal. You may use your bank card or PayPal profile to perform the deal.

- Step 6. Choose the file format from the legitimate form and down load it on your product.

- Step 7. Full, modify and printing or indication the Iowa Family Limited Partnership Agreement and Certificate.

Every legitimate file design you acquire is the one you have forever. You possess acces to every form you acquired inside your acccount. Go through the My Forms area and pick a form to printing or down load yet again.

Contend and down load, and printing the Iowa Family Limited Partnership Agreement and Certificate with US Legal Forms. There are millions of professional and status-distinct types you may use for your personal business or specific requires.