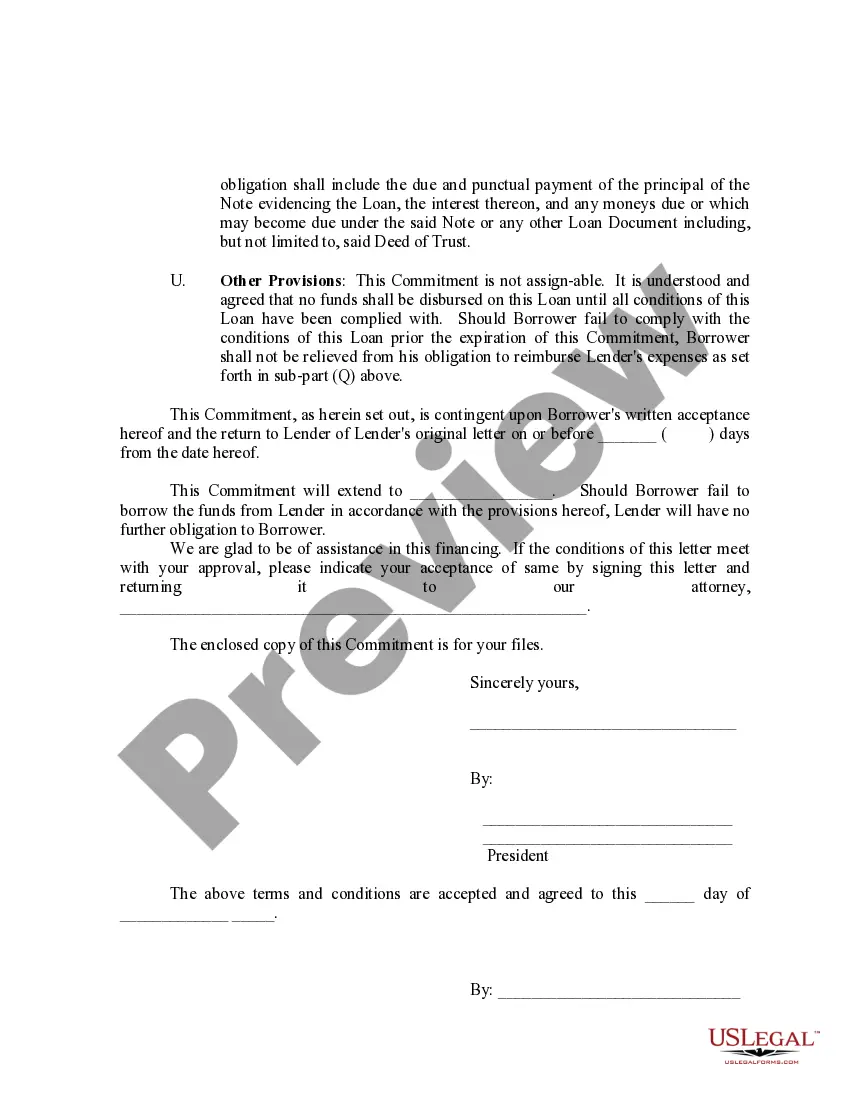

Iowa Loan Commitment Agreement Letter

Description

How to fill out Loan Commitment Agreement Letter?

If you wish to complete, obtain, or print lawful papers layouts, use US Legal Forms, the largest assortment of lawful kinds, which can be found on-line. Take advantage of the site`s simple and hassle-free search to get the paperwork you want. A variety of layouts for business and specific reasons are sorted by groups and says, or keywords. Use US Legal Forms to get the Iowa Loan Commitment Agreement Letter in just a number of click throughs.

If you are already a US Legal Forms client, log in to the bank account and click the Download button to get the Iowa Loan Commitment Agreement Letter. You can also entry kinds you previously delivered electronically from the My Forms tab of your bank account.

If you work with US Legal Forms initially, follow the instructions under:

- Step 1. Ensure you have chosen the form for your appropriate metropolis/country.

- Step 2. Utilize the Review solution to check out the form`s information. Don`t neglect to see the description.

- Step 3. If you are not satisfied together with the kind, use the Research discipline near the top of the screen to discover other models of your lawful kind template.

- Step 4. After you have located the form you want, select the Acquire now button. Select the pricing plan you choose and put your accreditations to register to have an bank account.

- Step 5. Process the financial transaction. You can use your bank card or PayPal bank account to accomplish the financial transaction.

- Step 6. Find the file format of your lawful kind and obtain it on your own gadget.

- Step 7. Complete, change and print or indicator the Iowa Loan Commitment Agreement Letter.

Every lawful papers template you acquire is the one you have permanently. You possess acces to each and every kind you delivered electronically with your acccount. Select the My Forms area and decide on a kind to print or obtain once again.

Remain competitive and obtain, and print the Iowa Loan Commitment Agreement Letter with US Legal Forms. There are millions of professional and condition-certain kinds you can utilize for your business or specific requirements.

Form popularity

FAQ

You can get a mortgage commitment letter (conditional version) by going through the mortgage preapproval process. Usually, that involves filling out a form with your lender and providing them with some basic financial information. Most people take this step near the beginning of their home search.

Because commitment letters are legally binding agreements, terms should be precise and detailed and include all material terms. Any ambiguity in the terms outlined in the commitment letter will often be construed against the lender.

As long as nothing changes financially with the applicant during the house hunting phase and the home's appraisal value covers the loan amount, the loan commitment generally stands. However, the lender reserves the right to reduce the loan amount or deny the application.

A commitment letter is typically not the final approval for a loan or financing. While a commitment letter indicates that a lender is willing to provide funding, it is usually contingent upon certain conditions being met.

How long does it take to get a mortgage commitment letter? It can take 20 ? 45 days to receive a mortgage commitment letter from the time the paperwork is submitted.

What is a Letter of Commitment? A letter of commitment is a formal binding agreement between a lender and a borrower. It outlines the terms and conditions of the loan and the nature of the prospective loan. It serves as the agreement that initiates an official loan borrowing process.

How long does it take to get a loan commitment letter? It varies, but receiving a mortgage commitment letter generally takes three to six weeks. Once you submit your application with all required documents, an appraisal can be ordered, and the loan file can be processed.