A detailed description of what is Iowa Notice of Redemption of Preferred Stock: In the state of Iowa, a Notice of Redemption of Preferred Stock is a formal document that notifies preferred stockholders of a company's intent to redeem or repurchase their preferred shares. This notice outlines the terms and conditions under which the redemption will take place, as well as the procedures that should be followed by the stockholders to redeem their shares. The Iowa Notice of Redemption of Preferred Stock serves as a legal notification to preferred stockholders about the forthcoming redemption. This typically occurs when a company wishes to retire or decrease its outstanding preferred stock, primarily to restructure its capital or eliminate a specific class of stock. By redeeming the preferred stock, the company aims to reduce its future dividend obligations and improve its financial standing or capital structure. This notice includes essential details such as the name of the issuing company, the class of preferred stock being redeemed, the total number of shares to be redeemed, the redemption price or the amount per share to be paid, the redemption date, and the method of payment. It may also contain information about any dividends or accrued interest that may be due to the stockholders upon redemption. It is crucial for stockholders to carefully review the Iowa Notice of Redemption of Preferred Stock to ensure they understand the terms and conditions of the redemption. Stockholders are typically required to complete specific actions, such as returning their stock certificates or completing a redemption request form, to complete the redemption process. Failure to comply with the procedures outlined in the notice may result in delays or complications in receiving the redemption proceeds. Different types of Iowa Notice of Redemption of Preferred Stock may exist based on the specific terms set by the company. Some common types include: 1. Optional Redemption: This type of redemption allows the company to choose whether to redeem the preferred stock and provides flexibility in determining the timing and quantity of shares to be redeemed. 2. Mandatory Redemption: In this case, the redemption of preferred stock is compulsory, usually triggered by a specific event such as a set date, change in control of the company, or violation of predetermined conditions. 3. Partial Redemption: This type allows the company to redeem only a portion of the outstanding preferred stock, leaving some shares outstanding. 4. Full Redemption: In contrast to partial redemption, a full redemption involves the complete repurchase of all outstanding preferred shares, aiming to eliminate the entire class of stock. In conclusion, an Iowa Notice of Redemption of Preferred Stock is a legally binding document that notifies preferred stockholders of a company's intention to repurchase their shares. It outlines the terms of redemption and the necessary procedures for stockholders to follow. Understanding the specific type of redemption being offered is crucial for stockholders wishing to redeem their shares effectively.

Iowa Notice of Redemption of Preferred Stock

Description

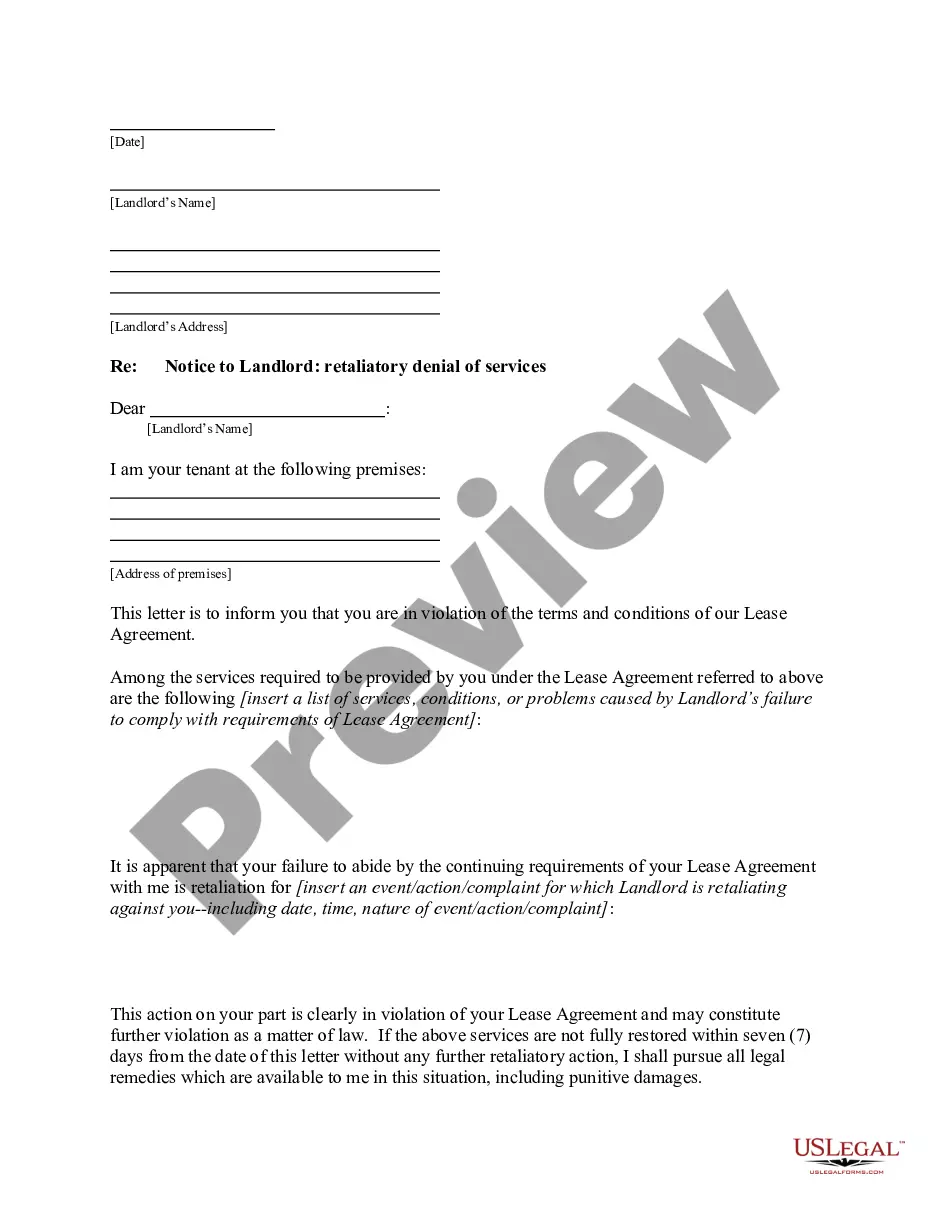

How to fill out Iowa Notice Of Redemption Of Preferred Stock?

You are able to commit hours online attempting to find the authorized record template that fits the state and federal demands you want. US Legal Forms provides 1000s of authorized types that are evaluated by experts. It is possible to down load or print out the Iowa Notice of Redemption of Preferred Stock from our support.

If you currently have a US Legal Forms profile, you may log in and click the Acquire option. After that, you may complete, modify, print out, or sign the Iowa Notice of Redemption of Preferred Stock. Each authorized record template you purchase is your own property permanently. To obtain an additional duplicate for any acquired form, proceed to the My Forms tab and click the corresponding option.

If you are using the US Legal Forms internet site the very first time, stick to the straightforward directions below:

- Initially, be sure that you have selected the correct record template for your state/metropolis that you pick. Look at the form explanation to ensure you have selected the appropriate form. If available, take advantage of the Preview option to look through the record template as well.

- In order to discover an additional version of the form, take advantage of the Look for discipline to discover the template that meets your needs and demands.

- Upon having found the template you would like, click Acquire now to proceed.

- Pick the rates prepare you would like, type your qualifications, and register for your account on US Legal Forms.

- Full the purchase. You can use your Visa or Mastercard or PayPal profile to fund the authorized form.

- Pick the structure of the record and down load it for your product.

- Make modifications for your record if necessary. You are able to complete, modify and sign and print out Iowa Notice of Redemption of Preferred Stock.

Acquire and print out 1000s of record web templates while using US Legal Forms site, that offers the greatest collection of authorized types. Use skilled and express-particular web templates to tackle your business or individual demands.