Iowa Breakdown of Savings for Budget and Emergency Fund: A Comprehensive Overview In Iowa, understanding the breakdown of savings for budget and emergency funds is crucial for effective financial planning and preparedness. By allocating funds strategically, Iowans can secure their financial stability and be well-prepared for unexpected expenses. This detailed description explores the various types of savings and their breakdown, highlighting the importance of each category for Iowa residents. 1. Emergency Fund: The emergency fund is a vital component of financial planning in Iowa. It serves as a safety net for unexpected expenses, such as medical emergencies, car repairs, or sudden unemployment. A healthy emergency fund typically aims to cover three to six months' worth of living expenses. It provides individuals and families with peace of mind, knowing they have a financial cushion to rely on when faced with unforeseen circumstances. 2. Short-Term Savings: Short-term savings are designed to cover upcoming expenses or purchases within the next one to three years. This may include saving for a down payment on a house, purchasing a new vehicle, or even planning for a vacation. By allocating a portion of their budget to short-term savings, Iowans can achieve their goals without incurring excessive debt or financial stress. 3. Long-Term Savings: Long-term savings focus on building wealth and financial security over an extended period, typically for retirement. Iowans can contribute to retirement plans such as employer-sponsored 401(k) or individual retirement accounts (IRAs). Investing in long-term savings early allows individuals to benefit from compound interest, maximizing their retirement savings potential. 4. Education Savings: Education savings is an essential aspect for many Iowa families, especially when planning for their children's college education. College costs continue to rise, making it crucial to start saving early to mitigate the burden of student loans. Iowa's 529 plans, such as the College Savings Iowa, are tax-advantaged accounts specifically designed to save for education expenses. By allocating funds to education savings accounts, residents of Iowa can better prepare for their children's future education costs. 5. Savings for Major Life Events: This category includes saving for major life events such as weddings, buying a house, or starting a family. By setting aside funds specifically for these occasions, Iowans can avoid the stress of accumulating debt or compromising other financial goals. These savings act as a buffer, allowing individuals and families to enjoy these significant milestones without straining their overall budget. 6. Health Savings Account (HSA): For Iowa residents with high-deductible health insurance plans, health savings accounts provide an excellent avenue to save for medical expenses. Has offer tax advantages and allow individuals to contribute pre-tax dollars, which can later be withdrawn tax-free for qualified medical expenses. Allocating funds to an HSA ensures a safety net for health-related emergencies, minimizing the financial strain caused by medical bills. By responsibly allocating funds across these various savings categories, Iowans can achieve their short and long-term financial goals while safeguarding against unexpected emergencies. This comprehensive breakdown of savings for budget and emergency fund underscores the importance of each category in ensuring financial stability, preparedness, and long-term security for Iowa residents.

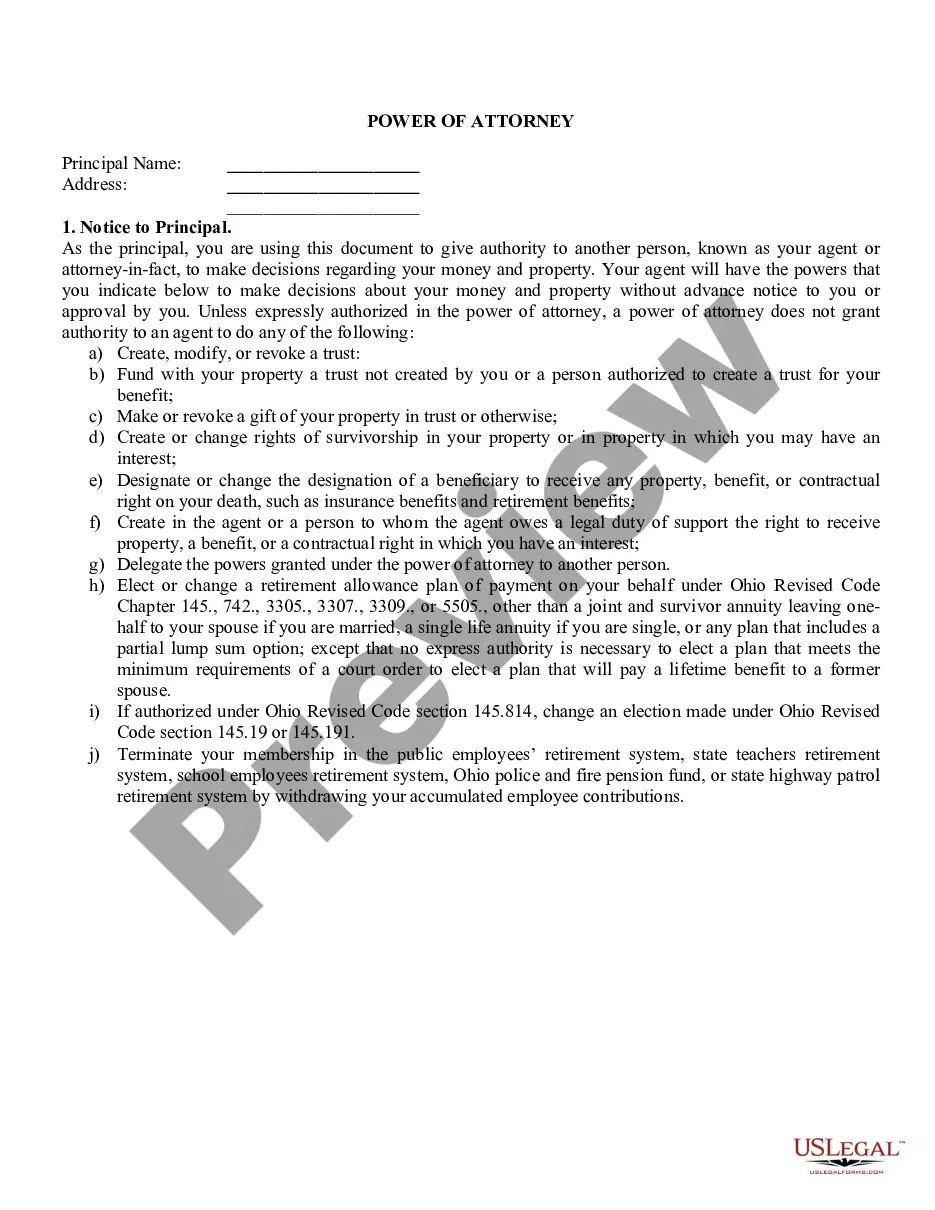

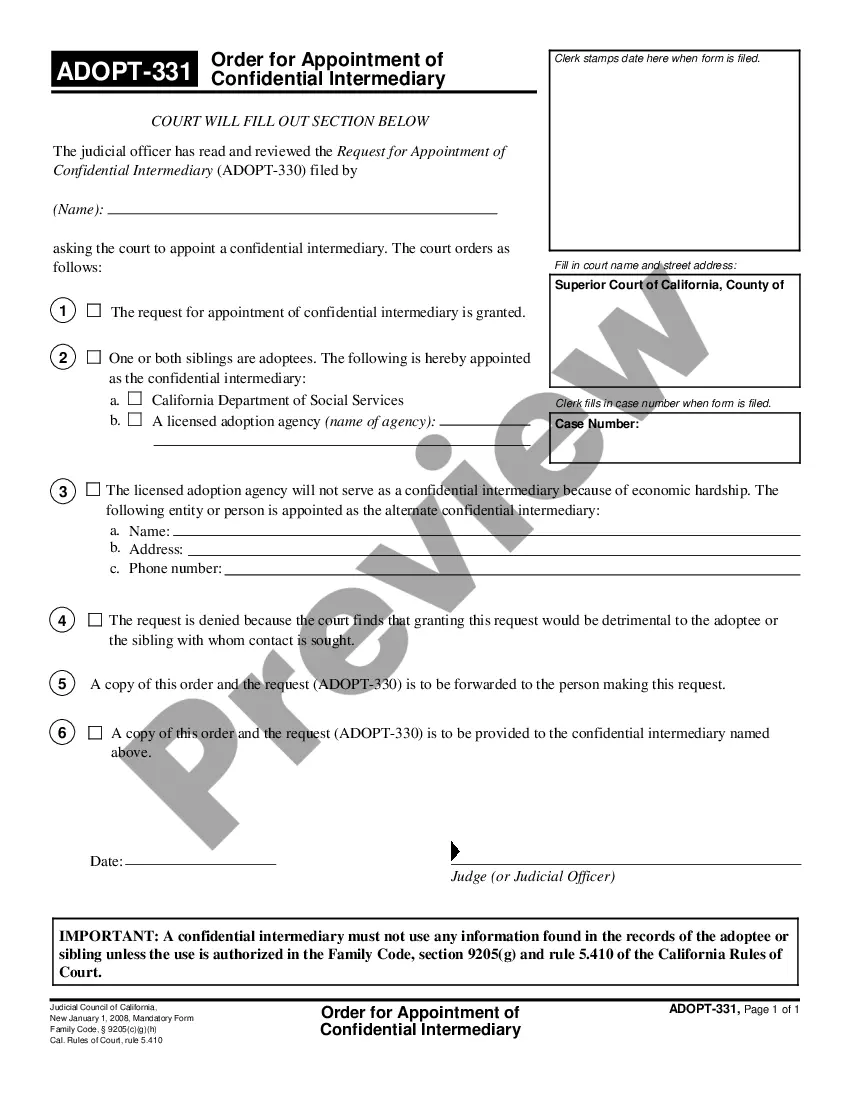

Iowa Breakdown of Savings for Budget and Emergency Fund

Description

How to fill out Iowa Breakdown Of Savings For Budget And Emergency Fund?

Finding the right authorized file template can be quite a have a problem. Needless to say, there are tons of layouts available on the Internet, but how do you discover the authorized develop you need? Take advantage of the US Legal Forms web site. The support provides 1000s of layouts, including the Iowa Breakdown of Savings for Budget and Emergency Fund, that you can use for business and private requires. Each of the forms are inspected by professionals and meet up with federal and state demands.

In case you are presently registered, log in for your account and click on the Obtain button to get the Iowa Breakdown of Savings for Budget and Emergency Fund. Utilize your account to look through the authorized forms you might have purchased earlier. Check out the My Forms tab of your respective account and get one more duplicate from the file you need.

In case you are a whole new customer of US Legal Forms, listed here are simple directions that you should stick to:

- Initial, make certain you have selected the right develop for your town/state. You are able to look through the shape utilizing the Preview button and look at the shape description to make sure this is the right one for you.

- When the develop does not meet up with your preferences, make use of the Seach area to discover the correct develop.

- Once you are certain that the shape would work, select the Buy now button to get the develop.

- Choose the pricing plan you want and type in the needed information and facts. Make your account and pay money for the order using your PayPal account or bank card.

- Opt for the data file structure and obtain the authorized file template for your product.

- Full, change and printing and indication the acquired Iowa Breakdown of Savings for Budget and Emergency Fund.

US Legal Forms is definitely the greatest library of authorized forms for which you will find different file layouts. Take advantage of the service to obtain appropriately-created paperwork that stick to status demands.

Form popularity

FAQ

5 Steps to Creating a BudgetStep 1: Determine Your Income. This amount should be your monthly take-home pay after taxes and other deductions.Step 2: Determine Your Expenses.Step 3: Choose Your Budget Plan.Step 4: Adjust Your Habits.Step 5: Live the Plan.

It recommends dividing your income in this way:50% - Spend for your needs. These include basic necessities like housing, food, utilities, health care (insurance, treatments), or car payments.30% - Spend for your wants.20% - Set aside for savings.

7 Steps to a Budget Made EasyStep 1: Set Realistic Goals.Step 2: Identify your Income and Expenses.Step 3: Separate Needs and Wants.Step 4: Design Your Budget.Step 5: Put Your Plan Into Action.Step 6: Seasonal Expenses.Step 7: Look Ahead.

Creating a budgetStep 1: Calculate your net income. The foundation of an effective budget is your net income.Step 2: Track your spending.Step 3: Set realistic goals.Step 4: Make a plan.Step 5: Adjust your spending to stay on budget.Step 6: Review your budget regularly.

While the size of your emergency fund will vary depending on your lifestyle, monthly costs, income, and dependents, the rule of thumb is to put away at least three to six months' worth of expenses.

Senator Elizabeth Warren popularized the so-called "50/20/30 budget rule" (sometimes labeled "50-30-20") in her book, All Your Worth: The Ultimate Lifetime Money Plan. The basic rule is to divide up after-tax income and allocate it to spend: 50% on needs, 30% on wants, and socking away 20% to savings.

The basic rule is to divide up after-tax income and allocate it to spend: 50% on needs, 30% on wants, and socking away 20% to savings.

The 50/30/20 budget divides your after-tax income into three separate categories: 50% for needs, 30% for wants and 20% for savings/financial goals. This approach is best for younger, average-income earners who have paid off their high-interest debt.

If You Are Paid Bi-Weekly: Multiply your take-home pay for one paycheck by the number of paychecks in a year: 26. Then divide this number by 12 to get your monthly income. If You Are Paid Weekly: Take your weekly pay and multiply it by the number of weeks in a year: 52.