Iowa Agreement Acquiring Share of Retiring Law Partner

Instant download

Description

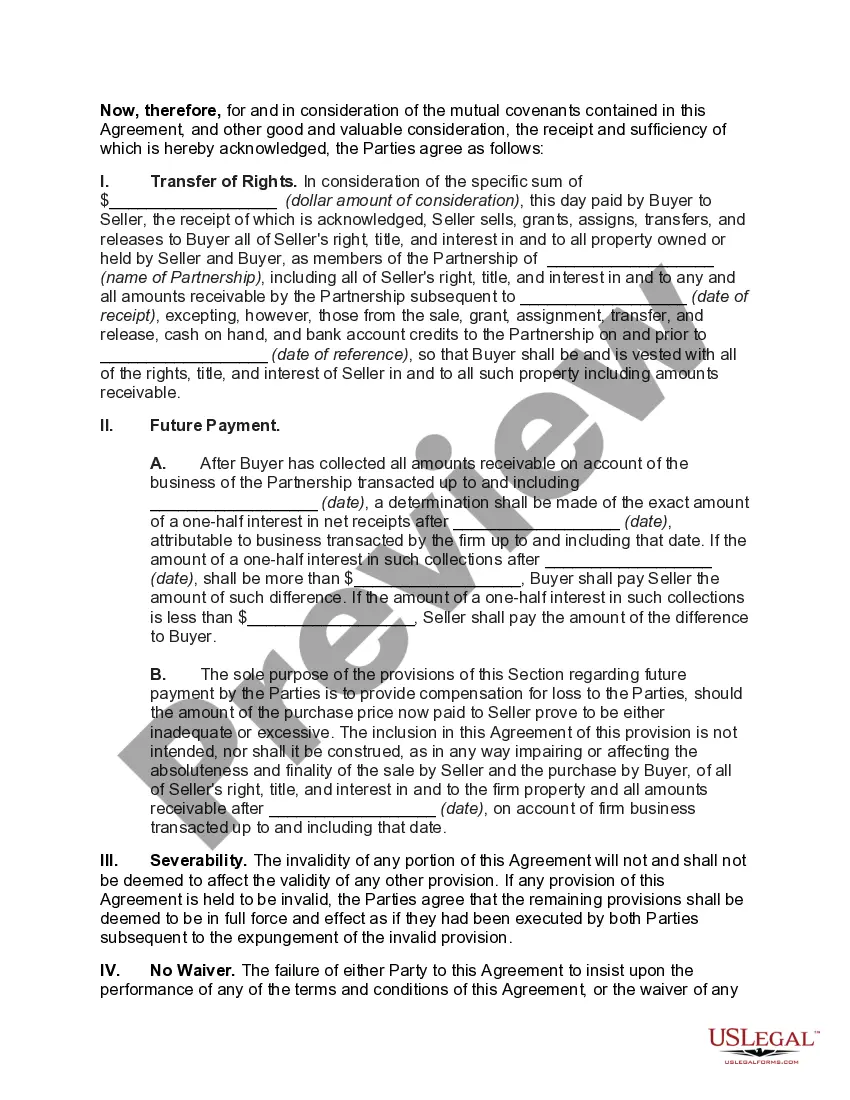

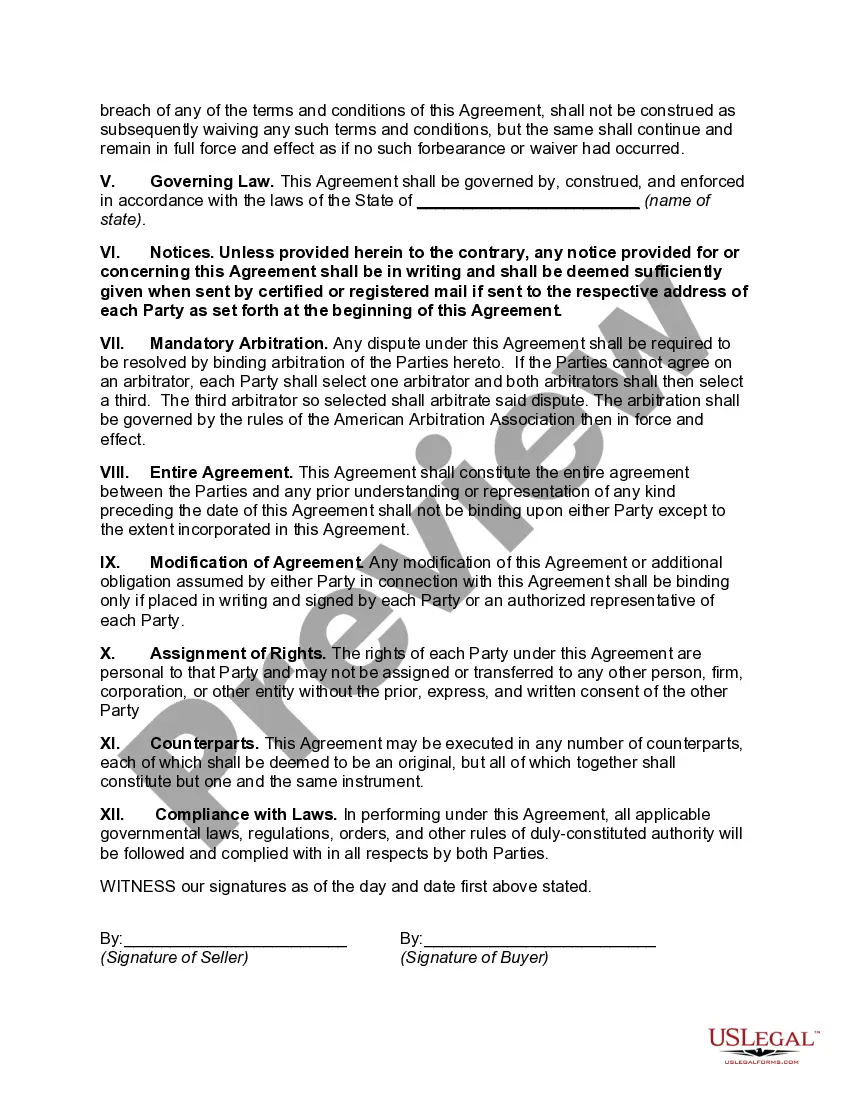

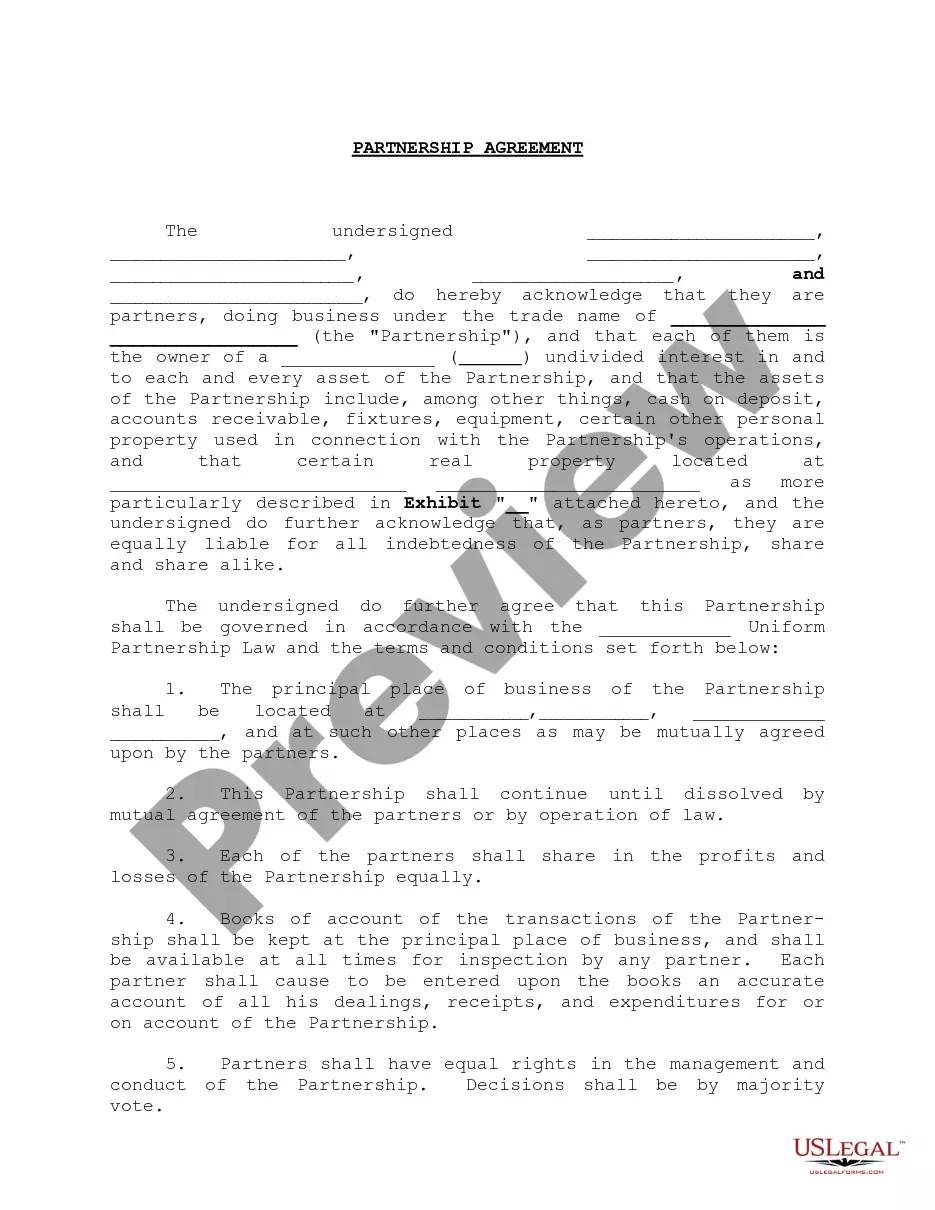

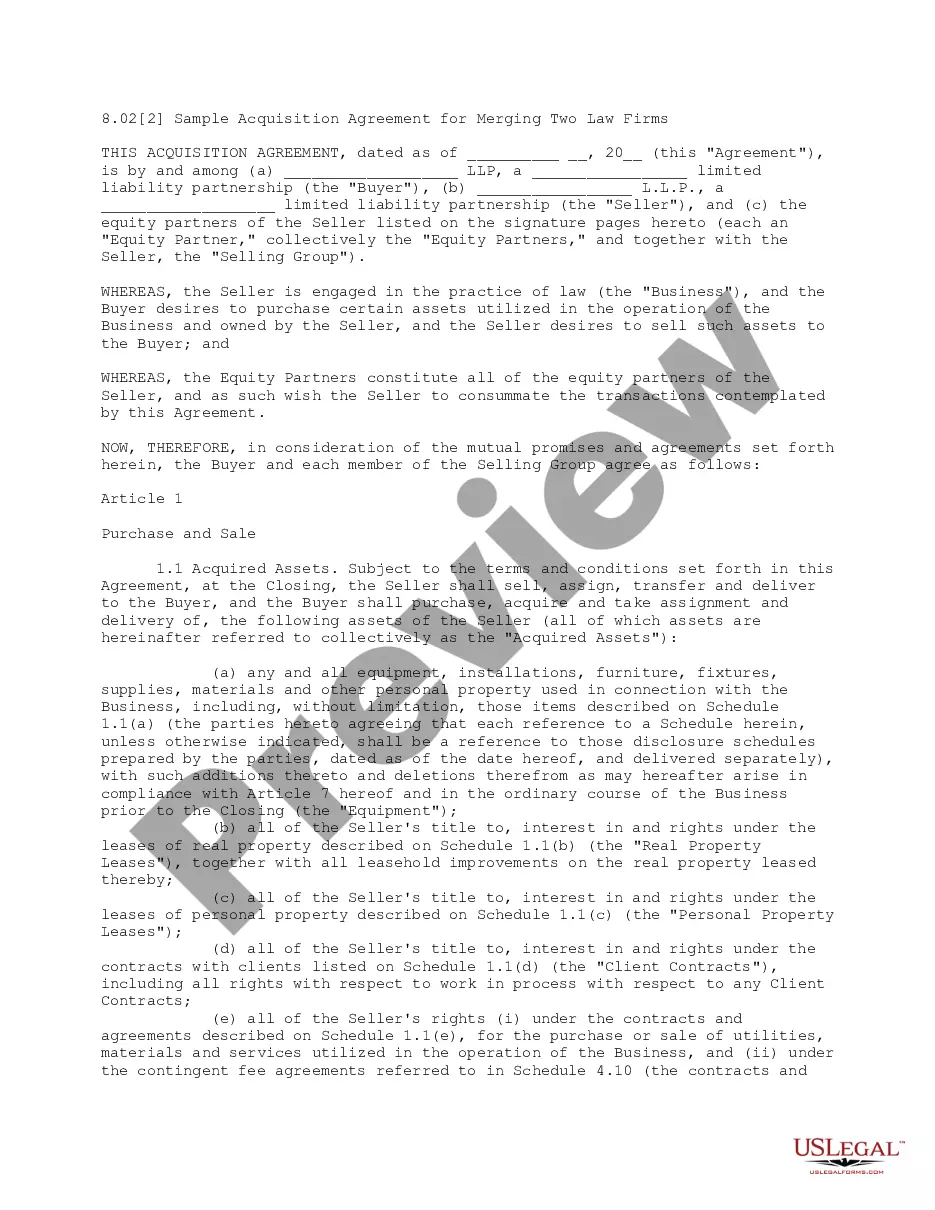

This is a simple agreement of an attorney purchasing the interest of a retiring law partner.

Free preview

How to fill out Agreement Acquiring Share Of Retiring Law Partner?

Are you in a location where you require documents for both business or personal purposes nearly every day.

There are numerous legal document templates accessible online, but finding ones you can trust isn't straightforward.

US Legal Forms offers thousands of template forms, including the Iowa Agreement Acquiring Share of Retiring Law Partner, which can be filled out to comply with federal and state requirements.

Once you find the appropriate form, click Acquire now.

Choose the payment plan you prefer, provide the required information to create your account, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- Then, you can download the Iowa Agreement Acquiring Share of Retiring Law Partner template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the document you need and ensure it corresponds to your specific city/state.

- Use the Review button to verify the form.

- Read the description to make sure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the document that fits your needs.