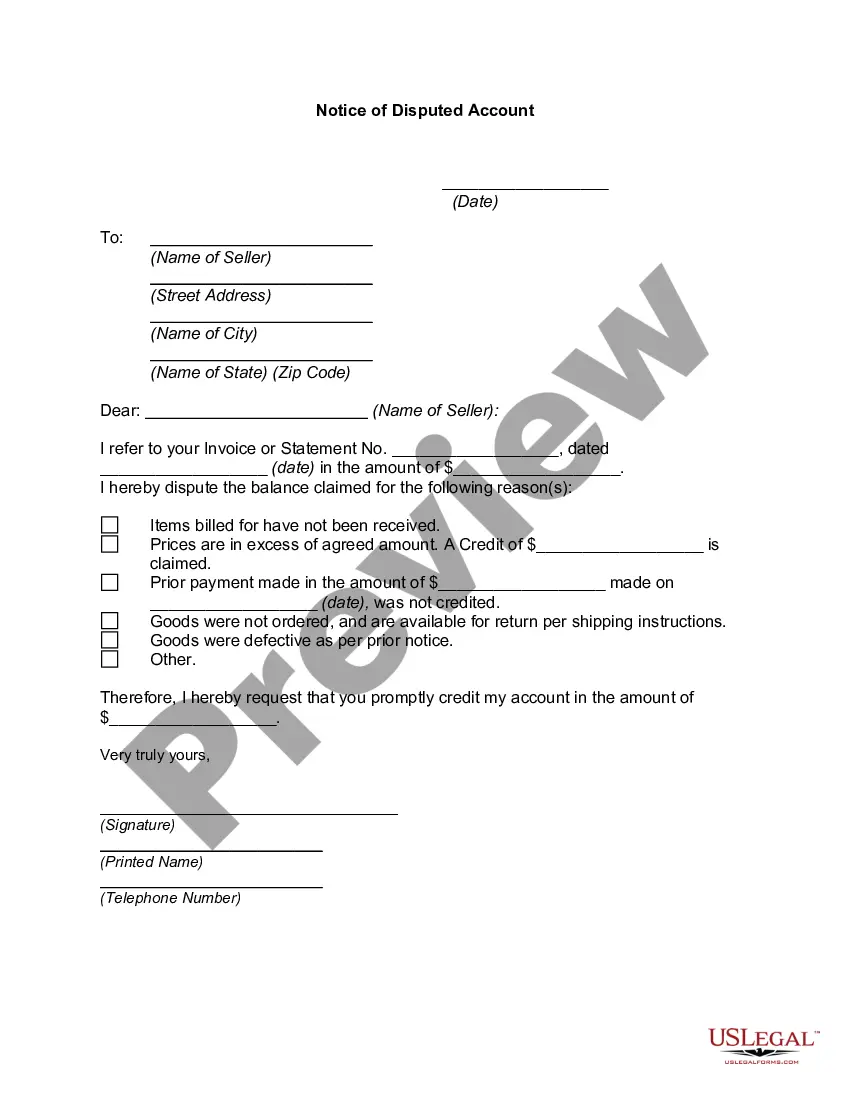

Iowa Notice of Disputed Account: Explained and Types If you reside in the state of Iowa and find yourself disputing an account, it is crucial to understand the Iowa Notice of Disputed Account process. This document is designed to protect consumer rights and ensure fair resolution for disputed accounts within the state. In this article, we will provide a comprehensive description of what the Iowa Notice of Disputed Account entails, its purpose, and the different types that may exist. The Iowa Notice of Disputed Account serves as a written communication between a consumer and a creditor or debt collector. It is utilized when a consumer believes there is an error or discrepancy related to their account, such as incorrect charges, inaccurate reporting, or unauthorized transactions. By submitting this notice, consumers can exercise their right to challenge the validity of the account and request a thorough investigation. This notice must adhere to specific guidelines set forth by the Iowa Consumer Credit Code (CCC) and the Fair Debt Collection Practices Act (FD CPA). It must be created in writing and sent via certified mail to the creditor or debt collector responsible for the account in question. The notice should include detailed information such as the consumer's name, address, account number, a clear description of the dispute, and any supporting documentation. Once the creditor or debt collector receives the Iowa Notice of Disputed Account, they are obligated to investigate the matter within a reasonable timeframe. During the investigation, they must review all relevant information provided by the consumer and correct any inaccuracies discovered. If necessary, the creditor or debt collector must update the account status, remove any erroneous entries, or cease collection activity until the dispute is resolved. It is important to note that while many disputed accounts can be resolved, there may be instances where an agreement cannot be reached, leading to further legal action. In such cases, consumers can seek assistance from an attorney to protect their rights and navigate the complexities of the legal system. Different types of Iowa Notice of Disputed Account: 1. Credit Card Dispute: This refers to disputes related to credit card accounts, including billing errors, fraudulent charges, or incorrect reporting by the credit card company or issuer. 2. Medical Billing Dispute: This type of dispute arises when there are errors in medical bills, such as incorrect charges, duplicate billing, or services not rendered. Consumers may submit an Iowa Notice of Disputed Account to address these issues with medical providers or billing agencies. 3. Debt Collection Dispute: In situations where consumers believe that an account has been inaccurately sent to a debt collection agency or the debt amount is incorrect, an Iowa Notice of Disputed Account can be submitted to initiate an investigation by the debt collector. 4. Loan Dispute: This category encompasses disputes concerning loans, such as personal loans, auto loans, or student loans. Any discrepancies in loan term, interest rates, or payment history can be addressed through an Iowa Notice of Disputed Account. Understanding the Iowa Notice of Disputed Account process and its applicable types is essential for consumers in Iowa who wish to challenge account-related issues. By utilizing this legal tool, individuals can protect their rights and seek fair resolution in cases of disputed accounts.

Iowa Notice of Disputed Account

Description

How to fill out Iowa Notice Of Disputed Account?

Have you ever entered a location where you require documents for either corporate or personal activities almost every day.

There are numerous legal document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms provides a vast array of form templates, such as the Iowa Notice of Disputed Account, which are designed to meet state and federal requirements.

Once you locate the correct form, click on Acquire now.

Select the pricing plan you desire, provide the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the Iowa Notice of Disputed Account template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/state.

- Utilize the Review button to assess the form.

- Examine the description to ensure that you have chosen the correct document.

- If the form is not what you are looking for, use the Search field to find the form that meets your specifications and requirements.

Form popularity

FAQ

While you generally have 30 days to file an appeal in Iowa, the actual time to write your appeal should be considered carefully. It is advisable to start drafting as soon as possible to gather your thoughts and ensure clarity in your case. If you’re dealing with an Iowa Notice of Disputed Account, utilizing our platform can provide you with the structure and resources needed to prepare a compelling appeal. Don’t rush; take the time to create a solid argument.

Filing a consumer complaint in Iowa involves contacting the Iowa Attorney General's Office or utilizing their online complaint form. It’s important to provide detailed information about your issue, including any relevant documentation. If your case pertains to an Iowa Notice of Disputed Account, our platform offers templates that can help you craft a comprehensive complaint. Thorough documentation can make a significant difference.

You have 30 days to file an appeal in Iowa, starting from the date of the final ruling. It's vital to act within this period, as missing the deadline may forfeit your rights to appeal. If your case involves an Iowa Notice of Disputed Account, securing support from a knowledgeable attorney can help keep you on track. Timeliness is key in legal processes.

The time limit to file an appeal in Iowa is generally 30 days from the date the judgment is issued. However, this can vary based on the type of case. If you're dealing with an Iowa Notice of Disputed Account, ensuring you meet this deadline is crucial for a successful appeal. We recommend consulting with a legal professional to avoid any missteps.

Filing for contempt in Iowa requires submitting a motion to the court that outlines the alleged contempt. This motion must detail how the other party failed to comply with a court order. If your situation involves an Iowa Notice of Disputed Account, consider using our platform to draft the necessary legal documents smoothly. Legal support can also help you navigate the complexities of contempt motions.

In Iowa, a case can typically be appealed for 30 days after the final judgment is entered. You'll want to ensure you file your appeal within this timeframe to preserve your rights. If you have an Iowa Notice of Disputed Account, seeking legal advice can help clarify your options, including appeal procedures. Remember, timely action is essential in any legal matter.

Generally, initiating a dispute does not hurt your credit score. However, while the dispute is ongoing, the status of the account might change, which can have temporary effects. When using the Iowa Notice of Disputed Account, you protect your rights and can ensure that any inaccuracies are corrected. It’s important to remain informed about how disputes can impact your credit profile.

When an account is disputed, the creditor must investigate the claim. They typically have a limited timeframe to respond to your dispute, especially when you reference the Iowa Notice of Disputed Account. During this process, the disputed item may be marked as 'under investigation' on your credit report. This leads to a temporary hold on the reporting of that item while the investigation occurs.

Writing a dispute letter to a bank involves clearly stating your account details and the reason for the dispute. Include the words 'Iowa Notice of Disputed Account' in your letter to emphasize its importance. It is crucial to describe the issue in detail and attach any relevant documents. A well-structured letter increases the likelihood of a prompt response from the bank.

To fill out a credit dispute form, gather all relevant information regarding the disputed account. Clearly state the reason for the dispute, and ensure you provide supporting documentation if available. When using the Iowa Notice of Disputed Account, be sure to include your contact information and sign the form. This clarity helps the creditor understand your situation and address your dispute effectively.

Interesting Questions

More info

Law Firm Search Court Case Search Court Rules/Reg's Search Court Rules Search To order copies of these materials, please contact the Court's Office for more information.