Title: Understanding the Iowa Agreement for Sale of All Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets Introduction: In Iowa, when a corporation sells all of its assets, including both tangible and intangible assets, an Agreement for Sale is required to ensure the smooth transfer of ownership and allocation of the purchase price. This article aims to provide a comprehensive overview of the Iowa Agreement for Sale of All Assets of a Corporation, emphasizing its key components and the allocation of the purchase price across different asset categories. I. Key Components of the Iowa Agreement for Sale of All Assets of a Corporation: 1. Parties involved: The agreement will identify the buyer(s) and seller(s) involved in the asset sale transaction, stating their legal names and addresses. 2. Assets included: The agreement will outline all tangible and intangible assets being sold, including but not limited to real estate, equipment, inventory, intellectual property rights, contracts, customer lists, and goodwill. It is crucial for both parties to have a complete understanding of the assets being transferred. 3. Purchase price and payment terms: The agreement specifies the total purchase price agreed upon by the buyer and seller, along with any down payment, lump-sum payments, or installments. The payment terms, including dates and methods of payment, are also addressed. 4. Representations and warranties: Both parties are likely to provide representations and warranties, ensuring that the assets being sold are legally owned by the seller, are free from encumbrances, and do not violate any laws or contracts. This section helps protect the buyer's interests while providing assurances to the seller. 5. Allocation of the purchase price: One of the significant aspects of the Iowa Agreement for Sale is the allocation of the purchase price across different asset categories, namely tangible and intangible assets. The agreement should specify the allocated value to each category to facilitate proper tax treatment for both parties. 6. Assumption and release of liabilities: The agreement may address the assumption of certain liabilities by the buyer, including outstanding debts, contractual obligations, and potential litigation. The seller may seek appropriate releases from future liability related to these assumed liabilities. II. Types of Iowa Agreements for Sale of All Assets with Allocation of Purchase Price: 1. Iowa Agreement for Sale of All Assets of a Corporation with Separate Allocation of Purchase Price: This type of agreement provides a separate allocation of the purchase price to each category of tangible and intangible assets, as well as potential tax implications of such allocations. 2. Iowa Agreement for Sale of All Assets of a Corporation with Proportional Allocation of Purchase Price: In this scenario, the purchase price is allocated proportionally based on the overall value of tangible and intangible assets. The agreement highlights the proportions used to allocate the purchase price to each category. 3. Iowa Agreement for Sale of All Assets of a Corporation with Contingent Allocation of Purchase Price: This type of agreement contemplates a contingent allocation, where part of the purchase price is determined based on the future performance or value of certain assets. This approach allows flexibility and negotiation based on specific business circumstances. Conclusion: The Iowa Agreement for Sale of All Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets is a crucial legal document that ensures a smooth and transparent transfer of ownership. With careful consideration of the key components and allocation of the purchase price, this agreement serves to protect the interests of both buyer and seller in Iowa's business asset sales transactions.

Iowa Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets

Description

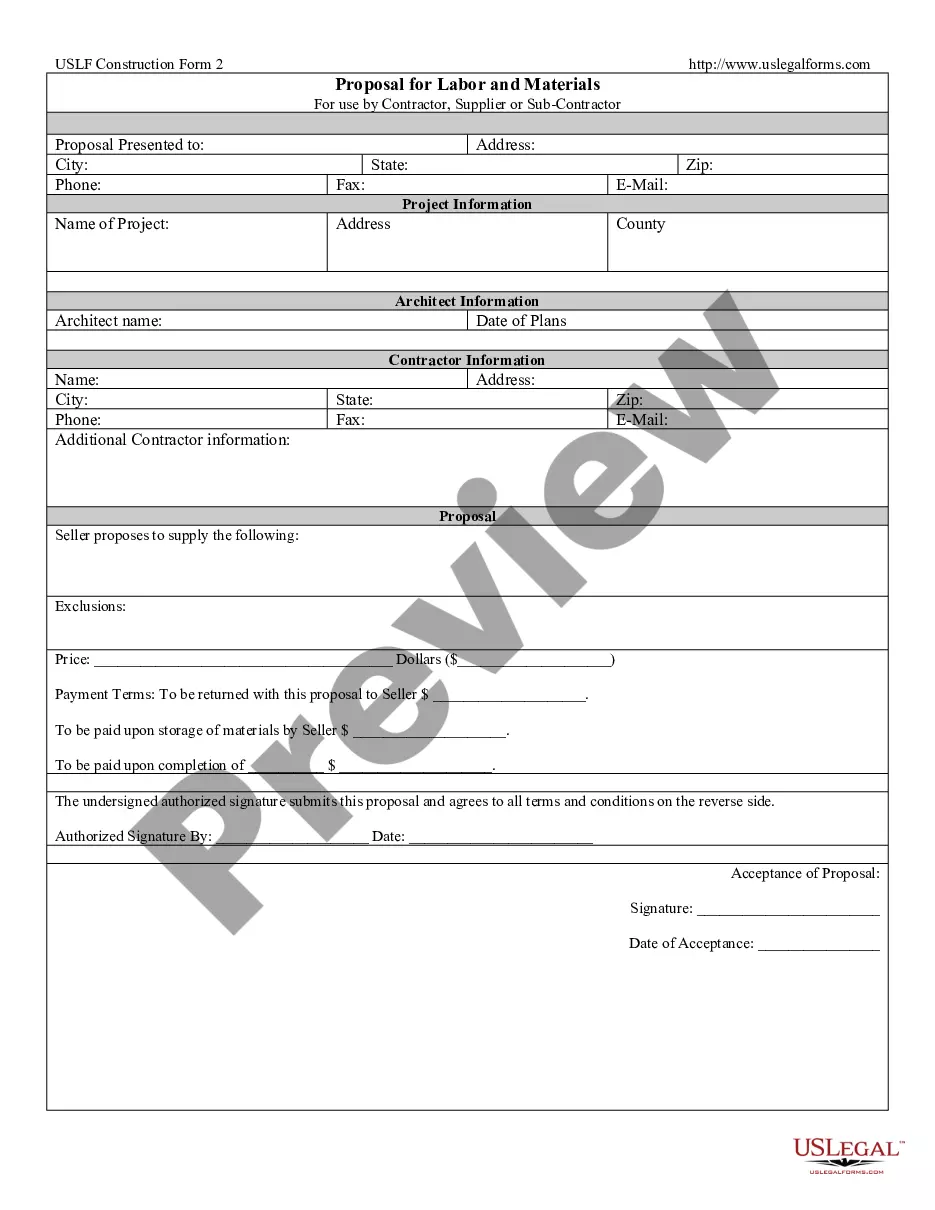

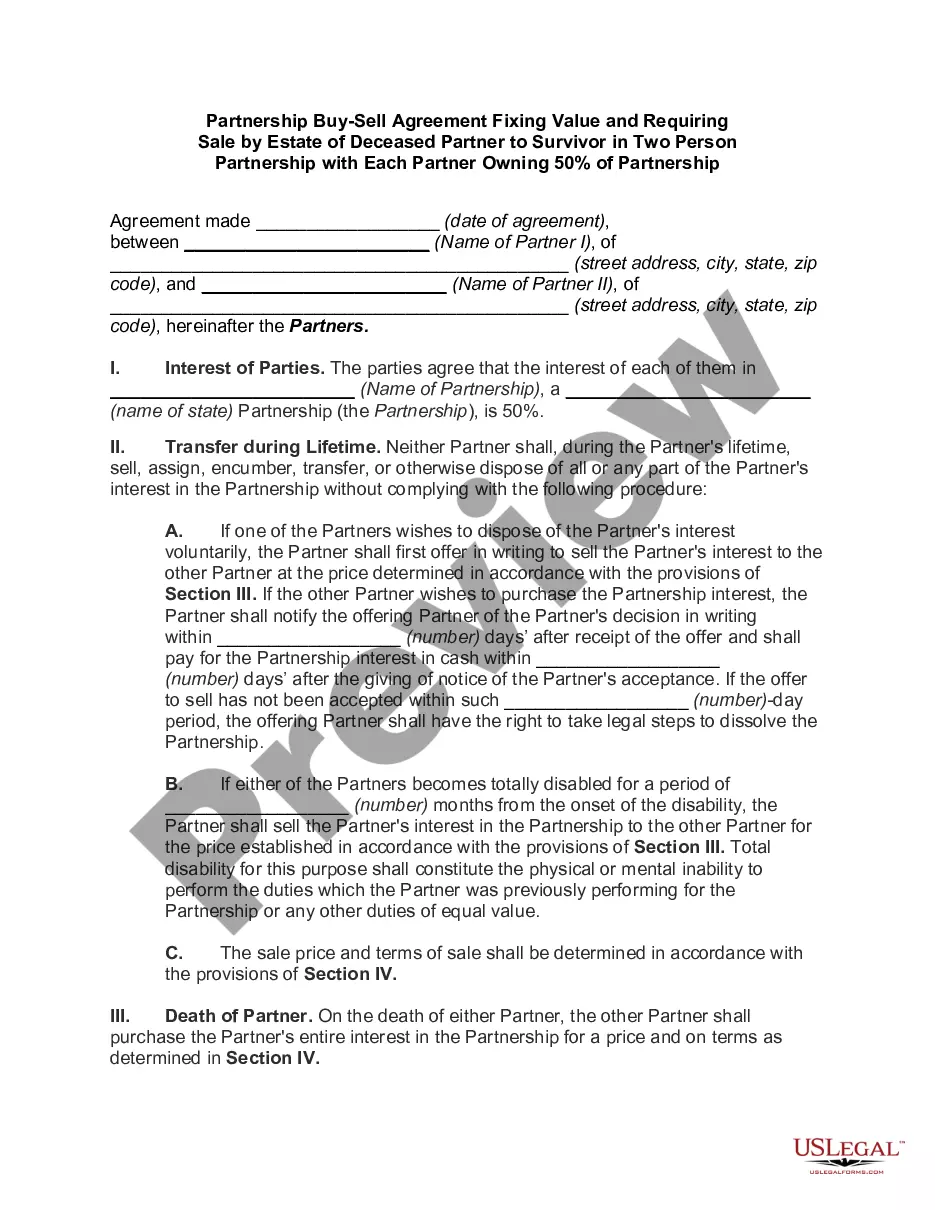

How to fill out Iowa Agreement For Sale Of All Assets Of A Corporation With Allocation Of Purchase Price To Tangible And Intangible Business Assets?

If you want to total, obtain, or print out lawful document web templates, use US Legal Forms, the greatest collection of lawful varieties, that can be found on the Internet. Take advantage of the site`s simple and easy practical search to discover the paperwork you want. Numerous web templates for company and personal reasons are sorted by groups and suggests, or search phrases. Use US Legal Forms to discover the Iowa Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets with a few mouse clicks.

In case you are presently a US Legal Forms client, log in in your accounts and then click the Down load button to obtain the Iowa Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets. You can even accessibility varieties you formerly saved inside the My Forms tab of your respective accounts.

If you use US Legal Forms the first time, follow the instructions below:

- Step 1. Ensure you have chosen the shape for your right city/nation.

- Step 2. Make use of the Preview choice to look through the form`s articles. Don`t neglect to learn the explanation.

- Step 3. In case you are unhappy with the form, take advantage of the Look for field at the top of the monitor to get other types from the lawful form design.

- Step 4. Upon having found the shape you want, go through the Acquire now button. Select the prices program you prefer and add your references to sign up for the accounts.

- Step 5. Procedure the purchase. You can use your bank card or PayPal accounts to finish the purchase.

- Step 6. Pick the structure from the lawful form and obtain it on your own device.

- Step 7. Complete, change and print out or indicator the Iowa Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets.

Every single lawful document design you buy is your own property for a long time. You have acces to each and every form you saved with your acccount. Go through the My Forms portion and decide on a form to print out or obtain again.

Be competitive and obtain, and print out the Iowa Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets with US Legal Forms. There are many skilled and condition-specific varieties you may use for your company or personal requires.