Iowa Assignment of Profits of Business is a legal agreement in which a business owner transfers their right to receive future profits from their business to another party. This allows the designated party to receive the profits on behalf of the business owner. In Iowa, there are two main types of Assignment of Profits of Business: 1. General Assignment of Profits: This type of assignment involves transferring all profit rights and future income generated by the business to another individual or entity. The assignee becomes entitled to receive all profits from the business for a specified period or until the assignment is revoked. 2. Limited Assignment of Profits: In this type of assignment, only a specific portion or percentage of the profits is transferred. The assignee has the right to collect and receive the assigned portion of profits according to the terms agreed upon in the assignment document. An Iowa Assignment of Profits of Business typically includes key details such as the names and contact information of the assignor (business owner) and the assignee (individual or entity receiving the profits). It also outlines the effective date of the assignment, the scope and duration of the assignment, and any restrictions or conditions imposed on the assignee's rights. This legal document serves various purposes, such as providing an individual an option to delegate their rights to receive profits when they are unable to personally manage their business affairs. It could also be utilized in the context of business estate planning, partnerships, or as a means to secure financing or pay off debts. It is important to consult with an attorney specializing in business law in Iowa to ensure that an Assignment of Profits of Business complies with all relevant legal requirements and to properly draft and execute the document.

Iowa Assignment of Profits of Business

Description

How to fill out Iowa Assignment Of Profits Of Business?

Are you presently inside a position in which you need files for sometimes company or individual uses virtually every day time? There are plenty of authorized papers templates available online, but finding ones you can rely isn`t easy. US Legal Forms delivers a large number of kind templates, such as the Iowa Assignment of Profits of Business, which are composed in order to meet state and federal specifications.

If you are already familiar with US Legal Forms website and also have your account, just log in. Next, you are able to obtain the Iowa Assignment of Profits of Business design.

If you do not come with an profile and would like to begin to use US Legal Forms, follow these steps:

- Discover the kind you want and ensure it is for your appropriate city/area.

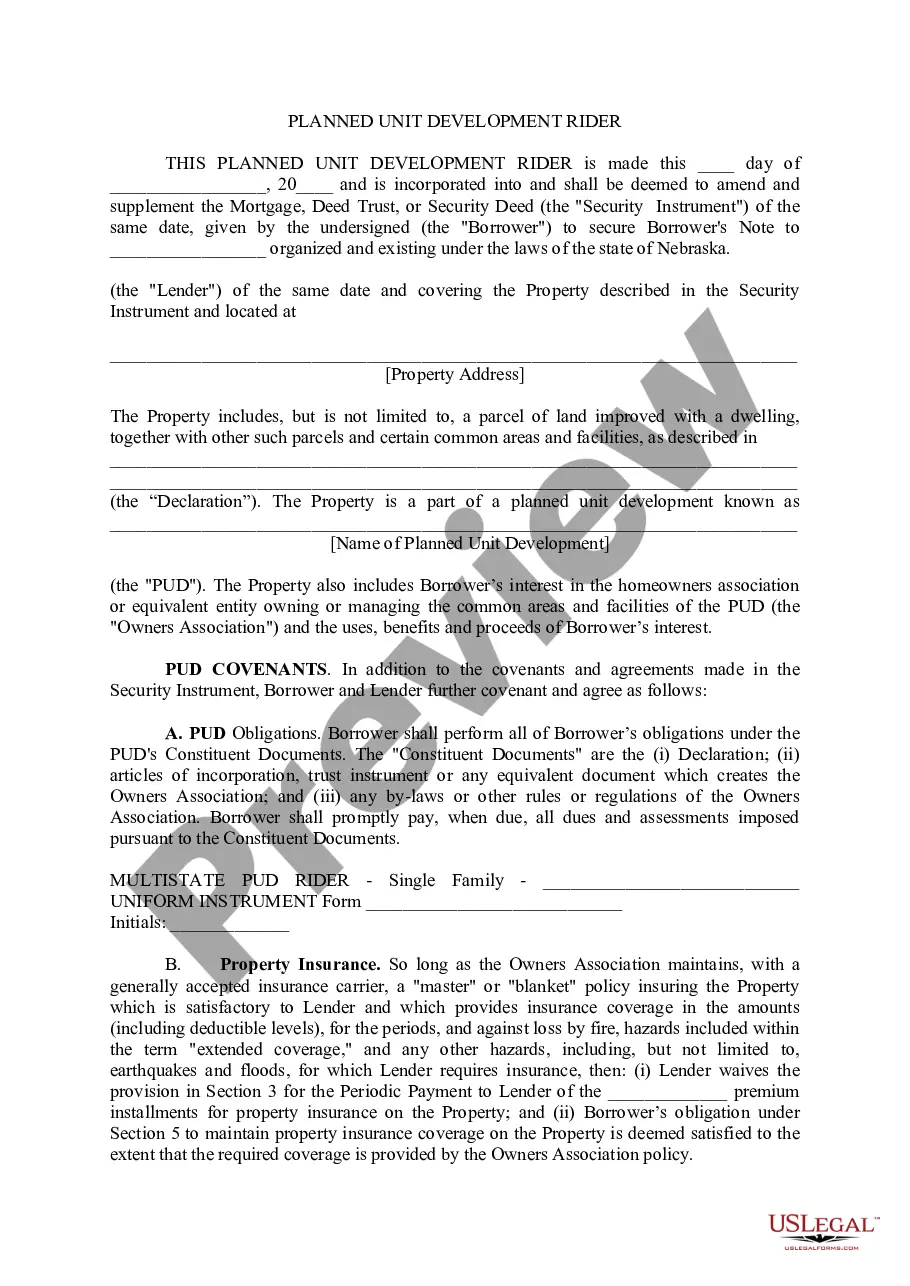

- Utilize the Review switch to review the shape.

- See the description to actually have selected the proper kind.

- In the event the kind isn`t what you`re trying to find, use the Look for field to discover the kind that fits your needs and specifications.

- If you discover the appropriate kind, simply click Acquire now.

- Select the rates prepare you desire, fill out the necessary details to create your bank account, and buy the order making use of your PayPal or Visa or Mastercard.

- Select a handy data file structure and obtain your copy.

Locate every one of the papers templates you possess bought in the My Forms menu. You can get a extra copy of Iowa Assignment of Profits of Business any time, if required. Just go through the necessary kind to obtain or print out the papers design.

Use US Legal Forms, the most substantial collection of authorized kinds, in order to save efforts and steer clear of mistakes. The assistance delivers expertly created authorized papers templates which can be used for a variety of uses. Create your account on US Legal Forms and start producing your life easier.