The Iowa Charitable Contribution Payroll Deduction Form is a document that allows individuals in the state of Iowa to make regular charitable contributions directly from their paychecks. This form serves as a means for individuals to support various charitable organizations and causes in their community. By completing this form, individuals can indicate the amount they wish to contribute and select the organization or organizations they want their funds to benefit. The Iowa Charitable Contribution Payroll Deduction Form is an efficient and convenient way for residents of Iowa to give back to their community and support causes they care about. It simplifies the process of making charitable donations by allowing individuals to allocate a specific amount from their paycheck on a regular basis. By doing so, donors can make a significant impact over time through small, consistent contributions. There are several types of Iowa Charitable Contribution Payroll Deduction Forms, each catering to different needs and preferences. These include: 1. Single Recipient Form — This form allows individuals to select a single charitable organization as the recipient of their payroll deduction. Donors can choose their preferred organization and specify the amount they wish to contribute. 2. Multiple Recipient Form — This form enables individuals to support multiple charitable organizations simultaneously. Donors can divide their payroll deduction among different organizations, allowing them to contribute to various causes they deem important. 3. General Charitable Fund Form — This form is designed for individuals who wish to support an overarching charitable fund rather than specific organizations. The general charitable fund distributes contributions to various causes based on predetermined criteria, ensuring a broader impact across different charitable initiatives. 4. Customizable Form — Some employers or organizations may offer a customizable Iowa Charitable Contribution Payroll Deduction Form. This form allows individuals to enter the name and details of a specific charitable organization that may not be listed in the provided options. It provides flexibility for individuals to support less well-known or local causes. The Iowa Charitable Contribution Payroll Deduction Form plays a vital role in empowering individuals to make a difference in their communities. By facilitating regular contributions, this form encourages a culture of giving and strengthens the nonprofit sector in Iowa. Whether donors choose to support a single organization, multiple recipients, or a general charitable fund, this form acts as a conduit to uphold the spirit of philanthropy and make a positive impact on various charitable causes.

Iowa Charitable Contribution Payroll Deduction Form

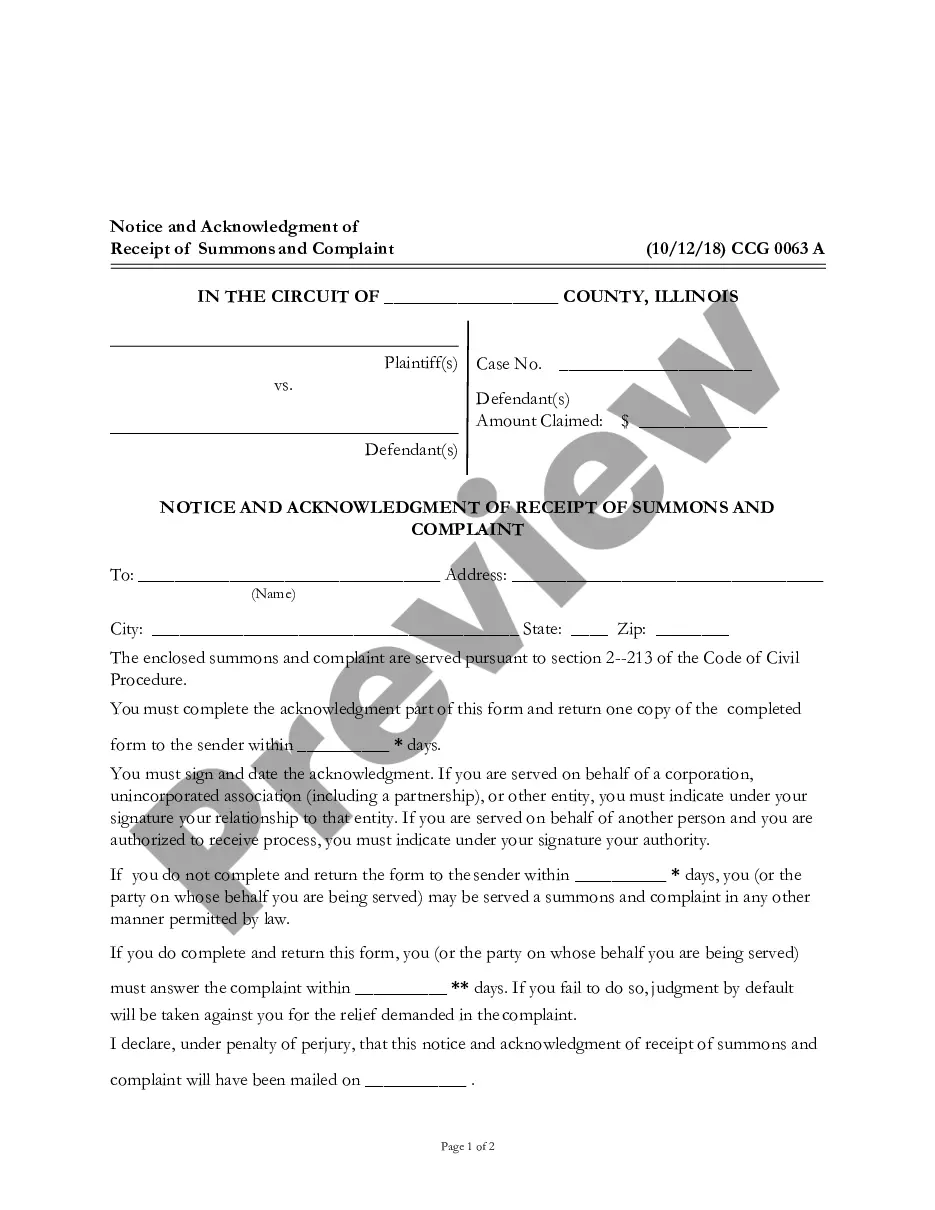

Description

How to fill out Iowa Charitable Contribution Payroll Deduction Form?

If you need to full, download, or print out legal papers web templates, use US Legal Forms, the greatest assortment of legal types, that can be found on-line. Make use of the site`s easy and handy look for to get the documents you need. A variety of web templates for company and individual purposes are categorized by groups and says, or keywords. Use US Legal Forms to get the Iowa Charitable Contribution Payroll Deduction Form in a couple of mouse clicks.

Should you be previously a US Legal Forms buyer, log in to your profile and click the Down load option to have the Iowa Charitable Contribution Payroll Deduction Form. You can also access types you in the past delivered electronically inside the My Forms tab of your respective profile.

If you are using US Legal Forms the very first time, follow the instructions under:

- Step 1. Be sure you have selected the shape for the correct city/country.

- Step 2. Take advantage of the Review choice to check out the form`s content material. Never overlook to learn the information.

- Step 3. Should you be unsatisfied using the form, utilize the Lookup area near the top of the monitor to locate other versions of your legal form web template.

- Step 4. After you have found the shape you need, click on the Purchase now option. Select the costs plan you choose and add your references to register to have an profile.

- Step 5. Process the financial transaction. You should use your Мisa or Ьastercard or PayPal profile to perform the financial transaction.

- Step 6. Select the structure of your legal form and download it on the gadget.

- Step 7. Complete, change and print out or indication the Iowa Charitable Contribution Payroll Deduction Form.

Every legal papers web template you acquire is yours permanently. You have acces to every form you delivered electronically inside your acccount. Click on the My Forms portion and select a form to print out or download once more.

Contend and download, and print out the Iowa Charitable Contribution Payroll Deduction Form with US Legal Forms. There are many professional and express-specific types you can utilize for the company or individual demands.