Iowa Payroll Deduction - Special Services

Description

How to fill out Payroll Deduction - Special Services?

Have you ever found yourself in a scenario where you require documents for either business or personal purposes almost daily.

There exists a myriad of legitimate document templates accessible online, but locating versions you can rely on is often challenging.

US Legal Forms offers an extensive collection of form templates, like the Iowa Payroll Deduction - Special Services, designed to meet both state and federal standards.

Once you find the correct form, click on Get now.

Choose the pricing plan you prefer, complete the required information to create your account, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- Next, you can download the Iowa Payroll Deduction - Special Services template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it corresponds to your correct area/county.

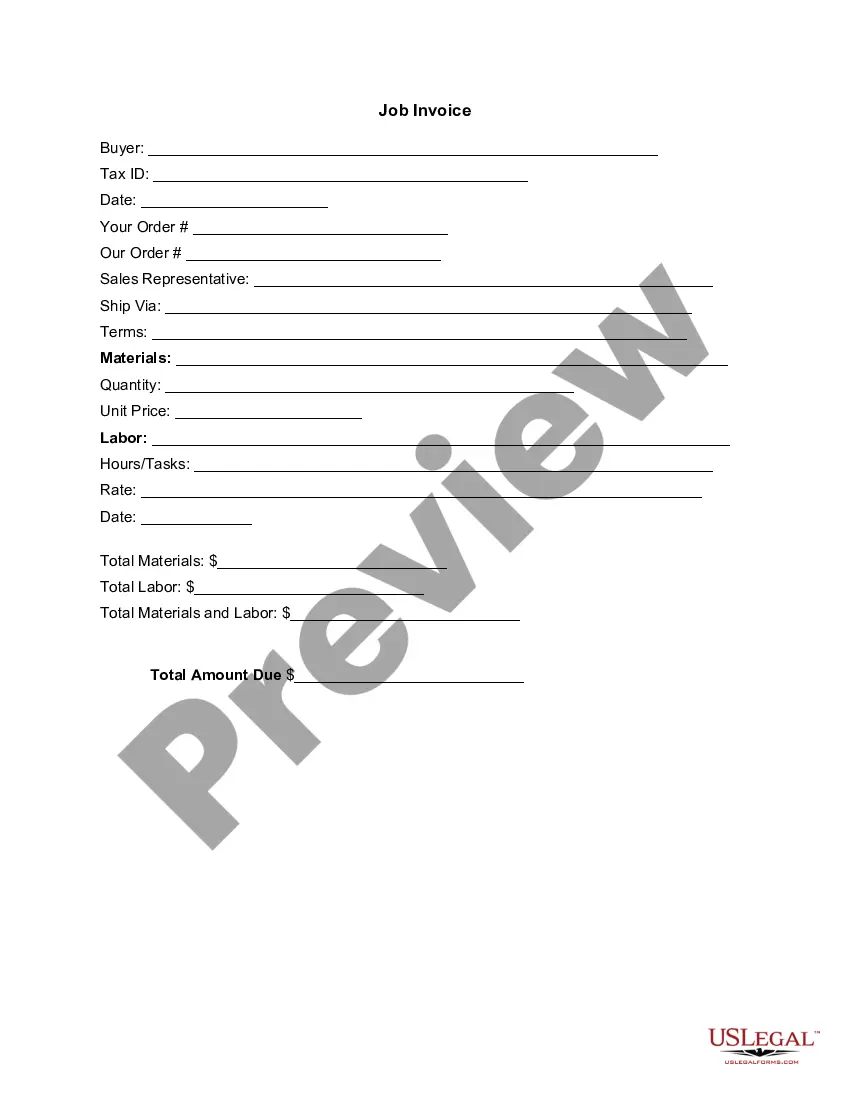

- Utilize the Review feature to evaluate the form.

- Check the summary to confirm that you have selected the right form.

- If the form does not fit your needs, use the Search field to find the document that matches your requirements.

Form popularity

FAQ

The key is to find the right balance. You are entitled to one allowance for yourself (line A), potentially bumped depending on your job situation (line B). You are also entitled to one allowance for your spouse (line C) and one allowance for each dependent you report on your tax return (line D).

1. Personal Allowances: You can claim the following personal allowances: 2022 1 allowance for yourself or 2 allowances if you are unmarried and eligible to claim head of household status, plus 1 allowance if you are 65 or older, and plus 1 allowance if you are blind.

Add your combined income, adjustments, deductions, exemptions and credits to figure your federal withholding allowances. You can divide your total allowances whichever way you prefer, but you can't claim an allowance that your spouse claims too.

The qualifying COVID-19 grant must be included in the federal income of the taxpayer as reported on the taxpayer's Iowa tax return. Any grant exempt from federal income tax, and thus not included in the taxpayer's base Iowa net income, will not qualify for an additional deduction on the taxpayer's Iowa tax return.

Paycheck Protection Program (PPP) loans that are forgiven and properly excluded from gross income for federal purposes will also qualify for exclusion from income for Iowa tax purposes.

YES, paid parental leave is taxable income.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.