Iowa Determining Self-Employed Contractor Status: A Comprehensive Guide Keywords: Iowa, determining self-employed contractor status, independent contractor, self-employed, classification, Iowa tax laws, worker classification, factors, control, integration, common law, classification agreement Introduction: Determining the employment status of workers is a crucial process for businesses in Iowa. Accurately classifying individuals as self-employed contractors or employees is essential to comply with state laws and tax regulations. This article aims to provide a detailed overview of Iowa's process for determining self-employed contractor status, including the various types of classifications and key factors to consider. Iowa Self-Employed Contractor Classification Types: 1. Independent Contractor: An individual who provides services to a business but operates independently and maintains control over their work. Independent contractors typically have a separate business entity and are responsible for their taxes, insurance, and expenses. 2. Self-Employed Individual: Similar to an independent contractor, a self-employed individual is someone who works for themselves and is not considered an employee. They have control over how and when they perform their services and are responsible for their taxes and business expenses. Factors in Determining Self-Employed Contractor Status in Iowa: 1. Control: The degree of control exerted by the hiring party over how the work is performed is a crucial factor. If the worker has autonomy and control over their schedule, methods, and means of completing tasks, it may indicate self-employment. 2. Integration: The extent to which the worker's services are integrated into the business is considered. If the individual's tasks are closely tied to the core functions of the business and are essential for its operations, they may be classified as an employee. 3. Nature of the Relationship: The overall relationship between the hiring party and the worker is evaluated. Factors such as the presence of a written contract, the provision of employee benefits, and how the parties perceive their relationship play a role in determining the individual's status. 4. Common Law Factors: Iowa law considers several common law factors to assess the degree of control, including the right to direct and control the worker, method of payment, provision of tools and equipment, and length of the working relationship. Classifying Agreement: To ensure clarity and avoid confusion, businesses and workers may enter into a classification agreement explicitly stating the intended worker classification. This agreement helps establish the understanding and expectations regarding the employment relationship and solidifies the self-employed contractor status. Conclusion: Determining self-employed contractor status in Iowa is crucial for businesses to comply with state laws and tax obligations. Considering factors like control, integration, nature of the relationship, and common law principles can provide guidance in classifying workers correctly. Remember that each situation is unique, so consulting legal and tax professionals is advisable to ensure compliance with Iowa's regulations.

Iowa Determining Self-Employed Contractor Status

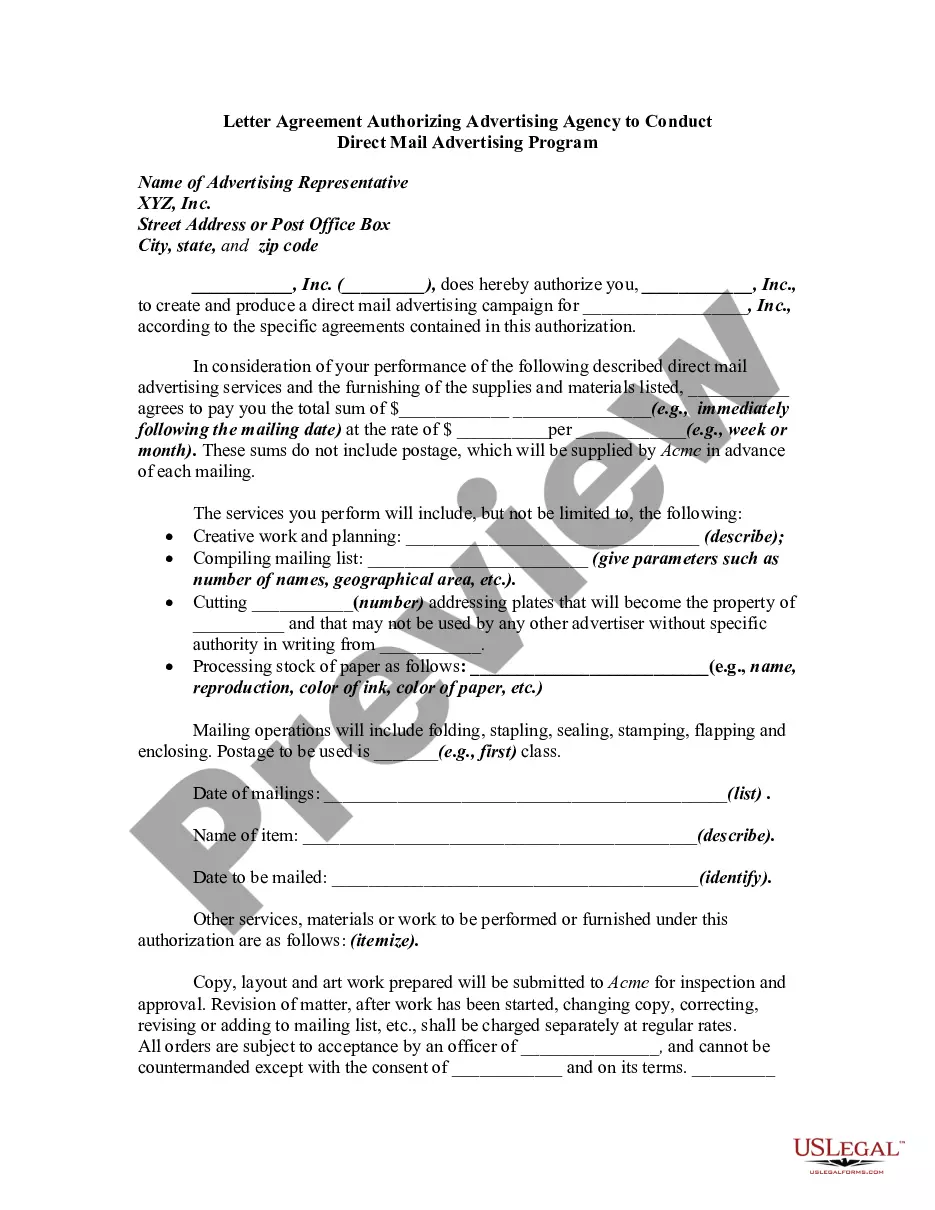

Description

How to fill out Iowa Determining Self-Employed Contractor Status?

If you wish to full, download, or produce lawful record web templates, use US Legal Forms, the most important selection of lawful forms, that can be found on-line. Utilize the site`s basic and convenient research to obtain the paperwork you want. A variety of web templates for business and personal reasons are categorized by categories and claims, or key phrases. Use US Legal Forms to obtain the Iowa Determining Self-Employed Contractor Status with a few clicks.

When you are currently a US Legal Forms consumer, log in in your account and click the Acquire key to get the Iowa Determining Self-Employed Contractor Status. You can even access forms you in the past downloaded within the My Forms tab of your account.

If you work with US Legal Forms initially, refer to the instructions beneath:

- Step 1. Be sure you have chosen the shape for the correct city/region.

- Step 2. Make use of the Preview choice to look over the form`s content material. Don`t overlook to read through the information.

- Step 3. When you are not happy with all the develop, take advantage of the Search area at the top of the display screen to discover other variations from the lawful develop web template.

- Step 4. Upon having identified the shape you want, click on the Acquire now key. Choose the prices prepare you prefer and include your qualifications to sign up on an account.

- Step 5. Procedure the transaction. You may use your Мisa or Ьastercard or PayPal account to finish the transaction.

- Step 6. Select the file format from the lawful develop and download it in your device.

- Step 7. Comprehensive, modify and produce or sign the Iowa Determining Self-Employed Contractor Status.

Every lawful record web template you acquire is yours for a long time. You may have acces to every develop you downloaded within your acccount. Select the My Forms segment and pick a develop to produce or download once more.

Remain competitive and download, and produce the Iowa Determining Self-Employed Contractor Status with US Legal Forms. There are many professional and state-specific forms you can utilize to your business or personal needs.