Iowa Wage Withholding Authorization

Description

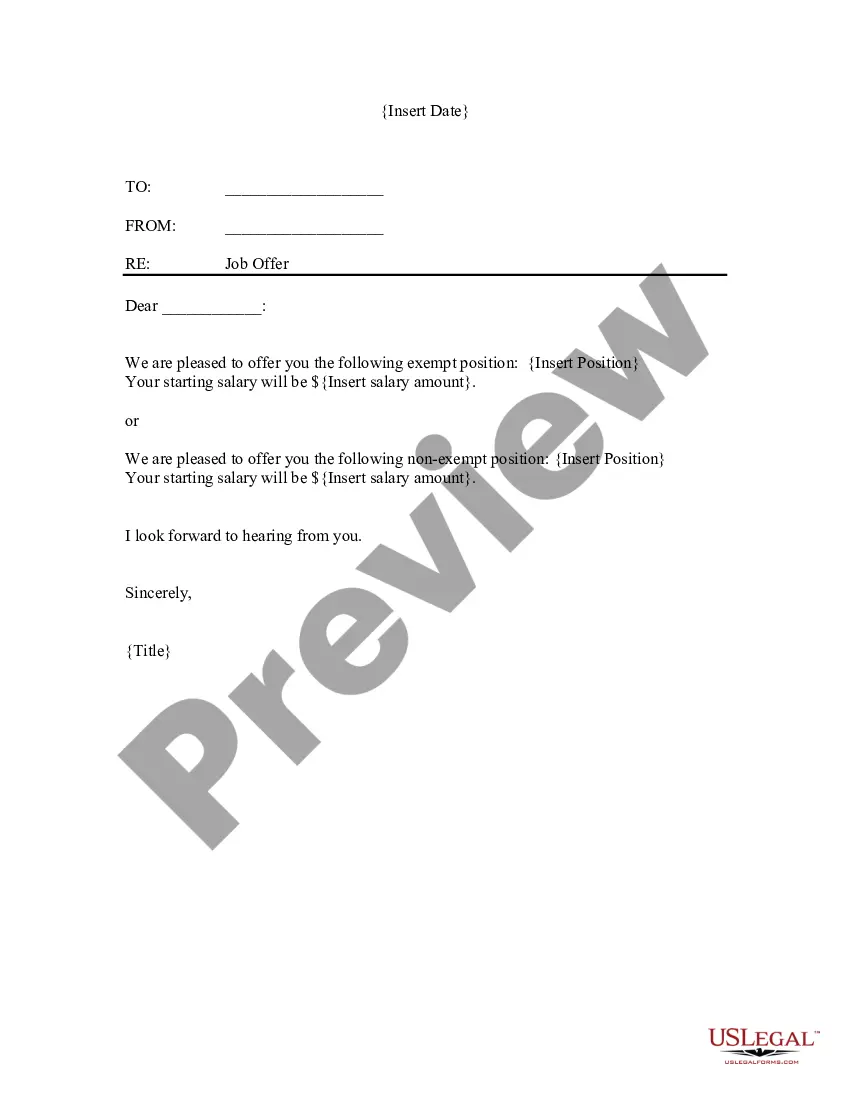

How to fill out Wage Withholding Authorization?

You are capable of spending hours online searching for the legal document template that satisfies the federal and state requirements you require.

US Legal Forms provides a multitude of legal documents that have been reviewed by professionals.

You can conveniently download or print the Iowa Wage Withholding Authorization from our platform.

If you are using the US Legal Forms website for the first time, follow the simple instructions below: First, ensure you have selected the correct document template for your state/city of choice. Review the form description to confirm you have chosen the right form. If available, utilize the Preview button to view the document template as well. To find an alternative version of the form, use the Search field to locate the template that meets your needs and requirements. Once you have found the template you desire, click Acquire now to move forward. Choose the pricing plan you wish, enter your information, and register for an account on US Legal Forms. Complete the purchase. You can use your Visa or Mastercard or PayPal account to buy the legal document. Select the format of the document and download it to your device. Make adjustments to the document if necessary. You can complete, edit, sign, and print the Iowa Wage Withholding Authorization. Obtain and print numerous document templates using the US Legal Forms website, which offers the largest selection of legal documents. Utilize professional and state-specific templates to meet your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and click on the Acquire button.

- Then, you can complete, modify, print, or sign the Iowa Wage Withholding Authorization.

- Every legal document template you purchase belongs to you permanently.

- To retrieve an additional copy of any purchased form, navigate to the My documents section and click the corresponding button.

Form popularity

FAQ

In most cases, state withholding applies to state residents only. In Maine, Massachusetts, Montana, Nebraska, Oregon, and Wisconsin, state withholding also applies to individuals required to file a state tax return in that state.

Find Your Iowa Tax ID Numbers and RatesLook these up online or on previous correspondence from the IA Department of Revenue.If you're unsure, contact the agency at 515-281-3114 or 800-367-3388.

Each employee must file this Iowa W-4 with his/her employer. Do not claim more allowances than necessary or you will not have enough tax withheld. You may file a new W-4 at any time if the number of your allowances increases.

You can apply for an FEIN online or you can use form SS-4 (pdf); this will become your state number for withholding tax purposes. Have each employee fill out a Federal W-4 (pdf) and an Iowa W-4 (access by filtering by Withholding Tax, search keyword W-4 and current year).

Employers are required by law to withhold employment taxes from their employees. Employment taxes include federal income tax withholding and Social Security and Medicare Taxes.

Register online at the IA Dept of Revenue portal to receive the number and a Business eFile Number (BEN) by mail within 4-6 weeks. However, the application cannot be processed until after first wages are paid. Find an existing Withholding Permit Number: on Form IA 44-095, Employer's Quarterly Withholding Return.

Iowa income tax is generally required to be withheld in cases where federal income tax is withheld. In situations where no federal income tax is withheld, the receiver of the payment may choose to have Iowa withholding taken out. Withholding on nonwage income may be made at a rate of 5 percent.

You can find your Withholding Permit Number and Business eFile Number (BEN) on notices received from the Iowa Department of Revenue.If you cannot find these numbers, please call the agency at 515-281-3114 or 800-367-3388.