Iowa Power of Attorney by Trustee of Trust is a legal document that allows a designated trustee to act on behalf of a trust in various financial and legal matters. This power of attorney designation grants significant authority to the trustee, giving them the power to make decisions and take actions as if they were the granter of the trust. There are different types of Iowa Power of Attorney by Trustee of Trust, each designed to address specific areas of trust administration and management. Some common types include: 1. Financial Power of Attorney: This type of power of attorney authorizes the trustee to handle financial matters on behalf of the trust. It allows the trustee to manage bank accounts, make investment decisions, pay bills, and handle tax-related matters. 2. Real Estate Power of Attorney: This power of attorney empowers the trustee to buy, sell, or manage real estate properties owned by the trust. The trustee can engage in real estate transactions, sign contracts, and make decisions regarding property maintenance and repairs. 3. Healthcare Power of Attorney: Although not directly related to the trust, this type of power of attorney allows the trustee to make healthcare decisions on behalf of the granter if they become unable to do so. It ensures that the designated trustee can communicate with medical professionals, make treatment decisions, and act in the best interest of the granter. 4. Limited Power of Attorney: In some cases, a granter may choose to grant limited powers to the trustee for specific purposes. This could include granting authority to manage a specific financial account or handle a single real estate transaction. This type of power of attorney is tailored to the specific needs of the trust and can be time-limited or task-specific. It is essential to consult with an attorney specializing in estate planning and trust law in Iowa to ensure the power of attorney document accurately reflects the granter's intentions and complies with all applicable laws and regulations. Creating a comprehensive and tailored power of attorney by a trustee of a trust is crucial for effective trust administration and management.

Iowa Power of Attorney by Trustee of Trust

Description

How to fill out Iowa Power Of Attorney By Trustee Of Trust?

If you have to total, download, or produce authorized record themes, use US Legal Forms, the most important assortment of authorized forms, which can be found online. Use the site`s simple and easy practical lookup to find the documents you will need. Different themes for enterprise and person reasons are sorted by classes and claims, or keywords. Use US Legal Forms to find the Iowa Power of Attorney by Trustee of Trust with a few mouse clicks.

Should you be previously a US Legal Forms client, log in in your bank account and then click the Down load switch to have the Iowa Power of Attorney by Trustee of Trust. You can even gain access to forms you formerly delivered electronically within the My Forms tab of your respective bank account.

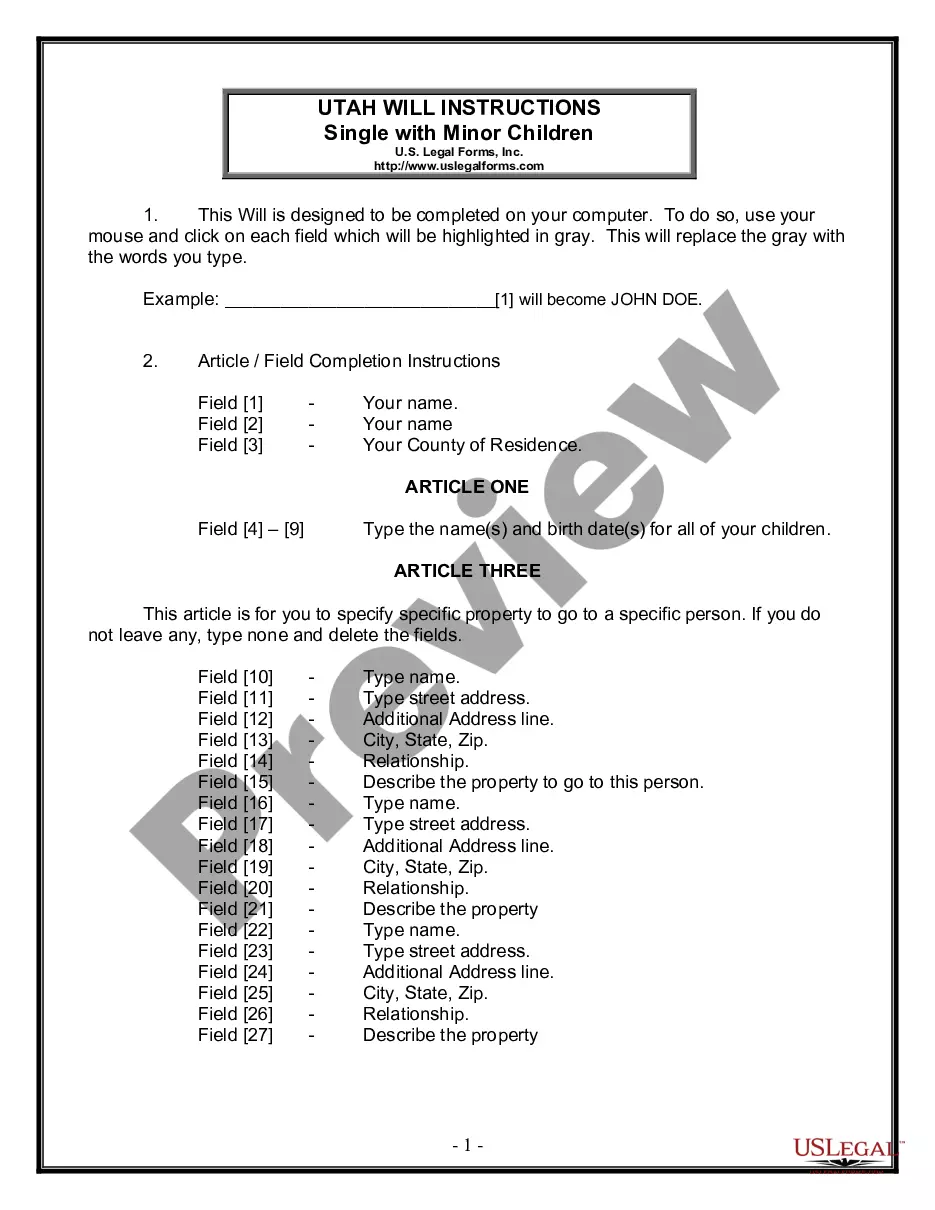

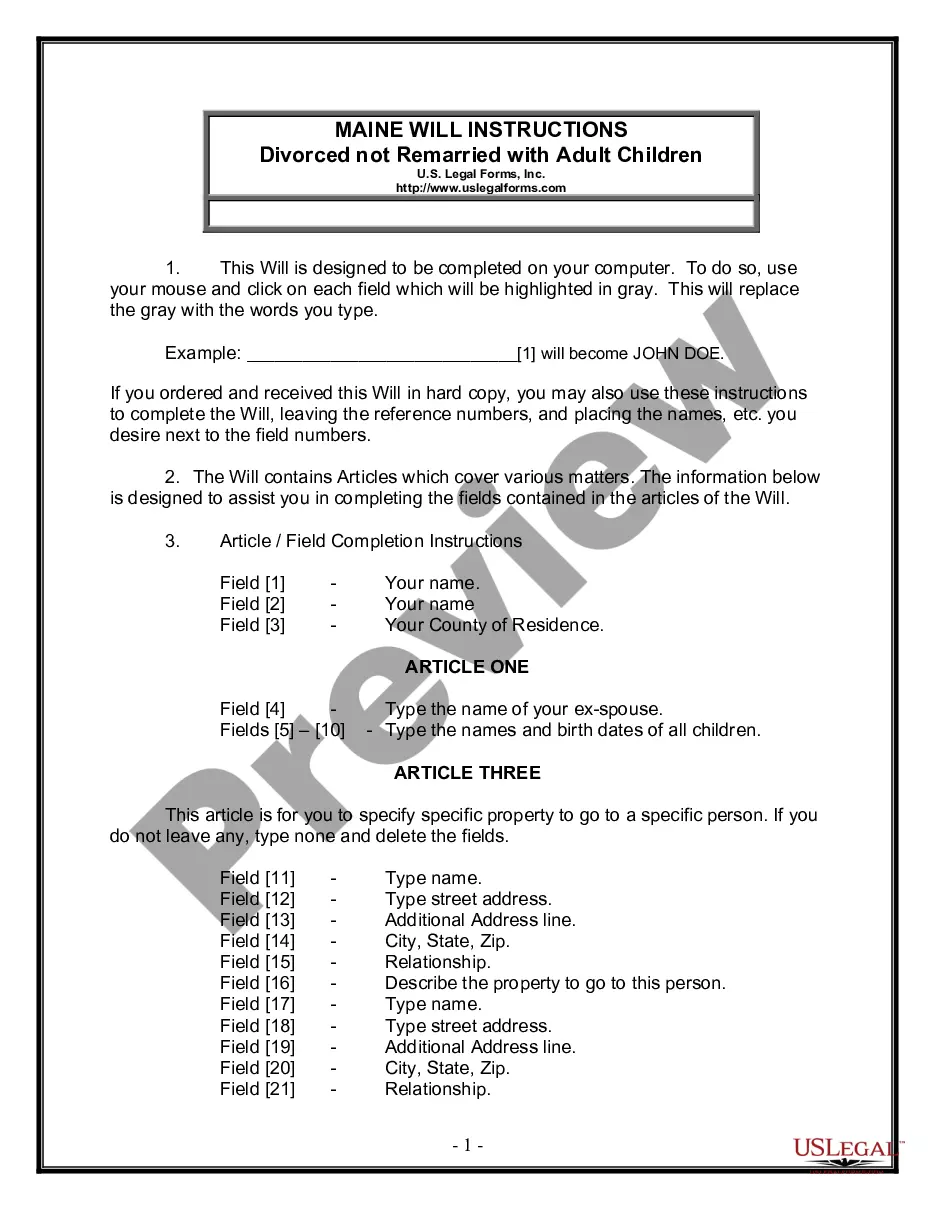

If you use US Legal Forms initially, follow the instructions listed below:

- Step 1. Ensure you have selected the form to the appropriate town/country.

- Step 2. Utilize the Preview choice to look through the form`s content. Never neglect to learn the outline.

- Step 3. Should you be not satisfied together with the type, use the Research area near the top of the monitor to locate other variations of your authorized type format.

- Step 4. When you have discovered the form you will need, click on the Get now switch. Select the prices strategy you favor and put your qualifications to register for the bank account.

- Step 5. Method the deal. You should use your charge card or PayPal bank account to complete the deal.

- Step 6. Pick the format of your authorized type and download it on your own product.

- Step 7. Total, edit and produce or sign the Iowa Power of Attorney by Trustee of Trust.

Every authorized record format you get is your own property permanently. You may have acces to every type you delivered electronically in your acccount. Click the My Forms segment and pick a type to produce or download yet again.

Remain competitive and download, and produce the Iowa Power of Attorney by Trustee of Trust with US Legal Forms. There are thousands of expert and express-particular forms you can use for the enterprise or person demands.

Form popularity

FAQ

The trustee cannot do whatever they want. They must follow the trust document, and follow the California Probate Code. More than that, Trustees don't get the benefits of the Trust. The Trust assets will pass to the Trust beneficiaries eventually.

1) Duty to Inform Beneficiaries (Section 16060). 2) Duty to Provide Terms of Trust at Beneficiary's Request (Section 16060.7). 3) Duty to Report at Beneficiary's Request (Section 16061).

Section 25 of the Trustee Act 1925 allows a trustee to grant a power of attorney delegating their functions as a trustee to the attorney. Section 25 provides a short form of power by which a single donor can delegate trustee functions under a single trust to a single donee. Trustees can use other forms.

The trustee cannot fail to carry out the wishes and intent of the settlor and cannot act in bad faith, fail to represent the best interests of the beneficiaries at all times during the existence of the trust and fail to follow the terms of the trust. A trustee cannot fail to carry out their duties.

Creation of a Trust To create a trust, the property owner (called the "trustor," "grantor," or "settlor") transfers legal ownership to a family member, professional, or institution (called the "trustee") to manage that property for the benefit of another person (called the "beneficiary").

All trustees have the power to manage trust assets. This may include the sale and purchase of trust property and making investments. The trustee must decide whether to use its power to manage assets on a case-by-case basis and must only consider relevant factors when deciding to exercise any power.

If the terms of the trust regarding the trust investments no longer seem reasonable, the trustee can obtain a court order to deviate from the terms of the trust.

Depending on the type of trust you are creating, the trustee will be in charge of overseeing your assets and the assets of your loved ones. Most people choose either a friend or family member, a professional trustee such as a lawyer or an accountant, or a trust company or corporate trustee for this key role.

A Trustee is considered the legal owner of all Trust assets. And as the legal owner, the Trustee has the right to manage the Trust assets unilaterally, without direction or input from the beneficiaries.

A trust is a legal arrangement through which one person, called a "settlor" or "grantor," gives assets to another person (or an institution, such as a bank or law firm), called a "trustee." The trustee holds legal title to the assets for another person, called a "beneficiary." The rights of a trust beneficiary depend