Title: Iowa Information Sheet — When are Entertainment Expenses Deductible and Reimbursable? Introduction: In Iowa, entertainment expenses play a significant role for business owners and professionals looking to deduct and reimburse their expenditures. This Iowa Information Sheet aims to provide comprehensive details and guidelines on when entertainment expenses are eligible for deductions and reimbursements. Understanding these regulations can help taxpayers maximize their deductible expenses and ensure compliance with Iowa tax laws. Key Keywords: Iowa, Information Sheet, Entertainment Expenses, Deductible, Reimbursable, Regulations, Tax Laws Section 1: What are Entertainment Expenses? — Definition: Entertainment expenses refer to the costs incurred by individuals or businesses for entertaining clients, customers, or employees. — Examples: These expenses may include meals, shows, sporting events, nightclubs, recreational activities, and other forms of entertainment. — Context: Entertainment expenses are typically incurred with the intent of building business relationships, fostering goodwill, or promoting the company's products or services. Section 2: Reducibility of Entertainment Expenses — Eligibility Criteria: Entertainment expenses must meet certain requirements to be deductible. — Ordinary and Necessary: The expenses must be ordinary and necessary for the business or trade. — Directly Related Test: The entertainment must have a clear business purpose, such as discussing business matters or engaging in active negotiations. — Substantial Business Discussion: A substantial and bona fide business discussion preceding or following the entertainment is required. — Entertainment Venue: The entertainment should occur in a setting suitable for conducting business discussions. Section 3: Reimbursable Entertainment Expenses — Reimbursement Policies: Businesses may have different guidelines regarding reimbursable entertainment expenses. — Company Policies: Companies often define their reimbursement policies, including the types of entertainment expenses eligible for reimbursement. Record keepingng: Records must be kept for all reimbursable entertainment expenses, including receipts, invoices, and any other relevant documentation. Section 4: Different Types of Iowa Information Sheets — When are Entertainment Expenses Deductible and Reimbursable? 1. Iowa Information Sheet Reducibilityty of Business Entertainment Expenses — Provides detailed information on the criteria and regulations for deducting entertainment expenses for business purposes. 2. Iowa Information Sheet — Reimbursable Entertainment Expenses for Business — Outlines the policies and guidelines relating to reimbursement procedures for business-related entertainment expenses. 3. Iowa Information Sheet — Entertainment Expenses for Self-Employed Individuals — Addresses the specific considerations and guidelines for self-employed individuals claiming deductions and reimbursements for entertainment expenses. Conclusion: Understanding the rules governing the reducibility and reimbursement of entertainment expenses is crucial for navigating Iowa's tax regulations. This Iowa Information Sheet serves as a valuable resource for individuals and businesses looking to optimize their tax benefits while ensuring compliance with Iowa's restrictions and requirements. Stay informed, keep accurate records, and consult with a tax professional to make the most of your business entertainment expenses.

Iowa Information Sheet - When are Entertainment Expenses Deductible and Reimbursable

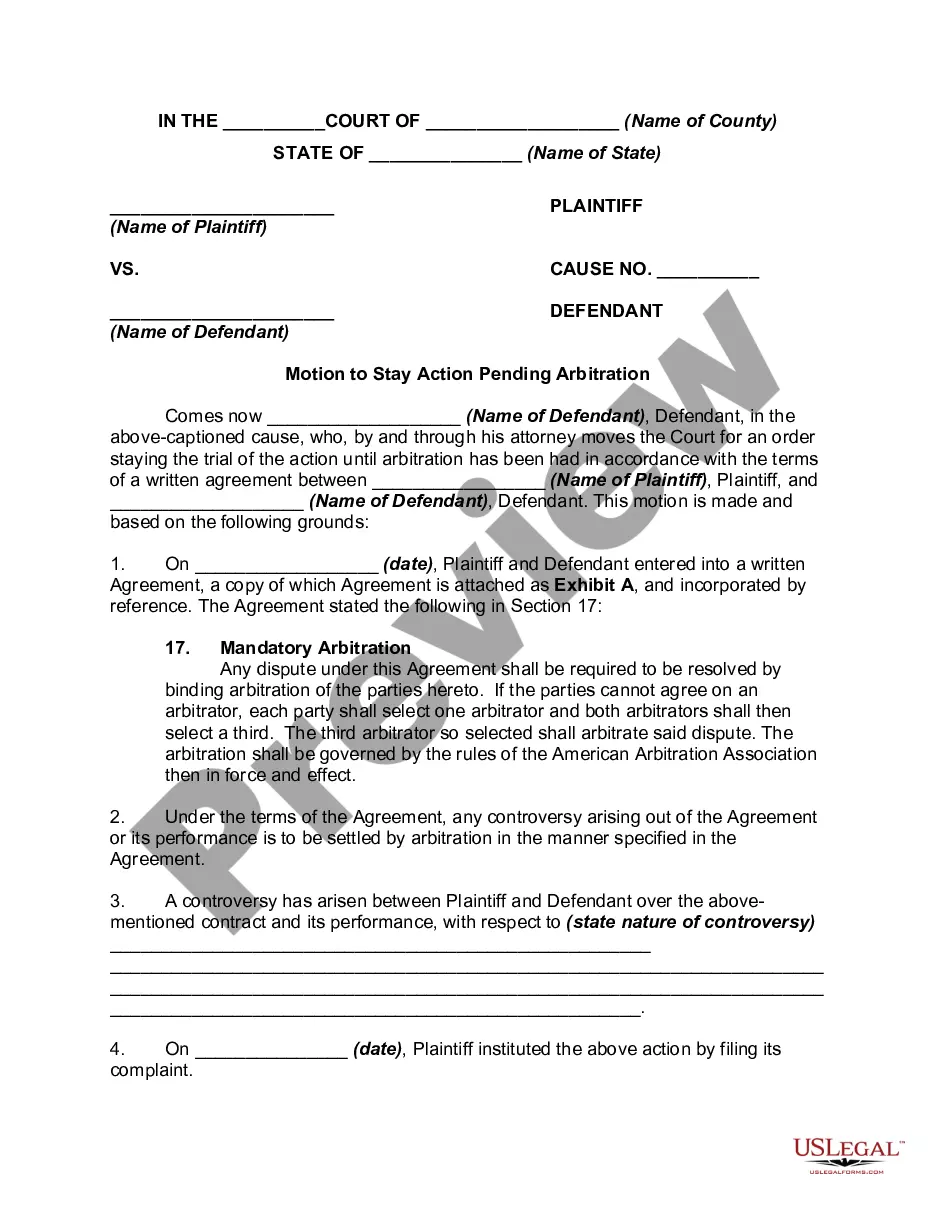

Description

How to fill out Iowa Information Sheet - When Are Entertainment Expenses Deductible And Reimbursable?

US Legal Forms - one of several most significant libraries of lawful kinds in the USA - provides a variety of lawful record layouts it is possible to down load or printing. Making use of the site, you may get a large number of kinds for company and person functions, sorted by groups, suggests, or search phrases.You can find the most up-to-date variations of kinds much like the Iowa Information Sheet - When are Entertainment Expenses Deductible and Reimbursable in seconds.

If you have a monthly subscription, log in and down load Iowa Information Sheet - When are Entertainment Expenses Deductible and Reimbursable through the US Legal Forms library. The Obtain option will show up on every kind you see. You have access to all previously acquired kinds from the My Forms tab of your account.

If you want to use US Legal Forms initially, allow me to share simple instructions to obtain started:

- Make sure you have picked the proper kind for your personal town/area. Click on the Review option to analyze the form`s articles. Browse the kind outline to ensure that you have selected the right kind.

- In the event the kind does not satisfy your requirements, take advantage of the Research area on top of the display to get the one that does.

- When you are pleased with the form, confirm your selection by visiting the Purchase now option. Then, choose the pricing strategy you want and offer your qualifications to sign up for an account.

- Approach the financial transaction. Make use of your Visa or Mastercard or PayPal account to complete the financial transaction.

- Pick the structure and down load the form in your gadget.

- Make alterations. Fill up, change and printing and indication the acquired Iowa Information Sheet - When are Entertainment Expenses Deductible and Reimbursable.

Every design you included with your bank account lacks an expiry date and is also yours permanently. So, if you want to down load or printing one more backup, just check out the My Forms section and then click around the kind you want.

Obtain access to the Iowa Information Sheet - When are Entertainment Expenses Deductible and Reimbursable with US Legal Forms, by far the most considerable library of lawful record layouts. Use a large number of specialist and state-specific layouts that meet your business or person requirements and requirements.