Title: Iowa Worksheet Analyzing a Self-Employed Independent Contractor: A Detailed Description Introduction: The Iowa Worksheet Analyzing a Self-Employed Independent Contractor is an essential resource for businesses and individuals to evaluate their working arrangements with independent contractors. This worksheet assists in determining whether an individual truly qualifies as an independent contractor or should be classified as an employee. In Iowa, the distinction is crucial as it impacts various tax obligations and legal responsibilities. This comprehensive worksheet offers a structured approach to analyze the relationship between the hiring party and the contractor while considering key factors and meeting regulatory compliance. Keywords: Iowa, Worksheet, Analyzing, Self-Employed, Independent Contractor, Tax obligations, Legal responsibilities, Regulatory compliance. 1. Overview of the Iowa Worksheet: The Iowa Worksheet is a specialized document that helps assess the employment relationship between a hiring party (employer) and a self-employed independent contractor. By analyzing various factors, the worksheet assists in determining the right classification for tax purposes and adherence to legal requirements. 2. Factors Considered: The worksheet takes into account specific factors which influence the classification of a self-employed individual as an independent contractor, including: — Nature and degree of control over work — Integration of contractor's services into the hiring party's business — Opportunity for profit or loss by the contractor — Permanency of the working relationship — Skill and initiative required for the work — The existence of a formal written contract 3. Importance of Correct Classification: Correctly classifying workers as either independent contractors or employees is crucial, as misclassification can result in severe consequences. Employers must follow Iowa state laws and regulations, including proper wage payment, tax withholding, workers' compensation, minimum wage, and unemployment insurance obligations. 4. Types of Iowa Worksheets: a) Iowa Worksheet for Individuals: Focuses on individuals working as self-employed independent contractors and guides them through the classification process. b) Iowa Worksheet for Businesses: Aims to assist employers in assessing their working arrangements with contractors, ensuring compliance with state employment laws and regulations. 5. Clear Guidance and Instructions: The Iowa Worksheet provides clear instructions on completing each section, along with relevant regulatory references and explanations of the factors' significance. This ensures accuracy in the evaluation process, reducing the risk of misclassification. 6. Record-Keeping and Documentation: The worksheet emphasizes the importance of maintaining appropriate documentation in support of the classification decision made. This includes contracts, invoices, business records, and any other evidence that substantiates the independent contractor relationship. Keywords: Record-keeping, Documentation, Classification decision, Independent contractor relationship. Conclusion: The Iowa Worksheet Analyzing a Self-Employed Independent Contractor is a valuable tool to help businesses and individuals classify workers accurately and comply with Iowa state laws. By diligently analyzing the working relationship and considering key factors, this worksheet ensures correct classification, reduces legal risks, and promotes fair employment practices. Keywords: Classification, Legal risks, Fair employment practices, Compliance.

Iowa Worksheet Analyzing a Self-Employed Independent Contractor

Description

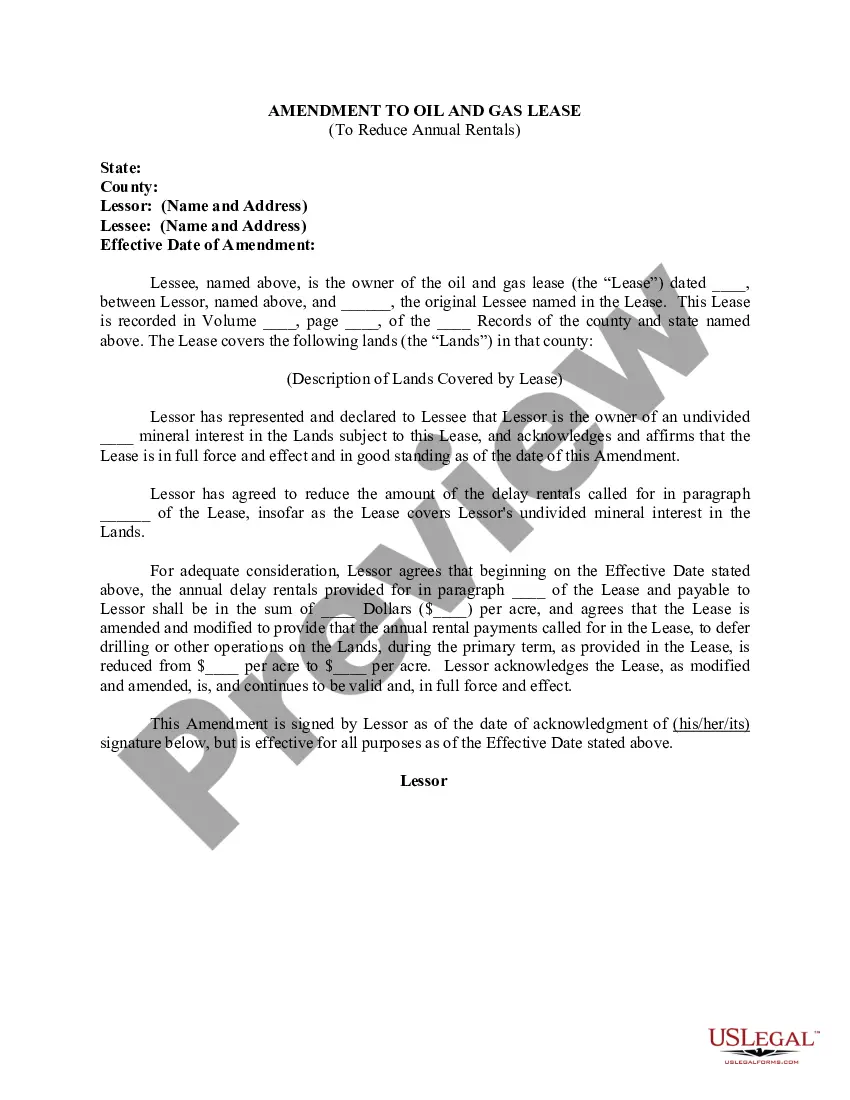

How to fill out Iowa Worksheet Analyzing A Self-Employed Independent Contractor?

US Legal Forms - one of the most significant libraries of authorized forms in the States - offers a wide array of authorized record layouts you may download or print out. Utilizing the internet site, you may get thousands of forms for company and specific functions, categorized by categories, suggests, or keywords and phrases.You can find the most recent variations of forms such as the Iowa Worksheet Analyzing a Self-Employed Independent Contractor in seconds.

If you have a monthly subscription, log in and download Iowa Worksheet Analyzing a Self-Employed Independent Contractor from the US Legal Forms local library. The Download button will show up on each and every develop you perspective. You get access to all previously delivered electronically forms inside the My Forms tab of your accounts.

If you would like use US Legal Forms for the first time, here are easy directions to help you began:

- Make sure you have picked out the best develop for the metropolis/state. Go through the Preview button to analyze the form`s content. Browse the develop explanation to ensure that you have chosen the proper develop.

- When the develop doesn`t suit your needs, utilize the Lookup field at the top of the display to find the the one that does.

- In case you are happy with the form, confirm your choice by simply clicking the Buy now button. Then, pick the costs prepare you want and supply your qualifications to sign up to have an accounts.

- Approach the financial transaction. Make use of your bank card or PayPal accounts to perform the financial transaction.

- Choose the formatting and download the form on your own device.

- Make changes. Complete, modify and print out and signal the delivered electronically Iowa Worksheet Analyzing a Self-Employed Independent Contractor.

Every web template you included in your money does not have an expiry date and it is your own property eternally. So, in order to download or print out one more copy, just proceed to the My Forms segment and click on about the develop you will need.

Gain access to the Iowa Worksheet Analyzing a Self-Employed Independent Contractor with US Legal Forms, by far the most extensive local library of authorized record layouts. Use thousands of professional and condition-certain layouts that meet your organization or specific requires and needs.

Form popularity

FAQ

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

A worker does not have to meet all 20 criteria to qualify as an employee or independent contractor, and no single factor is decisive in determining a worker's status. The individual circumstances of each case determine the weight IRS assigns different factors.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

To calculate gross income, add up your total sales revenue, then subtract any refunds and the cost of goods sold. Add in any extra income such as interest on loans, and you have your gross income for the business year.

What is the IRS 20-Factor Test? The IRS 20-Factor Test, commonly referred to as the Right-to-Control Test, is designed to evaluate who controls how the work is performed. According to the IRS's Common-Law Rules, a worker's status corresponds to the level of control and independence they have over their work.

The general rule is that you will be: An employee if you work for someone and do not have the risks of running a business. Self-employed if you have a trade, profession or vocation, are in business on your own account and are responsible for the success or failure of that business.