Full text and statutory guidelines for the Financial Services Modernization Act (Gramm-Leach-Bliley Act)

Iowa Financial Services Modernization Act (Gramm-Leach-Bliley Act)

Description

How to fill out Financial Services Modernization Act (Gramm-Leach-Bliley Act)?

You are able to invest several hours on the Internet searching for the legal papers format that suits the state and federal needs you will need. US Legal Forms supplies a large number of legal forms which are examined by professionals. You can easily down load or print out the Iowa Financial Services Modernization Act (Gramm-Leach-Bliley Act) from the assistance.

If you have a US Legal Forms account, you may log in and click the Acquire option. Following that, you may full, revise, print out, or signal the Iowa Financial Services Modernization Act (Gramm-Leach-Bliley Act). Every legal papers format you buy is your own property for a long time. To have yet another duplicate associated with a purchased kind, proceed to the My Forms tab and click the corresponding option.

If you work with the US Legal Forms website initially, keep to the easy instructions listed below:

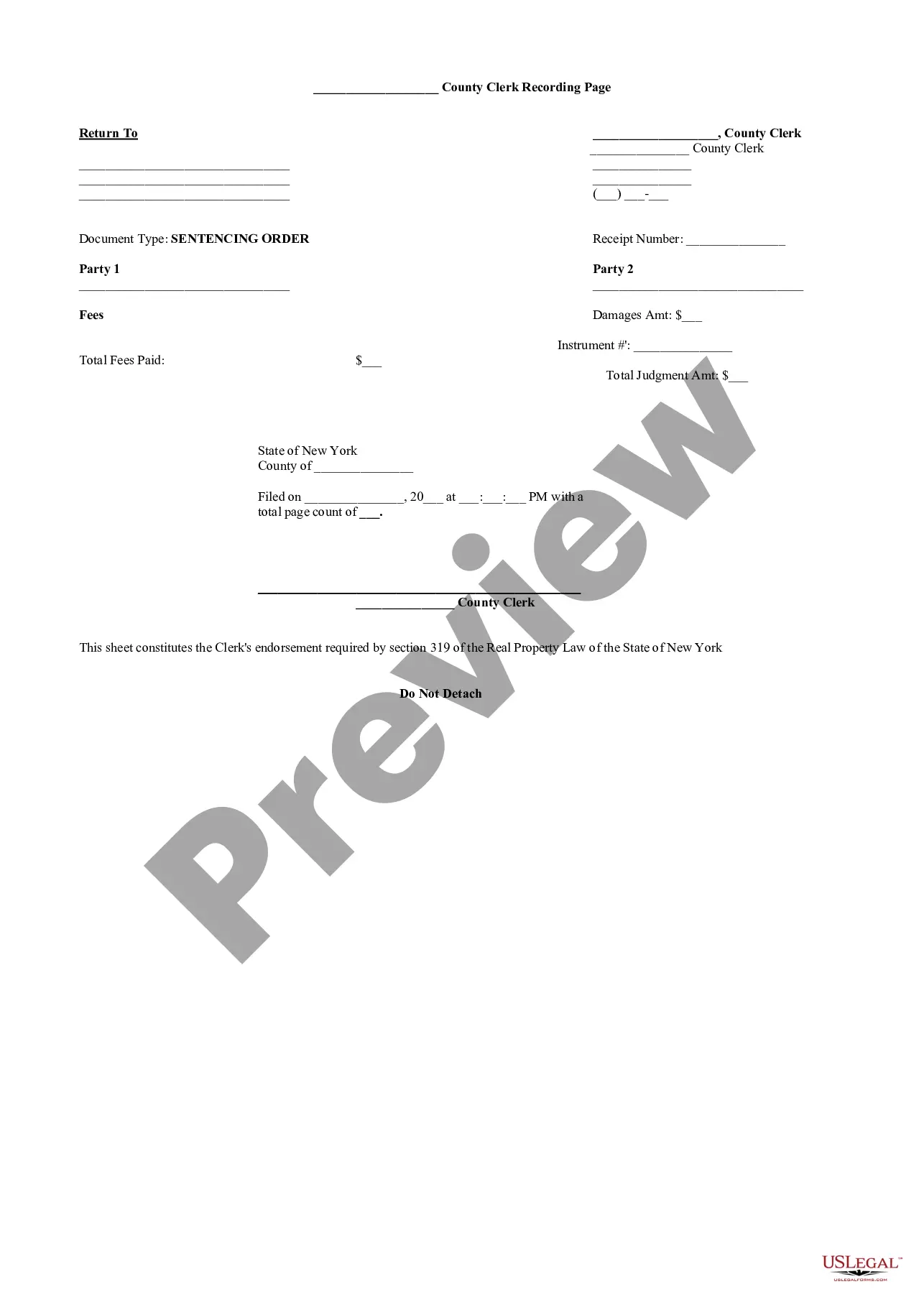

- First, make sure that you have selected the right papers format to the state/area of your liking. See the kind outline to ensure you have picked out the appropriate kind. If accessible, utilize the Review option to search through the papers format at the same time.

- If you wish to find yet another variation of the kind, utilize the Lookup area to obtain the format that fits your needs and needs.

- When you have discovered the format you would like, click Acquire now to continue.

- Select the pricing program you would like, key in your credentials, and register for an account on US Legal Forms.

- Complete the purchase. You can utilize your credit card or PayPal account to pay for the legal kind.

- Select the formatting of the papers and down load it in your gadget.

- Make modifications in your papers if necessary. You are able to full, revise and signal and print out Iowa Financial Services Modernization Act (Gramm-Leach-Bliley Act).

Acquire and print out a large number of papers layouts utilizing the US Legal Forms Internet site, which offers the biggest selection of legal forms. Use skilled and state-specific layouts to take on your business or specific demands.

Form popularity

FAQ

Privacy and Security The Gramm-Leach-Bliley Act requires financial institutions ? companies that offer consumers financial products or services like loans, financial or investment advice, or insurance ? to explain their information-sharing practices to their customers and to safeguard sensitive data.

Financial institutions covered by the Gramm-Leach-Bliley Act must tell their customers about their information-sharing practices and explain to customers their right to "opt out" if they don't want their information shared with certain third parties.

The Gramm-Leach-Bliley Act (GLB Act or GLBA), also known as the Financial Modernization Act of 1999, is a federal law enacted in the United States to control the ways financial institutions deal with the private information of individuals.

The Financial Services Modernization Act of 1999 is a law that serves to partially deregulate the financial industry. The law allows companies working in the financial sector to integrate their operations, invest in each other's businesses, and consolidate.

The Financial Privacy Rule. The Financial Privacy Rule is another name for the GLBA's requirement that financial institutions must give customers and consumers the right to opt out, or not allow, a financial institution to share the customer/consumer's information with nonaffiliated third parties prior to sharing it.

Privacy Rule: Ensuring the protection of consumers' personal financial information. Safeguards Rule: Requiring the establishment of security measures to prevent data breaches. Pretexting Provisions: Prohibiting deceptive methods of obtaining personal financial information.

The act was passed in late 1999 and allows banks to offer financial services previously forbidden by the Glass-Steagall Act. Under the GLBA, each manager or service-person is only allowed to sell or manage one type of financial product/instrument.