Iowa Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005

Description

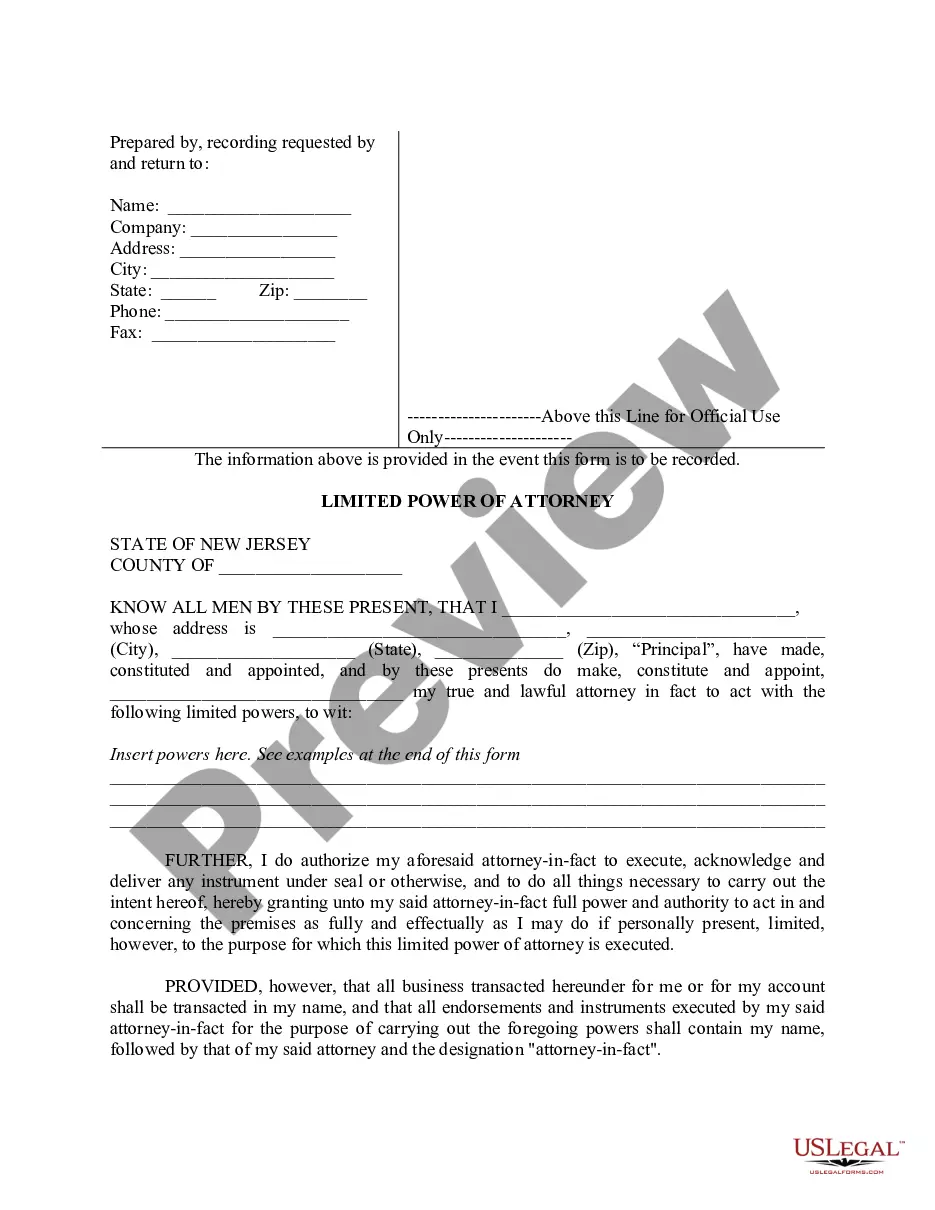

How to fill out Statement Of Current Monthly Income And Disposable Income Calculation For Use In Chapter 13 - Post 2005?

If you need to complete, download, or print legal record layouts, use US Legal Forms, the biggest assortment of legal forms, that can be found on the web. Take advantage of the site`s simple and easy practical research to get the files you will need. A variety of layouts for business and individual uses are sorted by groups and claims, or keywords. Use US Legal Forms to get the Iowa Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005 in just a number of mouse clicks.

In case you are presently a US Legal Forms buyer, log in in your account and then click the Down load key to get the Iowa Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005. Also you can access forms you formerly acquired from the My Forms tab of your respective account.

If you work with US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have chosen the form to the proper town/country.

- Step 2. Use the Review method to check out the form`s information. Don`t forget to read through the explanation.

- Step 3. In case you are not satisfied with the develop, take advantage of the Research field towards the top of the display to get other models of the legal develop design.

- Step 4. After you have identified the form you will need, click on the Get now key. Opt for the pricing plan you prefer and put your accreditations to register to have an account.

- Step 5. Process the transaction. You should use your bank card or PayPal account to accomplish the transaction.

- Step 6. Select the formatting of the legal develop and download it on your own gadget.

- Step 7. Complete, change and print or sign the Iowa Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005.

Every legal record design you acquire is your own eternally. You possess acces to each develop you acquired in your acccount. Click on the My Forms area and select a develop to print or download again.

Be competitive and download, and print the Iowa Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005 with US Legal Forms. There are millions of professional and status-distinct forms you may use for your business or individual requires.

Form popularity

FAQ

To calculate your monthly payment amount in a Chapter 13 bankruptcy, calculate your income for the six months before your bankruptcy filing. Deduct allowable expenses to determine your disposable income. Pay your priority debtors and any secured debts that you want to keep after the bankruptcy.

What is Disposable Personal Income? After-tax income. The amount that U.S. residents have left to spend or save after paying taxes is important not just to individuals but to the whole economy. The formula is simple: personal income minus personal current taxes.

Take your monthly income and deduct living expenses, priority debt payments, and secured payments. The remaining amount is your disposable income.

To calculate the total average monthly payment, add all amounts that are contractually due to each secured creditor in the 60 months after you file for bankruptcy. Then divide by 60.

A chapter 13 is a reorganization bankruptcy where you establish a repayment plan that usually lasts 5 years. Typically, the repayment plan is based on a budget that is created by looking at your net income and then your expenses.

For a Chapter 13, the ?Chapter 13 Statement of Your Current Monthly Income and Calculation of Commitment Period? (Form 122C-1) tells the court your average monthly income. Your income is compared to the median income for your state, which will assist in calculating your disposable income.

What is Disposable Personal Income? After-tax income. The amount that U.S. residents have left to spend or save after paying taxes is important not just to individuals but to the whole economy. The formula is simple: personal income minus personal current taxes.

You can't pay more than your disposable income in Chapter 13, because your disposable income represents all earnings that remain after paying required debts. However, there is another step in the Chapter 13 payment calculation, and if you don't meet the criteria, the judge won't approve your plan.