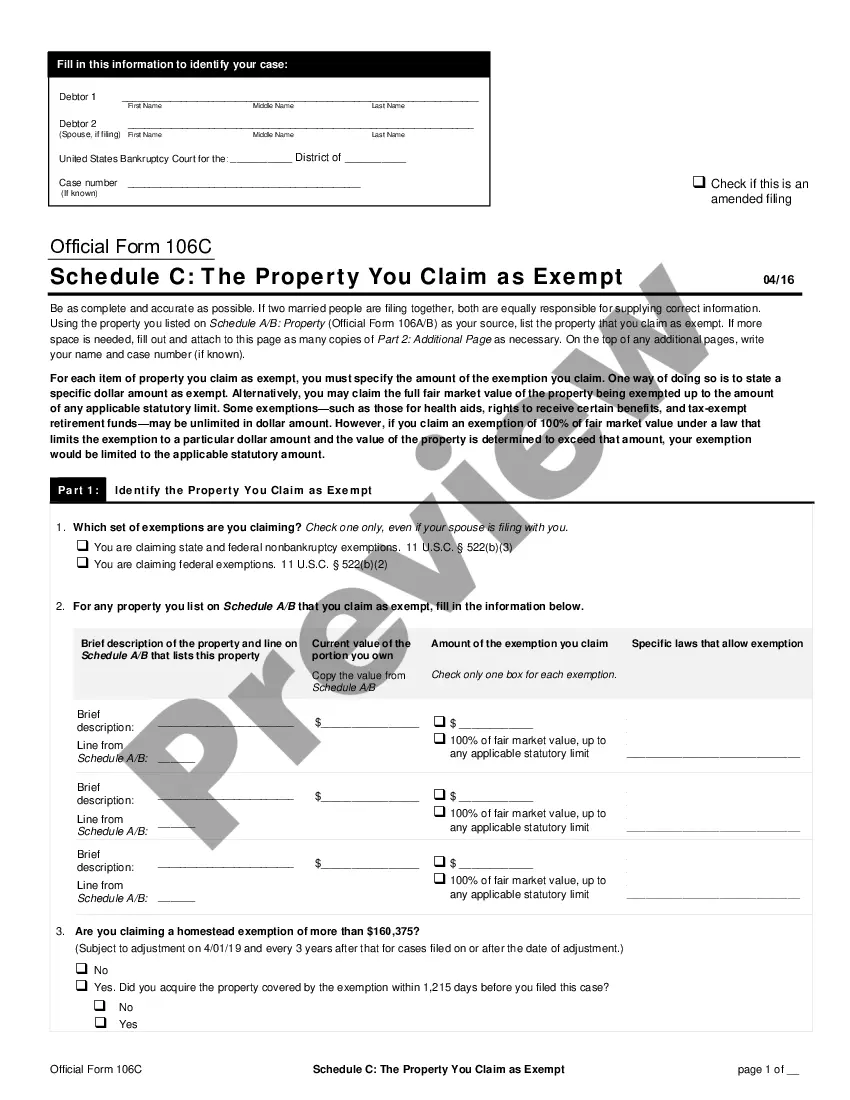

Iowa Property Claimed as Exempt - Schedule C - Form 6C - Post 2005

Description

How to fill out Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

Are you currently inside a placement in which you need files for both enterprise or person reasons almost every day time? There are a lot of legitimate document layouts available online, but discovering types you can depend on isn`t straightforward. US Legal Forms offers 1000s of kind layouts, like the Iowa Property Claimed as Exempt - Schedule C - Form 6C - Post 2005, that happen to be written to fulfill state and federal specifications.

In case you are previously informed about US Legal Forms web site and have your account, basically log in. Next, you can download the Iowa Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 web template.

Unless you provide an account and want to start using US Legal Forms, abide by these steps:

- Find the kind you require and ensure it is for that appropriate area/county.

- Make use of the Review key to examine the form.

- See the information to actually have chosen the correct kind.

- In case the kind isn`t what you`re trying to find, use the Lookup discipline to obtain the kind that meets your needs and specifications.

- When you get the appropriate kind, just click Get now.

- Pick the prices strategy you desire, fill in the specified information to create your money, and buy the order with your PayPal or charge card.

- Select a practical paper structure and download your backup.

Locate all of the document layouts you might have purchased in the My Forms food selection. You can get a additional backup of Iowa Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 whenever, if possible. Just select the necessary kind to download or produce the document web template.

Use US Legal Forms, probably the most considerable selection of legitimate forms, to save lots of time as well as prevent faults. The support offers skillfully manufactured legitimate document layouts that you can use for an array of reasons. Create your account on US Legal Forms and initiate making your lifestyle easier.

Form popularity

FAQ

(Official Form 106C) lists the property that you believe you are entitled to keep. If you do not claim the property on this form, it will not be exempted, despite your rights under the law. Before filling out this form, you have to decide whether you will use your state exemptions or the federal exemptions.