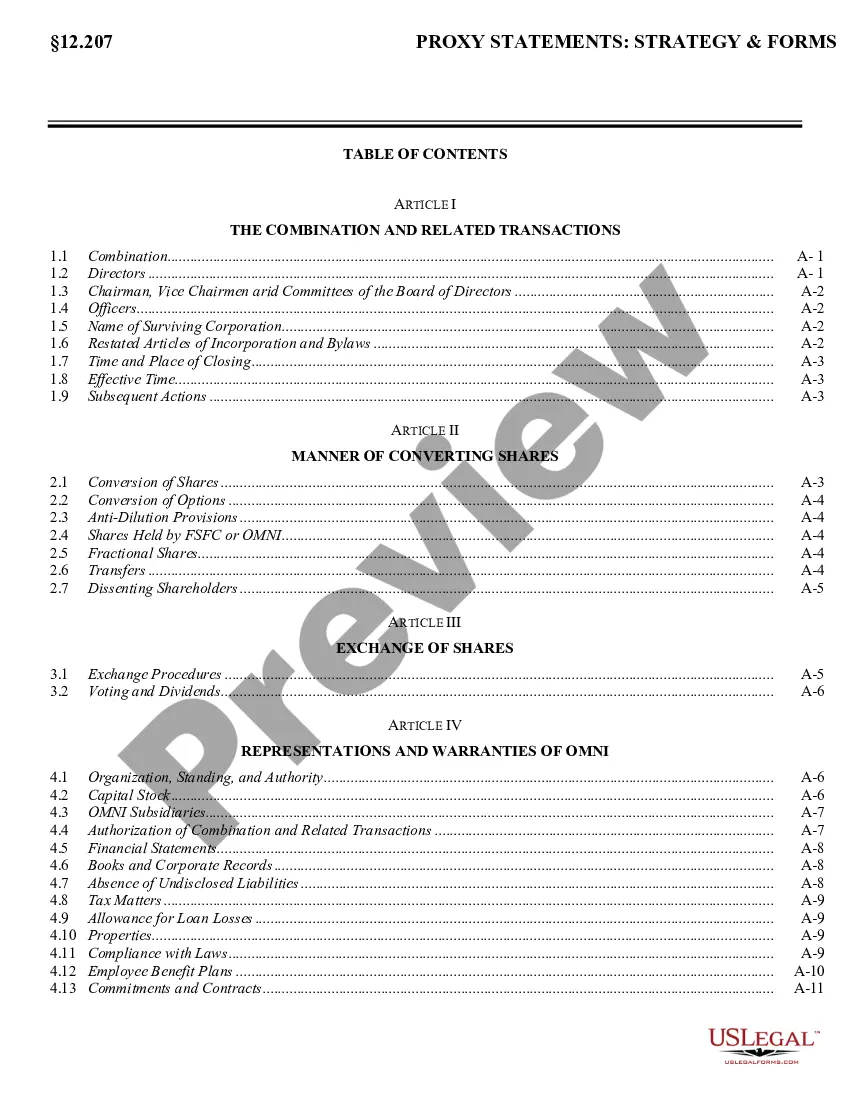

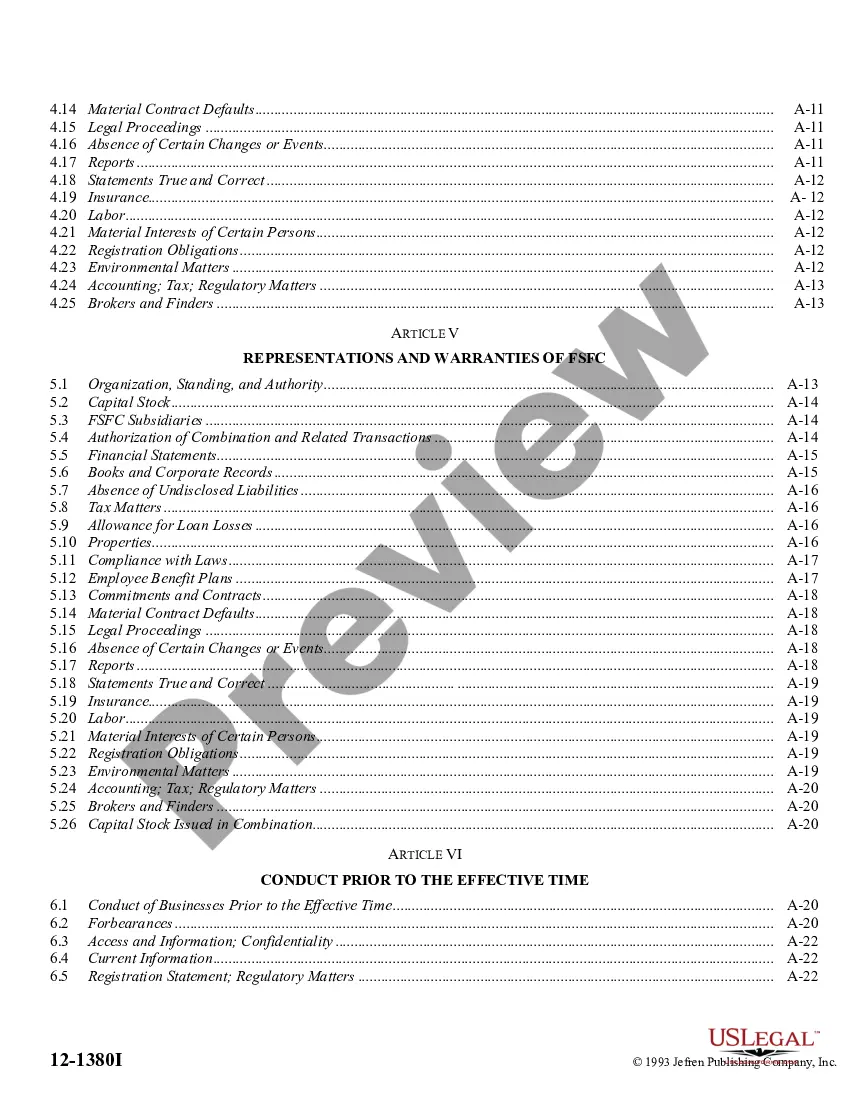

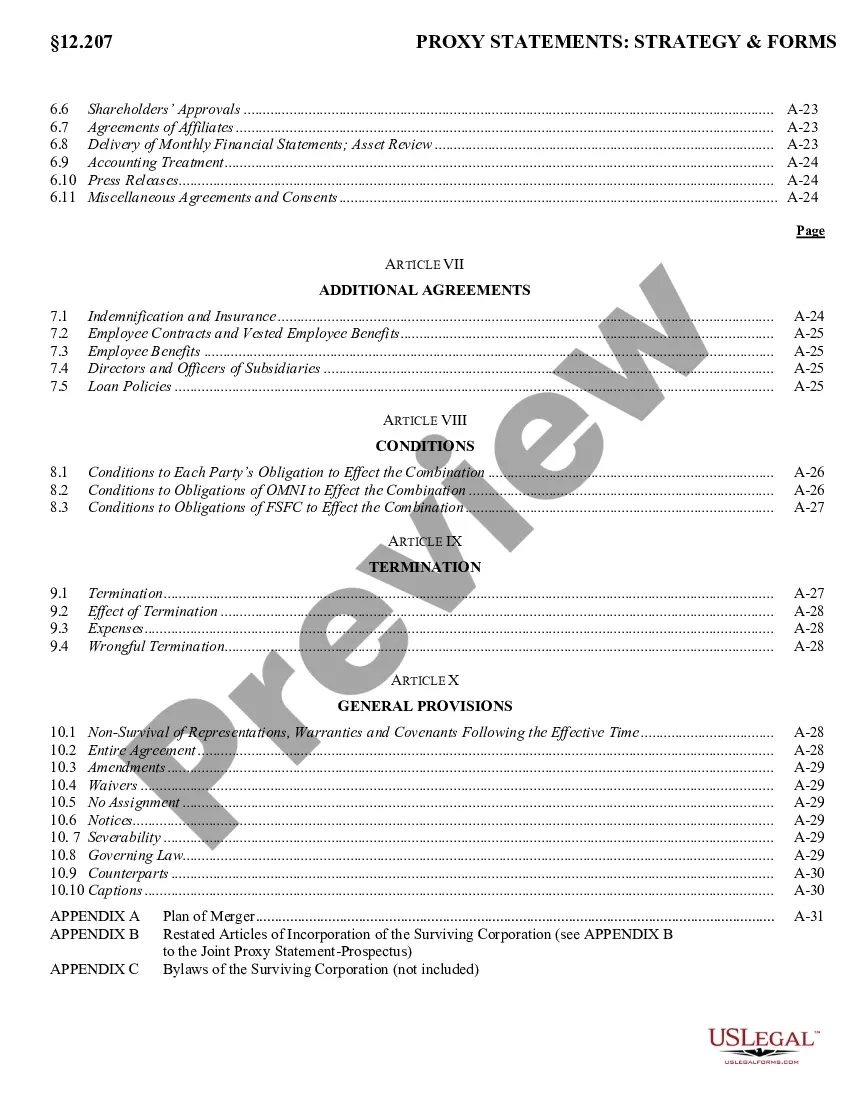

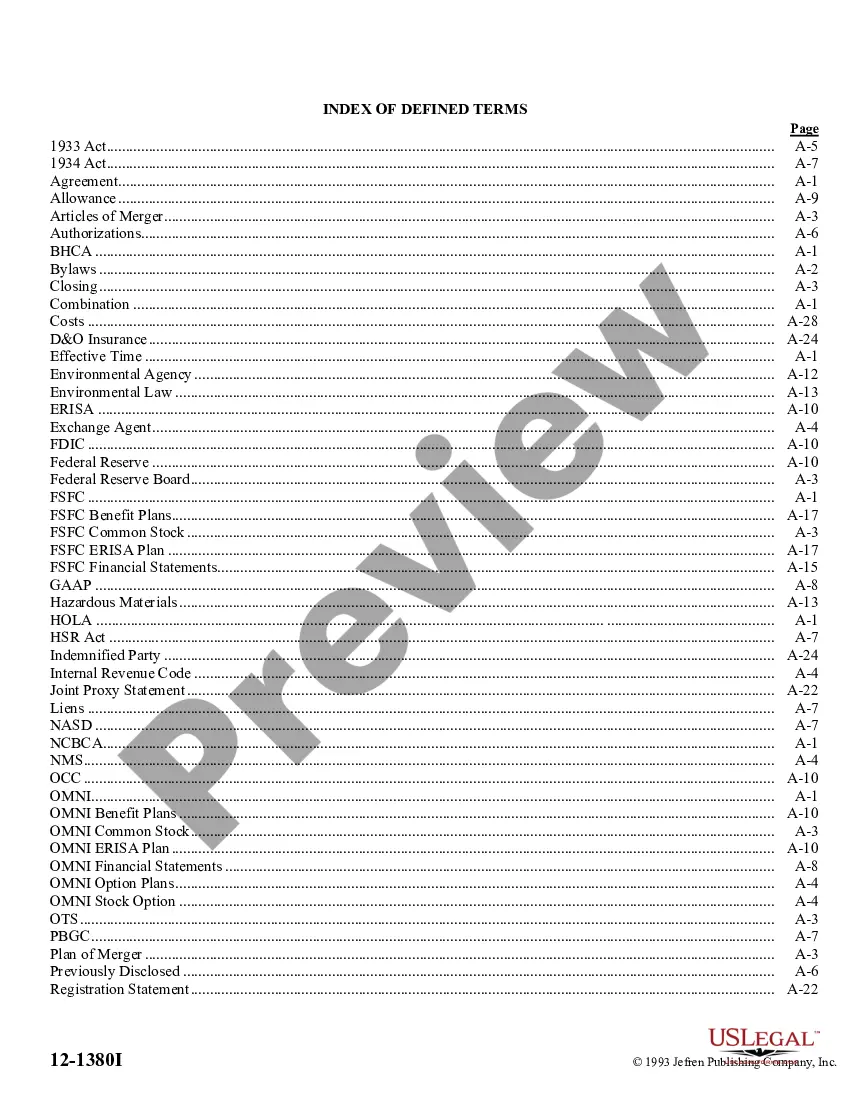

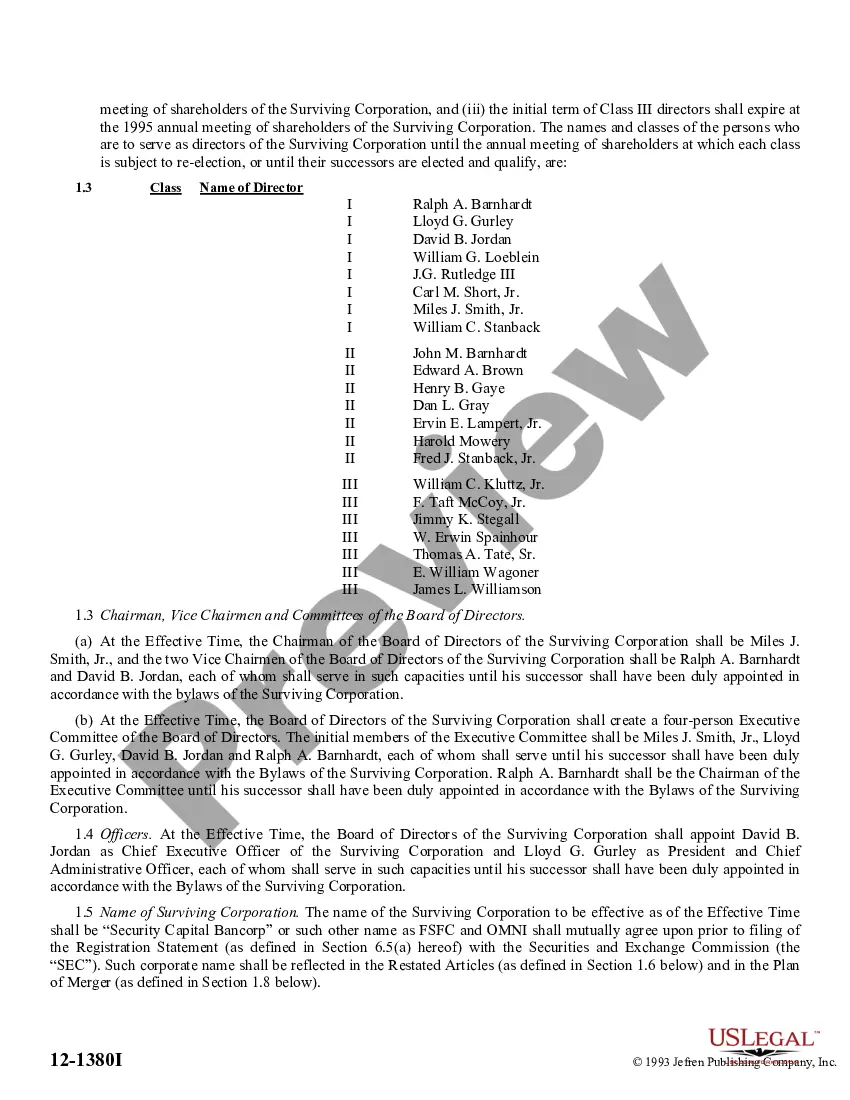

The Iowa Agreement of Combination refers to a legal document that outlines the terms and conditions for combining or merging two or more companies within the state of Iowa. This agreement provides a comprehensive framework for the consolidation of assets, liabilities, and operations of these entities, ensuring a smooth transition and legal compliance. The primary purpose of the Iowa Agreement of Combination is to establish a clear understanding between the participating parties regarding the structure and management of the newly formed entity. This agreement typically encompasses various aspects, including but not limited to: 1. Parties involved: The agreement identifies the companies or entities merging, clarifying their roles as merging entities and the resulting entity. 2. Terms and conditions: The agreement defines the terms and conditions under which the combination will take place. This includes details on the exchange of shares, stock options, or other considerations between the merging entities. 3. Transfer of assets and liabilities: The Iowa Agreement of Combination outlines the process for transferring assets and liabilities from one entity to another. It addresses issues such as intellectual property, real estate, contracts, customer relationships, and debts to be assumed by the new entity. 4. Governance and management: The agreement specifies the governance structure of the new entity, including the composition of the board of directors or management team, decision-making procedures, and voting rights of shareholders. It also addresses potential conflicts of interest and dispute resolution mechanisms. 5. Employee matters: The Iowa Agreement of Combination covers the treatment of employees from the merging entities. It outlines provisions for employee benefits, employment contracts, workforce integration, and potential layoffs or redundancies. 6. Regulatory compliance: The agreement ensures compliance with relevant laws and regulations, including those pertaining to competition, antitrust, tax implications, and any industry-specific rules governing the combination of entities. It's worth noting that while the Iowa Agreement of Combination serves as a general framework, there may be different types or variations depending on the specific circumstances and industries involved. For instance, there may be separate agreements tailored for mergers between corporations, limited liability companies (LCS), or partnerships. Additionally, the agreement may vary based on the nature of the industries, such as healthcare, finance, manufacturing, or technology sectors. In conclusion, the Iowa Agreement of Combination is a crucial legal document that sets forth the terms and conditions for merging or combining entities in Iowa. It covers a wide range of aspects, ensuring a smooth transition while addressing crucial matters such as asset transfer, governance, employee considerations, and regulatory compliance.

Iowa Agreement of Combination

Description

How to fill out Iowa Agreement Of Combination?

Are you in the situation where you require files for either company or specific uses nearly every working day? There are plenty of legitimate document templates available on the Internet, but getting types you can rely is not easy. US Legal Forms offers a huge number of kind templates, much like the Iowa Agreement of Combination, that are created to fulfill state and federal needs.

If you are previously acquainted with US Legal Forms site and have your account, merely log in. Following that, it is possible to download the Iowa Agreement of Combination web template.

Should you not offer an profile and want to begin using US Legal Forms, abide by these steps:

- Get the kind you need and ensure it is for that proper town/county.

- Utilize the Review option to check the form.

- Browse the outline to ensure that you have chosen the proper kind.

- If the kind is not what you`re looking for, use the Research discipline to get the kind that fits your needs and needs.

- When you find the proper kind, simply click Purchase now.

- Opt for the rates plan you need, submit the specified details to generate your bank account, and buy the transaction making use of your PayPal or credit card.

- Select a handy file format and download your copy.

Find every one of the document templates you have bought in the My Forms menus. You may get a extra copy of Iowa Agreement of Combination whenever, if required. Just go through the essential kind to download or produce the document web template.

Use US Legal Forms, by far the most extensive assortment of legitimate varieties, to conserve time as well as stay away from blunders. The services offers expertly produced legitimate document templates that can be used for a selection of uses. Make your account on US Legal Forms and commence producing your lifestyle easier.