Iowa Stock Option and Dividend Equivalent Plan with exhibits of UGI Corp.

Description

How to fill out Stock Option And Dividend Equivalent Plan With Exhibits Of UGI Corp.?

Have you been within a placement the place you will need paperwork for both company or personal functions virtually every day? There are a variety of legitimate record layouts accessible on the Internet, but discovering ones you can rely on isn`t effortless. US Legal Forms provides a huge number of form layouts, much like the Iowa Stock Option and Dividend Equivalent Plan with exhibits of UGI Corp., which can be created in order to meet federal and state specifications.

When you are already informed about US Legal Forms website and have an account, merely log in. Following that, you may acquire the Iowa Stock Option and Dividend Equivalent Plan with exhibits of UGI Corp. template.

Should you not come with an bank account and need to start using US Legal Forms, adopt these measures:

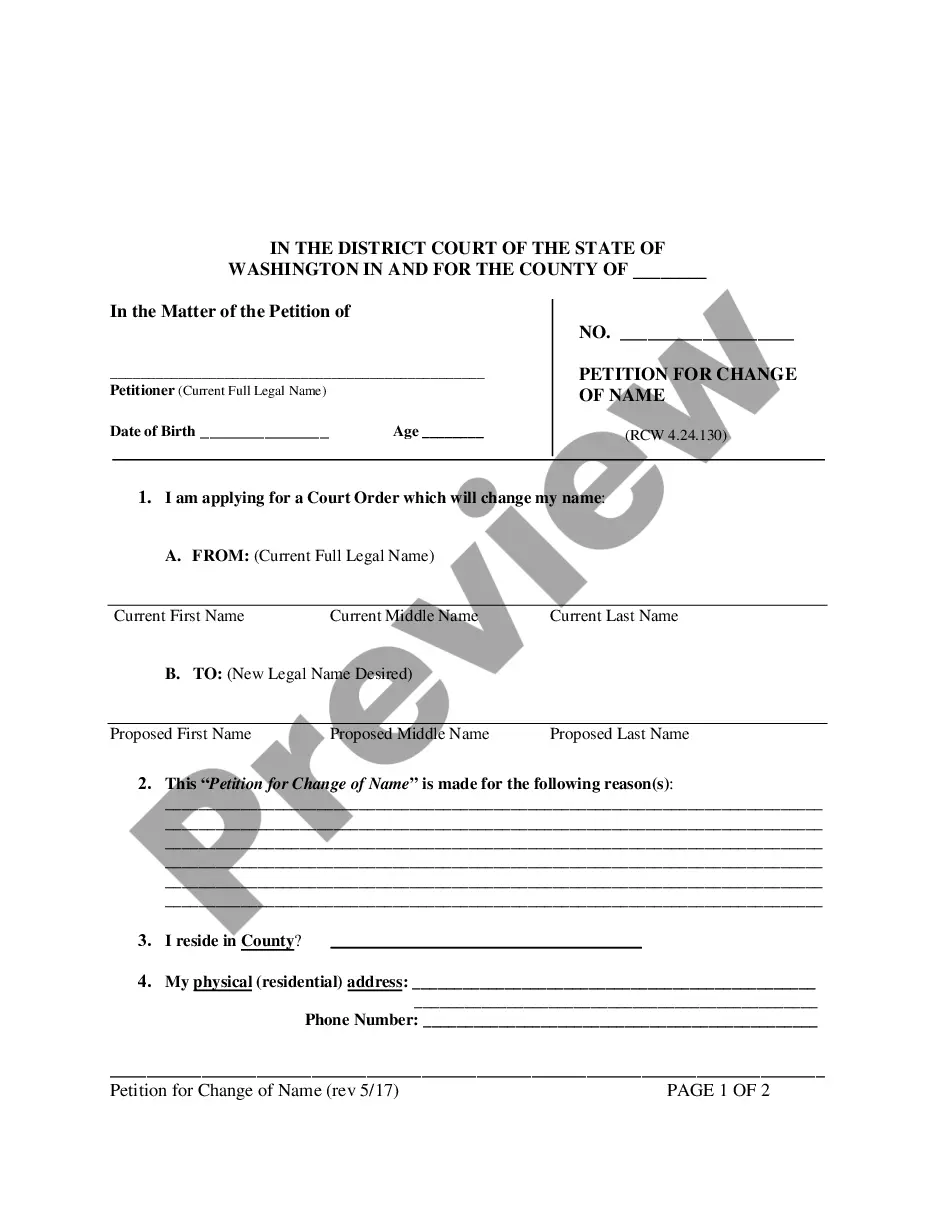

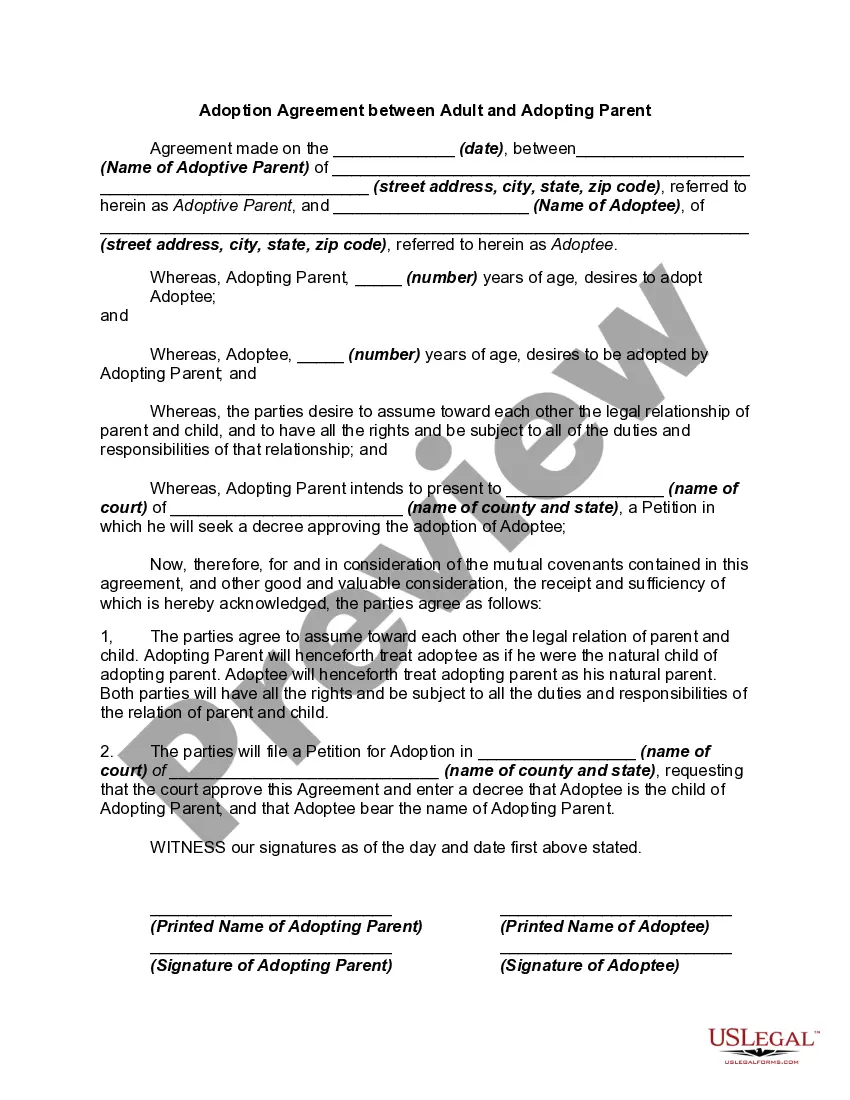

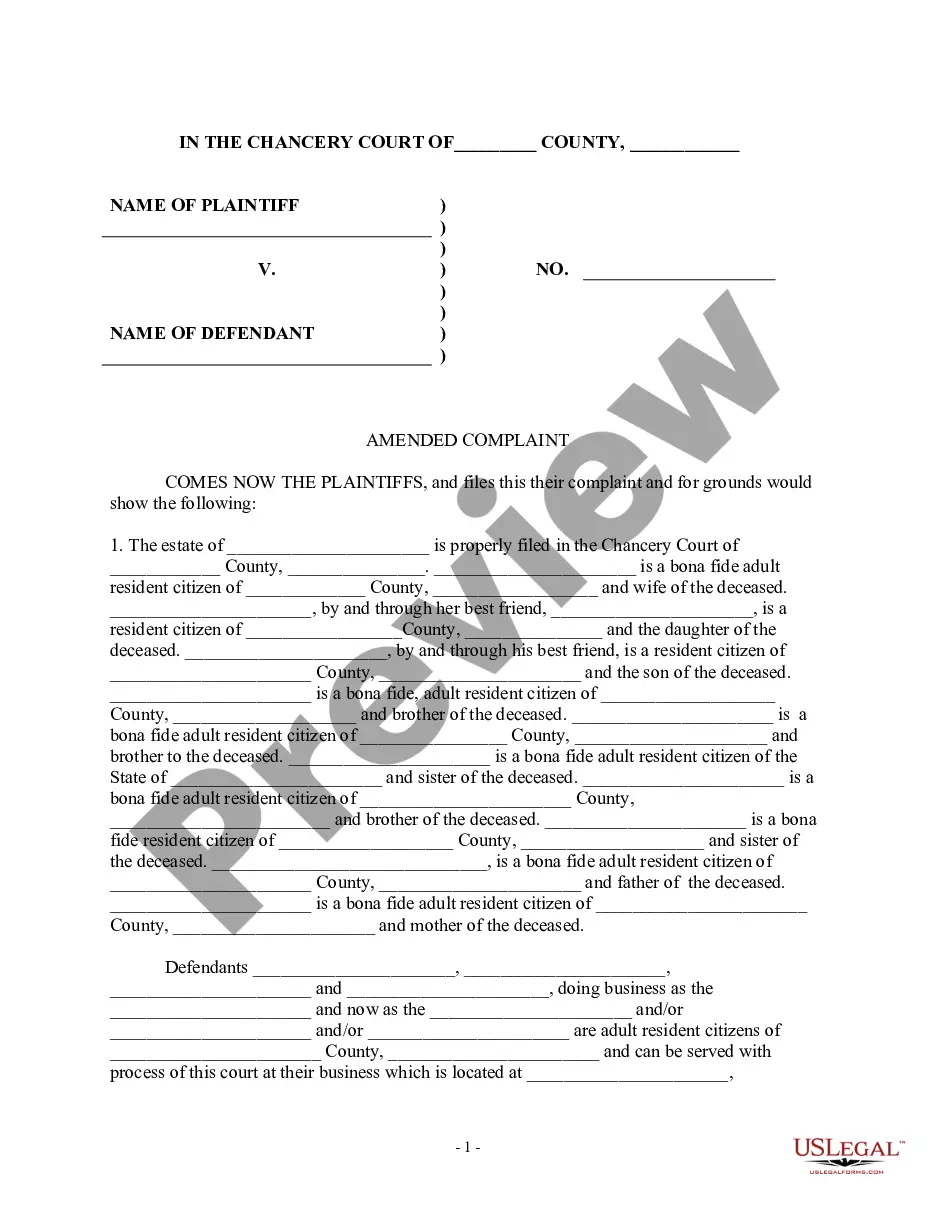

- Get the form you will need and make sure it is for the correct town/state.

- Take advantage of the Review key to review the shape.

- See the description to ensure that you have selected the appropriate form.

- When the form isn`t what you are trying to find, take advantage of the Research area to discover the form that suits you and specifications.

- Whenever you find the correct form, click Acquire now.

- Choose the costs program you need, submit the necessary info to make your bank account, and buy your order using your PayPal or credit card.

- Pick a convenient file structure and acquire your duplicate.

Get all the record layouts you might have purchased in the My Forms menu. You may get a additional duplicate of Iowa Stock Option and Dividend Equivalent Plan with exhibits of UGI Corp. anytime, if possible. Just click on the necessary form to acquire or printing the record template.

Use US Legal Forms, the most considerable collection of legitimate kinds, in order to save time as well as steer clear of blunders. The services provides appropriately made legitimate record layouts that you can use for a selection of functions. Create an account on US Legal Forms and initiate creating your way of life a little easier.

Form popularity

FAQ

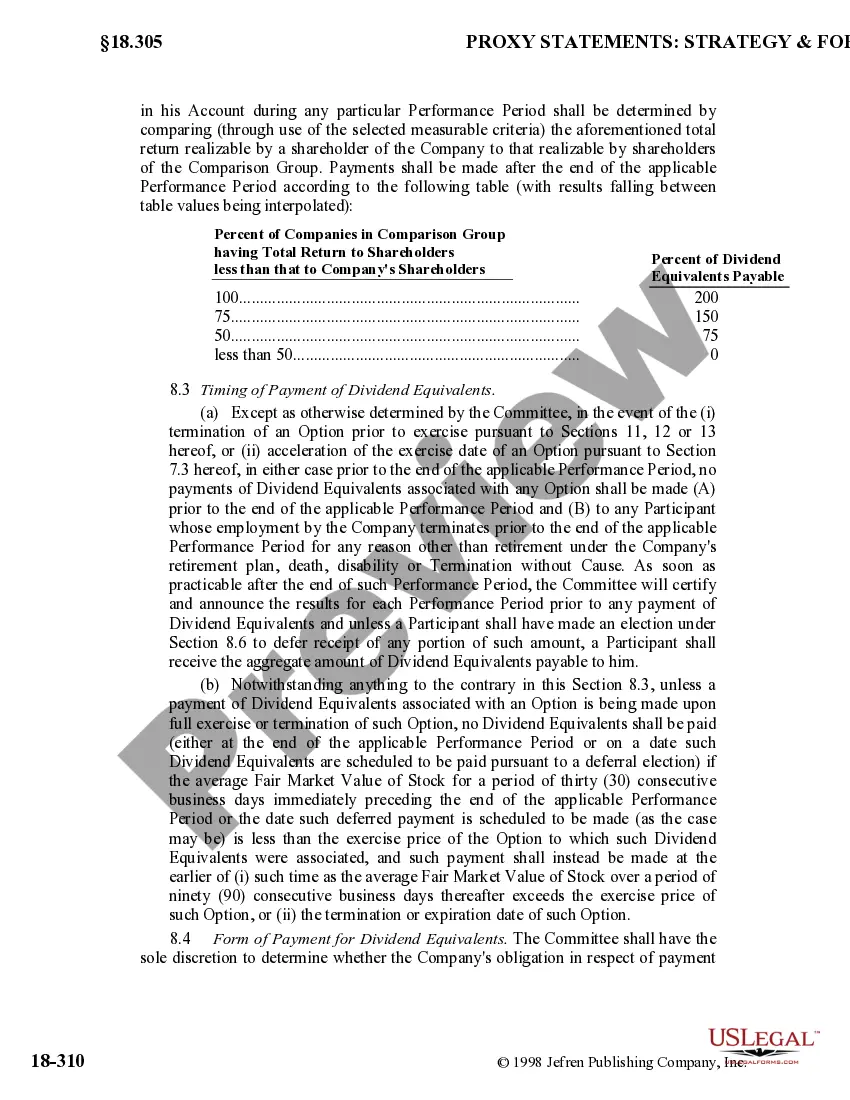

Dividend Equivalent Payment means, for each share of Stock represented by an outstanding RSU, a payment in an amount equal to, and in the same form of payment as, the dividend paid on one share of Stock.

A dividend equivalent right entitles the recipient to receive credits equal to the cash or stock dividends or other distributions that would have been received on shares of stock had the shares been issued and outstanding on the dividend record date.

A dividend equivalent payment is treated as a dividend from sources within the United States. ingly, the dividend is subject to the flat 30-percent withholding tax (or lower withholding tax rate, if provided for by a treaty) if received by a nonresident alien or foreign corporation (IRC § 871(m); Reg. §1.881-2).

Dividend Equivalent Amount means the amount to be credited to the Stock Compensation Sub?Account of a Member from time to time upon the payment by the Company of a dividend on its Common Stock (other than a dividend payable in shares of such Common Stock).

A dividend equivalent payment is treated as a dividend from sources within the United States. ingly, the dividend is subject to the flat 30-percent withholding tax (or lower withholding tax rate, if provided for by a treaty) if received by a nonresident alien or foreign corporation (IRC § 871(m); Reg. §1.881-2).

Dividend Equivalents means a right granted to a Participant under the Plan to receive the equivalent value (in cash or Shares) of dividends paid on Shares.