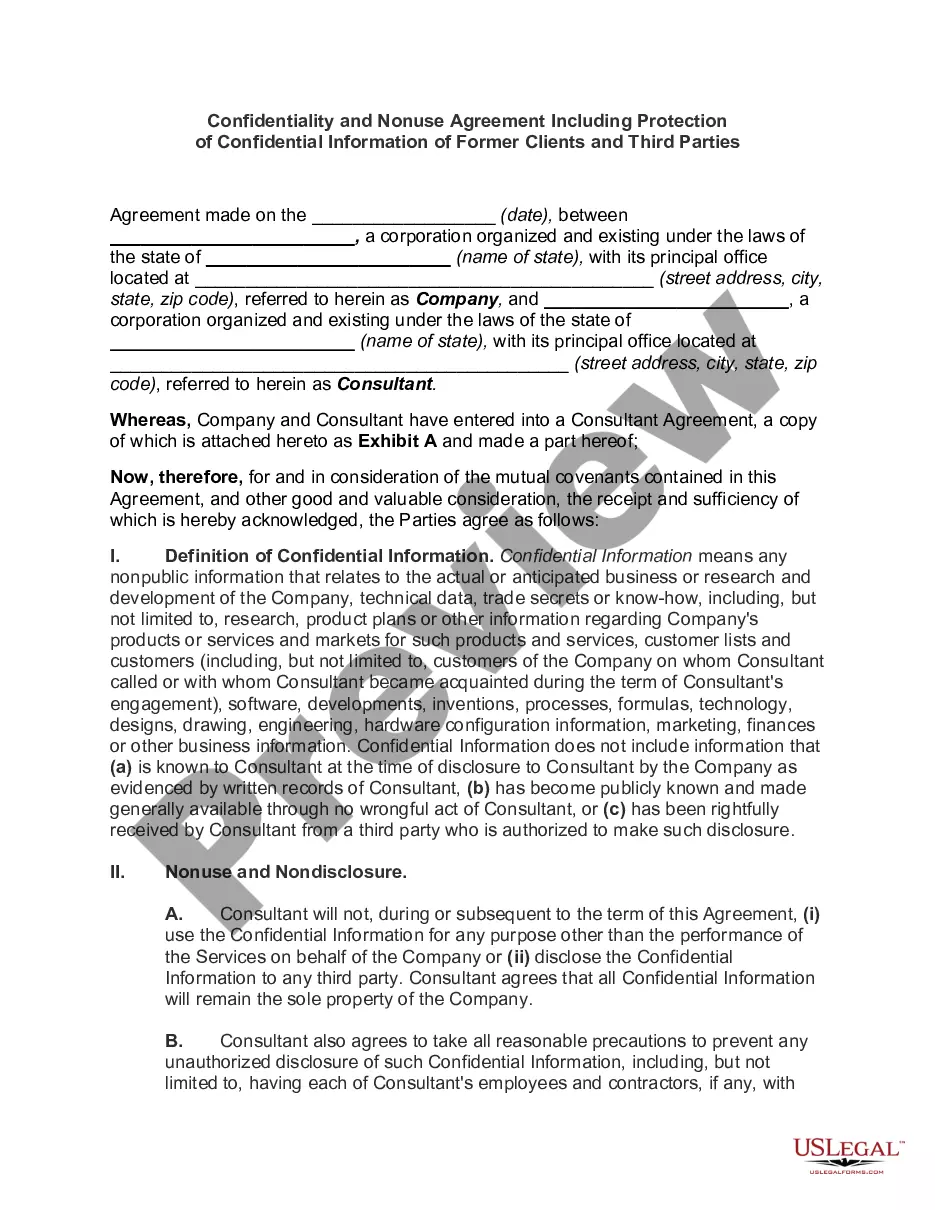

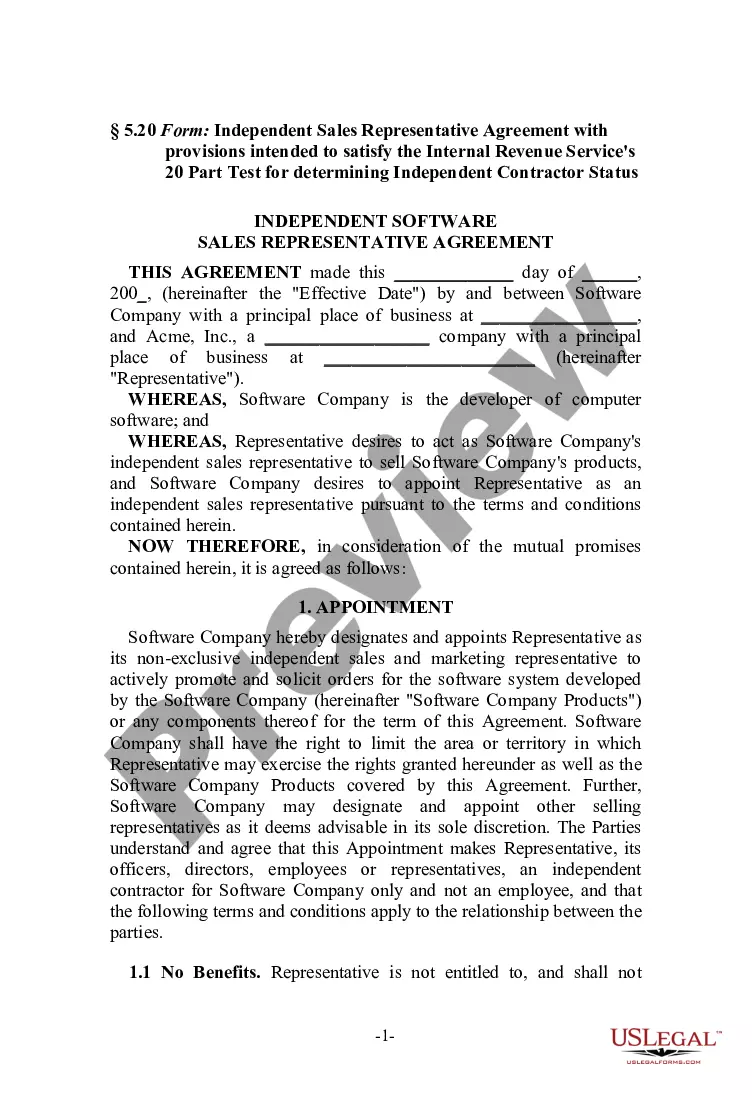

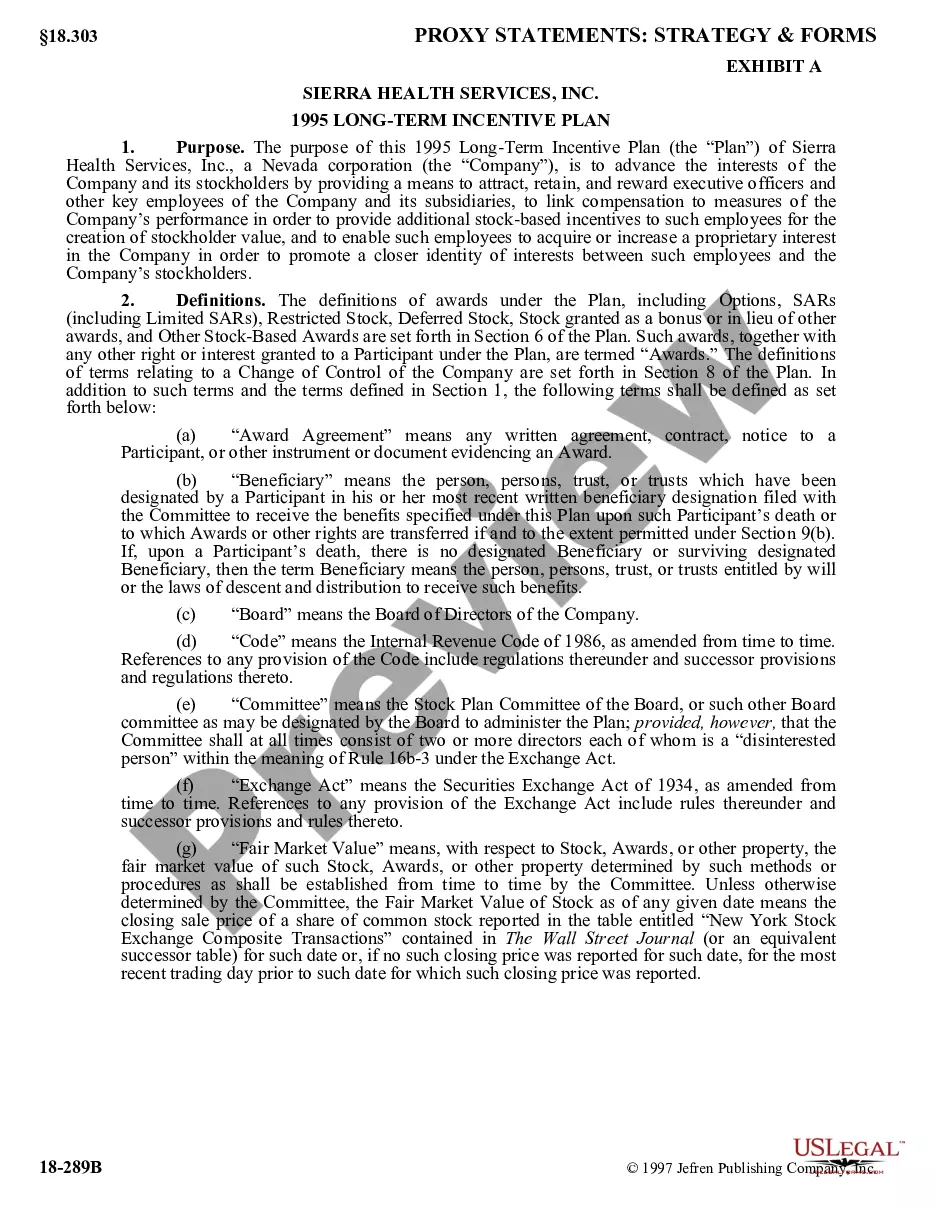

The Iowa Stock Incentive Plan of Abase Corp. is a comprehensive and strategic program designed to incentivize and reward employees of the company with stock-based compensation. This plan plays a crucial role in attracting, retaining, and motivating talent within the organization. Under this stock incentive plan, Abase Corp. offers various types of stock-based awards to eligible employees based in Iowa. These awards are granted in the form of stock options, restricted stock units (RSS), and performance-based stock awards. Each award type has its own unique characteristics and is subject to specific terms and conditions as outlined in the plan. 1. Stock Options: Employee stock options are a common component of the Iowa Stock Incentive Plan. These options provide employees with the right to purchase Abase Corp. common stock at a predetermined price, known as the exercise price, within a specified time frame. Stock options offer employees the opportunity to share in the company's growth and financial success. 2. Restricted Stock Units (RSS): RSS are another key feature of the plan. RSS represents a promise to deliver shares of Abase Corp. common stock to eligible employees at a future date, typically upon vesting. Unlike stock options, RSS do not require employees to make an upfront payment to acquire shares. Instead, the shares are granted outright after meeting specific time and/or performance-based criteria. 3. Performance-Based Stock Awards: Abase Corp. may also grant performance-based stock awards as part of the Iowa Stock Incentive Plan. These awards are tied to predetermined performance goals, such as financial targets, revenue growth, or market share. Achievement of these goals determines the number of shares awarded to employees. The Iowa Stock Incentive Plan of Abase Corp. is designed to align the interests of employees with those of the company's shareholders, fostering a sense of ownership, commitment, and accountability. The plan not only rewards employees for their contributions but also encourages them to actively participate in the company's long-term success. By offering different types of stock-based awards, Abase Corp. provides flexibility and ensures that the plan caters to the diverse needs and goals of its workforce in Iowa.

Iowa Stock Incentive Plan of Ambase Corp.

Description

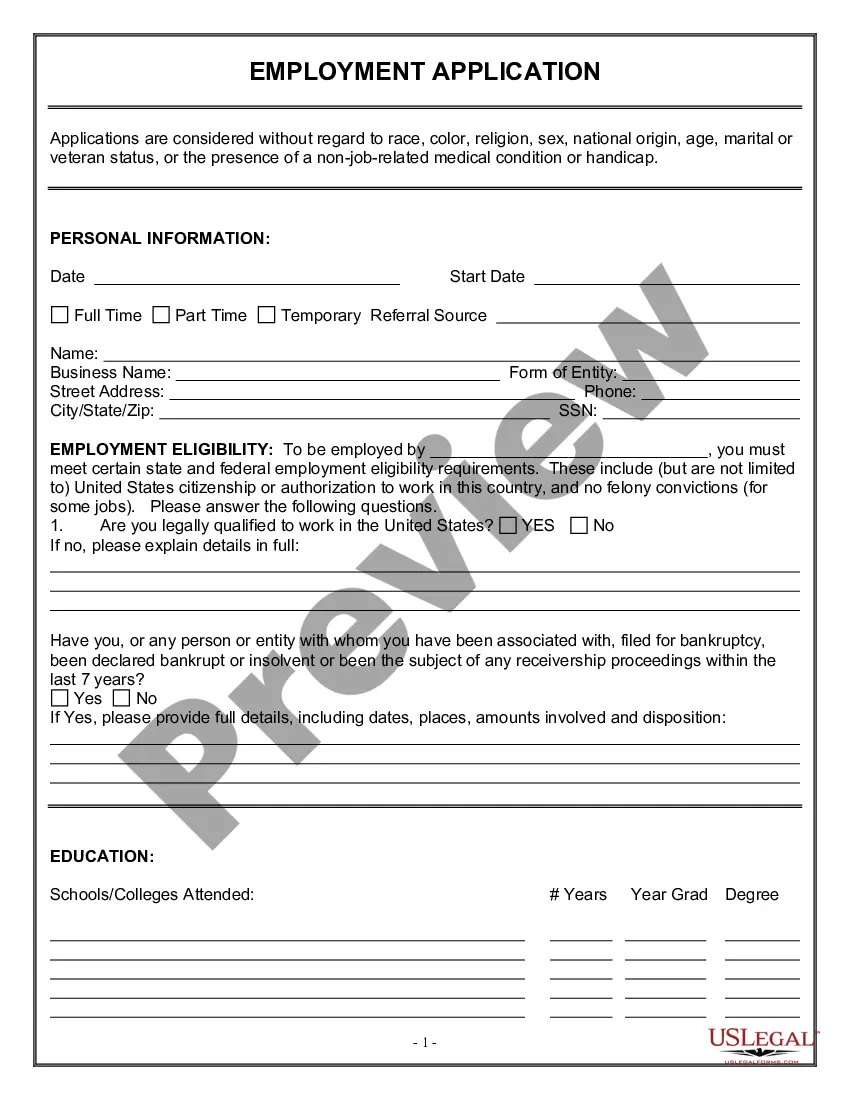

How to fill out Stock Incentive Plan Of Ambase Corp.?

US Legal Forms - among the most significant libraries of legal types in America - delivers a wide array of legal record themes you may obtain or print. While using site, you can get a large number of types for company and individual functions, categorized by categories, suggests, or keywords and phrases.You can find the latest versions of types just like the Iowa Stock Incentive Plan of Ambase Corp. in seconds.

If you currently have a membership, log in and obtain Iowa Stock Incentive Plan of Ambase Corp. through the US Legal Forms library. The Obtain switch will show up on every type you look at. You have access to all earlier delivered electronically types inside the My Forms tab of the account.

In order to use US Legal Forms the first time, listed below are simple directions to help you started:

- Ensure you have selected the correct type for your personal area/state. Select the Review switch to analyze the form`s information. Browse the type description to ensure that you have selected the proper type.

- In the event the type doesn`t satisfy your specifications, utilize the Research discipline on top of the display to obtain the one which does.

- Should you be happy with the form, validate your choice by clicking on the Purchase now switch. Then, pick the costs plan you want and give your credentials to sign up for the account.

- Approach the financial transaction. Utilize your Visa or Mastercard or PayPal account to accomplish the financial transaction.

- Pick the format and obtain the form on your device.

- Make modifications. Fill out, modify and print and indication the delivered electronically Iowa Stock Incentive Plan of Ambase Corp..

Every single template you put into your bank account does not have an expiration time and is yours forever. So, if you wish to obtain or print another version, just proceed to the My Forms section and then click in the type you need.

Get access to the Iowa Stock Incentive Plan of Ambase Corp. with US Legal Forms, probably the most substantial library of legal record themes. Use a large number of professional and express-specific themes that satisfy your small business or individual requires and specifications.

Form popularity

FAQ

Taxes and Incentive Stock Options Your employer isn't required to withhold income tax when you exercise an Incentive Stock Option since there is no tax due (under the regular tax system) until you sell the stock.

By following these steps in crafting your own incentive program, you will be sure to see long-term success. Determine Goals and Objectives. ... Identify Participants. ... Establish Program Details. ... Create a Budget. ... Outline a Reward. ... Report on Results. ... Launch the Program. ... Monitor Success.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit.

Employee stock options can be a lucrative part of an individual's overall compensation package, although not every company offers them. Workers can buy shares at a pre-determined price at a future date, regardless of the price of the stock when the options are exercised.

They provide employees the right, but not the obligation, to purchase shares of their employer's stock at a certain price for a certain period of time. Options are usually granted at the current market price of the stock and last for up to 10 years.