The Iowa Directors Stock Appreciation Rights Plan is a compensation program offered by American Annuity Group, Inc. to its directors based in Iowa. This plan is designed to incentivize and reward the directors for their contributions to the company's growth and financial success. Here is a detailed description of the Iowa Directors Stock Appreciation Rights Plan, including its key features and benefits: The Iowa Directors Stock Appreciation Rights Plan allows eligible directors of American Annuity Group, Inc. who are residing in Iowa to receive additional compensation in the form of stock appreciation rights (SARS). SARS is a type of equity-based compensation that provides the directors with the opportunity to benefit from the company's stock price appreciation over a specific period of time. Under this plan, eligible directors are granted a certain number of SARS, which represent the right to receive a cash payment or shares of the company's stock equivalent to the increase in stock price over a predetermined base price. The base price is typically the fair market value of the stock on the grant date. The value of the SARS granted to the directors is determined based on various factors, including the director's service tenure, position, and overall contribution to the company's success. The Iowa Directors Stock Appreciation Rights Plan offers several advantages to both the directors and American Annuity Group, Inc. Firstly, it aligns the interests of the directors with those of the company's shareholders, as the directors have a vested interest in the company's stock price appreciation. This encourages the directors to make decisions and take actions that enhance the company's long-term value. Secondly, the plan provides a competitive compensation package for the directors, helping attract and retain top talent in the boardroom. By offering SARS, the company ensures that directors are rewarded for their continued commitment and dedication to the company's success. This form of compensation also helps incentivize directors to make strategic decisions that lead to improved financial performance and shareholder value. It is worth noting that there may be variations or different types of Iowa Directors Stock Appreciation Rights Plans offered by American Annuity Group, Inc., depending on factors such as the director's position, tenure, and specific performance targets. These variations may include performance-based SARS, restricted stock units, or other forms of equity-based compensation that align with the company's objectives and desired outcomes. In summary, the Iowa Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. is a compensation program that provides eligible directors with stock appreciation rights as a reward for their contributions to the company's success. This plan aligns the interests of directors with the company's shareholders and helps attract and retain top boardroom talent. The specific details and variations of the plan may vary depending on individual circumstances and performance targets.

Iowa Directors Stock Appreciation Rights Plan of American Annuity Group, Inc.

Description

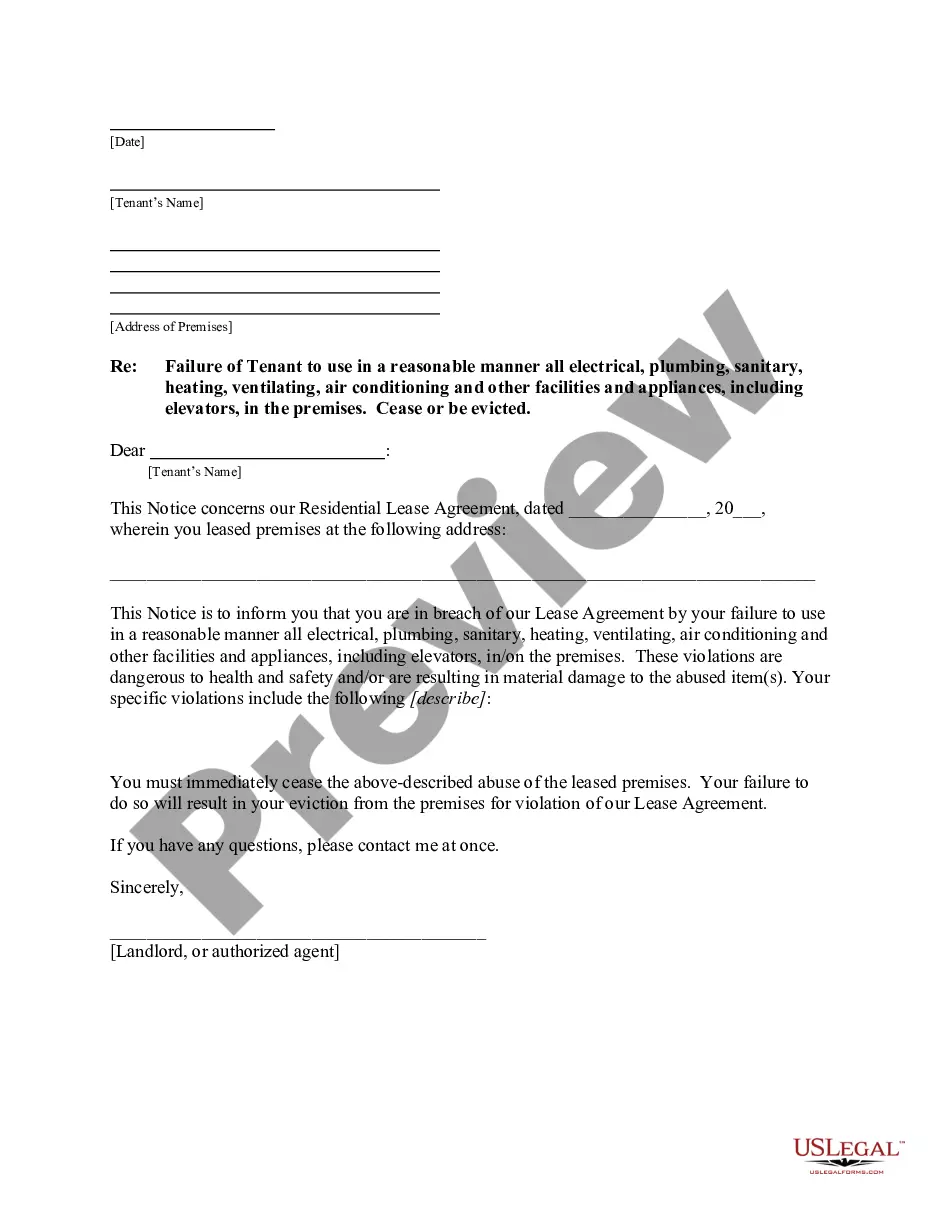

How to fill out Iowa Directors Stock Appreciation Rights Plan Of American Annuity Group, Inc.?

Discovering the right lawful papers template can be a struggle. Of course, there are a lot of templates accessible on the Internet, but how would you find the lawful develop you require? Utilize the US Legal Forms internet site. The assistance provides thousands of templates, including the Iowa Directors Stock Appreciation Rights Plan of American Annuity Group, Inc., that can be used for company and personal requirements. All the forms are checked out by specialists and satisfy state and federal specifications.

If you are previously signed up, log in for your profile and click the Acquire option to find the Iowa Directors Stock Appreciation Rights Plan of American Annuity Group, Inc.. Make use of your profile to search through the lawful forms you have ordered in the past. Visit the My Forms tab of your profile and acquire another copy in the papers you require.

If you are a new consumer of US Legal Forms, listed here are straightforward directions that you should comply with:

- First, make certain you have chosen the proper develop to your area/region. You may check out the shape using the Review option and look at the shape explanation to make certain this is basically the right one for you.

- If the develop will not satisfy your expectations, use the Seach discipline to find the appropriate develop.

- Once you are positive that the shape is suitable, go through the Get now option to find the develop.

- Select the prices strategy you want and enter the essential information and facts. Build your profile and buy your order using your PayPal profile or charge card.

- Pick the file format and obtain the lawful papers template for your system.

- Total, edit and print out and indication the obtained Iowa Directors Stock Appreciation Rights Plan of American Annuity Group, Inc..

US Legal Forms will be the greatest local library of lawful forms in which you will find numerous papers templates. Utilize the service to obtain expertly-produced papers that comply with condition specifications.

Form popularity

FAQ

The rights are valued once, divided evenly over the vesting period and marked as rights paid in capital. For example, a company that issues $5,000 in rights with a five-year vesting period would debit compensation expense for $1,000 and credit rights paid in capital for $1,000 once a year for five years. Accounting for Stock Appreciation Rights - Small Business - Chron.com chron.com ? accounting-stock-appr... chron.com ? accounting-stock-appr...

What is a Stock Appreciation Right (SAR)? A Stock Appreciation Right (SAR) refers to the right to be paid compensation equivalent to an increase in the company's common stock price over a base or the value of appreciation of the equity shares currently being traded on the public market.

A SAR is very similar to a stock option, but with a key difference. When a stock option is exercised, an employee has to pay the grant price and acquire the underlying security. However, when a SAR is exercised, the employee does not have to pay to acquire the underlying security. FAQs ? Stock Appreciation Rights (SARS) - Fidelity Investments Fidelity Investments ? stockoptions ? aboutsarfaq Fidelity Investments ? stockoptions ? aboutsarfaq

A ?Stock Appreciation Right? is the right to receive a payment from the Company in an amount equal to the ?Spread,? which is defined as the excess of the Fair Market Value (as defined in Plan) of one share of common stock, $1.00 par value (the ?Stock?) of the Company at the Exercise Date (as defined below) over a ...

A compensatory award granted to an employee or other service provider of a company. On exercise of a SAR, the recipient is entitled to receive an amount equal to the appreciation in the value of the underlying company shares from the date the SAR is granted until the SAR is exercised. Stock Appreciation Right (SAR) - Practical Law Canada Practical Law Canada ? ... Practical Law Canada ? ...