The Iowa Management Stock Purchase Plan (IMS PP) is a specialized investment program offered by Iowa-based management companies, designed to facilitate ownership of company shares by employees. This employee benefit plan allows eligible employees to purchase company stocks at discounted prices, fostering a sense of ownership, loyalty, and long-term commitment. The IMS PP encourages employees to invest in their employers' shares, which can generate several advantages for both the employees and the company. By participating in this program, employees often gain access to various financial incentives, such as competitive discounts on stock purchases, tax advantages, and potential capital appreciation. Within the Iowa Management Stock Purchase Plan, there are different types available, tailored to meet the needs of different employees. These variations ensure that the IMS PP remains inclusive and accommodating to diverse financial circumstances and goals. Some common types of IMS PP include: 1. Standard Stock Purchase Plan: This type enables employees to purchase company stocks at predetermined intervals, usually every quarter or annually, at a discounted price determined by a fixed percentage or a formula. 2. Restricted Stock Plan: In this plan, employers offer shares of their company to employees as a form of compensation or incentive. However, these stocks are "restricted," meaning employees cannot sell or transfer them immediately and may need to meet certain vesting requirements or remain with the company for a specific period. 3. Stock Option Plan: This plan grants employees the option to purchase company stocks at a predetermined price, known as the exercise price or strike price, for a specific period. Employees can choose to exercise this option if the company's stock price increases, enabling them to purchase stocks at a lower price and potentially profit from the price difference. 4. Employee Stock Ownership Plan (ESOP): This plan allows employees to acquire ownership interest in the company by purchasing company stocks as part of their retirement benefits. Sops contribute to building a retirement fund for employees, providing them with a stake in the company's success. It is important to note that the specific types and regulations of the Iowa Management Stock Purchase Plan may vary among different companies and Iowa-based management firms. Employees interested in participating in the IMS PP should carefully review their company's plan document, consult with their company's HR department, and potentially seek independent financial advice to fully understand the offerings and implications involved.

Iowa Management Stock Purchase Plan

Description

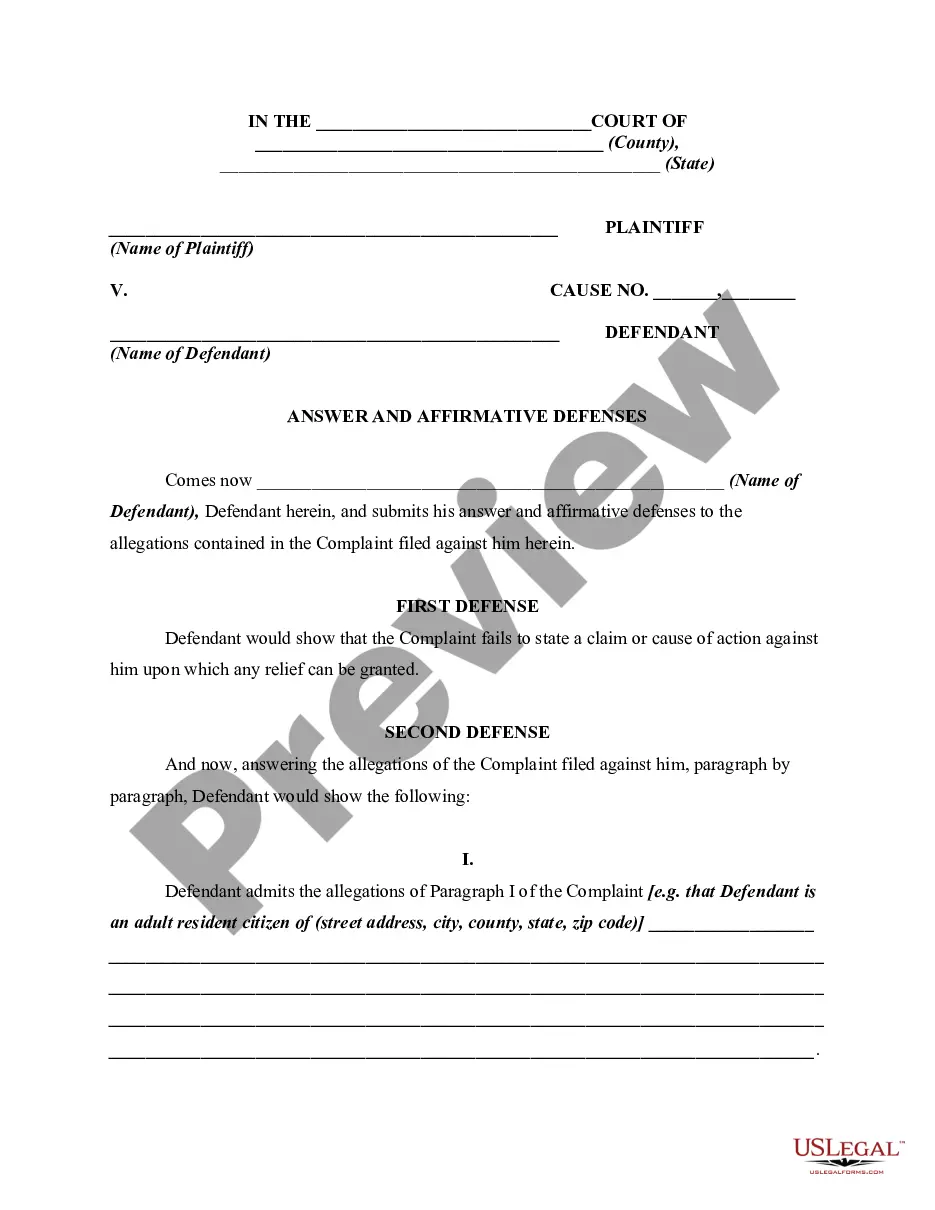

How to fill out Iowa Management Stock Purchase Plan?

You are able to spend hours online looking for the legal record design that fits the state and federal specifications you want. US Legal Forms gives thousands of legal types which can be examined by pros. You can actually down load or print out the Iowa Management Stock Purchase Plan from our assistance.

If you already have a US Legal Forms accounts, you can log in and click on the Obtain key. After that, you can full, modify, print out, or indicator the Iowa Management Stock Purchase Plan. Every legal record design you purchase is your own eternally. To have another copy associated with a bought form, check out the My Forms tab and click on the corresponding key.

Should you use the US Legal Forms website the first time, follow the simple recommendations below:

- Initial, make certain you have chosen the right record design for that county/area of your choosing. See the form description to make sure you have picked out the proper form. If available, take advantage of the Preview key to check throughout the record design too.

- If you want to find another edition from the form, take advantage of the Search discipline to find the design that meets your requirements and specifications.

- After you have located the design you want, simply click Get now to proceed.

- Pick the costs strategy you want, key in your accreditations, and register for a free account on US Legal Forms.

- Comprehensive the deal. You can use your Visa or Mastercard or PayPal accounts to cover the legal form.

- Pick the formatting from the record and down load it for your gadget.

- Make changes for your record if possible. You are able to full, modify and indicator and print out Iowa Management Stock Purchase Plan.

Obtain and print out thousands of record layouts using the US Legal Forms website, that provides the largest assortment of legal types. Use expert and status-certain layouts to take on your business or personal requires.

Form popularity

FAQ

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

Qualifying disposition: You sold the stock at least two years after the offering (grant date) and at least one year after the exercise (purchase date). If so, a portion of the profit (the ?bargain element?) is considered compensation income (taxed at regular rates) on your Form 1040.

An employee stock purchase plan (or ESPP) can be a very valuable benefit. In general, if your employer offers an ESPP, we think you should participate at the level you can comfortably afford and then sell the shares as soon as you can.

An employee stock purchase plan (ESPP) is a company-run program in which participating employees can purchase company stock directly, at a discounted price. Employees contribute to the plan through payroll deductions which build up between the offering date and the purchase date.

Top Companies Offering Employee stock purchase plan (1318) CreatorIQ. ... Caesars Sportsbook & . ... Kin + Carta. ... Free Agency. ... RS21. ... Astra. ... Outbrain. AdTech ? Big Data ? Digital Media ? Information Technology ? Marketing Tech. ... BillGO. Fintech ? Payments ? Software ? Financial Services.

Limited Liquidity: In some cases, ESPPs may have restrictions on when employees can sell their shares, making it difficult to access the funds in an emergency or for other purposes. This lack of liquidity can be a drawback, especially for employees who may need to sell their shares quickly.

A: Yes. You may withdraw from the ESPP by notifying Fidelity and completing a withdrawal election. When you withdraw, all of the contributions accumulated in your account will be returned to you as soon as administratively possible and you will not be able to make any further contributions during that offering period.

An employee stock purchase plan (or ESPP) can be a very valuable benefit. In general, if your employer offers an ESPP, we think you should participate at the level you can comfortably afford and then sell the shares as soon as you can.