Iowa Proposal to approve restricted stock plan

Description

How to fill out Proposal To Approve Restricted Stock Plan?

Have you been in a place in which you will need paperwork for both organization or personal reasons nearly every day time? There are a lot of authorized file templates available on the Internet, but getting types you can trust isn`t easy. US Legal Forms offers thousands of develop templates, like the Iowa Proposal to approve restricted stock plan, that happen to be composed in order to meet federal and state needs.

If you are already familiar with US Legal Forms web site and have an account, simply log in. Following that, you may download the Iowa Proposal to approve restricted stock plan web template.

Should you not offer an account and want to begin using US Legal Forms, abide by these steps:

- Discover the develop you want and make sure it is for that appropriate city/county.

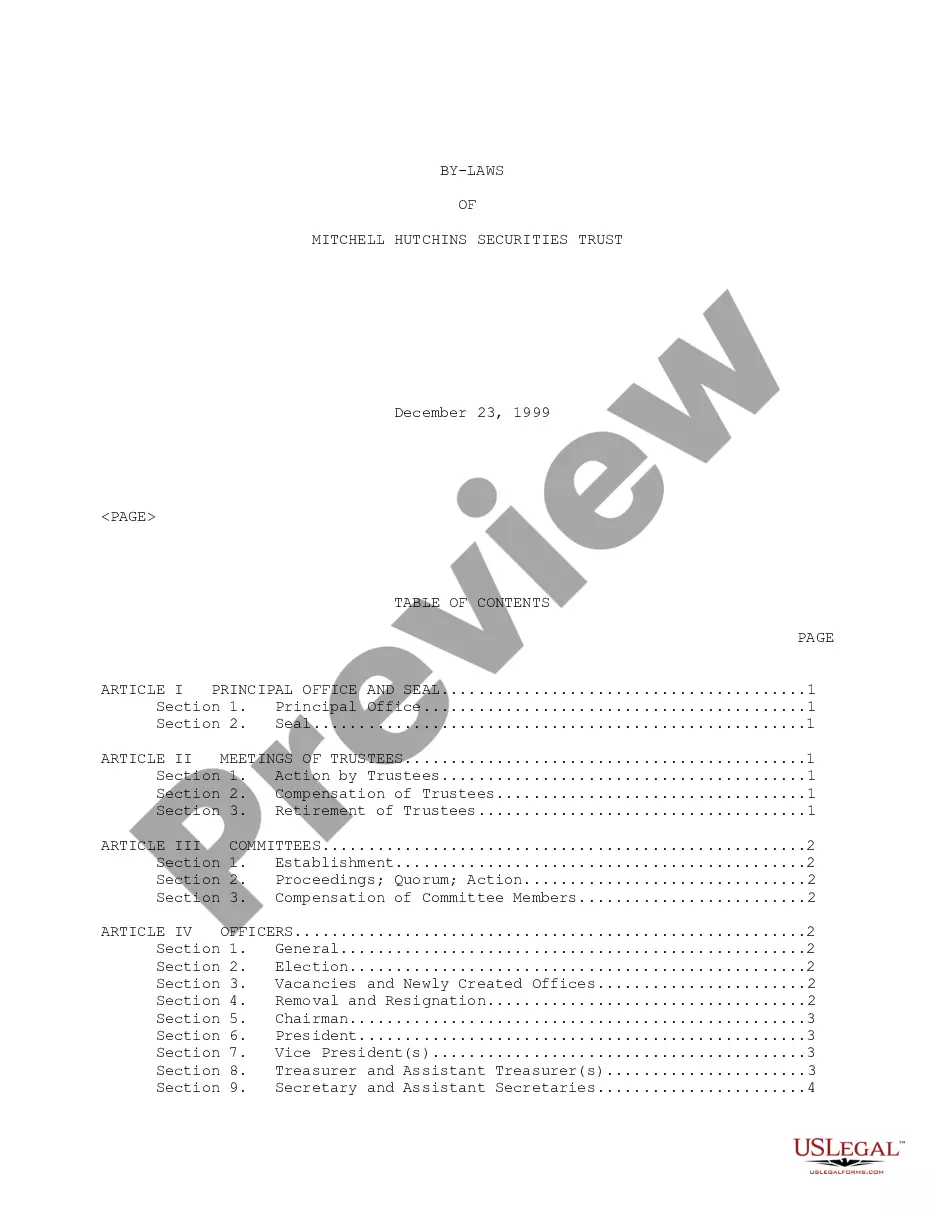

- Make use of the Review option to examine the form.

- Browse the information to actually have selected the correct develop.

- In case the develop isn`t what you are looking for, use the Lookup industry to get the develop that meets your needs and needs.

- Whenever you obtain the appropriate develop, click Acquire now.

- Select the rates plan you would like, submit the specified information to produce your account, and buy your order making use of your PayPal or bank card.

- Select a hassle-free document file format and download your version.

Discover every one of the file templates you might have bought in the My Forms menu. You may get a additional version of Iowa Proposal to approve restricted stock plan whenever, if required. Just click the necessary develop to download or print out the file web template.

Use US Legal Forms, by far the most considerable collection of authorized forms, to save lots of time and stay away from faults. The assistance offers professionally created authorized file templates that you can use for a variety of reasons. Create an account on US Legal Forms and initiate producing your way of life a little easier.

Form popularity

FAQ

515.138 Fire insurance contract standard policy provisions permissible variations. 1. The printed form of a policy of fire insurance as set forth in subsection 6 shall be known and designated as the "standard policy" to be used in the state of Iowa.

Judgments are valid for a period of twenty years. Iowa Code § 614.1. Judgments are liens upon the real estate owned by the defendant for a period of ten years from the date of the judgment.

723.1 Riot. A riot is three or more persons assembled together in a violent and disturbing manner, and with any use of unlawful force or violence by them or any of them against another person, or causing property damage.

What Does Iowa Consider to Be Disorderly Conduct? The state of Iowa has outlawed certain actions in public to protect Iowan citizens and visitors. ing to the Iowa Code 723.4, you can be charged with disorderly conduct if: You engage in fighting or violent behavior in a public place or near an assembly of people.