Iowa Authorization to Purchase Corporation's Outstanding Common Stock: A Detailed Description Keywords: Iowa, authorization, purchase, corporation's, outstanding common stock Introduction: In the state of Iowa, an Authorization to Purchase Corporation's Outstanding Common Stock is a legal declaration and approval granted to a corporation allowing it to acquire its own common stock from shareholders. This process involves the corporation buying back its own shares from existing investors, resulting in an increase in ownership percentage for the remaining shareholders. Types of Iowa Authorization to Purchase Corporation's Outstanding Common Stock: 1. General Authorization: A general authorization refers to a broad approval given to a corporation by its board of directors or shareholders. It empowers the corporation to repurchase its outstanding common stock up to a certain limit without the need for additional approvals, thereby providing flexibility and agility in executing stock buybacks. 2. Special Authorization: A special authorization is a targeted and specific approval obtained by a corporation for purchasing its outstanding common stock. It usually arises when the corporation intends to repurchase a substantial number of shares that go beyond the limits prescribed by the general authorization. Special authorization requires proper documentation, disclosure, and often, the approval of shareholders. Process of Authorization to Purchase Corporation's Outstanding Common Stock: 1. Board Resolution: The process typically begins with the corporation's board of directors passing a resolution outlining the intent to repurchase its outstanding common stock. This resolution specifies the maximum number of shares to be repurchased, the timeframe for repurchasing, and the funding mechanism for the transaction. 2. Shareholder Approval: In certain cases, Iowa law mandates seeking shareholder approval for the repurchase of outstanding common stock. Shareholders are notified of the company's intention and provided with necessary details about the buyback program. A special meeting may be called for shareholders to vote on the resolution, especially if the proposed repurchase exceeds the limits specified in the general authorization. 3. Compliance with Regulations: The corporation must ensure compliance with relevant laws, including the Iowa Business Corporation Act and any federal regulations governing stock repurchases. These laws impose restrictions on the timing, methods, and pricing of stock repurchases, aiming to protect shareholder rights and prevent unfair practices. 4. Execution of Buyback: Once the authorization is granted, and any necessary approvals obtained, the corporation may begin executing the buyback program. The company, acting on behalf of its shareholders, may make open-market purchases, negotiate private transactions, or utilize a tender offer process to repurchase the outstanding common stock. Benefits and Implications of Authorization to Purchase Corporation's Outstanding Common Stock: 1. Increased Control and Strategic Flexibility: By repurchasing outstanding common stock, a corporation can reduce the number of shares available in the market. This increases the ownership percentage of existing shareholders, allowing for greater control and decision-making power within the corporation. 2. Shareholder Value Enhancement: A well-executed stock repurchase program can potentially enhance shareholder value by boosting earnings per share and indicating confidence in the company's financial strength and future prospects. It can also create demand for the remaining shares in the market, potentially leading to increased share prices. 3. Potential Negative Impacts: Authorization to purchase a corporation's outstanding common stock should be exercised carefully, considering the impact on the company's financial position. Excessive buybacks can strain cash resources and limit investment opportunities. It is vital to strike a balance between returning value to shareholders and maintaining financial stability. Conclusion: In Iowa, an Authorization to Purchase Corporation's Outstanding Common Stock enables a corporation to repurchase its shares from shareholders through a well-defined process, either under a general authorization or a special authorization. This strategic move can benefit both the corporation and remaining shareholders, but it necessitates compliance with relevant regulations and careful consideration of potential implications.

Iowa Authorization to purchase corporation's outstanding common stock

Description

How to fill out Iowa Authorization To Purchase Corporation's Outstanding Common Stock?

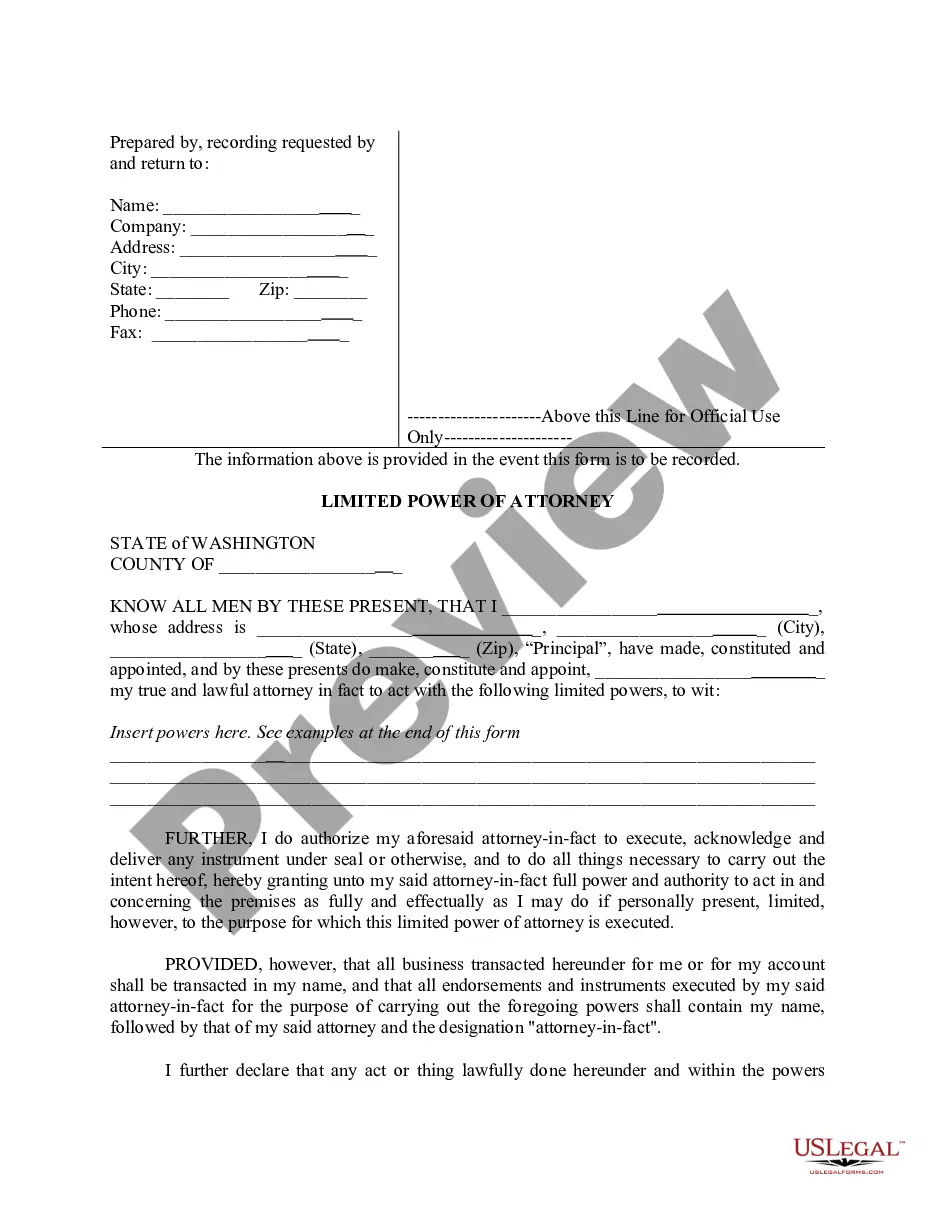

You may spend hrs on the web searching for the authorized document template that meets the federal and state requirements you need. US Legal Forms gives a huge number of authorized varieties which can be evaluated by specialists. It is possible to down load or produce the Iowa Authorization to purchase corporation's outstanding common stock from my support.

If you currently have a US Legal Forms account, you can log in and then click the Acquire key. Following that, you can full, revise, produce, or indicator the Iowa Authorization to purchase corporation's outstanding common stock. Every single authorized document template you buy is your own eternally. To get another duplicate of the purchased type, check out the My Forms tab and then click the corresponding key.

If you work with the US Legal Forms website initially, follow the basic directions under:

- Very first, make certain you have chosen the best document template for that state/metropolis of your choice. Read the type information to make sure you have selected the correct type. If available, make use of the Preview key to search from the document template also.

- If you would like find another edition from the type, make use of the Research discipline to get the template that meets your needs and requirements.

- Once you have identified the template you want, just click Acquire now to continue.

- Pick the rates prepare you want, type in your accreditations, and sign up for your account on US Legal Forms.

- Total the transaction. You should use your Visa or Mastercard or PayPal account to cover the authorized type.

- Pick the formatting from the document and down load it to your product.

- Make alterations to your document if required. You may full, revise and indicator and produce Iowa Authorization to purchase corporation's outstanding common stock.

Acquire and produce a huge number of document layouts making use of the US Legal Forms web site, which provides the largest variety of authorized varieties. Use skilled and status-specific layouts to take on your organization or personal requirements.

Form popularity

FAQ

490.1106 Articles of merger or share exchange.

490.1505 Activities not constituting doing business.

A Benefit Corporation is a corporate form designed for for-profit entities that want to consider society and the environment in addition to profit in their decision making process. Benefit corporations are different from traditional corporations in regards to their purpose, accountability and transparency.

Benefit corporation laws vary somewhat from state to state but, in general, a benefit corporation must have a general benefit purpose stated in its articles of incorporation. A B-Corporation is formed by filing articles of incorporation with the state?the same as with a traditional corporation.

Iowa allows professionals, such as accountants, attorneys and physicians to form a professional corporation (PC).

Disadvantages of Benefit Corporations Not available in every state: Not every state recognizes benefit corporations. ... Not available for every business: Not every type of business can register as a benefit corporation. ... Less profit: In some cases, promoting the public good means less profit for your shareholders.

With the enactment of HF 844, Iowa joins the majority of states that have enabling statutes allowing for benefit corporations.

The Difference Between a Benefit Corporation and a B Corp B Corps have a higher bar set for them than benefit corporations. Benefit corporations don't have a set performance standard like B Corps. B Corps have an outside entity ? B Lab ? holding companies accountable for performance.