Iowa Form of Convertible Promissory Note, Preferred Stock

Description

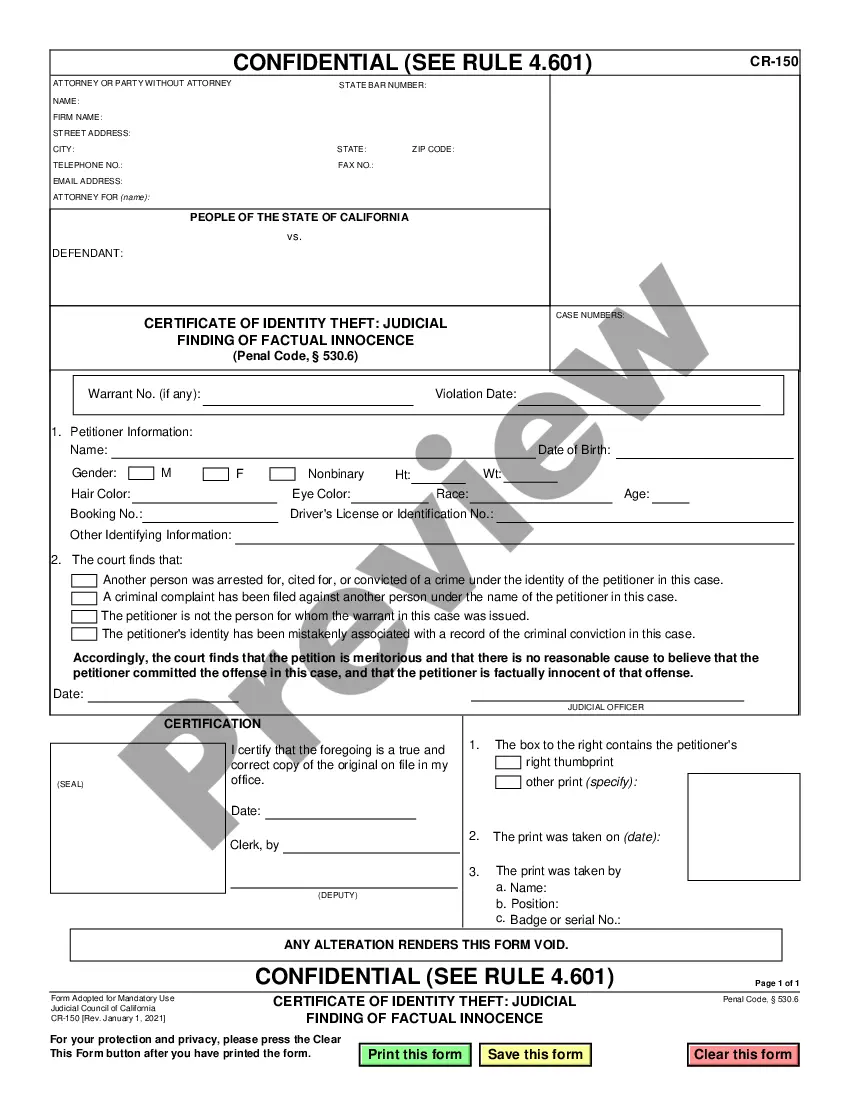

How to fill out Form Of Convertible Promissory Note, Preferred Stock?

If you have to full, acquire, or print out lawful record layouts, use US Legal Forms, the greatest selection of lawful types, which can be found on the Internet. Take advantage of the site`s simple and easy practical research to get the documents you will need. Numerous layouts for organization and individual reasons are categorized by classes and suggests, or keywords. Use US Legal Forms to get the Iowa Form of Convertible Promissory Note, Preferred Stock in a couple of mouse clicks.

Should you be already a US Legal Forms client, log in to the accounts and click the Down load option to find the Iowa Form of Convertible Promissory Note, Preferred Stock. You can even accessibility types you earlier saved from the My Forms tab of your accounts.

If you work with US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have selected the form for your right city/country.

- Step 2. Utilize the Review solution to examine the form`s articles. Never forget about to learn the explanation.

- Step 3. Should you be not happy with the form, use the Search industry on top of the monitor to discover other versions in the lawful form template.

- Step 4. Once you have located the form you will need, go through the Get now option. Pick the pricing program you choose and include your credentials to sign up for the accounts.

- Step 5. Method the transaction. You should use your charge card or PayPal accounts to accomplish the transaction.

- Step 6. Select the structure in the lawful form and acquire it in your system.

- Step 7. Comprehensive, revise and print out or indicator the Iowa Form of Convertible Promissory Note, Preferred Stock.

Each and every lawful record template you get is your own property forever. You have acces to every form you saved with your acccount. Click on the My Forms area and choose a form to print out or acquire once more.

Contend and acquire, and print out the Iowa Form of Convertible Promissory Note, Preferred Stock with US Legal Forms. There are millions of skilled and state-particular types you can utilize for the organization or individual demands.

Form popularity

FAQ

Advantages of convertible notes for capital raising: Flexibility: Convertible notes provide flexibility for both the investor and the startup. Investors can convert their debt to equity if the company meets certain conditions, and startups can avoid setting an initial valuation until later rounds of funding.

A convertible note is a debt instrument often used by angel or seed investors looking to fund an early-stage startup that has not been valued explicitly. After more information becomes available to establish a reasonable value for the company, convertible note investors can convert the note into equity.

A mandatory convertible is a security that automatically converts to common equity on or before a predetermined date. This hybrid security guarantees a certain return up to the conversion date, after which there is no guaranteed return but the possibility of a much higher return.

Convertible notes are loans that (ideally) convert into the preferred stock that is sold in a subsequent equity round of investmet. The note might also cover contingencies, such as what happens if the company does not get to the investment by the maturity date of the loan, or if the company is sold prior to conversion.

Convertible notes are promissory notes that serve an additional business purpose other than merely representing debt. Convertible notes include all of the terms of a vanilla promissory note, such as an interest rate and the pledge of underlying security (if applicable).

Conversion price can be calculated by dividing the convertible preferred stock's par value by the stipulated conversion ratio. Conversion premium: The dollar amount by which the market price of the convertible preferred stock exceeds the current market value of the common shares into which it may be converted.

A promissory note is a form of debt that companies and individuals sometimes use, like loans, to raise money. The issuer, through the notes, promises to return the buyer's funds (principal) and to make fixed interest payments to the buyer in exchange for borrowing the money.

The SAFE is legally a contract of the issuer, constituting an agreement to issue equity in the future at a purchase price paid in advance. It is not debt and, unlike a convertible promissory note, accrues no interest and has no maturity date.