Iowa Agreement and plan of merger by Gelco Corp. and Grossman Corp.

Description

How to fill out Agreement And Plan Of Merger By Gelco Corp. And Grossman Corp.?

Have you been inside a situation in which you require papers for sometimes company or person purposes almost every working day? There are plenty of legal document templates available on the net, but finding versions you can trust is not simple. US Legal Forms delivers a large number of develop templates, much like the Iowa Agreement and plan of merger by Gelco Corp. and Grossman Corp., which can be written in order to meet state and federal requirements.

In case you are already informed about US Legal Forms internet site and possess your account, simply log in. Afterward, you are able to down load the Iowa Agreement and plan of merger by Gelco Corp. and Grossman Corp. web template.

If you do not offer an bank account and want to start using US Legal Forms, abide by these steps:

- Discover the develop you want and make sure it is to the correct metropolis/county.

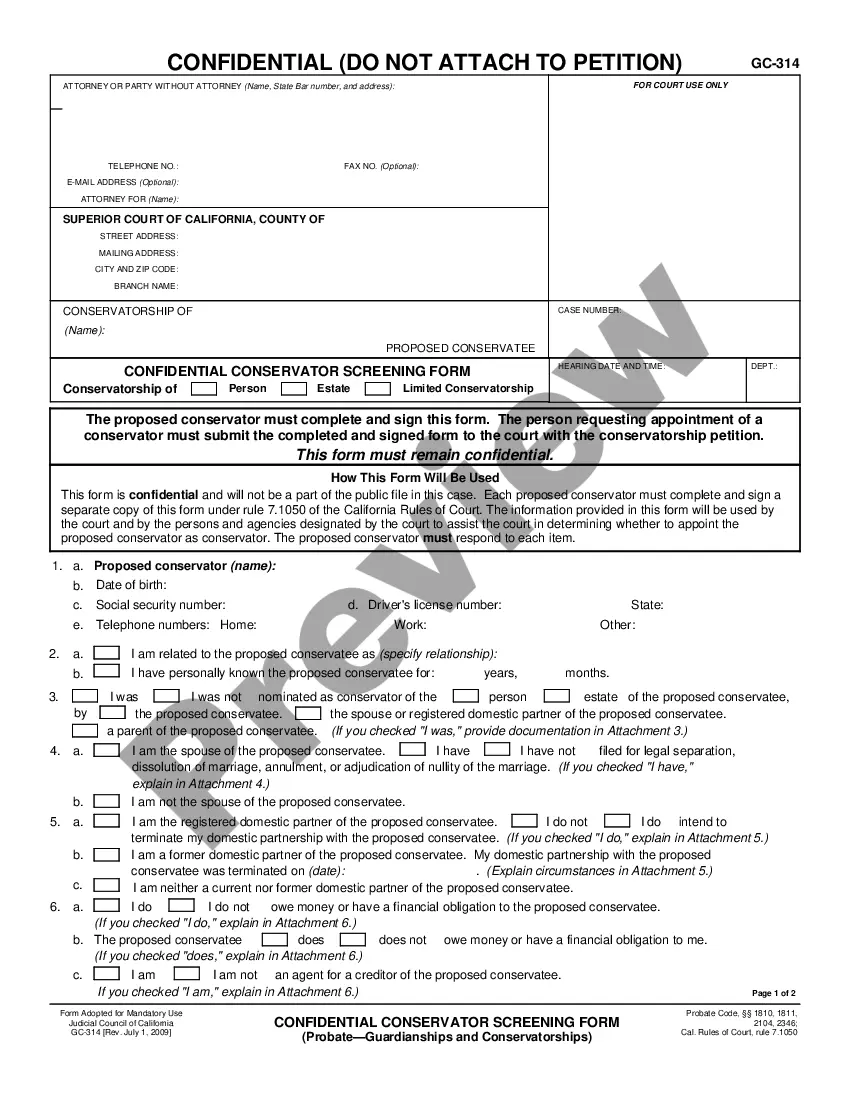

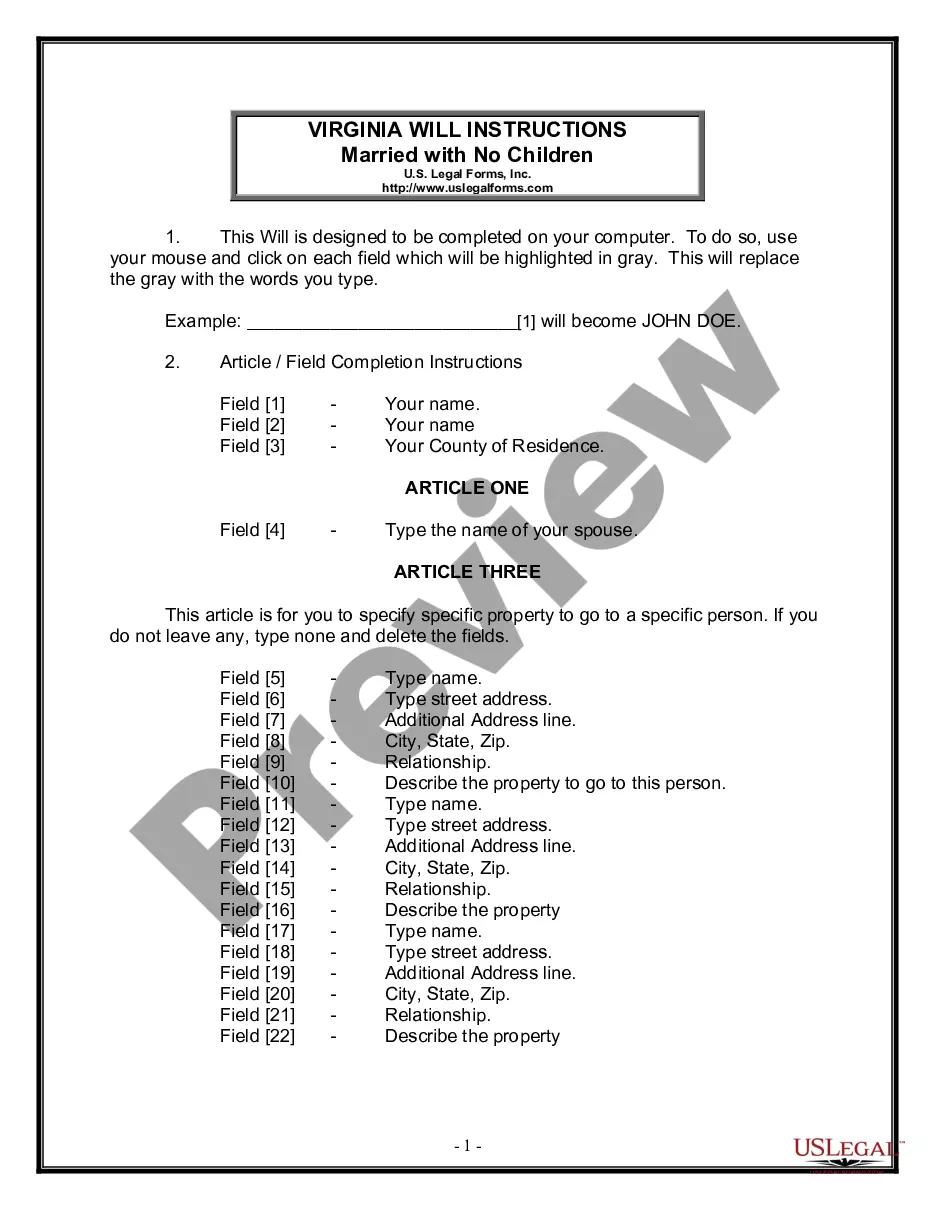

- Utilize the Review option to analyze the shape.

- See the explanation to ensure that you have chosen the appropriate develop.

- In the event the develop is not what you are looking for, utilize the Lookup area to find the develop that suits you and requirements.

- When you find the correct develop, click on Get now.

- Select the pricing prepare you want, complete the required info to create your bank account, and pay for the order making use of your PayPal or Visa or Mastercard.

- Pick a hassle-free document structure and down load your backup.

Get each of the document templates you may have bought in the My Forms menus. You can obtain a extra backup of Iowa Agreement and plan of merger by Gelco Corp. and Grossman Corp. any time, if necessary. Just go through the required develop to down load or print out the document web template.

Use US Legal Forms, one of the most considerable collection of legal forms, to save efforts and avoid faults. The assistance delivers expertly produced legal document templates which can be used for an array of purposes. Produce your account on US Legal Forms and initiate generating your daily life easier.

Form popularity

FAQ

An agreement setting out steps of a merger of two or more entities including the terms and conditions of the merger, parties, the consideration, conversion of equity, and information about the surviving entity (such as its governing documents).

A merger is the voluntary fusion of two companies on broadly equal terms into one new legal entity. The firms that agree to merge are roughly equal in terms of size, customers, and scale of operations. For this reason, the term "merger of equals" is sometimes used.

Sec. 76. Plan or merger of consolidation. - Two or more corporations may merge into a single corporation which shall be one of the constituent corporations or may consolidate into a new single corporation which shall be the consolidated corporation.

Steps for the buyer in the M&A process Step 1: Develop an acquisition strategy. ... Step 2: Set the M&A search criteria. ... Step 3: Search for potential acquisition targets. ... Step 4: Begin acquisition planning. ... Step 5: Perform valuation analysis. ... Step 6: Begin negotiations. ... Step 7: Perform M&A due diligence.

Mergers and acquisitions (M&As) are the acts of consolidating companies or assets, with an eye toward stimulating growth, gaining competitive advantages, increasing market share, or influencing supply chains.