The Iowa Plan of Reorganization is a legal process through which a struggling business or individual can restructure their financial affairs in order to regain solvency and repay creditors. It provides a framework for developing a repayment plan that suits the debtor's financial capabilities and facilitates the settlement of outstanding debts. Within the realm of Iowa Plan of Reorganization, there are various types and chapters that cater to different situations and entities. Some significant types include: 1. Chapter 11 Reorganization: This chapter is primarily designed for businesses, including corporations, partnerships, or individuals with extensive debt. It allows for substantial flexibility in the creation of a repayment plan while allowing the debtor to continue operating their business under court supervision. 2. Chapter 12 Reorganization: This chapter specifically addresses family farmers and fishermen who are facing financial difficulties. It provides them with an opportunity to reorganize their debts and develop a sustainable plan to continue agricultural operations. 3. Chapter 13 Repayment Plan: Chapter 13 primarily benefits individuals or sole proprietors who possess a regular income but are struggling with debt. With this chapter, debtors can propose a repayment plan lasting three to five years to gradually pay off their debts based on their income level. The Iowa Plan of Reorganization aims to balance the interests of the debtor and the creditors, striving to ensure the maximum possible payment to the creditors while allowing the debtor to regain financial stability. It involves careful analysis of the debtor's assets, liabilities, income, and expenses to devise a realistic and feasible repayment plan. To initiate the Iowa Plan of Reorganization, the debtor must file a petition with the Iowa bankruptcy court and provide detailed financial documentation. Upon filing, an automatic stay is put into effect, which halts any collection actions or legal proceedings initiated by creditors. Throughout the process, the debtor must work closely with their attorney, creditors, and the court-appointed trustee to develop and execute the reorganization plan. The plan must include provisions for the classification and treatment of each debt, repayment schedules, liquidation of certain assets if necessary, and a feasible path towards financial stability. Once the Iowa Plan of Reorganization is approved by the court, the debtor is expected to strictly adhere to the agreed-upon repayment plan. Failure to comply or meet the obligations may result in dismissal of the case or conversion to a different chapter, depending on the circumstances. In summary, the Iowa Plan of Reorganization is a valuable legal tool that offers businesses and individuals an opportunity to restructure their finances, repay their debts, and achieve a fresh start. It is crucial to consult with an experienced bankruptcy attorney to determine the most suitable chapter and navigate the intricate process effectively.

Iowa Plan of Reorganization

Description

How to fill out Iowa Plan Of Reorganization?

If you wish to complete, obtain, or produce legitimate papers web templates, use US Legal Forms, the greatest variety of legitimate forms, that can be found on-line. Make use of the site`s basic and practical lookup to get the papers you need. Various web templates for company and specific functions are categorized by categories and suggests, or search phrases. Use US Legal Forms to get the Iowa Plan of Reorganization in just a handful of click throughs.

If you are already a US Legal Forms consumer, log in in your accounts and click the Obtain key to have the Iowa Plan of Reorganization. You can also accessibility forms you in the past saved inside the My Forms tab of your respective accounts.

Should you use US Legal Forms for the first time, refer to the instructions under:

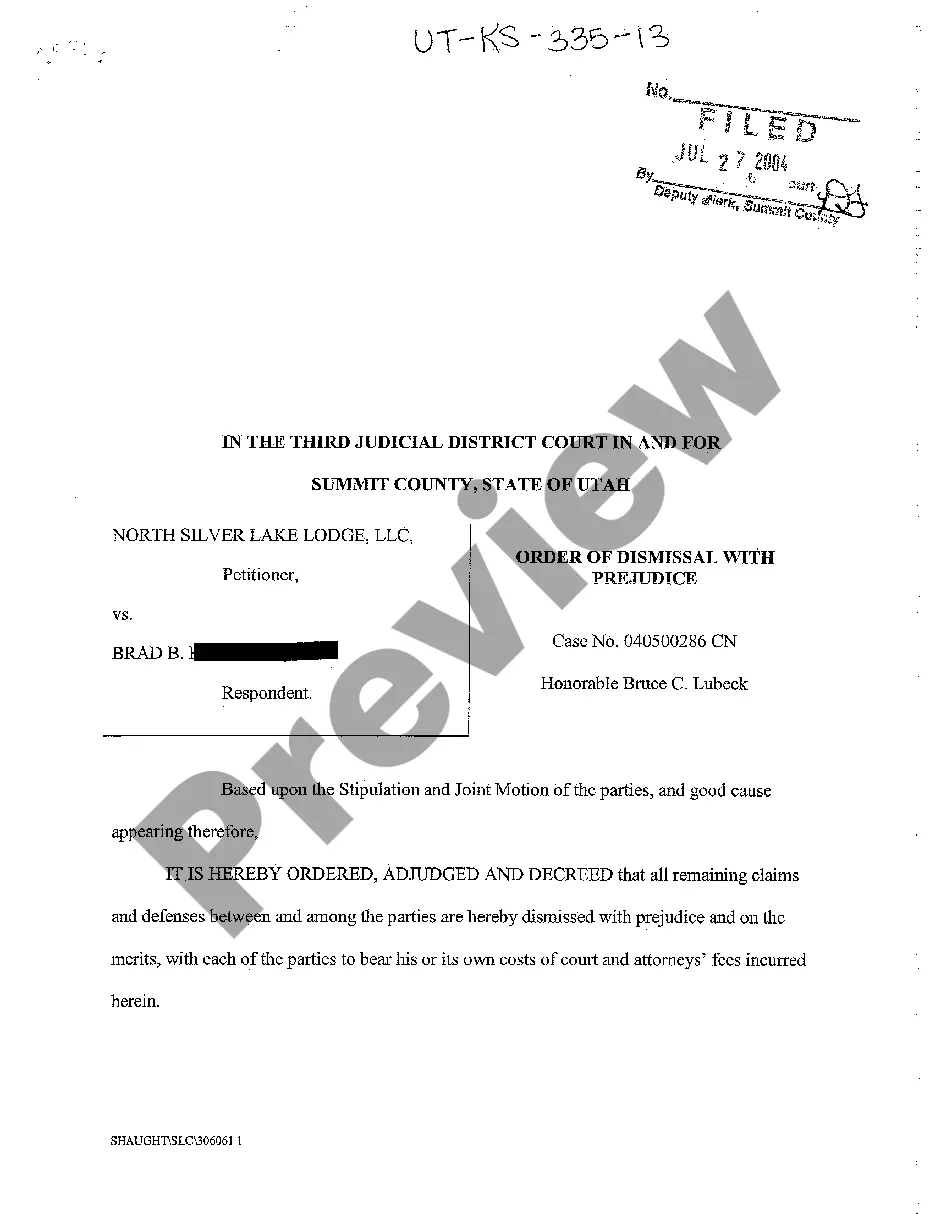

- Step 1. Ensure you have chosen the shape to the appropriate metropolis/land.

- Step 2. Utilize the Review method to examine the form`s information. Do not forget about to read through the description.

- Step 3. If you are not happy together with the type, take advantage of the Look for area near the top of the screen to find other models of your legitimate type web template.

- Step 4. After you have found the shape you need, click the Acquire now key. Pick the prices program you prefer and include your qualifications to sign up to have an accounts.

- Step 5. Approach the transaction. You can utilize your credit card or PayPal accounts to complete the transaction.

- Step 6. Choose the formatting of your legitimate type and obtain it on the gadget.

- Step 7. Complete, change and produce or indicator the Iowa Plan of Reorganization.

Every legitimate papers web template you acquire is yours for a long time. You possess acces to every type you saved with your acccount. Click the My Forms portion and select a type to produce or obtain again.

Compete and obtain, and produce the Iowa Plan of Reorganization with US Legal Forms. There are millions of expert and status-specific forms you can utilize for your personal company or specific requires.

Form popularity

FAQ

To satisfy the Southern Congressmen, a bill was introduced to admit Florida as a slave state and Iowa as a free state. Congress finally decided that Iowa might be admitted as a state, but only if the boundaries were changed. These new boundaries were usually called the Nicollet boundaries, after a famous surveyor.

Senate File 514, which became effective on July 1, reduces the number of cabinet-level departments from 37 to 16 by consolidating agencies with similar functions and centralizing programs that serve similar needs.

Iowa HHS provides high quality programs and services that protect and improve the health and resiliency of individuals, families, and communities.

There is much at stake as the state of Iowa continues to cement in state law the merger of three state departments ? human services, public health and aging ? into one mega-department: the new Iowa Department of Health and Human Services.

Governor Kim Reynolds signed Senate File 514 on April 4, 2023. The bill shrinks the executive branch of Iowa's State government from 37 to 16 cabinet-level agencies. As a result of that legislation, the Iowa Department of Inspections and Appeals (DIA) will grow significantly.

Senate File 514, which became effective on July 1, reduces the number of cabinet-level departments from 37 to 16 by consolidating agencies with similar functions and centralizing programs that serve similar needs.

Welcome to the official page for the Iowa Health and Human Services Alignment. The Iowa Departments of Public Health (IDPH) and Human Services (DHS) are becoming one, single, department. IDPH and DHS will fully transition into the Iowa Department of Health and Human Services (HHS) by July 1, 2023.