Iowa Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc.

Description

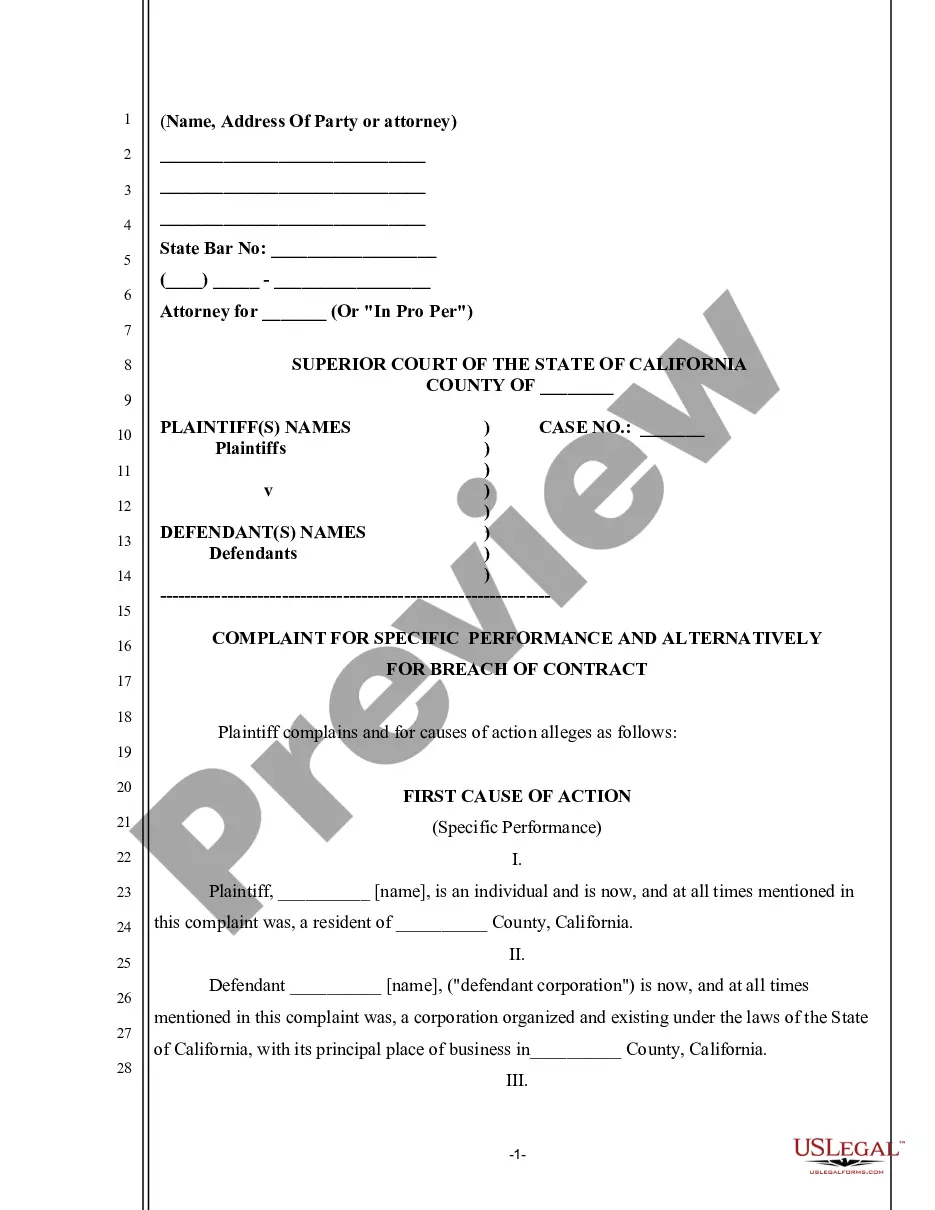

How to fill out Management Agreement Between Advisers Managers Trust And Neuberger And Berman Management Inc.?

If you have to comprehensive, download, or print lawful document layouts, use US Legal Forms, the most important variety of lawful forms, which can be found on-line. Make use of the site`s basic and handy look for to discover the papers you want. Various layouts for business and person uses are categorized by categories and suggests, or search phrases. Use US Legal Forms to discover the Iowa Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc. in a number of clicks.

When you are presently a US Legal Forms customer, log in to the account and then click the Download key to have the Iowa Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc.. You can also gain access to forms you earlier saved from the My Forms tab of your own account.

Should you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Be sure you have selected the form for the appropriate town/country.

- Step 2. Take advantage of the Preview solution to look over the form`s content. Don`t overlook to read the description.

- Step 3. When you are not satisfied using the form, use the Search area towards the top of the monitor to find other models of your lawful form design.

- Step 4. After you have located the form you want, go through the Purchase now key. Choose the pricing program you choose and include your accreditations to register to have an account.

- Step 5. Procedure the transaction. You may use your Мisa or Ьastercard or PayPal account to perform the transaction.

- Step 6. Select the file format of your lawful form and download it on your product.

- Step 7. Full, change and print or indication the Iowa Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc..

Each and every lawful document design you acquire is yours permanently. You might have acces to each form you saved in your acccount. Click the My Forms portion and select a form to print or download again.

Be competitive and download, and print the Iowa Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc. with US Legal Forms. There are thousands of expert and condition-certain forms you can utilize for your business or person needs.

Form popularity

FAQ

We believe this approach is the reason more than 600 employees are owners of the firm and we have a 96% retention rate for our senior investment professionals1.

Neuberger Berman peak revenue was $2.8B in 2022. Neuberger Berman annual revenue for 2021 was 2.4B, 17.17% growth from 2020. Neuberger Berman annual revenue for 2022 was 2.8B, 17.35% growth from 2021.

With 749 investment professionals and 2,799 employees in total, Neuberger Berman has built a diverse team of individuals united in their commitment to client outcomes and investment excellence.

For nine consecutive years, Neuberger Berman has been named first or second in Pensions & Investment's Best Places to Work in Money Management survey (among those with 1,000 employees or more). The firm manages $436 billion in client assets as of March 31, 2023.

Neuberger Berman Trust Company N.A. offers comprehensive fiduciary and investment services for individuals and institutions.

Neuberger Berman Group LLC is a private, independent, employee-owned investment management firm. The firm manages equities, fixed income, private equity and hedge fund portfolios for global institutional investors, advisors and high-net-worth individuals.