Iowa Changing state of incorporation

Description

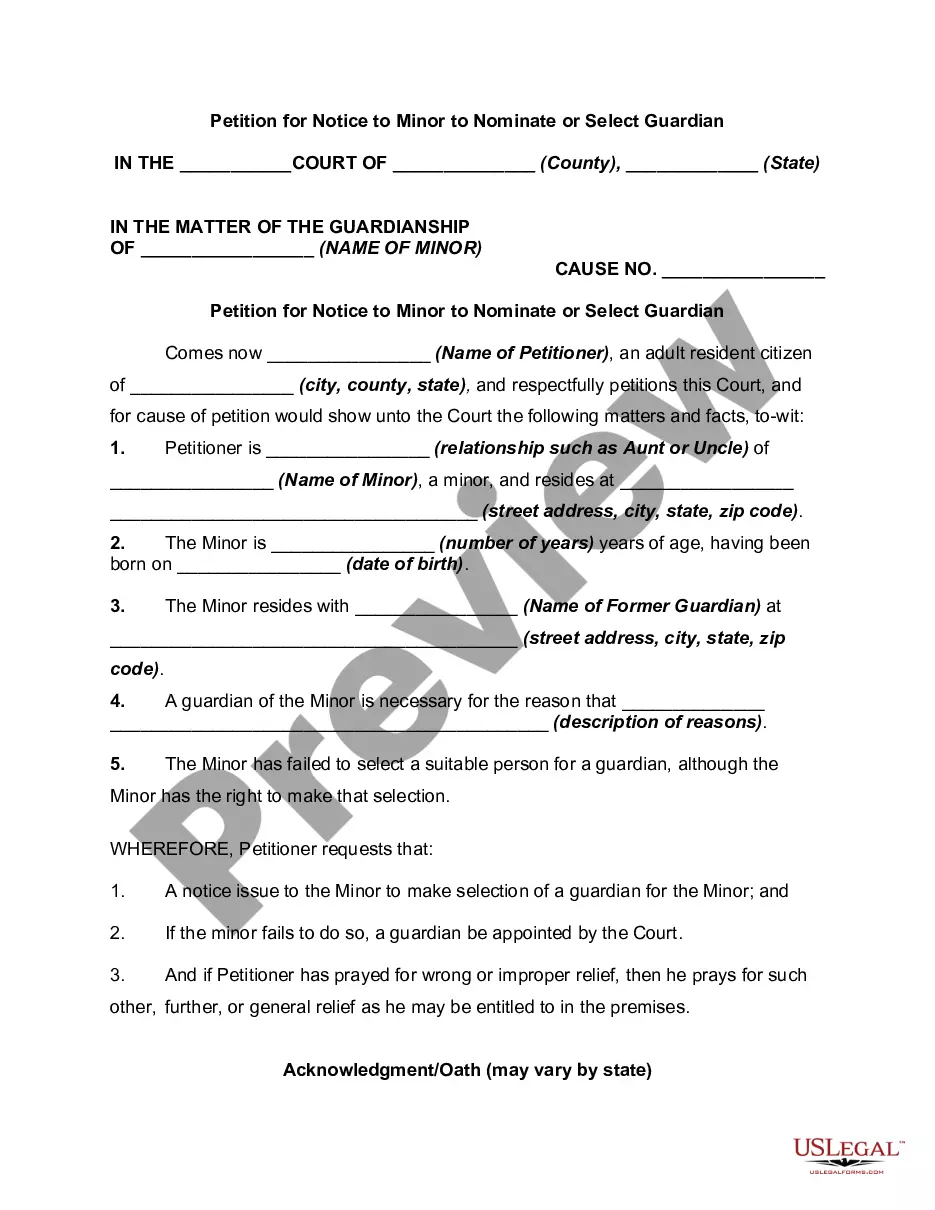

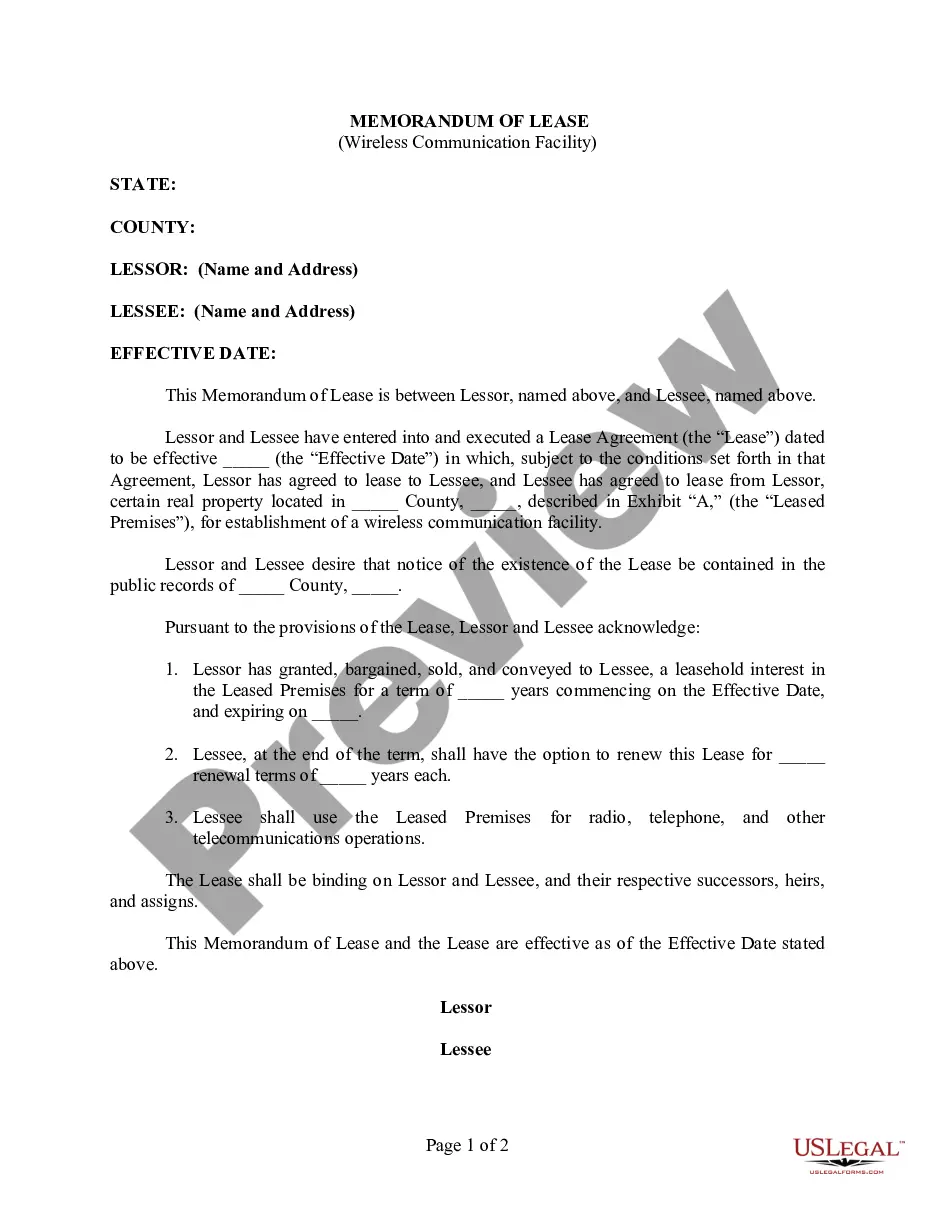

How to fill out Changing State Of Incorporation?

Choosing the best lawful record format can be a battle. Obviously, there are tons of templates available on the Internet, but how can you discover the lawful type you need? Take advantage of the US Legal Forms website. The support offers thousands of templates, like the Iowa Changing state of incorporation, which can be used for organization and personal requirements. All the forms are checked out by pros and fulfill federal and state needs.

When you are currently registered, log in to your bank account and click on the Down load button to have the Iowa Changing state of incorporation. Make use of your bank account to appear from the lawful forms you might have acquired previously. Check out the My Forms tab of your respective bank account and acquire another version from the record you need.

When you are a fresh customer of US Legal Forms, allow me to share simple guidelines for you to adhere to:

- Initially, ensure you have selected the right type for the town/county. It is possible to look through the shape while using Preview button and browse the shape description to ensure this is basically the best for you.

- When the type will not fulfill your preferences, take advantage of the Seach area to get the appropriate type.

- Once you are sure that the shape is suitable, go through the Buy now button to have the type.

- Opt for the costs program you need and enter the needed information and facts. Build your bank account and pay money for your order utilizing your PayPal bank account or bank card.

- Choose the file format and obtain the lawful record format to your device.

- Full, revise and printing and indicator the acquired Iowa Changing state of incorporation.

US Legal Forms is the biggest library of lawful forms where you will find a variety of record templates. Take advantage of the service to obtain appropriately-made paperwork that adhere to condition needs.

Form popularity

FAQ

How do I change my registered office? First, go to . You will need an account to file anything on Fast Track Filing (excluding Biennial Reports). ... A drop-down menu will appear. ... In the ?Existing Entities? menu, click on the ?Change of Registered Office? link.

You can easily change your Iowa LLC name. The first step is to file a form called the Articles of Amendment with the Secretary of State and wait for it to be approved. This is how you officially change your LLC name in Iowa. The filing fee for an Articles of Amendment in Iowa is $50.

Iowa LLC Cost. To form an LLC in Iowa, you'll start out by paying $50 to register your business with the Secretary of State. After that, you'll need to pay $30-45 dollars every two years to file your LLC's biennial report.

In order to amend your Certificate of Organization for an Iowa LLC, you must file an Amendment to Certificate of Organization with the Iowa Secretary of State, Business Services Division. In addition, you must pay the $50 filing fee.

To make amendments to your Iowa articles of incorporation, submit amendments to the Iowa Secretary of State, Business Services (SOS). The document can be filed by mail, fax, or in person.

Inside Scoop: You can choose to file the paperwork for your Iowa LLC online using the Fast Track Filing platform, or you can mail it to the Secretary of State's office. If you file online, your LLC will be approved within one business day (opposed to the 4-5 week processing time if you send through the mail).

You can file a Petition for Change of Name in the district court. See Iowa Code chapter 674. You will need to electronically file the Petition for Change of Name and pay the $195 filing fee. You must file electronically unless you get permission from the court to be excused from electronic filing.

Breadcrumb Go to govconnect.iowa.gov. Log in to your GovConnectIowa account. Click Register a New Business to get started. Follow the prompts on the screens to complete the business registration. Once the New Business Registration has been submitted, a confirmation number will appear on the screen.