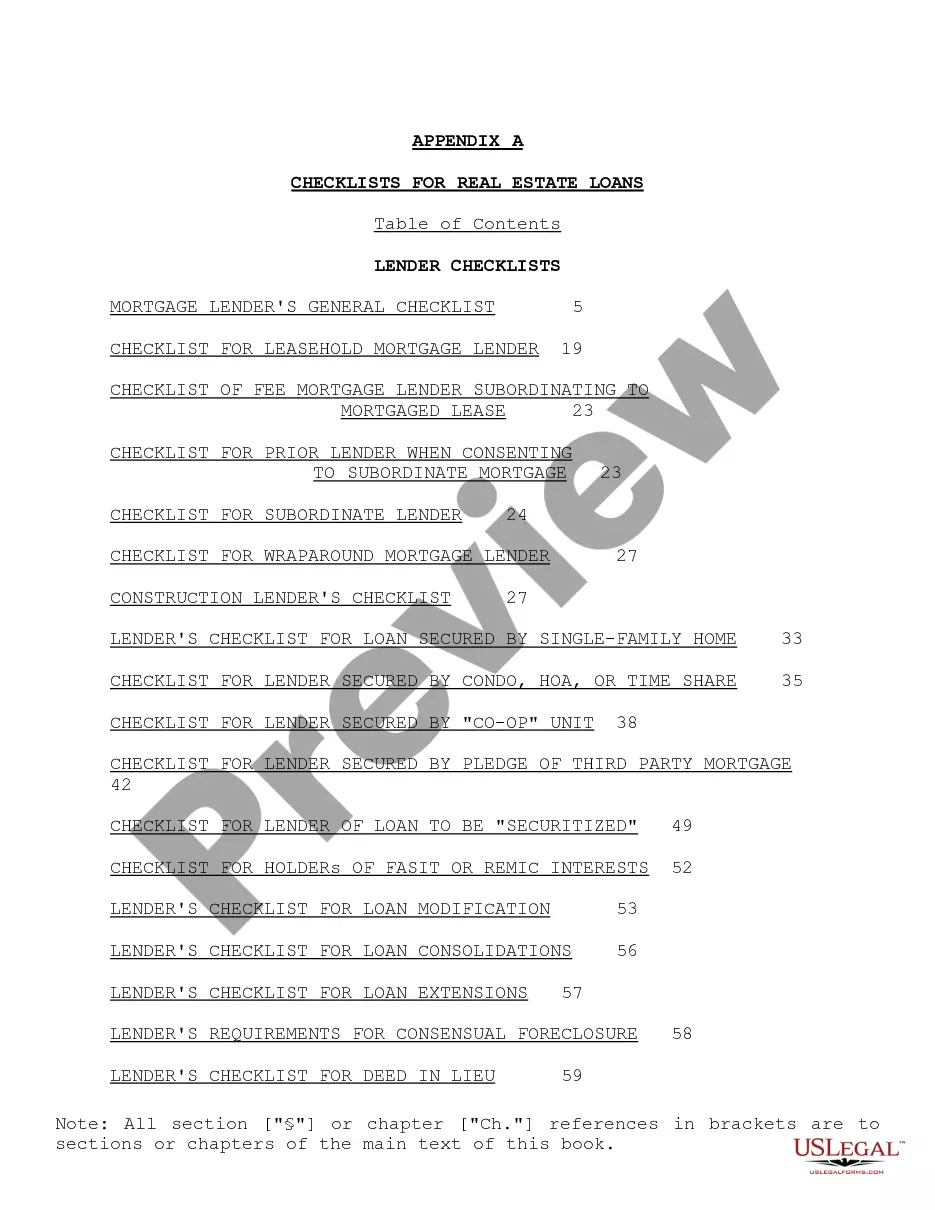

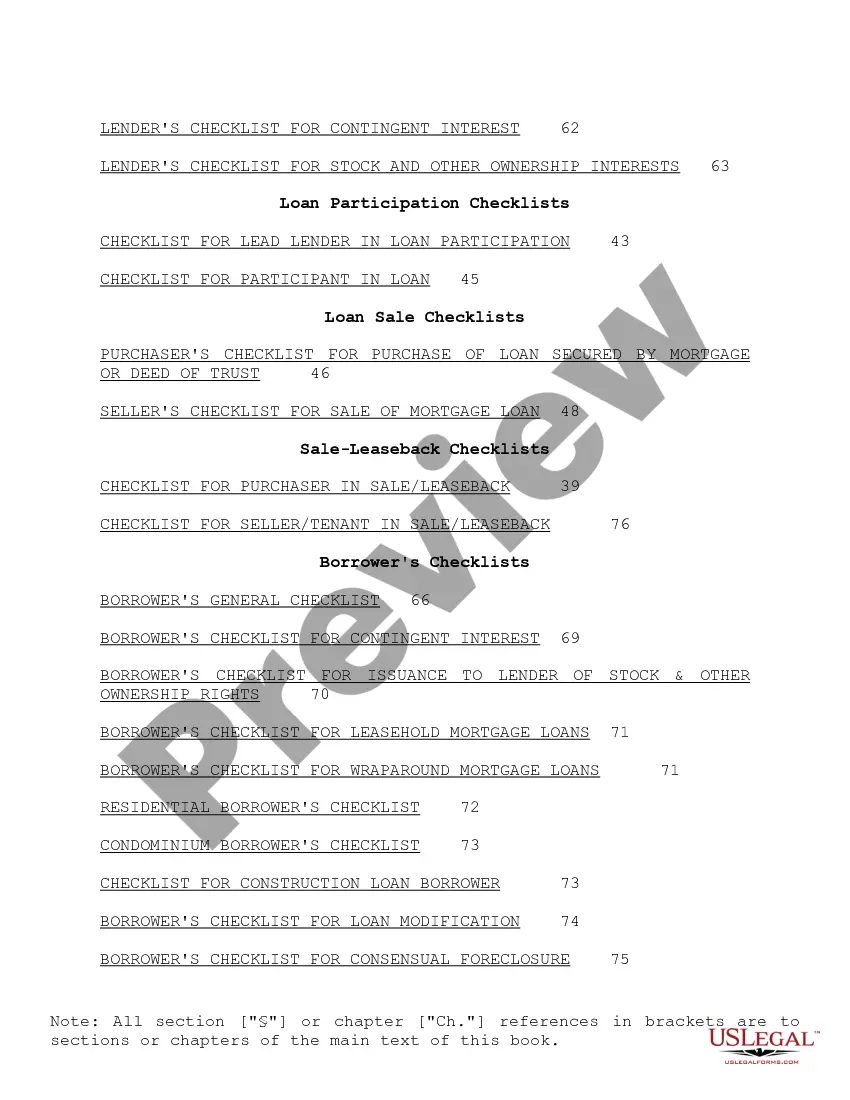

"Checklist for Real Estate Loans" is a American Lawyer Media form. This consist of many checklist that can be used for real estate loans.

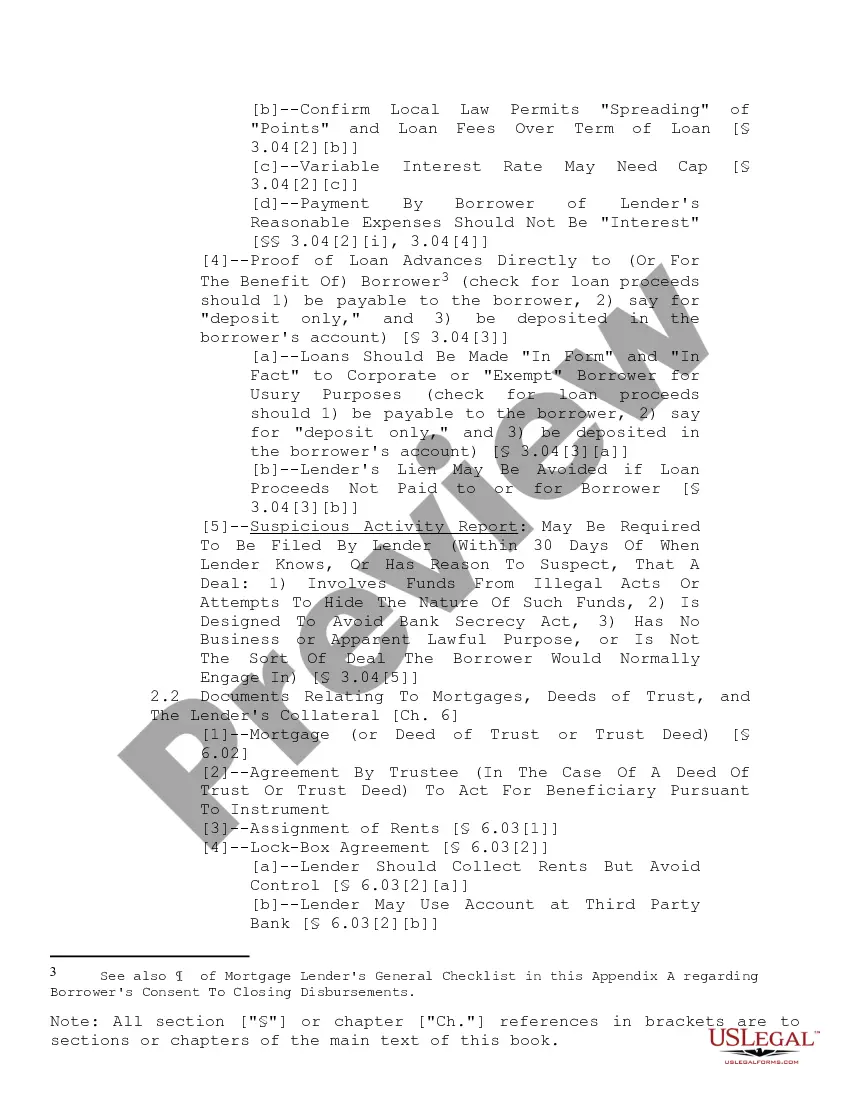

Iowa Checklist for Real Estate Loans: When applying for a real estate loan in Iowa, it is important to be prepared with the necessary documents and information to ensure a smooth loan approval process. The Iowa Checklist for Real Estate Loans provides a comprehensive list of required items and important considerations for both lenders and borrowers. Below are some key elements to include in an Iowa Checklist for Real Estate Loans: 1. Loan Application: Begin with a completed and signed loan application form, which includes important personal and financial information such as name, address, employment details, income, assets, and liabilities. 2. Proof of Identity and Residency: Provide a valid government-issued identification document such as a driver's license or passport along with proof of residency, which can be established through utility bills or lease agreements. 3. Credit Information: Gather credit reports from all major credit bureaus to give lenders a clear overview of your credit history and score. This helps in determining your creditworthiness and ability to repay the loan. 4. Employment and Income Verification: Present proof of steady income and employment, such as recent pay stubs, W-2 forms, and tax returns. Self-employed borrowers may need to provide additional documents like profit and loss statements or business tax returns. 5. Asset Documentation: Include information on all assets that can be used as collateral or contribute to down payment requirements. This may include bank statements, investment account statements, and real estate owned. 6. Property-related Documents: Provide necessary property documents like purchase agreement, property appraisal reports, property tax details, and homeowner's insurance information. 7. Legal Documents: Submit legal documents such as divorce decrees, child support agreements, bankruptcy filings, or other relevant court documents that may impact your financial situation. 8. Debt Obligations: Disclose any existing debts, including current mortgage statements, credit card statements, car loans, student loans, and any other outstanding obligations. 9. Loan-specific Documents: Depending on the type of real estate loan, additional documents may be required. For instance, if applying for a VA loan, necessary documents include a Certificate of Eligibility and Form DD-214, which verifies military service history. 10. Additional Considerations: It is crucial to note any specific requirements or considerations mentioned by the lender or the type of loan chosen. This could include specific income thresholds, debt-to-income ratios, or down payment information. Types of Iowa Checklist for Real Estate Loans: 1. Conventional Loan Checklist: This checklist applies to borrowers seeking a traditional mortgage without any specific government program involvement. 2. FHA Loan Checklist: Designed for borrowers applying for an FHA-insured loan, this checklist includes specific requirements outlined by the Federal Housing Administration. 3. VA Loan Checklist: Veterans, active-duty military personnel, and their spouses can use this checklist when applying for a VA-backed loan. 4. USDA Loan Checklist: Individuals seeking a real estate loan in rural areas may need to follow this checklist provided by the U.S. Department of Agriculture's Rural Development program. By using an Iowa Checklist for Real Estate Loans, borrowers can ensure they have all the necessary documentation and information to streamline the loan application process and increase their chances of loan approval.Iowa Checklist for Real Estate Loans: When applying for a real estate loan in Iowa, it is important to be prepared with the necessary documents and information to ensure a smooth loan approval process. The Iowa Checklist for Real Estate Loans provides a comprehensive list of required items and important considerations for both lenders and borrowers. Below are some key elements to include in an Iowa Checklist for Real Estate Loans: 1. Loan Application: Begin with a completed and signed loan application form, which includes important personal and financial information such as name, address, employment details, income, assets, and liabilities. 2. Proof of Identity and Residency: Provide a valid government-issued identification document such as a driver's license or passport along with proof of residency, which can be established through utility bills or lease agreements. 3. Credit Information: Gather credit reports from all major credit bureaus to give lenders a clear overview of your credit history and score. This helps in determining your creditworthiness and ability to repay the loan. 4. Employment and Income Verification: Present proof of steady income and employment, such as recent pay stubs, W-2 forms, and tax returns. Self-employed borrowers may need to provide additional documents like profit and loss statements or business tax returns. 5. Asset Documentation: Include information on all assets that can be used as collateral or contribute to down payment requirements. This may include bank statements, investment account statements, and real estate owned. 6. Property-related Documents: Provide necessary property documents like purchase agreement, property appraisal reports, property tax details, and homeowner's insurance information. 7. Legal Documents: Submit legal documents such as divorce decrees, child support agreements, bankruptcy filings, or other relevant court documents that may impact your financial situation. 8. Debt Obligations: Disclose any existing debts, including current mortgage statements, credit card statements, car loans, student loans, and any other outstanding obligations. 9. Loan-specific Documents: Depending on the type of real estate loan, additional documents may be required. For instance, if applying for a VA loan, necessary documents include a Certificate of Eligibility and Form DD-214, which verifies military service history. 10. Additional Considerations: It is crucial to note any specific requirements or considerations mentioned by the lender or the type of loan chosen. This could include specific income thresholds, debt-to-income ratios, or down payment information. Types of Iowa Checklist for Real Estate Loans: 1. Conventional Loan Checklist: This checklist applies to borrowers seeking a traditional mortgage without any specific government program involvement. 2. FHA Loan Checklist: Designed for borrowers applying for an FHA-insured loan, this checklist includes specific requirements outlined by the Federal Housing Administration. 3. VA Loan Checklist: Veterans, active-duty military personnel, and their spouses can use this checklist when applying for a VA-backed loan. 4. USDA Loan Checklist: Individuals seeking a real estate loan in rural areas may need to follow this checklist provided by the U.S. Department of Agriculture's Rural Development program. By using an Iowa Checklist for Real Estate Loans, borrowers can ensure they have all the necessary documentation and information to streamline the loan application process and increase their chances of loan approval.