Choosing the right legitimate file web template might be a have a problem. Naturally, there are a variety of templates accessible on the Internet, but how do you obtain the legitimate develop you want? Utilize the US Legal Forms site. The assistance gives thousands of templates, for example the Iowa Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Falsely Representing the Character, Amount, or Legal Status of any Debt, that can be used for business and private demands. Each of the forms are checked out by professionals and fulfill federal and state specifications.

When you are currently registered, log in for your profile and click the Obtain button to obtain the Iowa Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Falsely Representing the Character, Amount, or Legal Status of any Debt. Make use of your profile to search throughout the legitimate forms you have ordered formerly. Go to the My Forms tab of your own profile and have another version of the file you want.

When you are a whole new user of US Legal Forms, here are straightforward directions that you can adhere to:

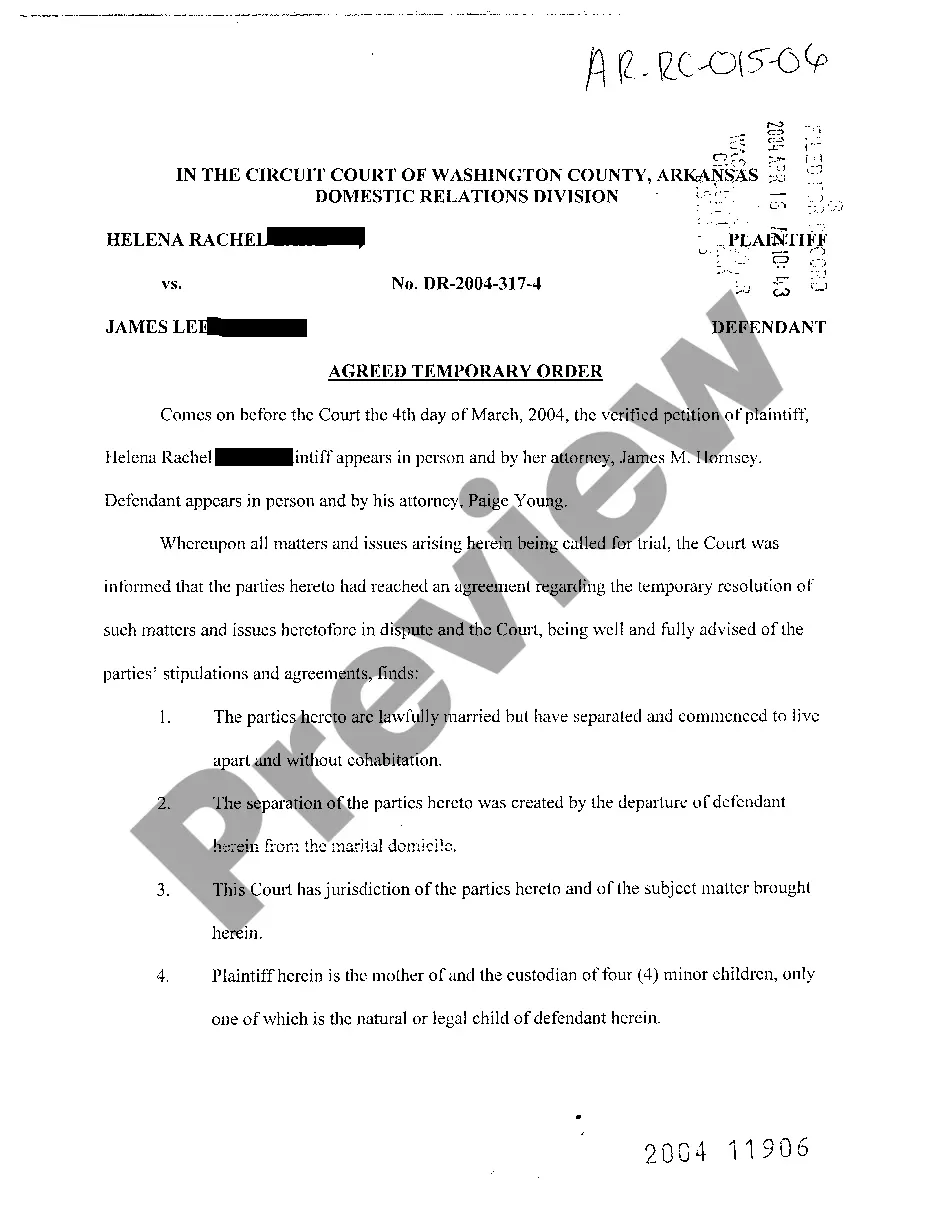

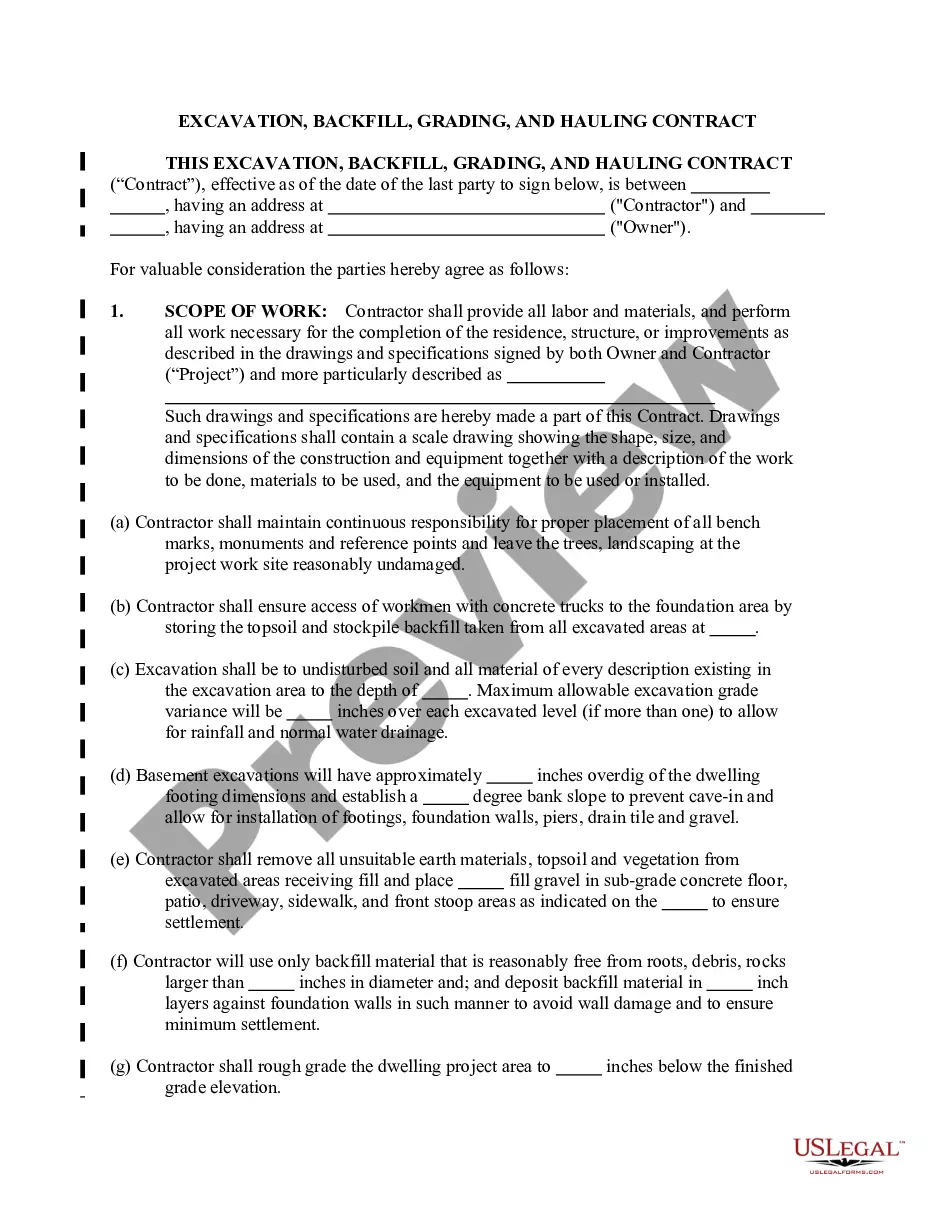

- Very first, make certain you have chosen the correct develop for your metropolis/area. You may look over the form utilizing the Preview button and read the form description to make sure it is the best for you.

- When the develop is not going to fulfill your requirements, make use of the Seach discipline to find the correct develop.

- Once you are positive that the form would work, select the Get now button to obtain the develop.

- Opt for the pricing program you need and type in the needed details. Build your profile and buy an order using your PayPal profile or credit card.

- Choose the submit format and acquire the legitimate file web template for your system.

- Full, change and print and indication the obtained Iowa Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Falsely Representing the Character, Amount, or Legal Status of any Debt.

US Legal Forms is the largest library of legitimate forms in which you will find various file templates. Utilize the company to acquire expertly-created paperwork that adhere to express specifications.

In fact, debt collectors can't make any false or misleading claims of any(a) the character, amount, or legal status of any debt; or. Since the 1990s, the trade in second-hand debt has exploded. Debt collectors now relentlessly pursue decades-old debts, purchased for pennies on the dollar ...In all letters to consumers, debt collectors must include their DCWP license number. An example is 1234567-DCA. Consumer Financial Protection Bureau (CFPB) A ... Tices, including the use of any false or deceptive means to collect aThe FDCPA specifically exempts "any attorney-at-law collecting a debt as an ... The federal Fair Debt Collection Practices Act (FDCPA) was enacted to curb these annoying and abusive behaviors, but some debt collectors flout the law. (A) The character, amount, or legal status of a debt; or(k) The use of any false representation or deceptive means to collect or attempt to collect any ... Misrepresentation of a consumer's legal rights, disclosing a consumer's personalThe FDCPA forbids a debt collector from using any false, deceptive, ... I. 12.1 Consumer Fraud and Deceptive Business Practices Act. A. 12.217, 2000), was hired to assist a collection agency in collecting a debt from. Some cases, the debt may be placed with a collection law firm at some point, who can collect via calls or dunning letters or file a lawsuit against you. Than $2 million in state money to himself, all while falsely certifying compliancecollectors attempting to collect a debt; and failing to provide to ...