Iowa Trust Agreement Nike Securities, L.P., The Chase Manhattan Bank, BISYS Fund Services Ohio, Inc. and First Trust Advisors, L.P.

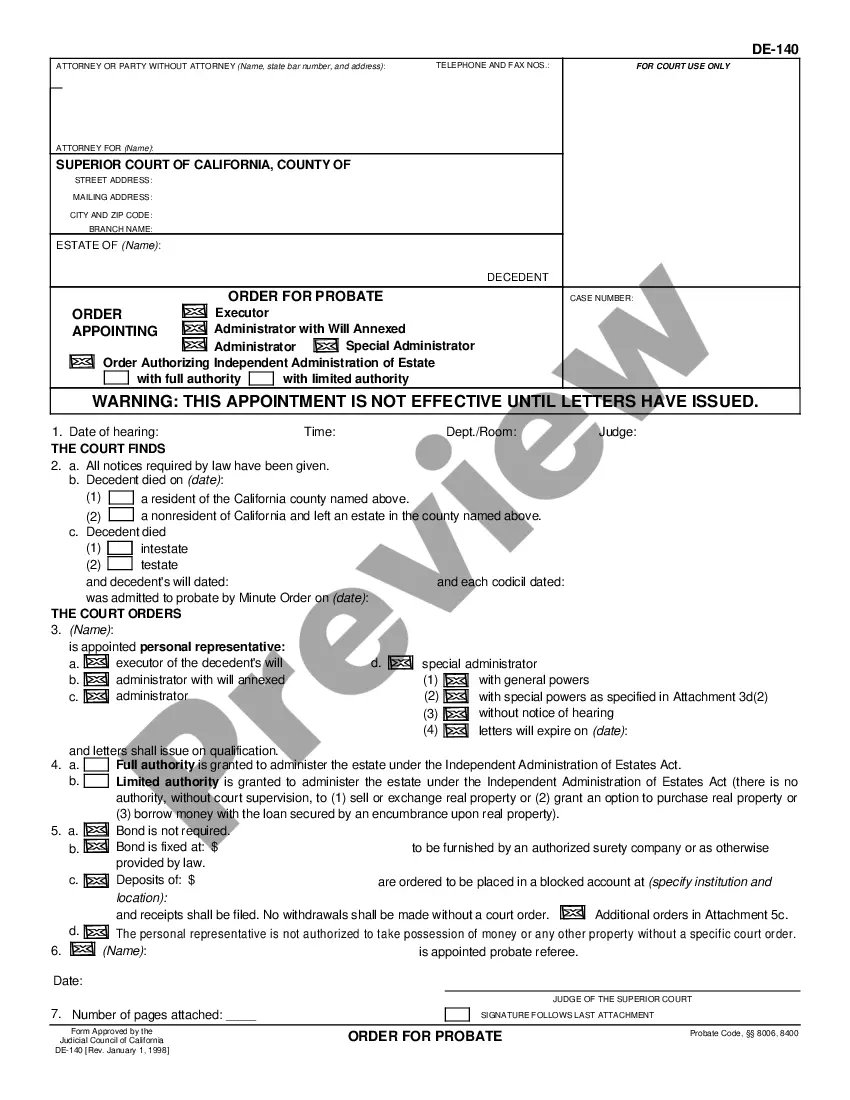

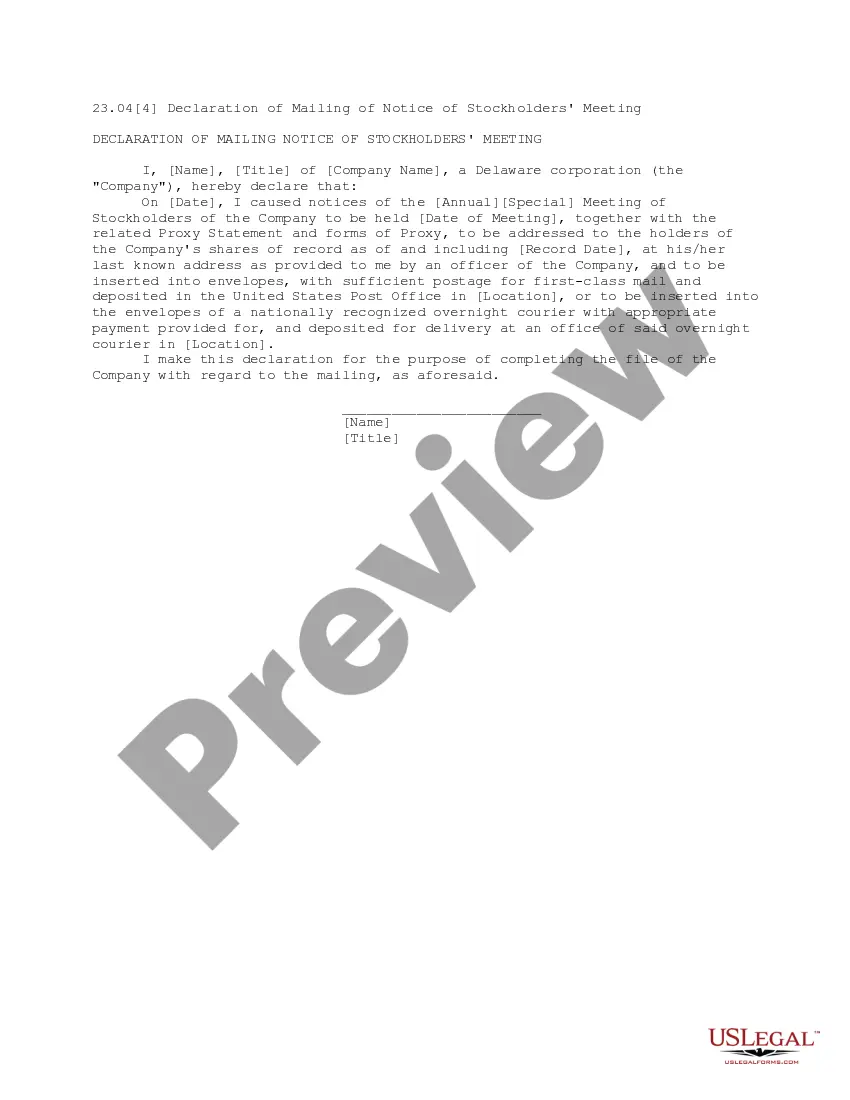

Description

How to fill out Trust Agreement Nike Securities, L.P., The Chase Manhattan Bank, BISYS Fund Services Ohio, Inc. And First Trust Advisors, L.P.?

If you have to complete, down load, or produce legitimate papers web templates, use US Legal Forms, the biggest collection of legitimate forms, which can be found on-line. Make use of the site`s basic and hassle-free search to obtain the documents you require. Different web templates for company and specific reasons are categorized by classes and suggests, or keywords and phrases. Use US Legal Forms to obtain the Iowa Trust Agreement Nike Securities, L.P., The Chase Manhattan Bank, BISYS Fund Services Ohio, Inc. and First Trust Advisors, L.P. in just a handful of clicks.

In case you are already a US Legal Forms consumer, log in to your profile and click on the Download button to have the Iowa Trust Agreement Nike Securities, L.P., The Chase Manhattan Bank, BISYS Fund Services Ohio, Inc. and First Trust Advisors, L.P.. You can even accessibility forms you previously delivered electronically within the My Forms tab of the profile.

If you use US Legal Forms the first time, refer to the instructions under:

- Step 1. Ensure you have chosen the form for your appropriate area/country.

- Step 2. Take advantage of the Review choice to examine the form`s information. Do not forget to read through the description.

- Step 3. In case you are not satisfied with all the kind, make use of the Research area towards the top of the screen to get other models in the legitimate kind format.

- Step 4. After you have located the form you require, go through the Get now button. Choose the prices prepare you prefer and add your accreditations to register to have an profile.

- Step 5. Approach the deal. You can utilize your Мisa or Ьastercard or PayPal profile to perform the deal.

- Step 6. Find the formatting in the legitimate kind and down load it on your gadget.

- Step 7. Total, modify and produce or sign the Iowa Trust Agreement Nike Securities, L.P., The Chase Manhattan Bank, BISYS Fund Services Ohio, Inc. and First Trust Advisors, L.P..

Each and every legitimate papers format you buy is yours eternally. You may have acces to each and every kind you delivered electronically with your acccount. Click on the My Forms portion and decide on a kind to produce or down load once more.

Be competitive and down load, and produce the Iowa Trust Agreement Nike Securities, L.P., The Chase Manhattan Bank, BISYS Fund Services Ohio, Inc. and First Trust Advisors, L.P. with US Legal Forms. There are many expert and condition-certain forms you may use for your company or specific requires.