Iowa Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc., also known as the Iowa PSA, is a legal contract that governs the securitization of mortgage loans by Ameriquest Mortgage Securities, Inc. This agreement outlines the rights and obligations of both the issuer (Ameriquest Mortgage Securities, Inc.) and the investors who purchase the mortgage-backed securities. The Iowa PSA serves as the foundation for the pooling and servicing of mortgage loans, ensuring that all parties involved adhere to specific terms and conditions. It provides a detailed framework for the creation, maintenance, and management of a mortgage-backed securities pool. By pooling numerous mortgage loans together, Ameriquest Mortgage Securities, Inc. creates a diversified investment product that spreads risk among multiple investors. Within the Iowa PSA, several key provisions are typically outlined: 1. Pooling of Mortgage Loans: The agreement specifies which mortgage loans are included in the pool. It provides details regarding loan types, characteristics, geographical distribution, and other relevant factors. This section ensures transparency and clarity regarding the pool's composition. 2. Servicing of Mortgage Loans: The Iowa PSA outlines the responsibilities and duties of the mortgage loan service, typically a separate entity from the issuer. It includes provisions related to loan servicing, collection of payments, default management, and foreclosure processes. The service is responsible for ensuring the timely collection and distribution of mortgage payments to the investors. 3. Distribution of Cash Flows: The agreement details how the cash flows generated by the mortgage loans will be distributed among the investors. This section includes provisions regarding the payment of principal and interest, the allocation of funds for servicing fees, and any subordinate classes of securities that may exist. 4. Reporting and Disclosure Requirements: The Iowa PSA mandates regular reporting and disclosure to the investors. This ensures transparency and allows investors to monitor the performance of their investments. Reports provide information on mortgage loan performance, default rates, prepayment rates, and other relevant metrics. 5. Indenture Trustee: The agreement establishes the role of the indenture trustee, who acts as a neutral third-party representative for the investors. The trustee ensures compliance with the terms of the PSA, protects the investors' interests, and manages the flow of funds between the service and investors. It's important to note that while the Iowa PSA generally follows a standard structure, there may be variations depending on the specific securitization transaction and the product offered by Ameriquest Mortgage Securities, Inc. Different versions of the Iowa PSA may arise due to variations in mortgage loan characteristics, risk profiles, or investor preferences.

Iowa Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc.

Description

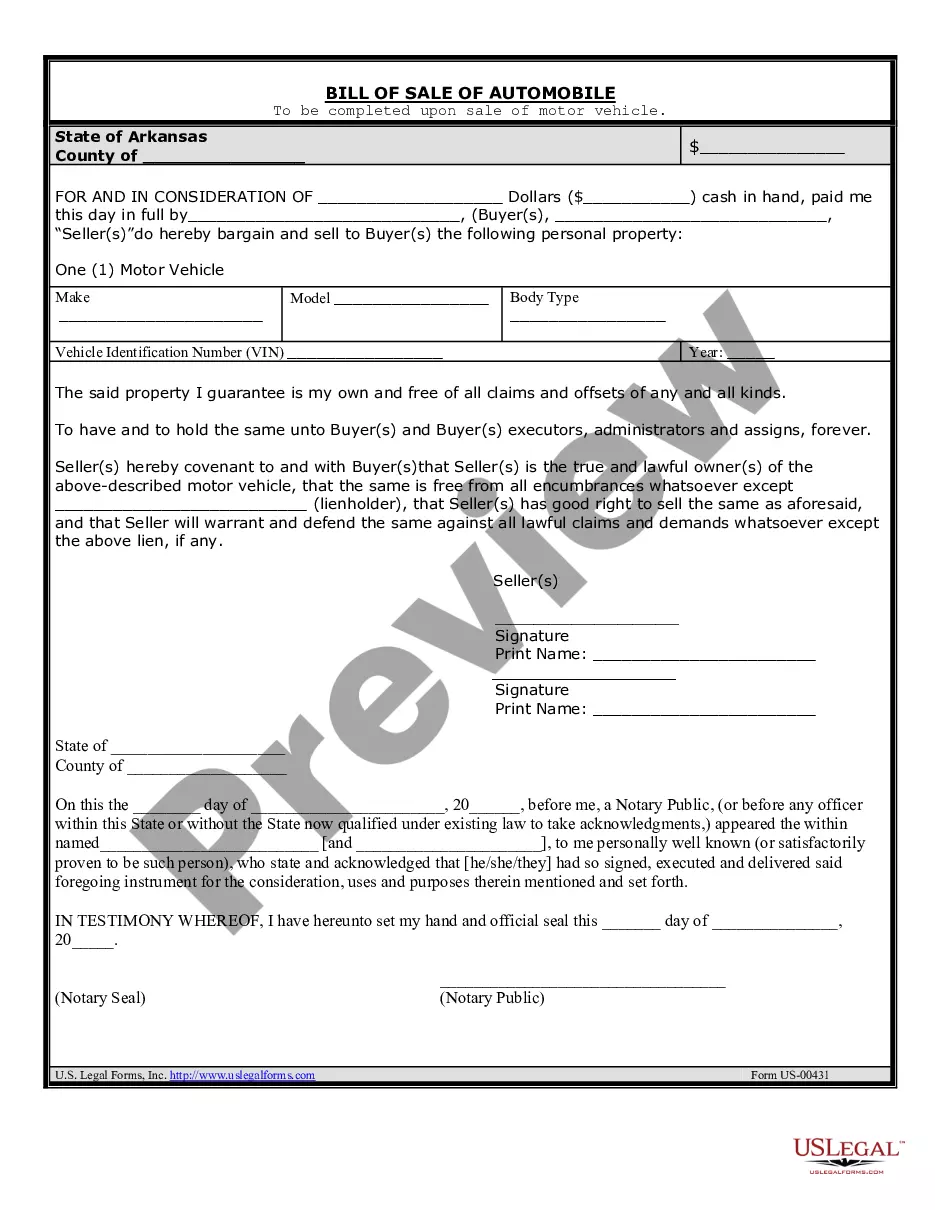

How to fill out Iowa Pooling And Servicing Agreement Of Ameriquest Mortgage Securities, Inc.?

Are you within a placement in which you need papers for both enterprise or personal purposes almost every working day? There are a lot of legal file themes available on the net, but locating versions you can rely on is not straightforward. US Legal Forms provides a large number of kind themes, like the Iowa Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc., that are written in order to meet federal and state requirements.

In case you are presently informed about US Legal Forms site and get an account, merely log in. After that, you are able to down load the Iowa Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc. design.

Should you not offer an accounts and want to start using US Legal Forms, adopt these measures:

- Discover the kind you require and make sure it is for the proper city/area.

- Utilize the Review key to analyze the form.

- Browse the explanation to actually have chosen the proper kind.

- In the event the kind is not what you`re seeking, take advantage of the Research area to get the kind that meets your requirements and requirements.

- Whenever you discover the proper kind, click Get now.

- Pick the rates program you want, submit the required info to generate your money, and pay for an order utilizing your PayPal or bank card.

- Pick a handy document structure and down load your copy.

Get all the file themes you possess bought in the My Forms food selection. You can get a extra copy of Iowa Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc. any time, if needed. Just click the required kind to down load or print out the file design.

Use US Legal Forms, by far the most substantial variety of legal forms, to conserve time and steer clear of blunders. The assistance provides expertly created legal file themes which you can use for a variety of purposes. Create an account on US Legal Forms and begin generating your daily life easier.

Form popularity

FAQ

Lenders mortgage insurance (LMI), also known as private mortgage insurance (PMI) in the US, is a type of insurance payable to a lender or to a trustee for a pool of securities that may be required when taking out a mortgage loan.

On September 1, 2007, Citigroup completed its acquisition of Argent Mortgage and AMC Mortgage Services, shutting down Ameriquest Mortgage.

A mortgage pool is a group of mortgages held in trust as collateral for the issuance of a mortgage-backed security. Some mortgage-backed securities issued by Fannie Mae, Freddie Mac, and Ginnie Mae are known as "pools" themselves. These are the simplest form of mortgage-backed security.

The Pooling and Servicing Agreement can be a stand-alone document or it can be part of another paper, usually called the ?Prospectus.? If the securitization is public, these documents must be filed with the Securities and Exchange Commission (SEC), and will be available to the public at .sec.gov.

How to Get a Copy of the Pooling and Servicing Agreement. If the securitization is public, the PSA will be filed with the Securities and Exchange Commission (SEC). You can usually find a copy on EDGAR (Electronic Data Gathering, Analysis, and Retrieval) at .sec.gov. What Is a Pooling and Servicing Agreement (PSA)? - Nolo Nolo ? legal-encyclopedia ? what-po... Nolo ? legal-encyclopedia ? what-po...

A pooling agreement is a type of contract in which shareholders of a corporation create a voting trust by pooling their voting rights and transferring them to a trustee. This is also called a voting agreement or shareholder-control agreement since it is used to control the affairs of the corporation. Pooling Agreement: Everything You Need to Know - UpCounsel upcounsel.com ? pooling-agreement upcounsel.com ? pooling-agreement

What is a Loan Servicing Agreement? A loan servicing agreement is a legal agreement between a lender and a third party, the servicer, that outlines the terms and conditions for which that third party will provide loan servicing services. Loan Servicing Agreement: Definition & Sample - Contracts Counsel contractscounsel.com ? loan-servicing-agree... contractscounsel.com ? loan-servicing-agree...

Mortgage servicing rights (MSR) refer to a contractual agreement in which the right to service an existing mortgage is sold by the original mortgage lender to another party that specializes in the various functions involved with servicing mortgages. Mortgage Servicing Rights (MSR) Meaning, Example, and History investopedia.com ? terms ? msr investopedia.com ? terms ? msr