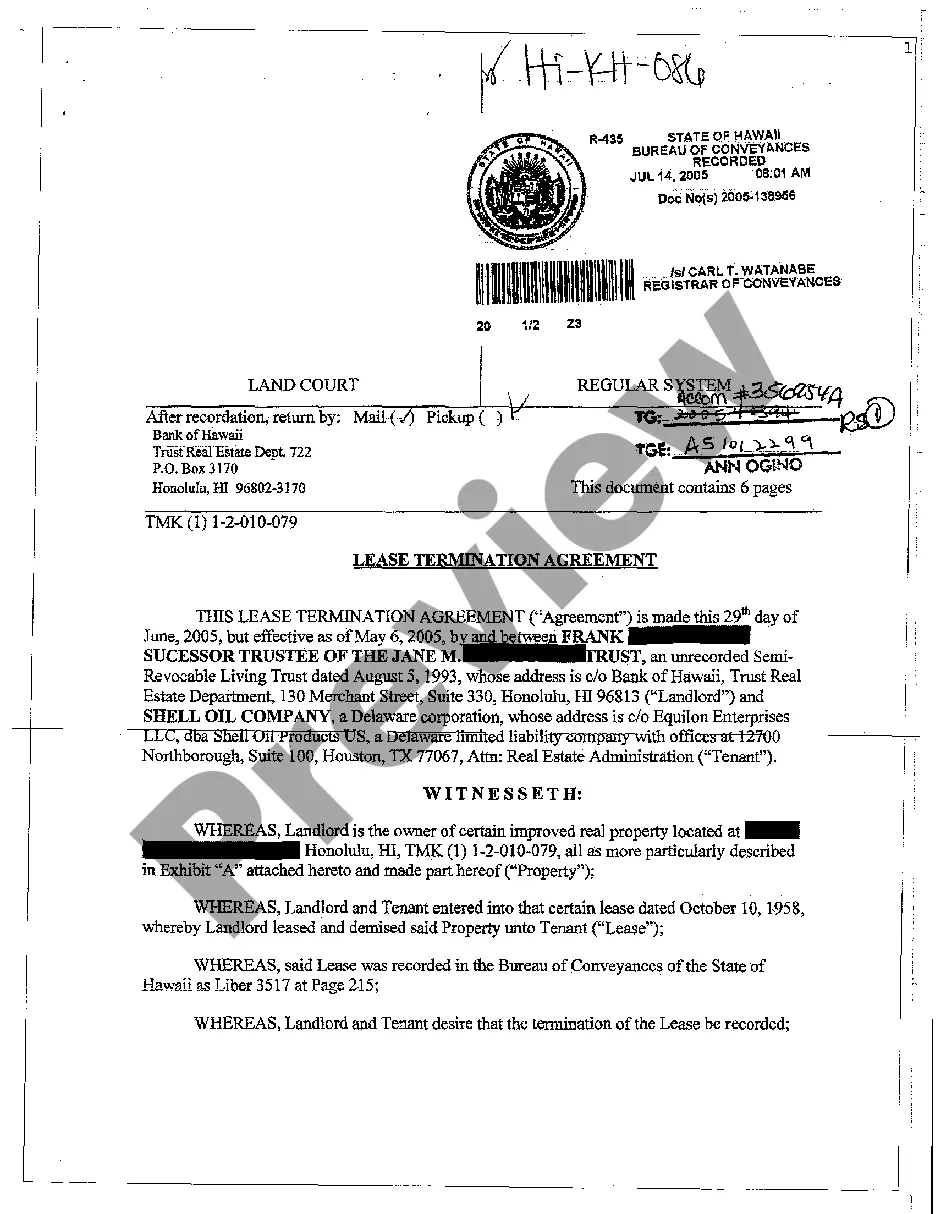

Title: Iowa Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York Keywords: Iowa Investment Advisory Agreement, BNY Hamilton Large Growth CRT Fund, The Bank of New York Introduction: The Iowa Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York governs the investment advisory services provided by The Bank of New York to the CRT Fund. This agreement outlines the roles and responsibilities of both parties, the fee structure, investment objectives, and other important details pertaining to the investment advisory services. Several types of Iowa Investment Advisory Agreements may exist between BNY Hamilton Large Growth CRT Fund and The Bank of New York, which can vary based on specific requirements or investment strategies. Types of Iowa Investment Advisory Agreements: 1. General Iowa Investment Advisory Agreement: This type of agreement is commonly used for providing ongoing investment advisory services to the BNY Hamilton Large Growth CRT Fund. It includes comprehensive terms and conditions, investment objectives, guidelines, and limitations that govern the relationship between the fund and The Bank of New York. 2. Customized Iowa Investment Advisory Agreement: If the investment strategy of the BNY Hamilton Large Growth CRT Fund differs from the general investment approach, a customized agreement may be established. This type of agreement reflects tailored investment directives, risk limits, and specific guidelines that align with the fund's unique investment goals. 3. Fixed-Term Iowa Investment Advisory Agreement: In certain cases, BNY Hamilton Large Growth CRT Fund may engage The Bank of New York for a fixed duration/specific project. This agreement defines the scope of work, the expected outcomes, and the timeline within which the advisory services will be provided. Upon completion, the agreement may be renewed or terminated based on the fund's requirements. 4. Performance-Based Iowa Investment Advisory Agreement: To align the interests of the BNY Hamilton Large Growth CRT Fund and The Bank of New York, a performance-based agreement may be established. This type of agreement specifies that the investment advisory fee is subject to achieving predefined performance benchmarks. It rewards The Bank of New York for generating positive investment returns and incentivizes them to exceed the set objectives. Key Elements of the Iowa Investment Advisory Agreement: 1. Roles and Responsibilities: Clearly defined roles and responsibilities of the BNY Hamilton Large Growth CRT Fund and The Bank of New York, outlining who will perform specific activities related to investment management, reporting, and compliance. 2. Investment Objectives and Restrictions: The investment objectives of the CRT Fund, such as capital appreciation, preservation, or income generation, along with any restrictions on certain types of investments or sectors. 3. Fee Structure: The fee structure, including the calculation method, frequency of payment, and a breakdown of the advisory fees charged by The Bank of New York for their services. 4. Reporting and Communications: Details regarding the frequency and format of reports, meetings, and other forms of communication between the BNY Hamilton Large Growth CRT Fund and The Bank of New York. Conclusion: The Iowa Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York serves as a legally binding contract that ensures both parties understand their obligations and expectations. By establishing a solid framework, this agreement allows for a transparent and productive relationship, enabling effective investment management that aligns with the objectives of the CRT Fund.

Iowa Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York

Description

How to fill out Iowa Investment Advisory Agreement Between BNY Hamilton Large Growth CRT Fund And The Bank Of New York?

Discovering the right legitimate file format could be a have difficulties. Naturally, there are a lot of templates available online, but how would you find the legitimate type you want? Make use of the US Legal Forms website. The service delivers a large number of templates, such as the Iowa Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York, that can be used for organization and personal requirements. All of the kinds are inspected by specialists and satisfy state and federal specifications.

If you are presently registered, log in to the account and click on the Obtain switch to get the Iowa Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York. Make use of your account to check from the legitimate kinds you possess ordered in the past. Visit the My Forms tab of your own account and get yet another backup from the file you want.

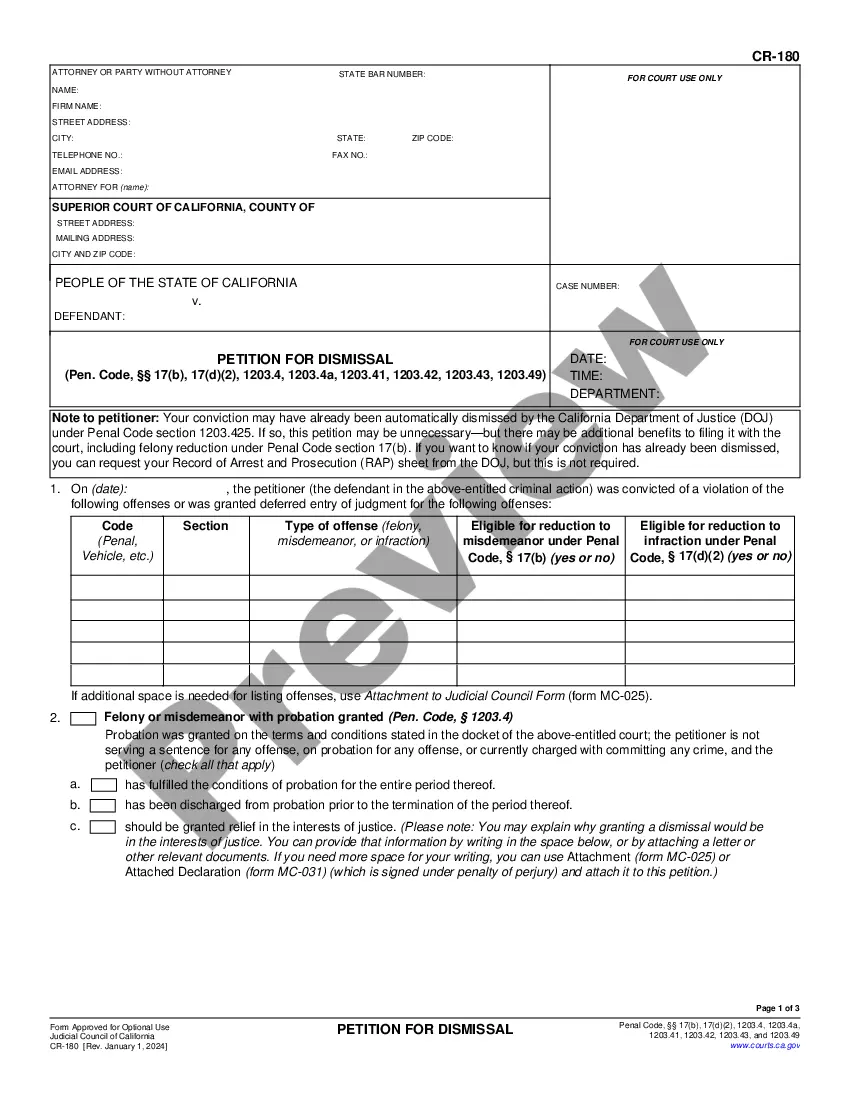

If you are a whole new customer of US Legal Forms, allow me to share basic directions for you to comply with:

- Initial, ensure you have chosen the correct type for the city/county. You are able to look through the form utilizing the Preview switch and browse the form outline to make certain it will be the right one for you.

- When the type fails to satisfy your requirements, utilize the Seach discipline to find the appropriate type.

- When you are sure that the form is proper, select the Purchase now switch to get the type.

- Opt for the pricing strategy you would like and type in the essential information and facts. Create your account and purchase an order making use of your PayPal account or bank card.

- Select the data file structure and obtain the legitimate file format to the device.

- Full, modify and print out and sign the received Iowa Investment Advisory Agreement between BNY Hamilton Large Growth CRT Fund and The Bank of New York.

US Legal Forms may be the most significant local library of legitimate kinds for which you can find a variety of file templates. Make use of the service to obtain skillfully-manufactured paperwork that comply with status specifications.