The Iowa Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds is a strategic merger agreement designed to combine the strengths and resources of both entities for the benefit of their stakeholders. This plan aims to restructure and streamline operations, enhance profitability, and create a stronger competitive position in the market. Under this reorganization plan, Ingenuity Capital Trust and Firsthand Funds will collaborate closely to identify synergistic opportunities and eliminate any redundant functions or processes. This merger will leverage the specialized expertise and diverse investment portfolios of both trusts, aiming to provide a wider range of investment options and improve overall returns for their respective shareholders. One of the key objectives of the Iowa Plan of Reorganization is to optimize cost-efficiency by consolidating administrative functions, reducing expenses, and achieving economies of scale. By combining resources, the trusts aim to improve operational effectiveness and enhance their ability to navigate complex financial markets. Furthermore, this plan may involve the reevaluation and adjustment of investment strategies to maximize growth potential and mitigate risks. Ingenuity Capital Trust and Firsthand Funds will pool their collective knowledge and experience to develop innovative and robust investment plans that align with the evolving market dynamics and cater to the changing needs of their investors. The Iowa Plan of Reorganization may also encompass organizational restructuring, such as changes in management and governance structures, ensuring a smooth integration and effective decision-making processes between the two entities. This collaborative effort aims to create a harmonious working environment and foster a culture of shared values and goals. While there might not be different types of Iowa Plans of Reorganization between Ingenuity Capital Trust and Firsthand Funds specifically, these trusts may consider variations of the agreement based on their unique circumstances and objectives. This could involve adjusting the terms, timelines, or areas of focus to optimize the outcome of the reorganization. Overall, the Iowa Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds signifies a proactive and strategic initiative to optimize operations, accelerate growth, and create sustainable long-term value for their respective stakeholders. Through collaboration, consolidation, and innovative investment strategies, this merger aims to position the trusts for enhanced success in the competitive financial market.

Iowa Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds

Description

How to fill out Iowa Plan Of Reorganization Between Ingenuity Capital Trust And Firsthand Funds?

Finding the right legitimate papers web template might be a have difficulties. Of course, there are tons of web templates available on the Internet, but how can you discover the legitimate form you will need? Make use of the US Legal Forms internet site. The services offers thousands of web templates, like the Iowa Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds, that can be used for company and personal demands. All of the forms are inspected by pros and satisfy federal and state specifications.

If you are currently listed, log in to the bank account and then click the Download option to obtain the Iowa Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds. Make use of your bank account to appear throughout the legitimate forms you possess bought in the past. Proceed to the My Forms tab of the bank account and get another backup of the papers you will need.

If you are a fresh end user of US Legal Forms, listed here are simple instructions that you can follow:

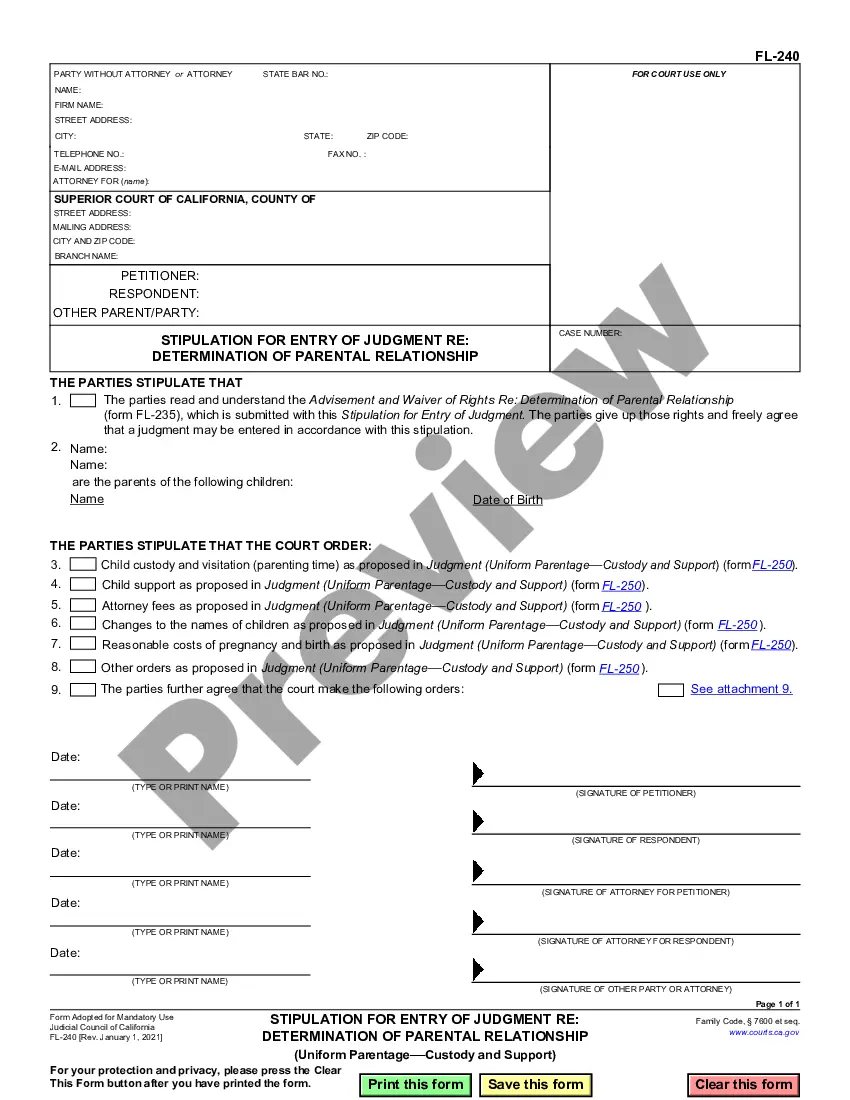

- First, ensure you have chosen the correct form for your personal metropolis/area. It is possible to check out the form while using Review option and browse the form description to make certain it is the right one for you.

- In the event the form will not satisfy your needs, utilize the Seach area to find the correct form.

- Once you are certain the form is suitable, select the Get now option to obtain the form.

- Choose the costs prepare you want and type in the necessary info. Create your bank account and pay money for the transaction with your PayPal bank account or charge card.

- Pick the document structure and obtain the legitimate papers web template to the system.

- Comprehensive, change and printing and signal the acquired Iowa Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds.

US Legal Forms may be the most significant catalogue of legitimate forms in which you can see numerous papers web templates. Make use of the company to obtain professionally-produced papers that follow state specifications.