The Iowa Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc., and ASECB Corporation is a strategic agreement aimed at combining the resources, expertise, and market presence of these three entities. This merger plan outlines the comprehensive blueprint for the integration of the companies, ensuring a smooth transition and maximizing synergistic opportunities. Key Findings: — Micro Component Technology, Inc., MCT Acquisition, Inc., and ASECB Corporation are collaborating on a merger plan to create a consolidated entity that would leverage their collective strengths. — The Iowa Plan of Merger is designed to bring together the technological prowess of Micro Component Technology, Inc., the acquisition capabilities of MCT Acquisition, Inc., and the market reach of ASECB Corporation. — The merger aims to streamline operations, enhance efficiency, and capitalize on new business opportunities in the rapidly evolving tech industry. — The Iowa Plan of Merger outlines the terms and conditions of the consolidation, including the exchange ratio of the companies' shares and the allocation of assets and liabilities. — This merger plan is expected to create a stronger market presence, enabling the combined entity to expand its product range, diversify its customer base, and capitalize on cost-saving synergies. — A range of benefits is anticipated from the merger, such as increased research and development capabilities, improved financial stability, and enhanced innovation potential. — It is important to note that the Iowa Plan of Merger may vary based on the specific agreement reached between Micro Component Technology, Inc., MCT Acquisition, Inc., and ASECB Corporation, as each merger plan is unique to the circumstances and dynamics of the companies involved. — The successful implementation of the merger plan requires approval by the relevant regulatory bodies and shareholders of each company, as well as adherence to legal requirements and industry standards. — By leveraging the combined expertise, resources, and market presence, the Iowa Plan of Merger aims to position the new entity at the forefront of the industry, poised for sustained growth and success. Overall, the Iowa Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc., and ASECB Corporation represents a strategic alignment that holds great promise in terms of expanding capabilities, increasing competitiveness, and capitalizing on emerging opportunities in the technology sector.

Iowa Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation

Description

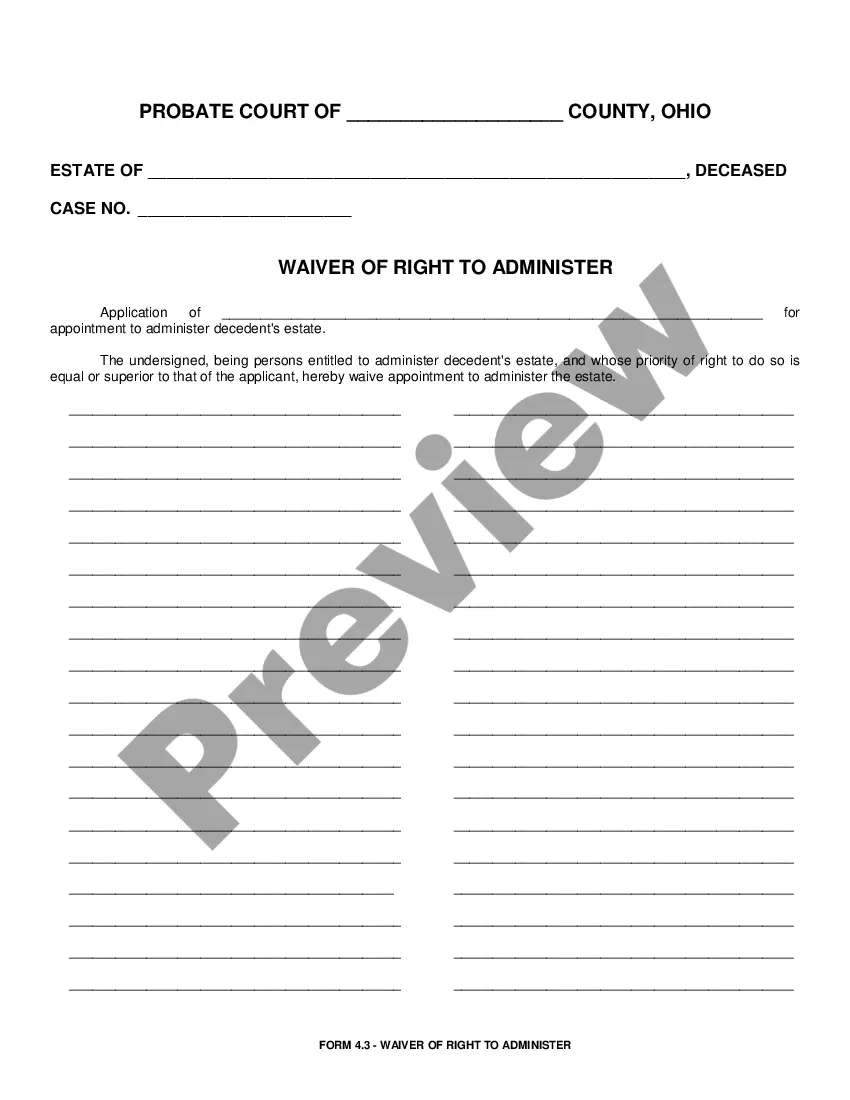

How to fill out Iowa Plan Of Merger Between Micro Component Technology, Inc., MCT Acquisition, Inc. And Aseco Corporation?

If you need to comprehensive, down load, or print out authorized record layouts, use US Legal Forms, the largest collection of authorized types, that can be found on the web. Utilize the site`s easy and hassle-free research to get the papers you need. Different layouts for business and specific functions are categorized by categories and claims, or keywords. Use US Legal Forms to get the Iowa Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation in just a couple of click throughs.

If you are presently a US Legal Forms buyer, log in for your profile and click on the Down load key to get the Iowa Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation. You may also gain access to types you previously acquired from the My Forms tab of your profile.

Should you use US Legal Forms for the first time, refer to the instructions under:

- Step 1. Ensure you have chosen the shape to the correct city/country.

- Step 2. Use the Review method to check out the form`s information. Do not forget to read the explanation.

- Step 3. If you are not happy together with the type, make use of the Look for area at the top of the monitor to discover other models of your authorized type web template.

- Step 4. When you have discovered the shape you need, go through the Acquire now key. Choose the pricing plan you favor and add your credentials to sign up for the profile.

- Step 5. Approach the transaction. You should use your Мisa or Ьastercard or PayPal profile to perform the transaction.

- Step 6. Pick the structure of your authorized type and down load it on your device.

- Step 7. Comprehensive, revise and print out or sign the Iowa Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation.

Every single authorized record web template you acquire is your own property permanently. You have acces to every single type you acquired inside your acccount. Click the My Forms segment and pick a type to print out or down load yet again.

Be competitive and down load, and print out the Iowa Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation with US Legal Forms. There are many skilled and express-certain types you can utilize to your business or specific requirements.