Title: Understanding the Iowa Borrower Security Agreement between ADAC Laboratories and ABN AFRO Bank Keywords: Iowa Borrower Security Agreement, ADAC Laboratories, ABN AFRO Bank, types, detailed description Introduction: The Iowa Borrower Security Agreement is a legally binding document that establishes the terms and conditions pertaining to the security granted by ADAC Laboratories to ABN AFRO Bank in Iowa. This agreement aims to safeguard the interests of both parties involved. Let's delve into its components and explore any existing variations. Components of the Iowa Borrower Security Agreement: 1. Parties involved: The agreement is entered into by ADAC Laboratories (the borrower) and ABN AFRO Bank. Both parties must be identified explicitly, including their legal names and addresses. 2. Purpose: The agreement outlines the purpose for which the security is being provided. This could include securing a loan, credit facility, or any other financial arrangement between ADAC Laboratories and ABN AFRO Bank in the state of Iowa. 3. Identification of collateral: The Iowa Borrower Security Agreement specifies the collateral being offered by ADAC Laboratories to secure their obligations. Collateral could include real estate, machinery, equipment, accounts receivable, inventory, or any other eligible assets as agreed upon by both parties. 4. Granting and perfection of security interest: The agreement establishes the mechanism for granting and perfecting the security interest held by ABN AFRO Bank. This typically involves filing appropriate financing statements with relevant authorities, like the Iowa Secretary of State, to provide public notice of the bank's security interest. 5. Priority of security interest: This section determines the priority of ABN AFRO Bank's security interest over other claims or liens against ADAC Laboratories' assets. It could specify whether the bank holds a first priority, second priority, or subordinate interest in the collateral. 6. Obligations of the borrower: The borrower's responsibilities and obligations, such as maintaining insurance coverage on the collateral and ensuring its proper maintenance, are outlined in the agreement. If the borrower defaults on their obligations, the bank may have rights to take possession and dispose of the collateral. 7. Conditions of default and remedies: The conditions under which a default can occur, such as non-payment of debts or breach of covenants, are detailed in this section. It further outlines the remedies available to ABN AFRO Bank in the event of default, which may include the right to foreclose on the collateral and recover outstanding amounts. Types of Iowa Borrower Security Agreement: While the specific types of Iowa Borrower Security Agreements between ADAC Laboratories and ABN AFRO Bank may vary, the core components mentioned above remain generally consistent. The specific variations might arise due to the nature and size of the secured transaction or any additional negotiated terms between the parties. Conclusion: The Iowa Borrower Security Agreement between ADAC Laboratories and ABN AFRO Bank is a crucial contractual document that ensures the protection of both parties' interests. This comprehensive legal agreement provides a framework for securing financial obligations and establishing remedies in the event of default or breach. Understanding the components of this agreement is vital for parties involved in secured lending transactions in Iowa.

Iowa Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank

Description

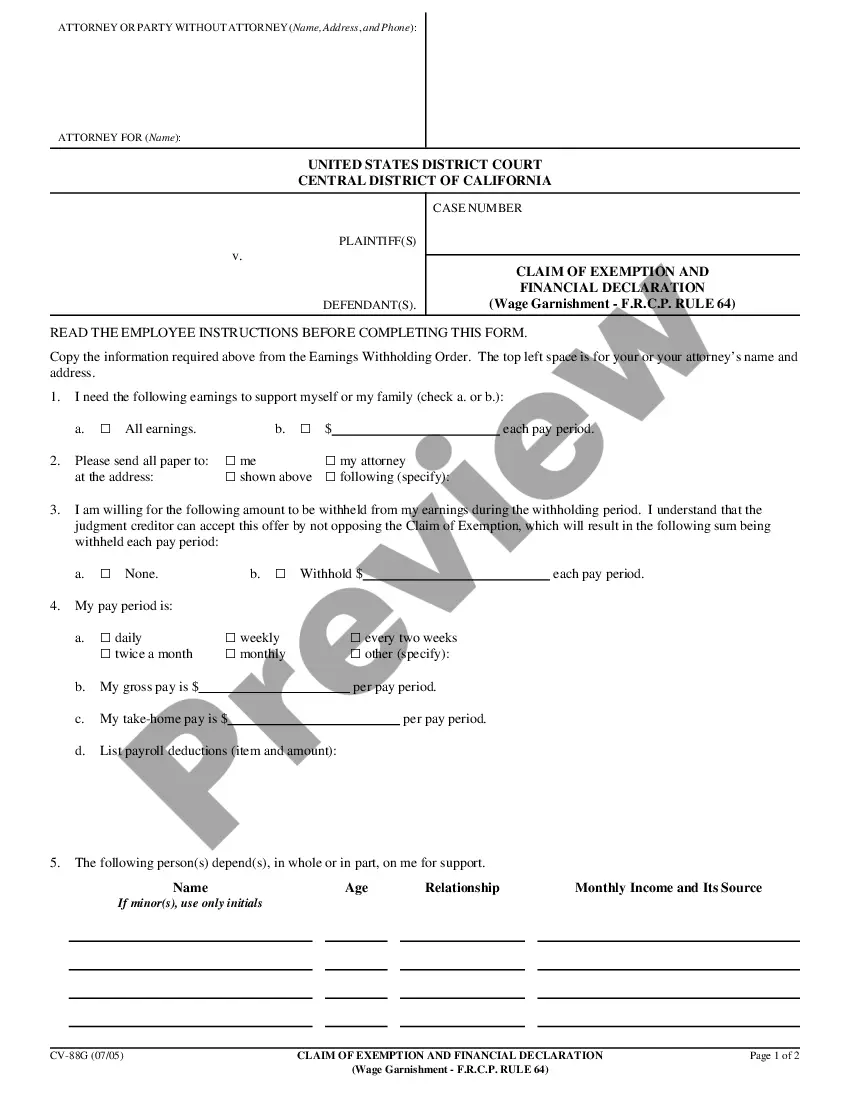

How to fill out Iowa Borrower Security Agreement Between ADAC Laboratories And ABN AMRO Bank?

Are you presently inside a situation where you require paperwork for sometimes organization or person reasons virtually every day time? There are a lot of legitimate file web templates accessible on the Internet, but locating ones you can rely isn`t simple. US Legal Forms gives thousands of form web templates, much like the Iowa Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank, that are created in order to meet state and federal requirements.

If you are previously familiar with US Legal Forms web site and have a free account, basically log in. Next, you can acquire the Iowa Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank design.

If you do not provide an profile and would like to begin to use US Legal Forms, follow these steps:

- Discover the form you want and make sure it is for that proper town/region.

- Utilize the Review key to review the form.

- Read the outline to actually have selected the proper form.

- In case the form isn`t what you`re looking for, utilize the Lookup field to discover the form that suits you and requirements.

- Whenever you find the proper form, just click Buy now.

- Pick the rates prepare you desire, fill out the desired information to create your bank account, and pay for the order with your PayPal or Visa or Mastercard.

- Select a hassle-free data file structure and acquire your duplicate.

Find each of the file web templates you have bought in the My Forms menu. You can aquire a additional duplicate of Iowa Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank at any time, if possible. Just click the needed form to acquire or printing the file design.

Use US Legal Forms, one of the most considerable collection of legitimate kinds, to save efforts and prevent errors. The support gives skillfully created legitimate file web templates that can be used for a variety of reasons. Generate a free account on US Legal Forms and commence generating your daily life a little easier.

Form popularity

FAQ

A pledge and security agreement is a legal document that outlines an arrangement in which one party (the pledgor) unconditionally transfers the title to a specific property or asset to another person or entity (the pledgee), who accepts it for safekeeping, usually in return for some form of compensation.

Under the UCC, a pledge agreement is a security agreement. The nature of the pledged assets means that a pledge agreement may contain different representations and warranties and covenants than a security agreement over business assets (for example, voting rights).

A pledge contract is an agreement between two or more parties that outlines the specific actions that each party will take in order to achieve a common goal. The terms of the contract are typically decided upon by the parties involved, and may be revised or updated as necessary.

Pledging here refers to an activity in which the borrower (pledgor) of funds uses securities as a form of collateral to secure the funds it borrows or takes from the lender (Pledgee).

In simple words, a pledge is a promise to repay a loan, and collateral is what you lose if you don't keep your promise. For example, I can take a loan from a friend, pledge to return it within 30 days, and offer my bike as collateral. As long as I return the loan within 30 days, the bike is safe.