Iowa Merger Agreement between Bay Micro Computers, Inc. and BMC Acquisition Corporation is a legally binding document that outlines the terms and conditions of the merger between the two entities. It serves as a roadmap for the merger process and ensures a smooth transition of ownership and operations. This agreement is specific to the state of Iowa and must adhere to the relevant laws and regulations governing mergers. Key phrases: Iowa Merger Agreement, Bay Micro Computers, Inc., BMC Acquisition Corporation, merger process, transition of ownership, operations, laws and regulations Different types of Iowa Merger Agreement between Bay Micro Computers, Inc. and BMC Acquisition Corporation include: 1. Stock-for-Stock Merger Agreement: This type of agreement occurs when the shareholders of Bay Micro Computers, Inc. exchange their shares for BMC Acquisition Corporation's stock. It outlines the exchange ratio and any other conditions regarding the stock-for-stock transaction. 2. Asset Acquisition Merger Agreement: In this type of agreement, BMC Acquisition Corporation acquires specific assets of Bay Micro Computers, Inc., such as technology, intellectual property rights, or customer contracts. The agreement defines the assets to be transferred and the consideration to be paid for them. 3. Merger by Absorption Agreement: This agreement outlines the merger of Bay Micro Computers, Inc. into BMC Acquisition Corporation. It specifies the rights and obligations of both parties during the merger, including the treatment of existing contracts, employees, and liabilities. 4. Triangular Merger Agreement: A triangular merger involves the creation of a new entity, often a subsidiary of BMC Acquisition Corporation, which acquires both Bay Micro Computers, Inc. and BMC Acquisition Corporation. This agreement outlines the formation of the new entity and the terms of the merger. 5. Reverse Merger Agreement: This agreement describes a scenario where Bay Micro Computers, Inc. acquires BMC Acquisition Corporation, resulting in Bay Micro Computers, Inc. becoming the surviving entity. It establishes the terms of the reverse merger, including the exchange of shares and the rights and obligations of the parties involved. It is important for both Bay Micro Computers, Inc. and BMC Acquisition Corporation to carefully review and negotiate the terms of the Iowa Merger Agreement to ensure that their interests and rights are protected throughout the merger process. Legal counsel should be sought to ensure compliance with Iowa laws and regulations.

Iowa Merger Agreement between Bay Micro Computers, Inc. and BMC Acquisition Corporation

Description

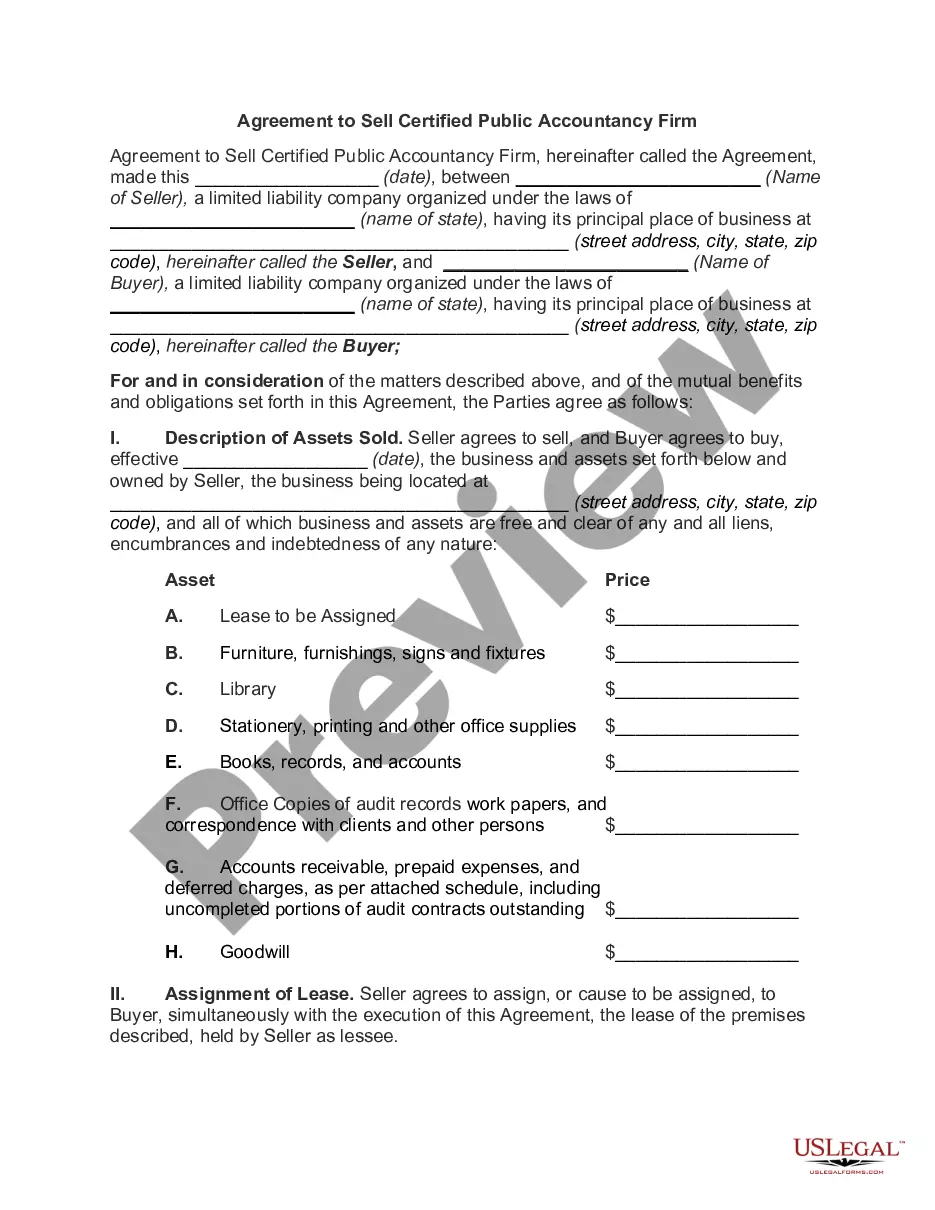

How to fill out Iowa Merger Agreement Between Bay Micro Computers, Inc. And BMC Acquisition Corporation?

US Legal Forms - one of many largest libraries of lawful kinds in the States - gives an array of lawful file web templates you are able to acquire or print. Making use of the website, you can get 1000s of kinds for enterprise and specific purposes, categorized by types, says, or key phrases.You can get the most up-to-date variations of kinds just like the Iowa Merger Agreement between Bay Micro Computers, Inc. and BMC Acquisition Corporation within minutes.

If you already possess a subscription, log in and acquire Iowa Merger Agreement between Bay Micro Computers, Inc. and BMC Acquisition Corporation from your US Legal Forms catalogue. The Download key will appear on every form you perspective. You have access to all in the past saved kinds from the My Forms tab of the bank account.

In order to use US Legal Forms the very first time, allow me to share straightforward recommendations to obtain started:

- Be sure you have chosen the right form for the city/area. Go through the Preview key to analyze the form`s content. See the form explanation to ensure that you have selected the appropriate form.

- If the form does not suit your needs, utilize the Search field near the top of the monitor to get the one that does.

- If you are happy with the form, validate your decision by clicking on the Buy now key. Then, pick the costs plan you like and give your accreditations to sign up on an bank account.

- Approach the deal. Use your Visa or Mastercard or PayPal bank account to accomplish the deal.

- Choose the formatting and acquire the form on your device.

- Make adjustments. Load, modify and print and sign the saved Iowa Merger Agreement between Bay Micro Computers, Inc. and BMC Acquisition Corporation.

Every web template you put into your bank account does not have an expiration day and is the one you have forever. So, if you would like acquire or print one more copy, just check out the My Forms area and click about the form you need.

Gain access to the Iowa Merger Agreement between Bay Micro Computers, Inc. and BMC Acquisition Corporation with US Legal Forms, the most comprehensive catalogue of lawful file web templates. Use 1000s of professional and condition-specific web templates that satisfy your business or specific demands and needs.