The Iowa Retirement Plan Transfer Agreement refers to a legal document designed to facilitate the transfer of retirement plan assets in compliance with the requirements set forth by the Internal Revenue Service (IRS). This agreement governs the process by which an Iowa retirement plan can be transferred from one entity or individual to another, ensuring that all contributions made to the plan meet the necessary IRS regulations. When it comes to different types of Iowa Retirement Plan Transfer Agreements, there are two main categories to consider: Individual Retirement Accounts (IRAs) and Employer-Sponsored Retirement Plans. Within these categories, there are specific subtypes that may be applicable, such as Traditional IRAs, Roth IRAs, Simplified Employee Pension (SEP) IRAs, Savings Incentive Match Plan for Employees (SIMPLE) IRAs, 401(k) plans, and 403(b) plans. The Iowa Retirement Plan Transfer Agreement for Individual Retirement Accounts encompasses the transfer of funds from one IRA custodian to another while ensuring that the contributions adhere to IRS rules. This agreement typically involves a direct trustee-to-trustee transfer, rollover, or conversion to maintain the tax-deferred status of the assets. On the other hand, the Iowa Retirement Plan Transfer Agreement for Employer-Sponsored Retirement Plans focuses on the movement of retirement funds from one employer-sponsored plan, such as a 401(k) or 403(b), to another plan or account without incurring tax penalties. It ensures that the contributions, whether made by the employee or the employer, meet the IRS regulations regarding plan eligibility, annual contribution limits, and distribution rules. In both cases, the Iowa Retirement Plan Transfer Agreement serves as a crucial document to ensure the seamless and compliant transfer of retirement plan assets. It outlines the terms and conditions under which the transfer occurs, including the responsibilities of both parties involved, the timeline for the transfer, and any fees or expenses associated with the process. Overall, the Iowa Retirement Plan Transfer Agreement is a legal instrument that safeguards the integrity of retirement plan transfers in Iowa, guaranteeing that all contributions made to the plan meet the rigorous requirements established by the Internal Revenue Service.

Iowa Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service

Description

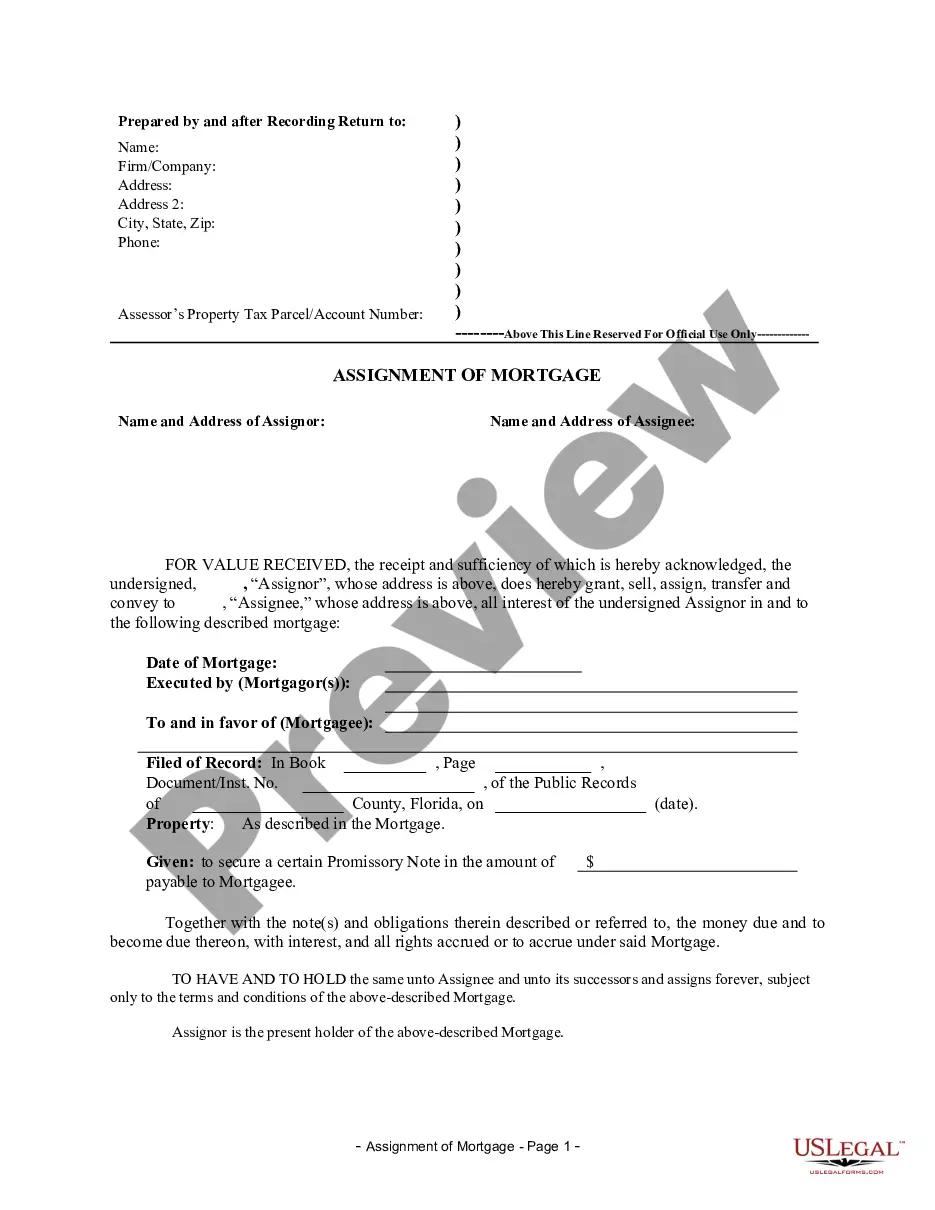

How to fill out Iowa Retirement Plan Transfer Agreement Regarding Contribution Plan Meeting Requirements Of The Internal Revenue Service?

Are you in the situation the place you need to have papers for both business or person functions almost every day time? There are plenty of legal file web templates available on the net, but getting versions you can trust isn`t simple. US Legal Forms delivers a large number of form web templates, like the Iowa Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service, which can be created in order to meet state and federal demands.

If you are already informed about US Legal Forms internet site and possess a free account, just log in. Next, you are able to obtain the Iowa Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service template.

If you do not offer an bank account and need to begin to use US Legal Forms, adopt these measures:

- Obtain the form you will need and ensure it is for your right area/region.

- Use the Review switch to examine the shape.

- See the explanation to actually have chosen the appropriate form.

- In the event the form isn`t what you are looking for, use the Look for area to get the form that meets your requirements and demands.

- Whenever you get the right form, click Get now.

- Choose the prices prepare you need, fill in the desired info to generate your bank account, and buy the order with your PayPal or bank card.

- Pick a hassle-free file format and obtain your version.

Discover all of the file web templates you possess purchased in the My Forms menus. You can get a more version of Iowa Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service at any time, if required. Just click the needed form to obtain or print out the file template.

Use US Legal Forms, the most considerable assortment of legal kinds, to save some time and steer clear of mistakes. The service delivers appropriately created legal file web templates that you can use for a selection of functions. Make a free account on US Legal Forms and commence generating your daily life a little easier.

Form popularity

FAQ

Many popular plans are defined contribution plans, such as the 401(k), 457, and 403(b) plans. These plans generally require the employees to choose from investment options to fit their retirement goals, such as portfolios with higher returns and risk or more conservative portfolios with lower risk and returns.

Defined contribution pension schemes These pensions are also known as "money purchase schemes". Your employer decides which type of scheme you are offered. In a defined contribution pension scheme, your pension pot is put into various types of investment, such as shares (shares are a stake in a company).

sharing plan accepts discretionary employer contributions. There is no set amount that the law requires you to contribute. If you can afford to make some amount of contributions to the plan for a particular year, you can do so.

Examples of defined contribution plans include 401(k) plans, 403(b) plans, employee stock ownership plans, and profit-sharing plans.

Traditional 401(k). This is the most common defined contribution plan. Offered by for-profit companies, 401(k)s are funded by pre-tax employee contributions as well as matching or non-matching contributions from employers.

It requires California businesses with five or more California-based employees (one of whom is at least 18 years old), to offer either an employer-sponsored retirement plan or the state-sponsored retirement plan to their workers.

All employees must be 100% vested by the time that they attain Normal Retirement Age under the plan and when the plan is terminated. Amounts that are not vested may be ?forfeited? by the employees when they separate from service with the employer.

What Is a Defined Contribution (DC) Plan? A defined contribution (DC) plan is a retirement plan that's typically tax-deferred, like a 401(k) or a 403(b), in which employees contribute a fixed amount or a percentage of their paychecks to an account that is intended to fund their retirements.