Iowa Tax Sharing and Disaffiliation Agreement is a legal contract between two or more entities in the state of Iowa that outlines the terms and conditions for sharing taxes and disaffiliating from a shared tax arrangement. This agreement is primarily used by businesses, organizations, or governments that previously had a shared tax arrangement or were part of a consolidated tax filing group but now wish to separate and share taxes independently. The main purpose of the Iowa Tax Sharing and Disaffiliation Agreement is to establish clear guidelines for the allocation and distribution of tax liabilities, assets, and obligations among the parties involved. It ensures that each party understands their respective tax obligations when disaffiliating and transitioning into separate tax entities. The agreement includes detailed provisions on various aspects such as the division of tax revenues, the allocation of tax credits, the treatment of tax carryovers, the settlement of intercompany accounts, and the resolution of any potential tax controversies or disputes. It also addresses potential issues related to the division of tax liabilities and any tax obligations that may arise after the disaffiliation. Different types of Iowa Tax Sharing and Disaffiliation Agreements can be categorized based on the specific tax types or entities involved. For example, there may be agreements related to sales tax disaffiliation, income tax disaffiliation, property tax disaffiliation, or corporate tax disaffiliation. Each type of agreement may have its own set of unique provisions and considerations, tailored to the specific tax regulations and requirements applicable to the respective tax type. It is important to note that the Iowa Tax Sharing and Disaffiliation Agreement should be drafted with the assistance of legal professionals experienced in tax law to ensure compliance with the applicable laws and regulations. The agreement should be carefully reviewed and customized to fit the specific circumstances and objectives of the parties involved, as well as protect their respective rights and interests throughout the disaffiliation process.

Iowa Tax Sharing and Disaffiliation Agreement

Description

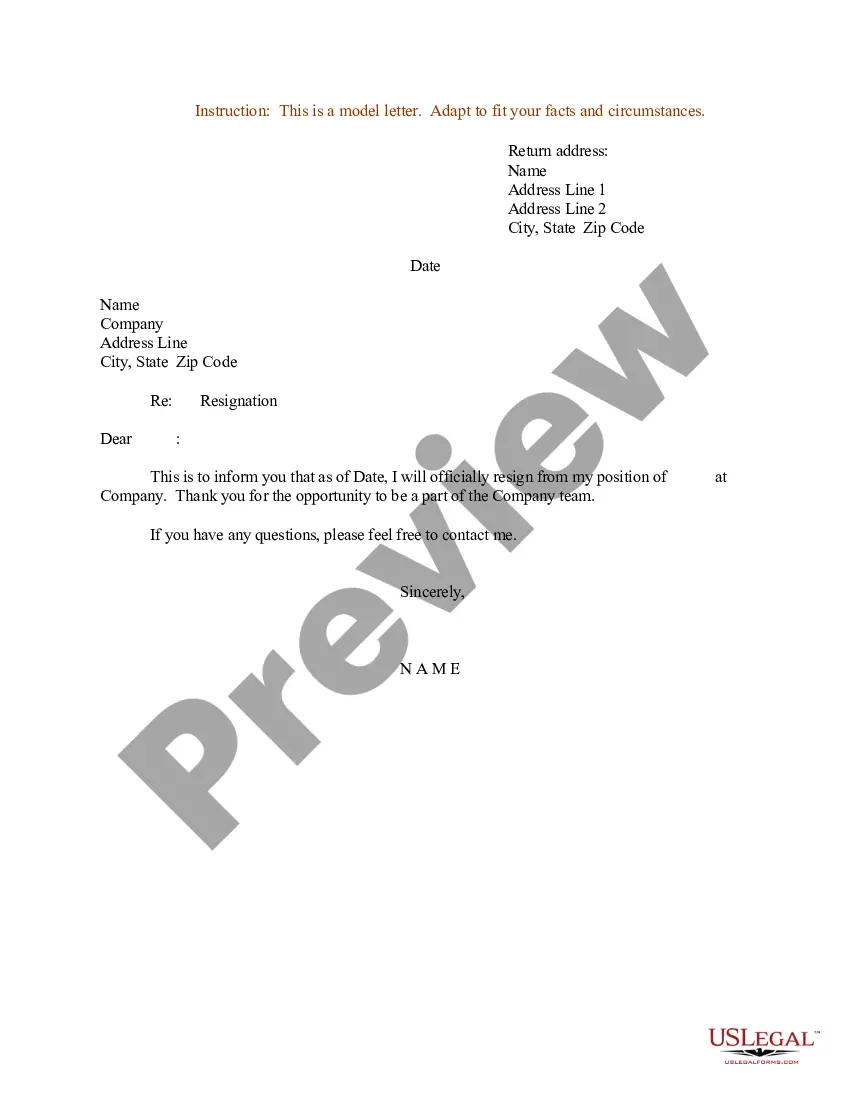

How to fill out Tax Sharing And Disaffiliation Agreement?

Are you currently in a placement where you need to have files for possibly business or specific purposes almost every working day? There are a variety of legal papers themes accessible on the Internet, but locating versions you can trust is not simple. US Legal Forms provides 1000s of kind themes, much like the Iowa Tax Sharing and Disaffiliation Agreement, that happen to be composed in order to meet state and federal specifications.

Should you be presently acquainted with US Legal Forms web site and get an account, merely log in. After that, you can acquire the Iowa Tax Sharing and Disaffiliation Agreement web template.

Unless you offer an bank account and want to start using US Legal Forms, adopt these measures:

- Discover the kind you will need and ensure it is to the proper city/state.

- Make use of the Preview button to review the shape.

- Browse the explanation to ensure that you have chosen the proper kind.

- When the kind is not what you`re trying to find, take advantage of the Look for area to discover the kind that meets your requirements and specifications.

- Once you get the proper kind, click Get now.

- Select the costs plan you want, submit the necessary info to produce your bank account, and pay money for an order with your PayPal or credit card.

- Select a practical data file format and acquire your copy.

Get all the papers themes you have purchased in the My Forms food selection. You can aquire a additional copy of Iowa Tax Sharing and Disaffiliation Agreement at any time, if needed. Just click the necessary kind to acquire or produce the papers web template.

Use US Legal Forms, by far the most comprehensive assortment of legal kinds, to save lots of time and stay away from faults. The service provides appropriately manufactured legal papers themes which you can use for a range of purposes. Produce an account on US Legal Forms and initiate producing your way of life easier.

Form popularity

FAQ

Apply for a federal identification number (FEIN) with the Internal Revenue Service. You can apply for an FEIN online or you can use form SS-4 (pdf); this will become your state number for withholding tax purposes.

S corporations that are subject to federal tax on built-in gains under Internal Revenue Code (IRC) section 1374 or passive investment income under IRC section 1375 are subject to Iowa corporation income tax on this income to the extent received from business carried on in this state or from sources in this state.

In order to legally conduct business within the state of Iowa, you will need to register your business.

IA W-4 Employee's Withholding Certificate and Centralized Employee Registry 44-019 | Iowa Department Of Revenue.

Registering as an Iowa Withholding Agent Register with the Internal Revenue Service first to obtain a Federal Identification Number (FEIN) or call the IRS at 1-800-829-4933. There is no fee for registering. After obtaining a FEIN, register with Iowa.

You will receive a letter containing your permit number and instructions on how to file and remit taxes. Please allow up to 6 weeks from the time you submit your application to receive your documents in the mail.