The Term Sheet is not a commitment to invest, and is conditioned on the completion of the conditions to closing set forth.

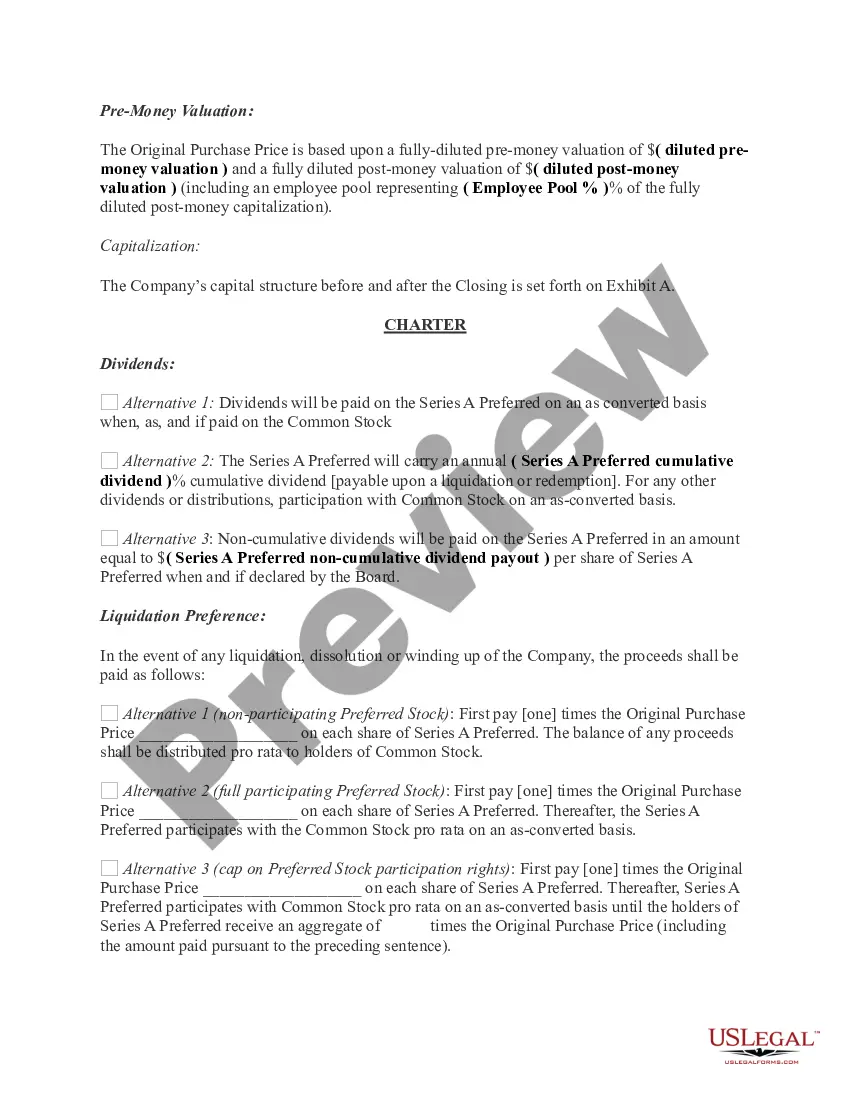

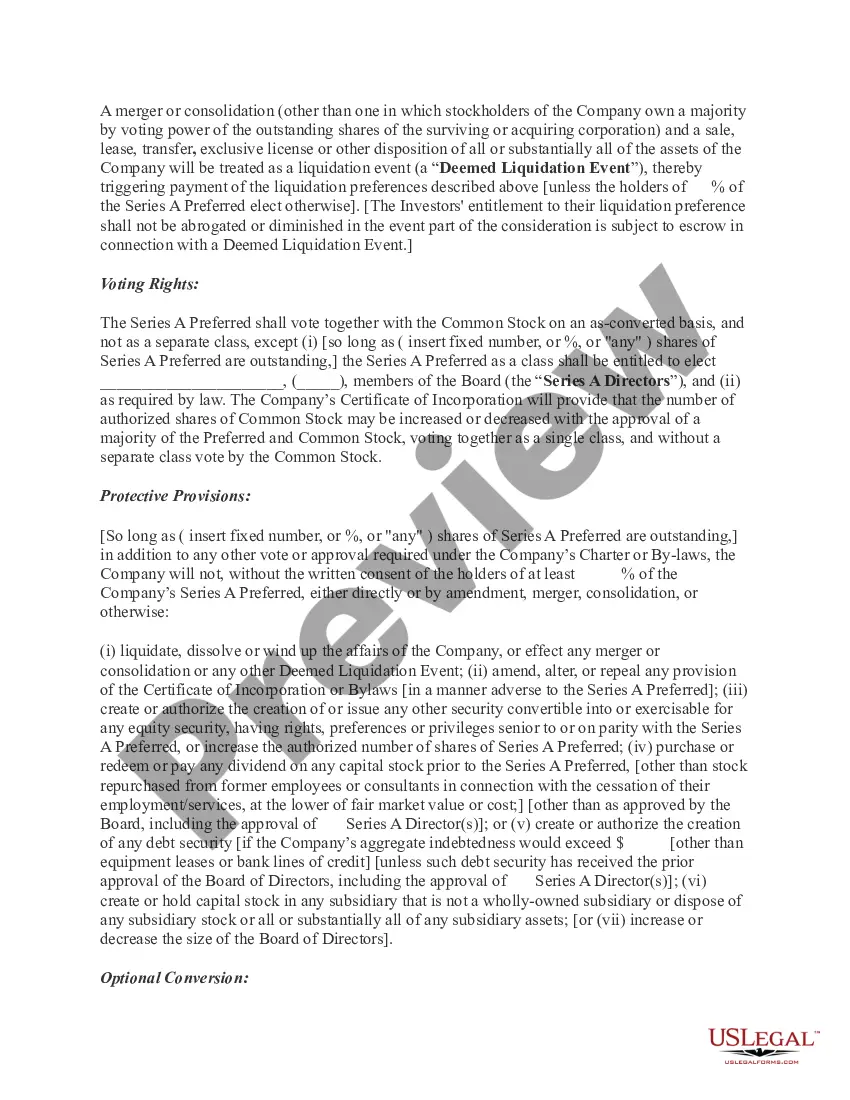

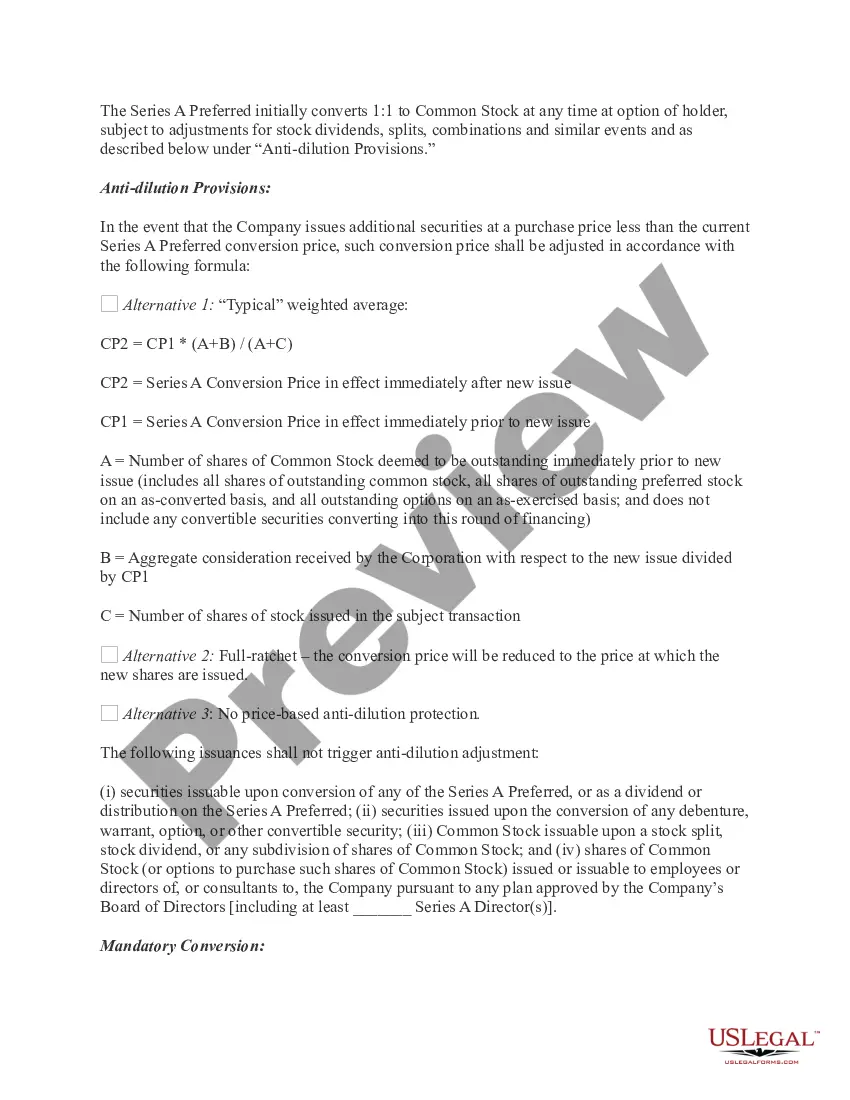

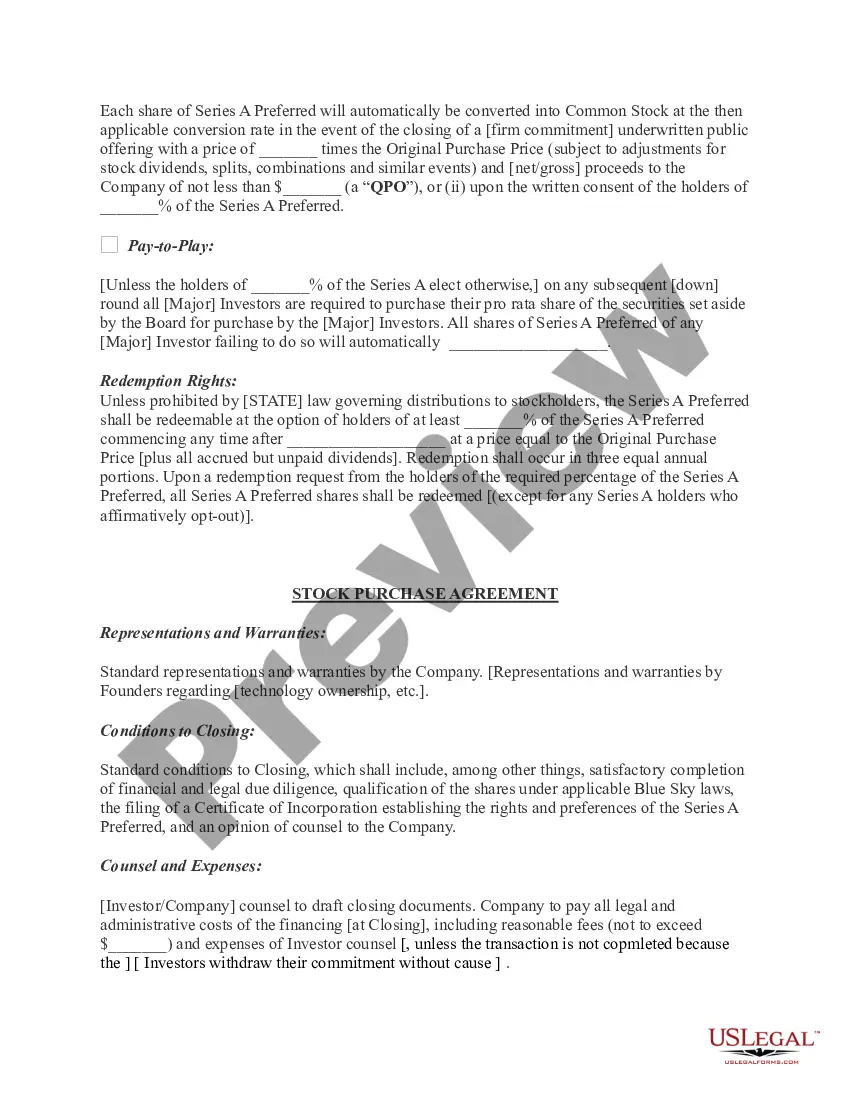

Iowa Term Sheet — Series A Preferred Stock Financing is a crucial aspect of funding for startup companies in Iowa. This term sheet outlines the terms and conditions under which investors provide capital in exchange for preferred stock in the company. It specifies the rights, preferences, and privileges associated with this class of stock, providing protection and potential benefits to both the company and the investors. The term sheet for Iowa Series A Preferred Stock Financing typically includes various key components, including: 1. Valuation: It outlines the pre-money valuation of the company, representing its worth before the investment. This valuation determines the number of shares the investors will receive in exchange for their capital. 2. Investment Amount: The term sheet specifies the amount the investor is willing to invest in the company, which may be a fixed sum or a range. This investment is critical for the continued growth and development of the company. 3. Liquidation Preferences: This clause defines the order in which the company distributes proceeds to investors in the event of a sale, liquidation, or acquisition. It ensures that investors, especially preferred stockholders, receive their investment back before other shareholders. 4. Dividend Provisions: The term sheet may address whether the preferred stockholders are entitled to dividends, their frequency, and whether they are cumulative or non-cumulative. Dividends provide investors with a consistent income stream and can be based on a fixed rate or tied to the company's performance. 5. Conversion Rights: The term sheet clarifies the conditions under which preferred stock can be converted into common stock. This conversion is often triggered by specific events, such as an initial public offering (IPO), and allows preferred stockholders to participate in the potential growth of the company. 6. Anti-Dilution Protection: This clause safeguards investors from future dilution of their ownership stake in case the company issues additional shares at a lower price. It ensures that the investors' percentage of ownership remains intact or is adjusted accordingly to protect their investment. It is important to note that while the term sheet generally follows a standard structure, the specifics can vary among different Iowa Series A Preferred Stock Financing agreements, reflecting the unique needs and requirements of the participants. Some variations include: 1. Fully Participating Preferred Stock: This type of preferred stock allows investors to both receive dividends and participate in any remaining distribution during a liquidation event, thereby offering additional potential returns. 2. Convertible Preferred Stock: Unlike typical preferred stock, convertible preferred stock can be converted into common stock, enabling investors to potentially benefit from the company's future success and increase in valuation. 3. Preferred Stock with Voting Rights: In certain cases, preferred stockholders may be granted voting rights, allowing them to influence certain company decisions collectively. This grants them a voice in the strategic direction of the company, alongside common shareholders. In conclusion, Iowa Term Sheet — Series A Preferred Stock Financing serves as a crucial agreement between investors and start-up companies in Iowa. It provides clarity on investment terms, investor protections, and potential benefits, ensuring a fair and mutually beneficial relationship between the company and its investors.

Iowa Term Sheet — Series A Preferred Stock Financing is a crucial aspect of funding for startup companies in Iowa. This term sheet outlines the terms and conditions under which investors provide capital in exchange for preferred stock in the company. It specifies the rights, preferences, and privileges associated with this class of stock, providing protection and potential benefits to both the company and the investors. The term sheet for Iowa Series A Preferred Stock Financing typically includes various key components, including: 1. Valuation: It outlines the pre-money valuation of the company, representing its worth before the investment. This valuation determines the number of shares the investors will receive in exchange for their capital. 2. Investment Amount: The term sheet specifies the amount the investor is willing to invest in the company, which may be a fixed sum or a range. This investment is critical for the continued growth and development of the company. 3. Liquidation Preferences: This clause defines the order in which the company distributes proceeds to investors in the event of a sale, liquidation, or acquisition. It ensures that investors, especially preferred stockholders, receive their investment back before other shareholders. 4. Dividend Provisions: The term sheet may address whether the preferred stockholders are entitled to dividends, their frequency, and whether they are cumulative or non-cumulative. Dividends provide investors with a consistent income stream and can be based on a fixed rate or tied to the company's performance. 5. Conversion Rights: The term sheet clarifies the conditions under which preferred stock can be converted into common stock. This conversion is often triggered by specific events, such as an initial public offering (IPO), and allows preferred stockholders to participate in the potential growth of the company. 6. Anti-Dilution Protection: This clause safeguards investors from future dilution of their ownership stake in case the company issues additional shares at a lower price. It ensures that the investors' percentage of ownership remains intact or is adjusted accordingly to protect their investment. It is important to note that while the term sheet generally follows a standard structure, the specifics can vary among different Iowa Series A Preferred Stock Financing agreements, reflecting the unique needs and requirements of the participants. Some variations include: 1. Fully Participating Preferred Stock: This type of preferred stock allows investors to both receive dividends and participate in any remaining distribution during a liquidation event, thereby offering additional potential returns. 2. Convertible Preferred Stock: Unlike typical preferred stock, convertible preferred stock can be converted into common stock, enabling investors to potentially benefit from the company's future success and increase in valuation. 3. Preferred Stock with Voting Rights: In certain cases, preferred stockholders may be granted voting rights, allowing them to influence certain company decisions collectively. This grants them a voice in the strategic direction of the company, alongside common shareholders. In conclusion, Iowa Term Sheet — Series A Preferred Stock Financing serves as a crucial agreement between investors and start-up companies in Iowa. It provides clarity on investment terms, investor protections, and potential benefits, ensuring a fair and mutually beneficial relationship between the company and its investors.